Revenue Recognition Policy Template

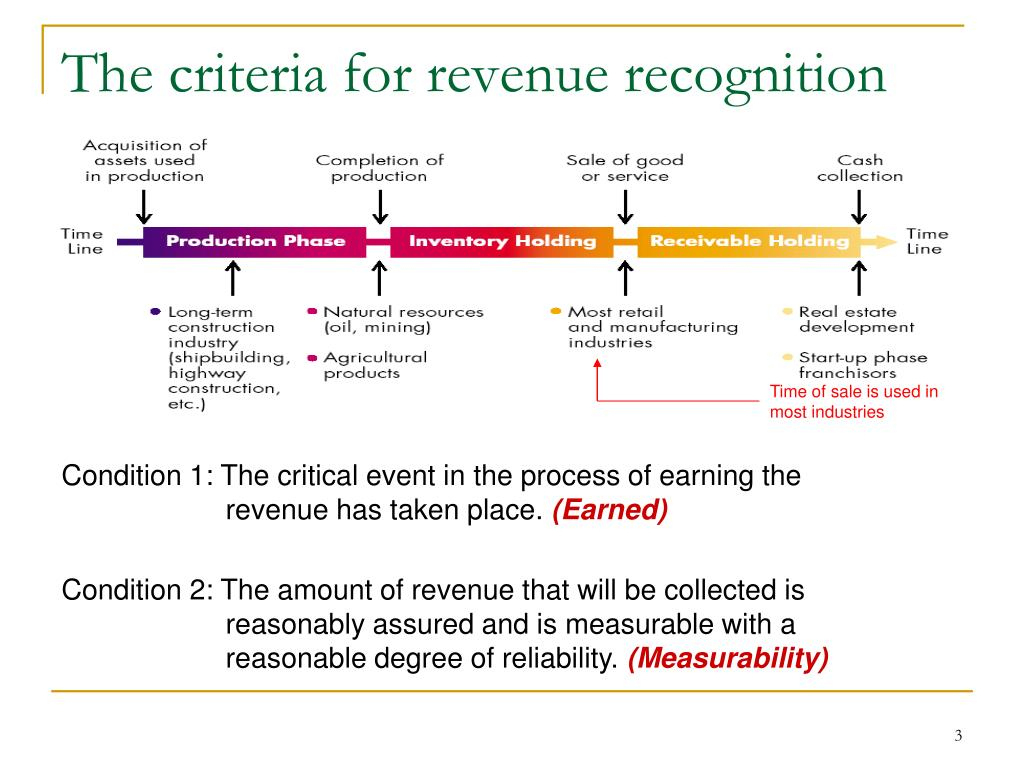

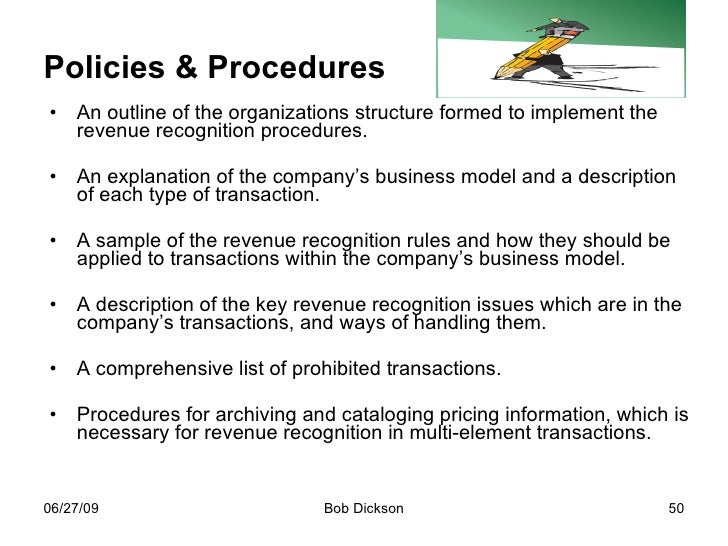

Revenue Recognition Policy Template - Step 1 → identify the signed contract between the seller and customer. Detailed instructions for the 5 step method. Revenues are generally earned when goods are shipped or services are performed. Web pwc's latest q&a guide helps these companies navigate common issues. Your business can apply different methods and policies when deciding how to recognize revenue. Identify the contract (s) with a customer. The company shall adopt a written revenue recognition policy within 2 months from the initial closing as such. The policy should be documented, reviewed and approved by appropriate levels of management and include the following for each performance obligation: Removes inconsistencies and weaknesses in existing revenue requirements. Identification of type of revenue. Web use this template to: Seller shall and cognizant will cause seller to continue its normal revenue recognition policy (i.e., revenue is not recognized until delivery of reports to ims). The company shall adopt a written revenue recognition policy within 2 months from the initial closing as such. With asc 606 in place, it has never been more important to. These guidelines are organized within the following sections: Ad answer your new standards questions with our simple, downloadable asc 606 template. Answer your questions around asc 606 and remove the complexity. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Understand rev rec and strategize for the future. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). The policy should be documented, reviewed and approved by appropriate levels of management and include the following for each performance obligation: While retail return policies are nuanced, you can bucket them into one of four general groups: Seller shall and cognizant will cause seller. With asc 606 in place, it has never been more important to ensure that your business is in compliance with revenue recognition regulations. Recognize revenue when (or as) the entity satisfies a performance obligation. The policy should be documented, reviewed and approved by appropriate levels of management and include the following for each performance obligation: Evaluate revenue streams relative to. Revenues are generally earned when goods are shipped or services are performed. Major sources of revenue and normal categorization. While retail return policies are nuanced, you can bucket them into one of four general groups: Answer your questions around asc 606 and remove the complexity. Step 2 → identify the distinct performance obligations within the contract. Put forth by the financial accounting standards board (fasb), asc 606 is a set of requirements that companies must satisfy before they can recognize revenue. Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. Identify the performance obligations in the contract. Web asc 606 revenue recognition template. Your business can apply different methods. Gauge the material impact on your financials. Web revenue recognition policy guidelines. Provide guidance on the allocation of transaction prices. Allocate the transaction price to performance obligations. Revenue recognition is a generally accepted accounting principle (gaap) that identifies the specific conditions in which revenue is recognized and. Revenue recognition resources provide information, guidance and other resources for the changes on. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Web revenue recognition policy guidelines. While retail return policies are nuanced, you can bucket them into one of four general groups: Step 1 → identify the signed contract between the seller. Put forth by the financial accounting standards board (fasb), asc 606 is a set of requirements that companies must satisfy before they can recognize revenue. Revenue recognition resources provide information, guidance and other resources for the changes on. Free accounting department organizational chart template. Revenue recognition is a generally accepted accounting principle (gaap) that identifies the specific conditions in which. Revenue recognition is an accounting principle used to determine when and how revenue is recognized or accounted for. Revenue recognition is a generally accepted accounting principle (gaap) that identifies the specific conditions in which revenue is recognized and. Web use this template to: Recognize revenue when (or as) the entity satisfies a performance obligation. Web each entity should consider developing. The type of business determines which policy to apply. Revenue recognition is an accounting principle used to determine when and how revenue is recognized or accounted for. Web use this template to: Step 2 → identify the distinct performance obligations within the contract. Please fill out form fields. The university requires that revenues be recognized on the accrual basis, meaning when they are earned, not necessarily when payment is received. This policy establishes when revenue must be recorded at the university. Step 3 → determine the specific transaction price (and other pricing terms) stated in the contract. The company shall adopt a written revenue recognition policy within 2 months from the initial closing as such. Provide guidance on the allocation of transaction prices. These guidelines are organized within the following sections: Provides a more robust framework for addressing revenue issues. Step 1 → identify the signed contract between the seller and customer. Allocate the transaction price to performance obligations. Choose a type of return policy. Evaluate revenue streams relative to new standards. Web pwc's latest q&a guide helps these companies navigate common issues. Answer your questions around asc 606 and remove the complexity. Revenue recognition should be based on accrual accounting in accordance with generally accepted accounting principles (gaap). Improves comparability of revenue recognition practices across entities, industries, jurisdictions, and capital markets.Accounting Policy Revenue Recognition

Simple Revenue Recognition Policy Template Policy template, Statement

Understanding the Importance of Revenue Recognition Policy

Awesome Revenue Recognition Policy Template Policy template

Professional Revenue Recognition Policy Template Sparklingstemware

Revenue Recognition

Revenue Recognition Principles, Criteria for Recognizing Revenues

Revenue Policy SaaSOptics

Revenue Recognition In Accounting Pdf REVNEUS

Revenue Recognition Policies Revenue Accrual

Related Post: