Response Letter To Irs Template

Response Letter To Irs Template - • you owe additional tax; We offer a comprehensive selection of affordable precisely written letters for response to any irs correspondence you may have. Web order the ultimate communicator now. Format one business letter and. The likelihood of getting an. Web how should you format a letter to the irs? Web home > notices > notice / letter template. If your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Full name of the person or business requesting the review of an irs penalty, known going forward as the. If you reply directly to an encrypted email you received from the irs within the secure webpage, the body of your reply and any attachments you send are. However, you have nothing to fear when you need to write them a letter. Web irs response letter template. The letters you write on behalf of your clients make a huge difference in the results you can achieve for them. You must show you’re in compliance with the. There is no magic formula for writing a letter to the irs. Web draft a response letter to the irs, outlining any claims that you dispute. The main thing you need to do is clearly explain why you are. If your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web that irs is one of the most feared government agencies. The. To minimize additional interest and. Generally, the irs sends a letter if: It is different for asking for abatement of the penalty of one year and abatement of the penalty of more than one previous year, as shown below. There is no magic formula for writing a letter to the irs. Or • the irs is requesting payment or needs. If you reply directly to an encrypted email you received from the irs within the secure webpage, the body of your reply and any attachments you send are. 100k+ visitors in the past month Web how should you format a letter to the irs? Generally, the irs sends a letter if: The main thing you need to do is clearly. To minimize additional interest and. Web how to survive getting an irs audit notice (with free response template!) by. The likelihood of getting an. There is usually no need to call the irs. Web how should you format a letter to the irs? Web order the ultimate communicator now. Fax your information to the fax number in the letter using either a fax machine or an online fax service. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip.. Web draft a response letter to the irs, outlining any claims that you dispute. • you owe additional tax; There is no magic formula for writing a letter to the irs. Web order the ultimate communicator now. Full name of the person or business requesting the review of an irs penalty, known going forward as the. The likelihood of getting an. There is usually no need to call the irs. Web draft a response letter to the irs, outlining any claims that you dispute. Web but what about extensions when the irs demands a response to a notice or letter within 30 days? Web order the ultimate communicator now. Depending on your requirement, there are different samples for you to look at and write a letter of explanation to the irs. Web that irs is one of the most feared government agencies. There is no magic formula for writing a letter to the irs. Web full name and spouse's full name if applicable ssn here (if you and your. The likelihood of getting an. 100k+ visitors in the past month Web that irs is one of the most feared government agencies. Or • the irs is requesting payment or needs additional. Web home > notices > notice / letter template. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first on your return) address 1 address 2 city, state zip. Try not to make any changes in the letters. The letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web reply to irs. A template to help those experiencing irs trouble fight for their rights! Web but what about extensions when the irs demands a response to a notice or letter within 30 days? Web home > notices > notice / letter template. It is different for asking for abatement of the penalty of one year and abatement of the penalty of more than one previous year, as shown below. Web order the ultimate communicator now. To minimize additional interest and. You can use this irs penalty response letter to file a request with. Web reply only if instructed to do so. Depending on your requirement, there are different samples for you to look at and write a letter of explanation to the irs. There is usually no need to call the irs. Web irs response letter template. Web how should you format a letter to the irs? Web draft a response letter to the irs, outlining any claims that you dispute. Provide specific reasons why you believe the irs is mistaken, and reference your. If your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: 100k+ visitors in the past monthLetter to the IRS IRS Response Letter Form (with Sample)

Cp2000 Response Letter Template Samples Letter Template Collection

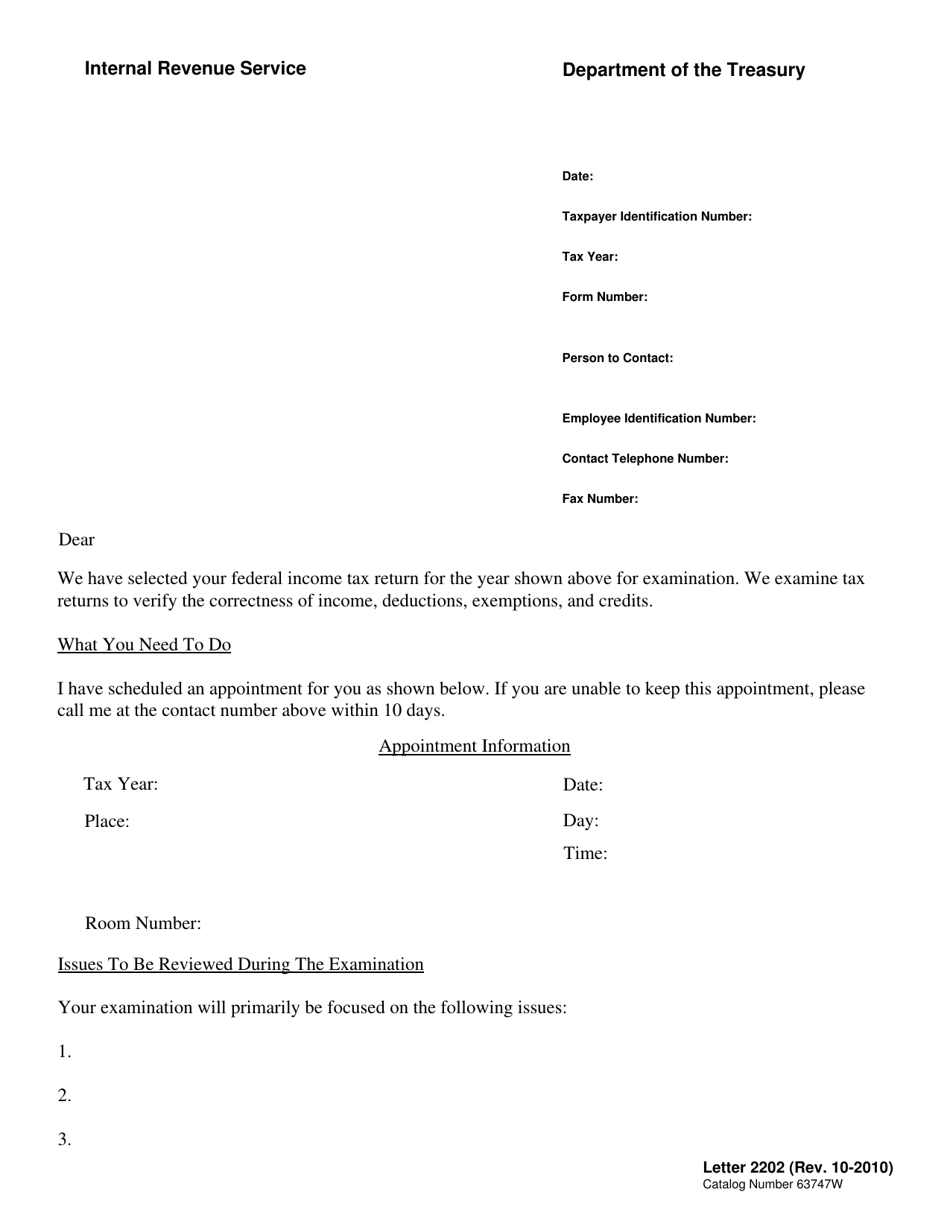

IRS Letter 2202, IRS Audit Letter Fill Out, Sign Online and Download

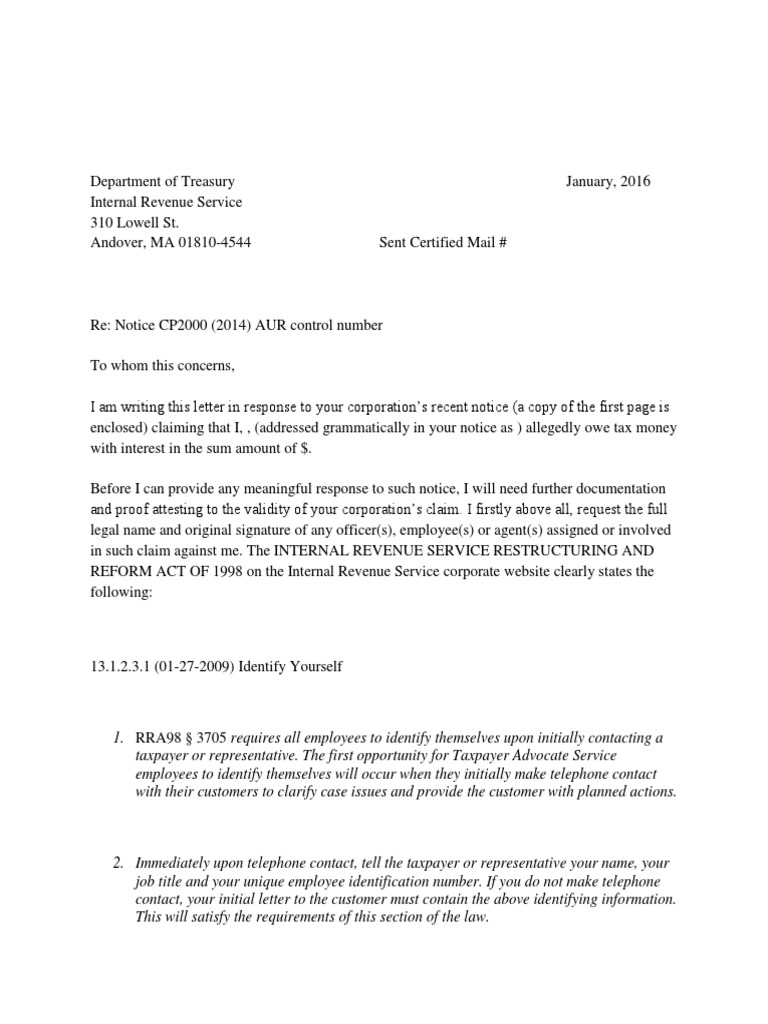

IRS Response Letter Template Federal Government Of The United States

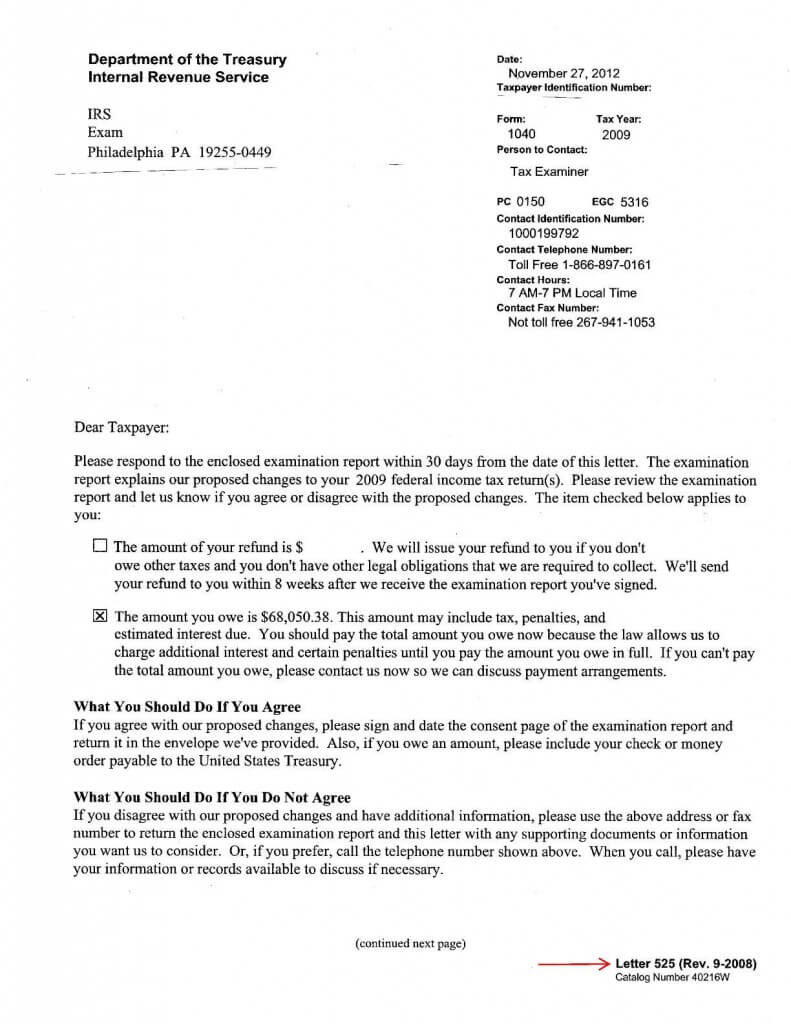

CP22E IRS Response Letter United States Federal Policy Politics

Sample Letter To Irs Free Printable Documents

IRS Audit Notice How to Survive One (With Free Response Template!)

Irs Letter Templates Colona.rsd7 With Irs Response Letter Template

How To Write A Disagreement Letter To The Irs Business Letter

Sample Letter To Irs

Related Post: