S-Corp Bookkeeping Template

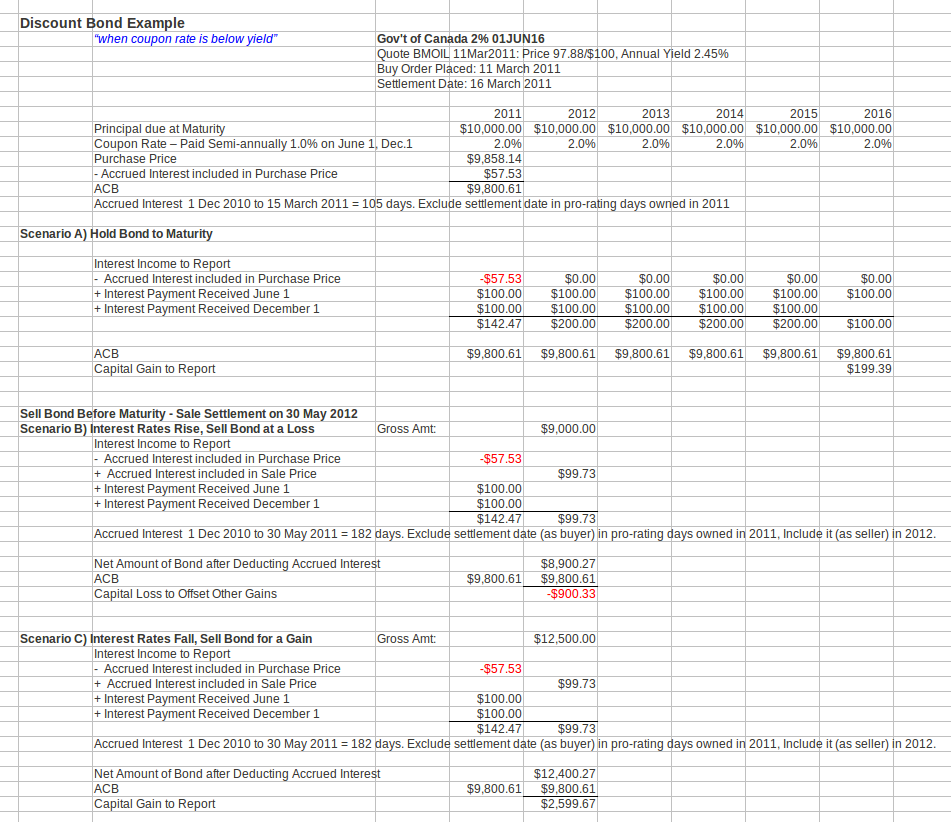

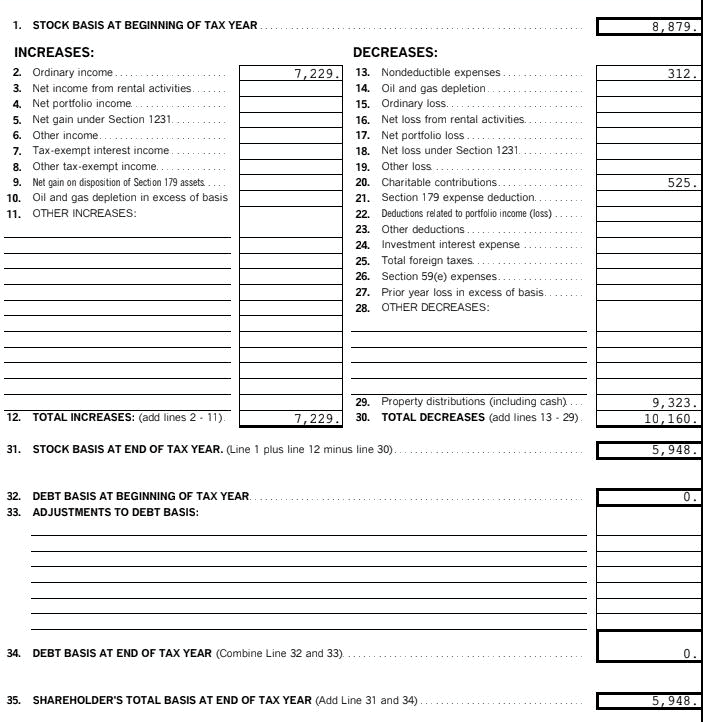

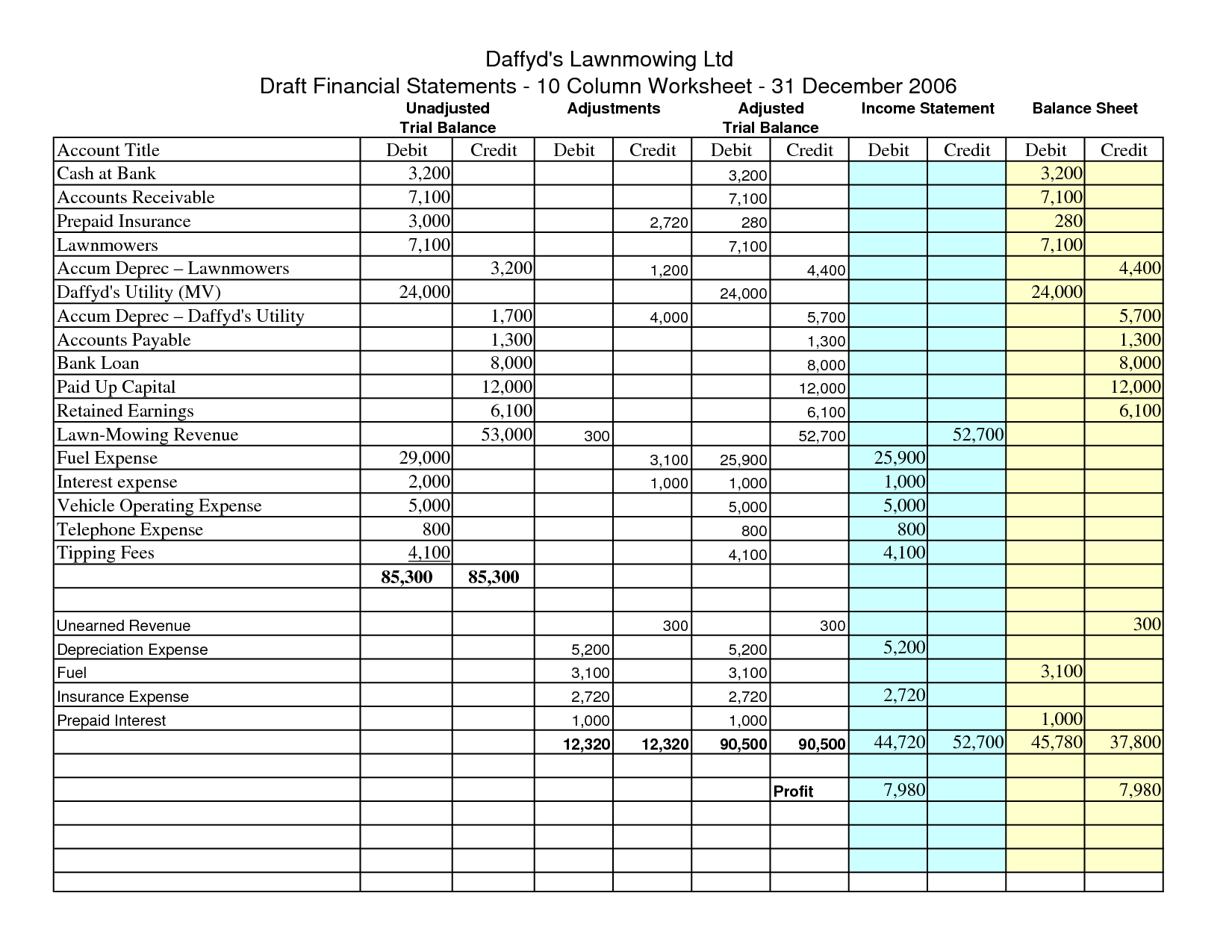

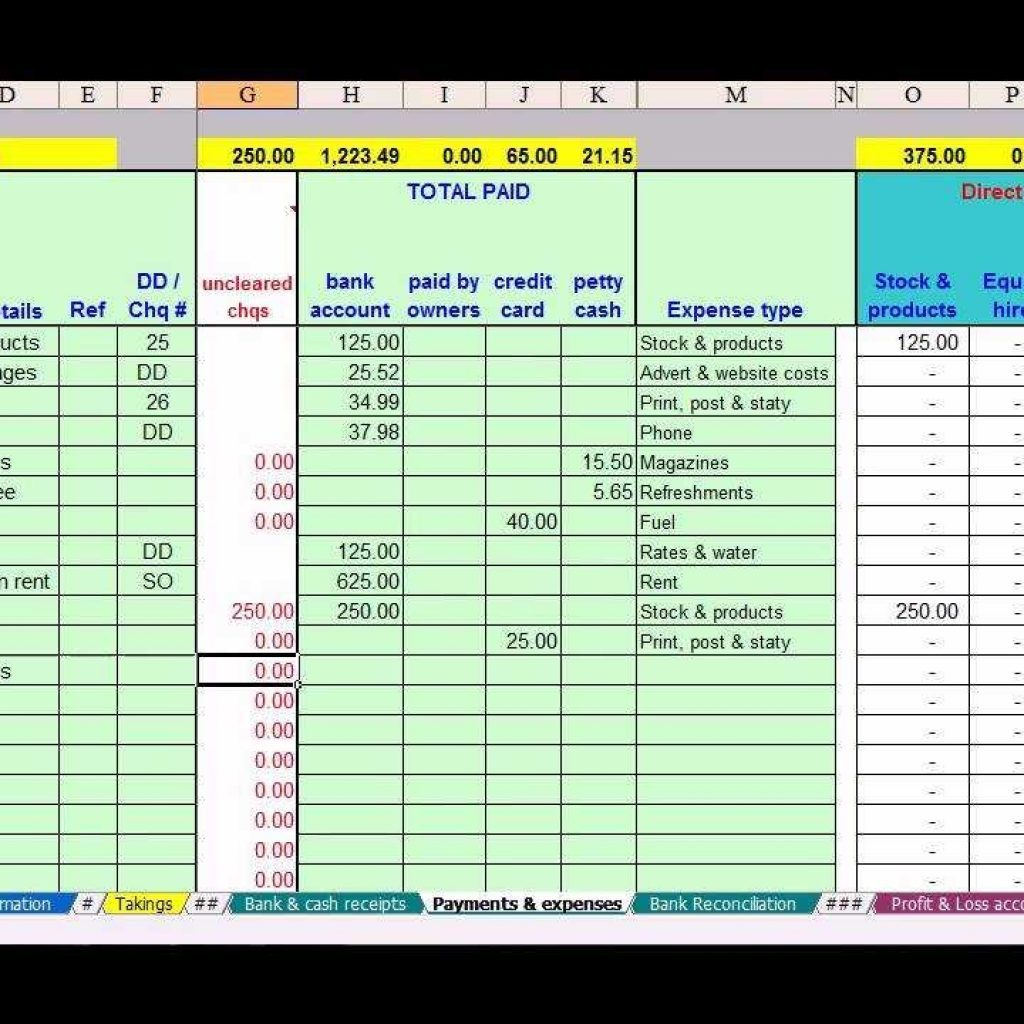

S-Corp Bookkeeping Template - Web we’ve collected 23 of the top bookkeeping templates for small business owners. Easily evaluate your revenue streams and gauge impact on your financials. It encompasses a variety of. Ad the complete legal accounting software available across all your devices. Each template is free to download, printable, and fully customizable to meet. We have unmatched experience in forming businesses online. Web get a free excel bookkeeping template for small business owners, plus a quick and painless guide to doing your own bookkeeping. Web s corporation basic bookkeeping. Web bookkeeping records ‐ if you use a bookkeeping system other than xero, you can provide us with a year‐end income statement, balance sheet and statement of cash flows. Stay compliant & maintain visibility over all firm transactions. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Web what is an excel accounting template? Leading accounting, bookkeeping & budgeting software for small & enterprise restaurants. Stay compliant & maintain visibility over all firm transactions. We have unmatched experience in forming businesses online. Web which excel templates are needed for accounting and bookkeeping? Web s corporation basic bookkeeping. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Learn how to set up payroll for your s corp with our s. Stay compliant & maintain visibility over all firm transactions. Ad integration & automation turns complex restaurant accounting work into simple tasks. We have unmatched experience in forming businesses online. Stay compliant & maintain visibility over all firm transactions. Start a free trial today! Ad the complete legal accounting software available across all your devices. Track everything in one place. Start a free trial today! Web get a free excel bookkeeping template for small business owners, plus a quick and painless guide to doing your own bookkeeping. Ad the complete legal accounting software available across all your devices. Start your corporation with us. Stay compliant & maintain visibility over all firm transactions. Web if an s corporation repays reduced basis debt to the shareholder, part or all of the repayment is taxable to the shareholder. Best overall payroll software for small businesses by business.com We have unmatched experience in forming businesses online. Web s corporation basic bookkeeping. Ad answer your new standards questions with our simple, downloadable asc 606 template. Regardless of the size of your s corporation, you must keep track of your business transactions. Web the s corporation can pay you rent for the home office. Each template is free to download, printable, and fully customizable to meet. Start a free trial today! Ad integrate book keeping with all your operations to avoid double entry. Completing a tax organizer will help you avoid. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. Web bookkeeping records ‐ if you use a bookkeeping system other than xero, you can provide us. Best overall payroll software for small businesses by business.com Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Start a free trial today! Start a free trial today! Ad integration & automation turns complex restaurant accounting work into simple tasks. Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, cash. Regardless of the size of your s corporation, you must keep track of your business transactions. Web s corporation basic bookkeeping. Leading accounting, bookkeeping & budgeting software for small & enterprise restaurants. Web according to the internal revenue service (irs),. Easily evaluate your revenue streams and gauge impact on your financials. Web s corporation basic bookkeeping. We have unmatched experience in forming businesses online. Web bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business. Track everything in one place. Ad manage all your business expenses in one place with quickbooks®. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Start your corporation with us. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Web if an s corporation repays reduced basis debt to the shareholder, part or all of the repayment is taxable to the shareholder. Start a free trial today! S corporations are subject to both state. Accounting is all about making sure you always have a clear view of your income, petty cash, cost management, cash. Web which excel templates are needed for accounting and bookkeeping? The s corporation can pay you for the costs of a home office under an accountable plan for employee business expense. Stay compliant & maintain visibility over all firm transactions. Ad integrate book keeping with all your operations to avoid double entry. Ad integration & automation turns complex restaurant accounting work into simple tasks. Excel templates for accounting and bookkeeping can boost productivity and save. Learn how to set up payroll for your s corp with our s. Explore the #1 accounting software for small businesses. Track everything in one place. Web according to the internal revenue service (irs), “s corporations are corporations that elect to pass corporate income, losses, deductions, and credits to. Start a free trial today! Ad the complete legal accounting software available across all your devices.Balance Sheet Sole Proprietorship Accounting Sample Verkanarobtowner

Excel Accounting And Bookkeeping (Template Included) Bench For Excel

Simple Bookkeeping Template 1 —

Scorp savings Singletrack Accounting

Sole Proprietorship vs SCorp Tax Spreadsheet for Publisher

Can you afford to be an S Corp? Bookkeeping business, Business tax

What Is the Basis for My SCorporation? TL;DR Accounting

Small Business Bookkeeping Template —

Excel cashbook template Download and edit for your business

Free Simple Bookkeeping Spreadsheet — DBC

Related Post: