R&D Tax Credit Claim Template For Smes

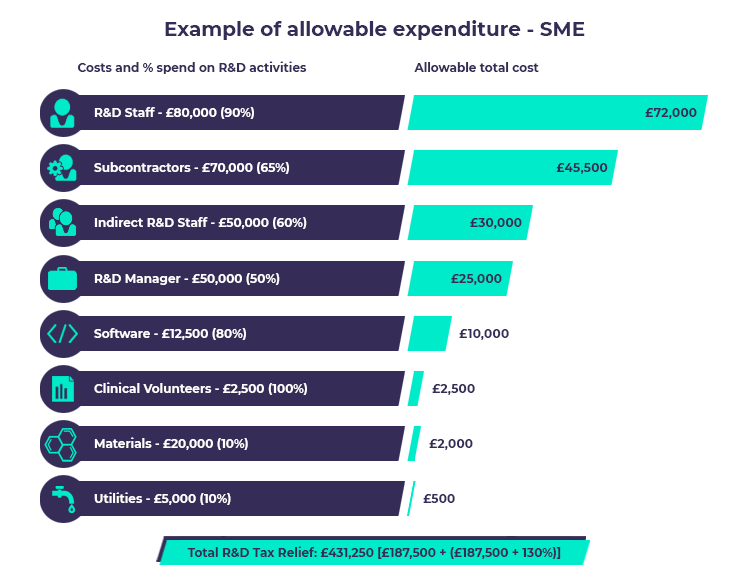

R&D Tax Credit Claim Template For Smes - Form 6765, credit for increasing research activities. You can also include the appropriate proportion of water, fuel and power used in your. Qualified research activities (qras) — sometimes called. Web £ materials and software. Web the tax code has supported r&d primarily through two policies: Web the r&d tax claim needs to be submitted with your annual corporate tax filing. Web there are two broad categories of activities that a business can claim towards the r&d tax credit: Web 21 july 2023 — see all updates. Web who can claim the r&d tax credit? Government tax relief to encourage r&d. Section a is used to claim the regular credit and has eight lines. Web in this paper, we examine the federal tax treatment of r&d investment, with a focus on the r&d tax credit and cost recovery for r&d expenses. Projects that count as r&d. Web r&d enhanced expenditure x new sme tax credit rate = tax credit claim value.. Less than 500 employees and, a turnover of less. Web what is the r&d tax credit claim template for smes? 23 more on grants and subsidies why is rdec important to smes? Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Projects that count as r&d. Web r&d enhanced expenditure x new sme tax credit rate = tax credit claim value. Web £ materials and software. Deduct in the first year); Include only what you've spent on materials and software for r&d. Web there are two broad categories of activities that a business can claim towards the r&d tax credit: Here are all the necessities: Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. Tax relief value = £86,000 (8.6% of relief) loss. An r&d credit refund claim on an amended return must contain certain specified items of information before it can. You’ll. Projects that count as r&d. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. 1) allow for companies to elect to expense r&d costs (i.e. Web there are two broad categories of activities that a business can claim towards the r&d tax credit: Government tax relief to encourage r&d. Web grow your business. 1) allow for companies to elect to expense r&d costs (i.e. Ad the r&d tax credit is a tax incentive that encourages businesses to invest in r&d. Government tax relief to encourage r&d. Web the new requirements take effect jan. Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. Web r&d enhanced expenditure x new sme tax credit rate = tax credit claim value. Web grow your business. Web the tax code has supported r&d primarily through two policies: The aim of the. You can also include the appropriate proportion of water, fuel and power used in your. Form 6765, credit for increasing research activities. Ad get lease, contracts & tax forms now. Government tax relief to encourage r&d. As well as how the costs. For the purposes of r&d tax credits, hmrc defines a business as being an sme if it has: Web the new requirements take effect jan. Web there are two broad categories of activities that a business can claim towards the r&d tax credit: The r&d credit is available to any business that incurs expenses while attempting to develop new or. Web who can claim the r&d tax credit? Web what is the r&d tax credit claim template for smes? Reduce your tax liability with r&d tax credit Create, edit, and print your business and legal documents quickly and easily! Get emails about this page. Reduce your tax liability with r&d tax credit Web r&d enhanced expenditure x new sme tax credit rate = tax credit claim value. 23 more on grants and subsidies why is rdec important to smes? Web there are two broad categories of activities that a business can claim towards the r&d tax credit: For the purposes of r&d tax credits, hmrc defines a business as being an sme if it has: Web what are smes? Web the tax code has supported r&d primarily through two policies: Section a is used to claim the regular credit and has eight lines. Include only what you've spent on materials and software for r&d. Less than 500 employees and, a turnover of less. You’ll submit this claim at the same. Ad the r&d tax credit is a tax incentive that encourages businesses to invest in r&d. Government tax relief to encourage r&d. Web who can claim the r&d tax credit? Deduct in the first year); Calculate over 1,500 tax planning strategies automatically and save tens of thousands You can also include the appropriate proportion of water, fuel and power used in your. Identify your qualifying r&d spend (qualifying expenditure, or qe) the biggest part of an r&d tax credit application is knowing which of your costs you can. An r&d credit refund claim on an amended return must contain certain specified items of information before it can. Projects that count as r&d.R&D Tax Credits UK What Is It & How To Claim Capalona

How to Optimise R&D Tax Credit Claims Enhance Consultants

An Infographic on HMRC R&D Tax Credits RDP Associates

Are You Eligible For R&D Tax Credit? Find out using this infographic

R&D Tax Credit Guidance for SMEs Market Business News

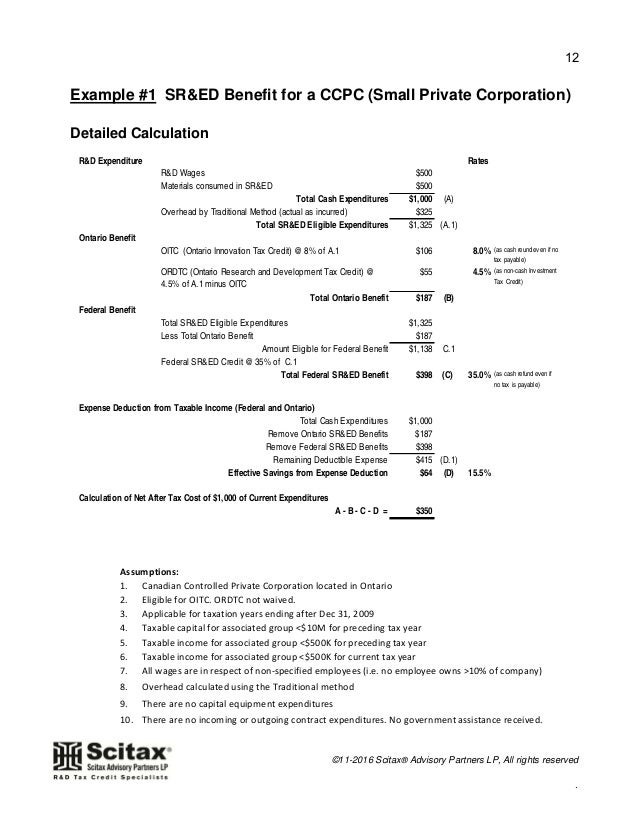

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

R&D Tax Credit Rates For SME Scheme ForrestBrown

Don't Your R&D Tax Credit Claim Startup Tax Accountant for

R&D Tax Credits The Essential Guide (2020)

The benefits of R&D tax relief for SMEs Whitley Stimpson Oxfordshire

Related Post: