Snowball Debt Template

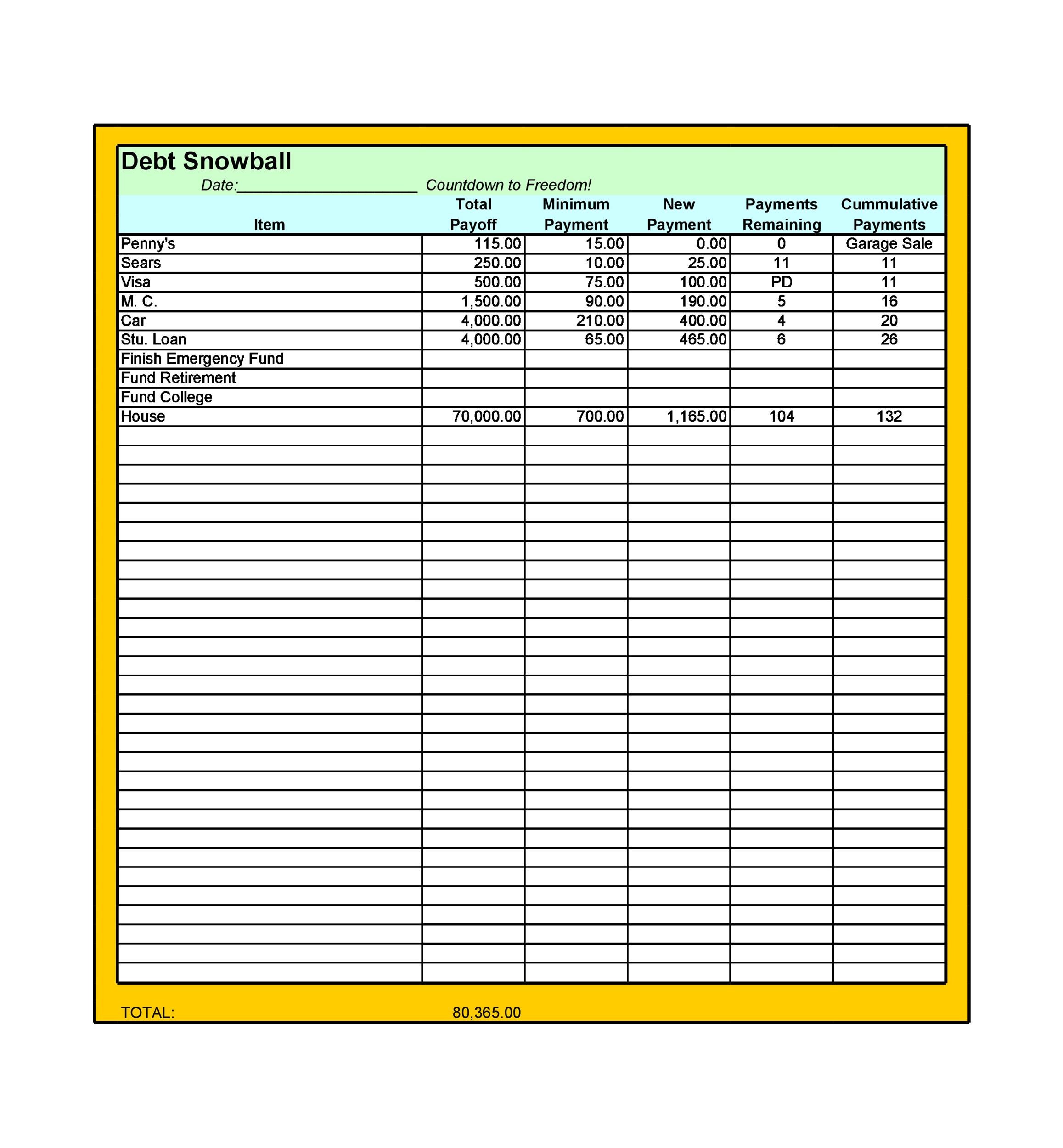

Snowball Debt Template - This debtbuster worksheet works best if you put the smallest debt at the top of the list and the biggest debt at the. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. Repeat until each debt is paid in full. Web how to use this debt snowball excel spreadsheet in excel and google docs. Download allocated spending plan give every dollar a name. Here are 6 free debt snowball spreadsheets for google sheets and excel to help you save money, reduce. Divide the total by the monthly payment to obtain your payoff date. Web printable debt snowball worksheet / template / form. The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and repeat it so that the full cash may pay off. Download lump sum payment form Here are 6 free debt snowball spreadsheets for google sheets and excel to help you save money, reduce. Between student loans, mortgages, and credit cards in general, it’s actually quite easy to find yourself under a mountain of debt. Or buy the debt free playbook for $47. Web keep a clear, confident view of all your money in one place,. Web debt snowball templates provide a structured and organized approach to debt repayment. Web keep a clear, confident view of all your money in one place, with private spreadsheets, flexible templates, and no ads: In the first worksheet, you enter your creditor information and your total monthly payment. Please read our disclosure for more information. The snowball debt means to. Please read our disclosure for more information. One of these forms is known as the debt snowball spreadsheet. Or buy the debt free playbook for $47. Web for example, below is the list of your debts: Both of these will make it easier to set up your debt snowball in excel or google sheets. The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and repeat it so that the full cash may pay off. Web the debt snowball google sheets template is the perfect tool for guiding you through the debt snowball. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. Web last updated june 30, 2023 debt snowball spreadsheet template + guide (debt free 2023) google sheets has always been helpful when you need to calculate your earnings and need a way to organize. Web here’s how it could look in real life: Sum up your arrears and the interest rate. Web the debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. Download lump sum payment form Both of these will make it easier to set up your debt snowball in. Download allocated spending plan give every dollar a name. Sum up your arrears and the interest rate. Between student loans, mortgages, and credit cards in general, it’s actually quite easy to find yourself under a mountain of debt. Web debt snowball spreadsheet: You put any extra money you can towards the first debt on your list. You put any extra money you can towards the first debt on your list. Tiller money offers several types of spreadsheets including a debt snowball spreadsheet. Web keep a clear, confident view of all your money in one place, with private spreadsheets, flexible templates, and no ads: Pay as much as possible on your smallest debt. In the first worksheet,. Web here’s how the debt snowball works: Then you can plan out how much you’ll set aside per month for your debts. Or buy the debt free playbook for $47. Web how do i create a debt snowball chart? Use this form to break down each paycheck and tell your money where to go. By utilizing these templates, individuals can prioritize and tackle their debts effectively , gaining momentum and motivation as they see. Web here’s how the debt snowball works: Web the debt snowball worksheet from template lab for excel is a simplified template that can be used to work out successive payments due, starting from the smallest amount owed to the largest. Make minimum payments on all your debts except the smallest. The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and repeat it so that the full cash may pay off. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. You put any extra money you can towards the first debt on your list. Here are 6 free debt snowball spreadsheets for google sheets and excel to help you save money, reduce. Web how to use this debt snowball excel spreadsheet in excel and google docs. Web 9+ debt snowball excel templates. The ramsey team created this helpful downloadable debt snowball worksheet pdf template that you can print off as you work your way through the process… have you used the snowball method yourself? Divide the total by the monthly payment to obtain your payoff date. Web here’s how it could look in real life: So far, we’ve gone through the basics of the debt snowball excel spreadsheet, but there’s even more you can do with it— download your free debt snowball excel template. Web here’s how the debt snowball works: Sum up your arrears and the interest rate. In the first worksheet, you enter your creditor information and your total monthly payment. Use this form to break down each paycheck and tell your money where to go. Pay as much as possible on your smallest debt. With this spreadsheet you can customize the amount you want to pay on each debt to work with your personal budget. Tiller money tiller money is a budgeting tool that can help you manage your money and pay off your debt. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. One of these forms is known as the debt snowball spreadsheet.Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy

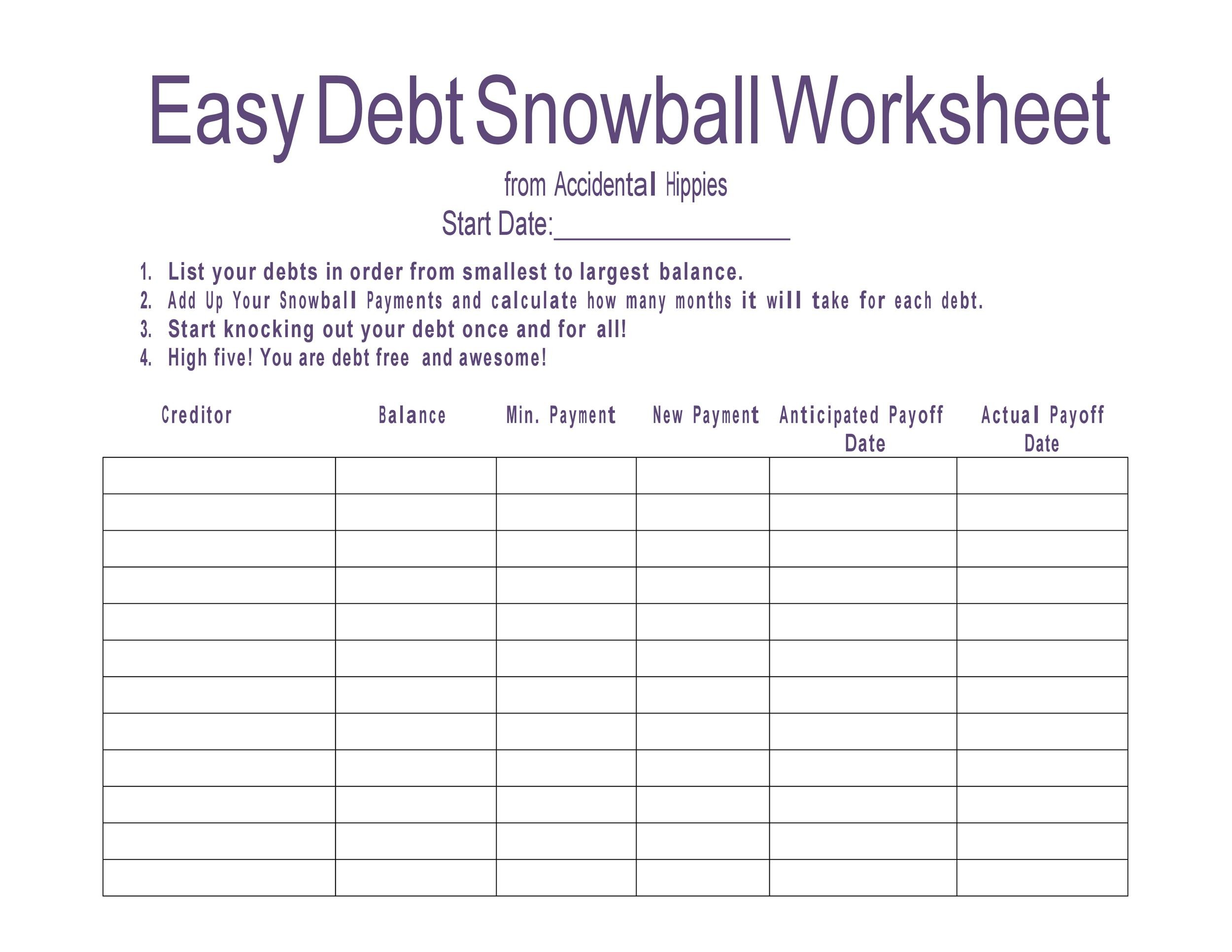

Dave Ramsey Debt Snowball Worksheets —

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Debt Snowball Printable Worksheets Simplistically Living

38 Debt Snowball Spreadsheets, Forms & Calculators

5 Debt Snowball Excel Templates Excel xlts

Related Post: