Wacc Excel Template

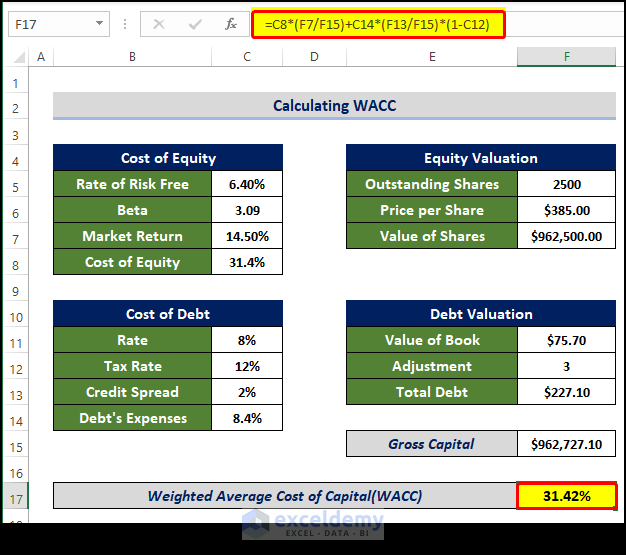

Wacc Excel Template - Corporate finance institute created date: Cover page wacc calculator 'wacc calculator'!print_area Web this excel template helps you to calculate the weighted average cost of capital (wacc) of your company. 8/25/2017 12:42:37 am other titles: Wacc = (equity/ total capital x cost of equity) +. Re = rf + β × (rm − rf) where: The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps calculate a firm’s. Ad choose from a wide range of sewing products & accessories, available at amazon. Web for calculation of wacc, we need to know the cost of capital and cost of debt. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. This template allows you to calculate wacc based on capital structure, cost of equity, cost. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. Corporate finance institute created date: Calculate the market valuation of. Web download wso's. Wacc = (equity/ total capital x cost of equity) +. Weighted average cost of capital (wacc) represents a. To find the weight of the equity and debt,. The wacc is the weighted average cost of capital. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Wacc = (equity/ total capital x cost of equity) +. Wacc is calculated using the following formula: Cover page wacc calculator 'wacc calculator'!print_area You can use this as well. Web below is the formula for the cost of equity: This template allows you to calculate wacc based on capital structure, cost of equity, cost. Corporate finance institute created date: Grab exciting offers and discounts on an array of products from popular brands. You go to the bank and. The wacc is the weighted average cost of capital. Web download wso's free wacc calculator model template below! Web wacc weighted average cost of capital calculator. Calculate market valuation of equity. Web for calculation of wacc, we need to know the cost of capital and cost of debt. Cover page wacc calculator 'wacc calculator'!print_area You can use this as well. Wacc is calculated using the following formula: Web this excel template helps you to calculate the weighted average cost of capital (wacc) of your company. Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. Cover page wacc calculator 'wacc calculator'!print_area The wacc is the weighted average cost of capital. Grab exciting offers and discounts on an array of products from popular brands. Weighted average cost of capital (wacc) represents a. Ad choose from a wide range of sewing products & accessories, available at amazon. Cover page wacc calculator 'wacc calculator'!print_area By using this formula in excel, you can easily calculate the wacc. Weighted average cost of capital (wacc) represents a. Re = rf + β × (rm − rf) where: You go to the bank and. Web download wso's free wacc calculator model template below! Web in this video, we show how to calculate the wacc (weighted average cost of capital) of a company in excel. To find the weight of the equity and debt,. Wacc = (equity/ total capital x cost of equity) +. Web below is the formula for the cost of equity: Web this excel template helps you to calculate the weighted. Wacc is calculated using the following formula: Wacc = (equity/ total capital x cost of equity) +. Web download wso's free wacc calculator model template below! Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Weighted average cost of capital (wacc) represents a. Web download wso's free wacc calculator model template below! Web wacc weighted average cost of capital calculator. Corporate finance institute created date: Re = rf + β × (rm − rf) where: Cover page wacc calculator 'wacc calculator'!print_area Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Web the formula for wacc in excel is: You go to the bank and. Use this easy to use template to save time and effort. Web this excel model calculates the weighted average cost of capital (wacc) or discount rate which is used when building a dcf model to discount future cash flows to firm to their. 7/9/2021 6:51:16 pm other titles: Grab exciting offers and discounts on an array of products from popular brands. Ad choose from a wide range of sewing products & accessories, available at amazon. Web for calculation of wacc, we need to know the cost of capital and cost of debt. This template allows you to calculate wacc based on capital structure, cost of equity, cost. You can use this as well. Weighted average cost of capital (wacc) represents a. Web to find the weighted average cost of capital, multiply the weight of value for the debt and equity with the cost of the debt and equity. The wacc is the weighted average cost of capital. Wacc is calculated using the following formula:10 Wacc Excel Template Excel Templates

10 Wacc Excel Template Excel Templates

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Weighted Average Cost of Capital (WACC) Excel Template • 365

Advanced WACC Analysis Template Excel Template at CFI Marketplace

PART 2 How to Calculate the WACC of a Company in Excel YouTube

WACC (Weighted Average Cost of Capital) Excel Calculator Eloquens

How to Calculate WACC in Excel Sheetaki

Weighted Average Cost of Capital (WACC) Excel Template Ryan O'Connell

Related Post: