Probate Accounting Template

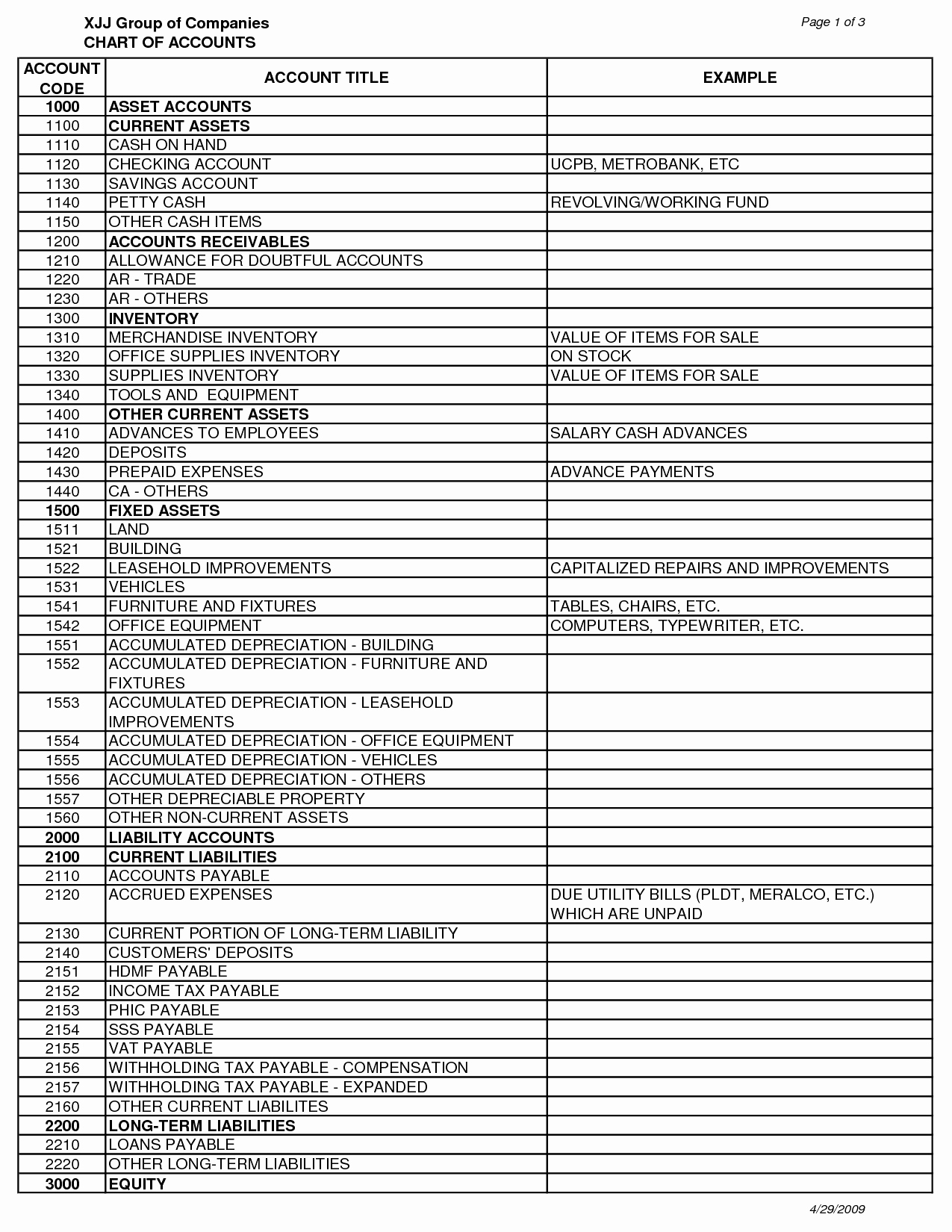

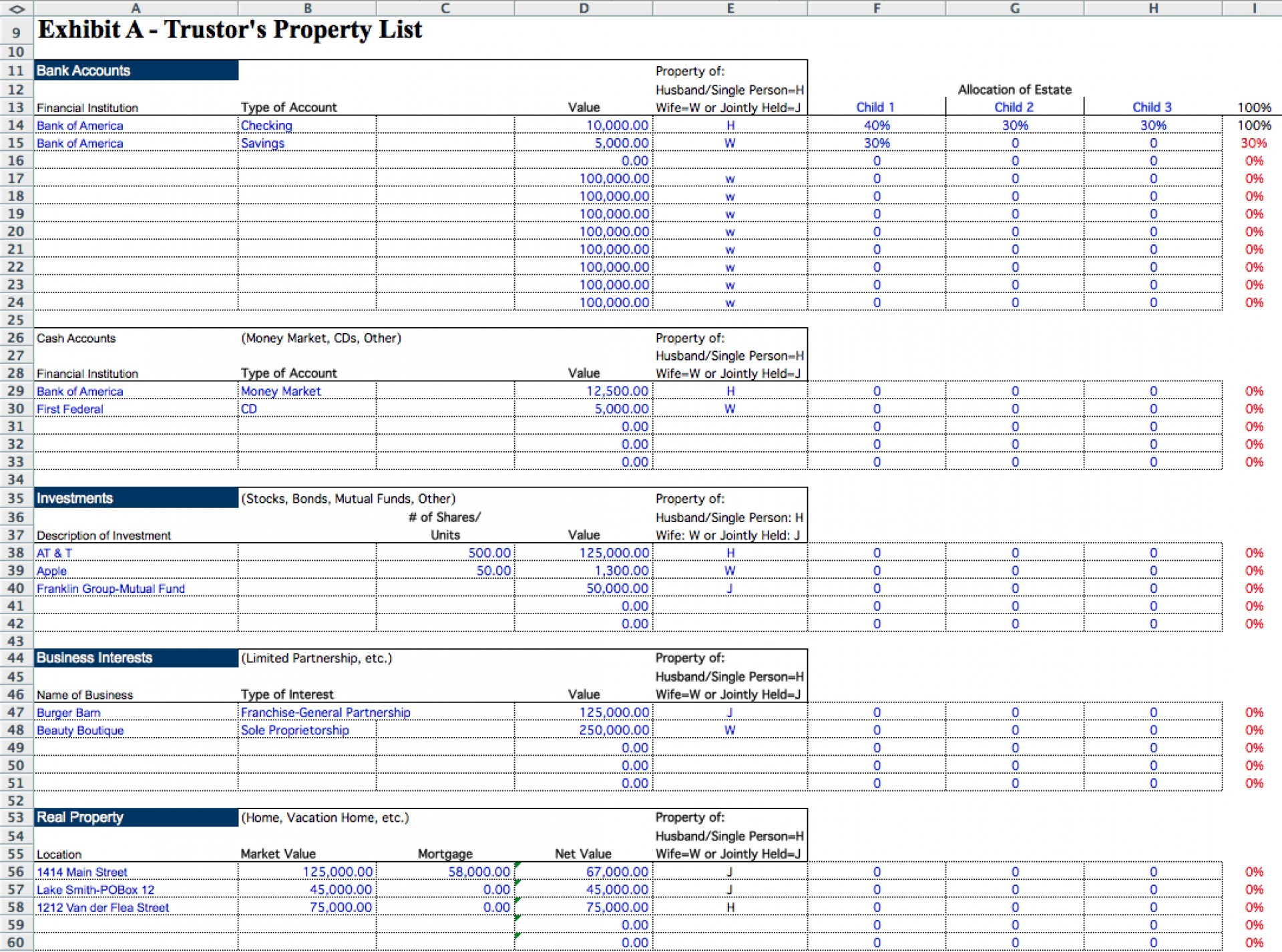

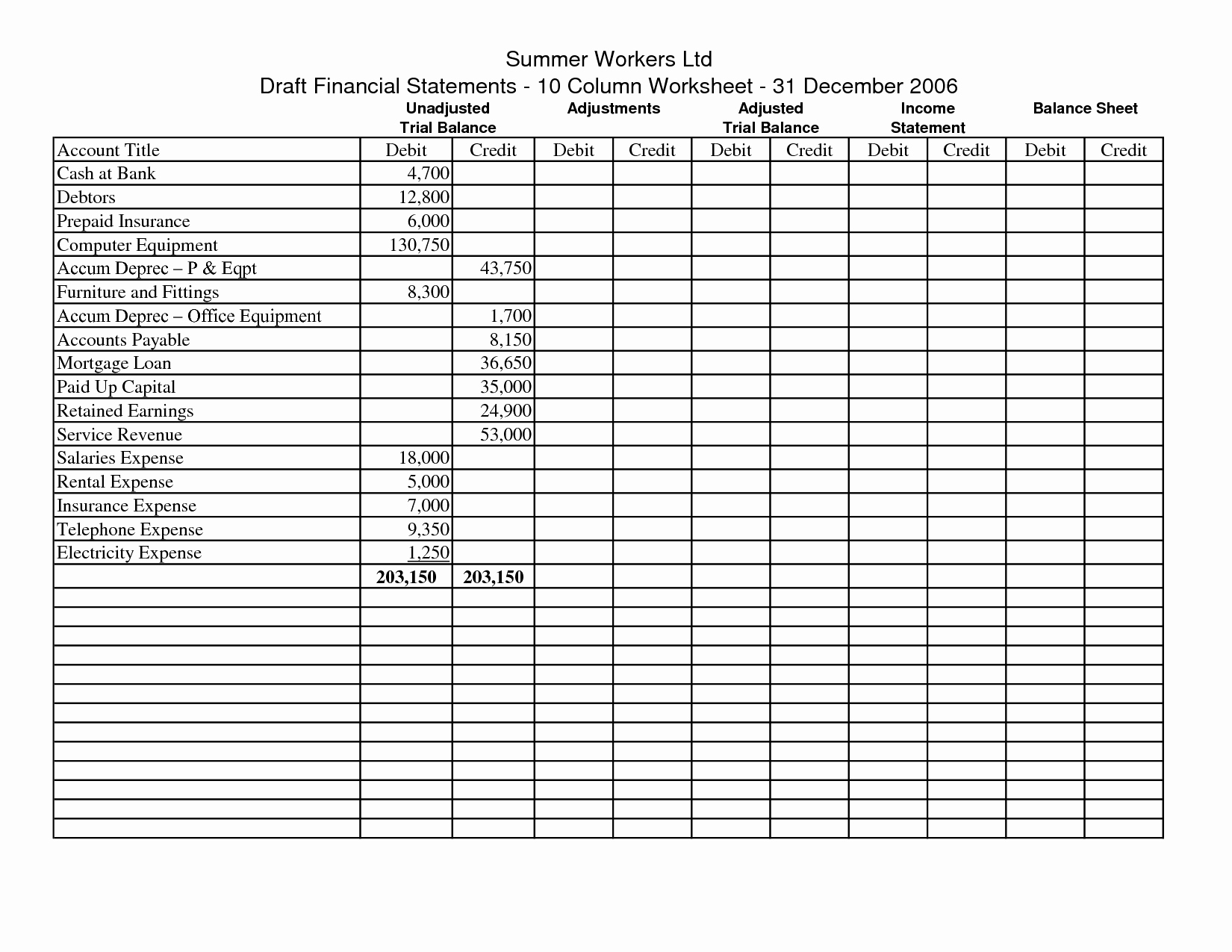

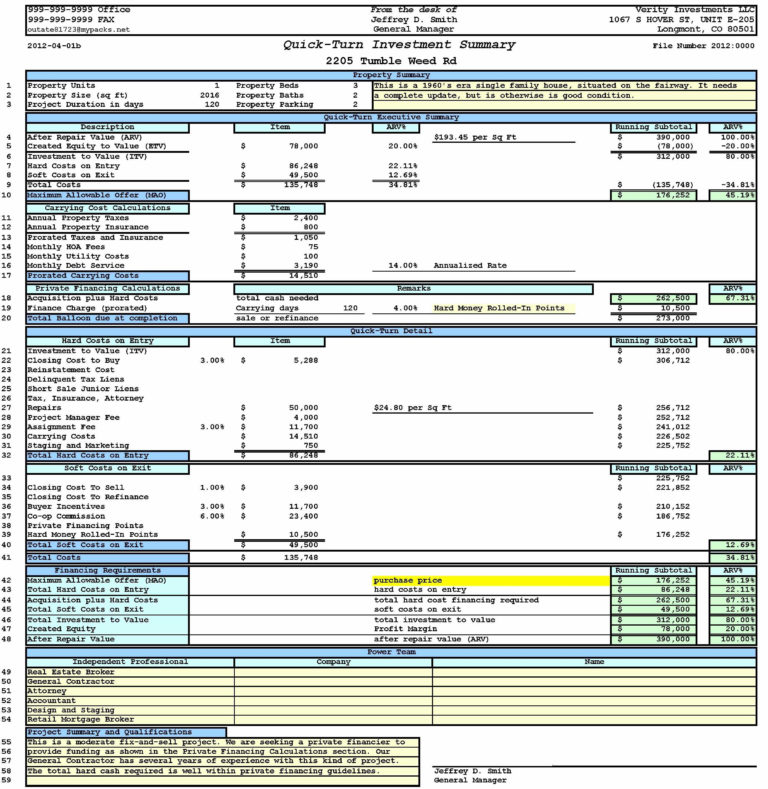

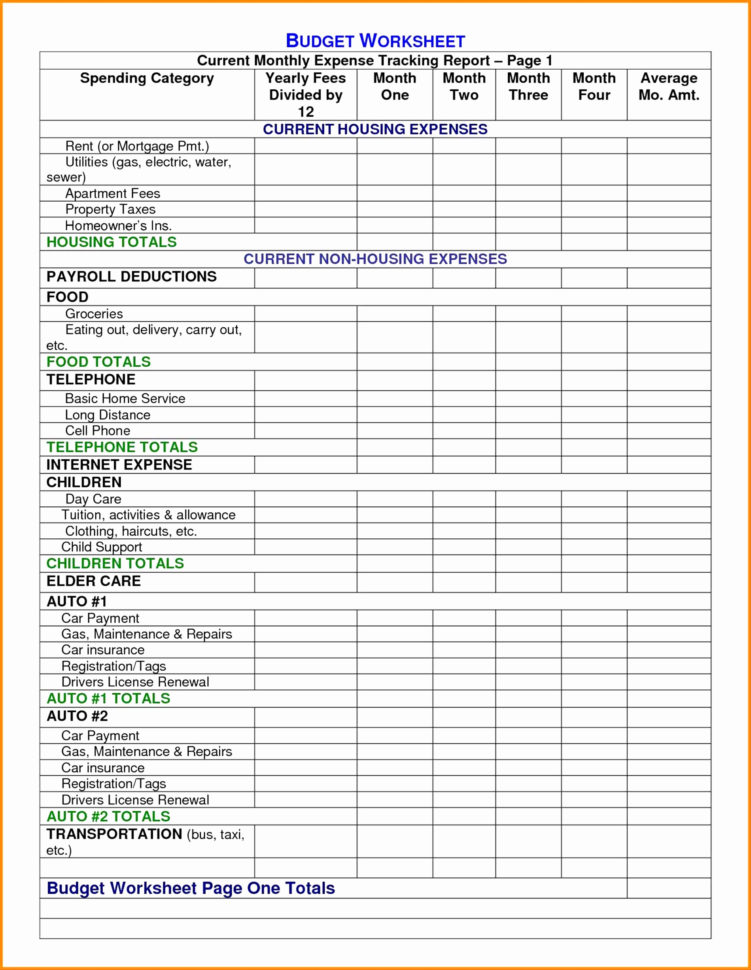

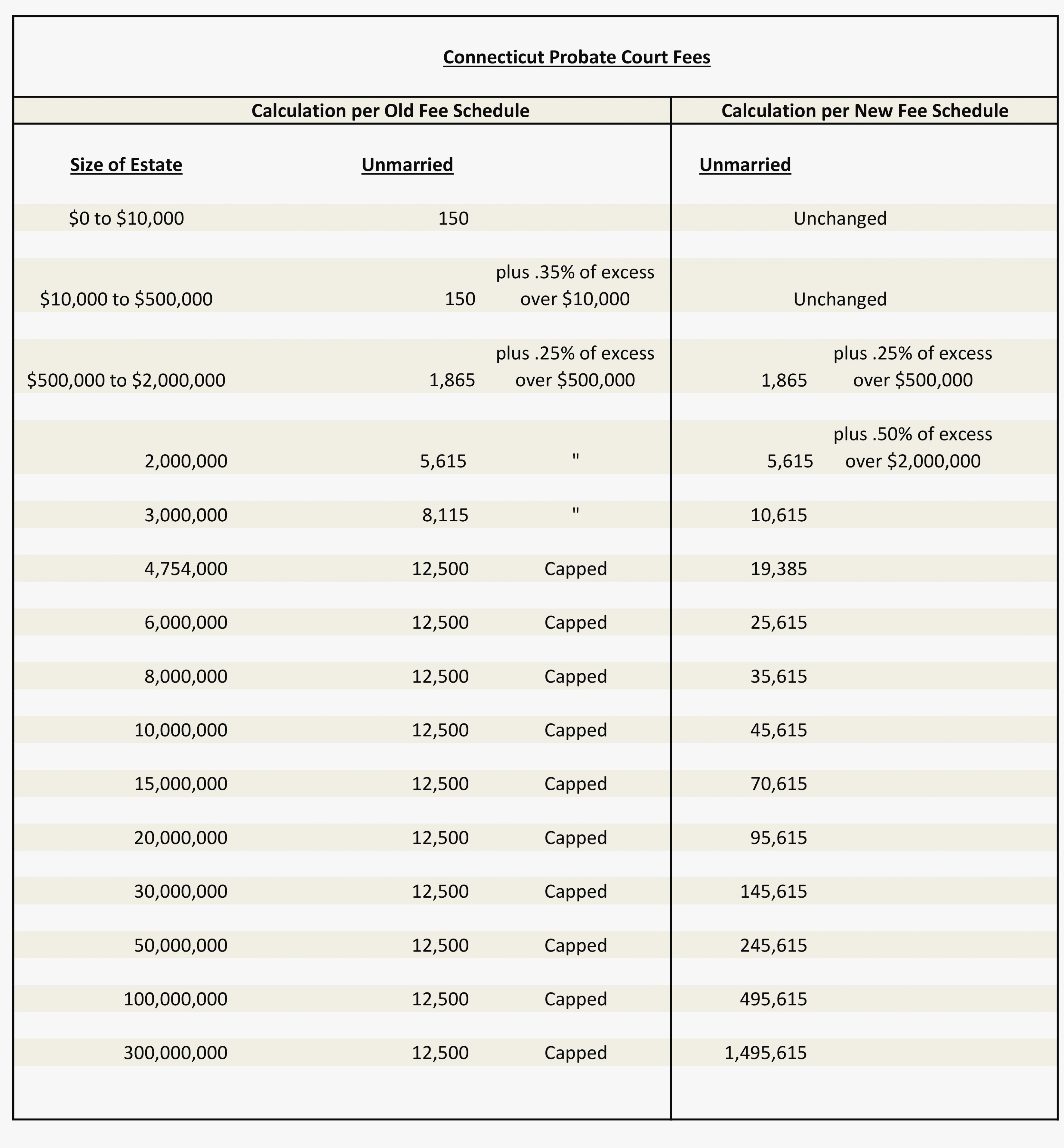

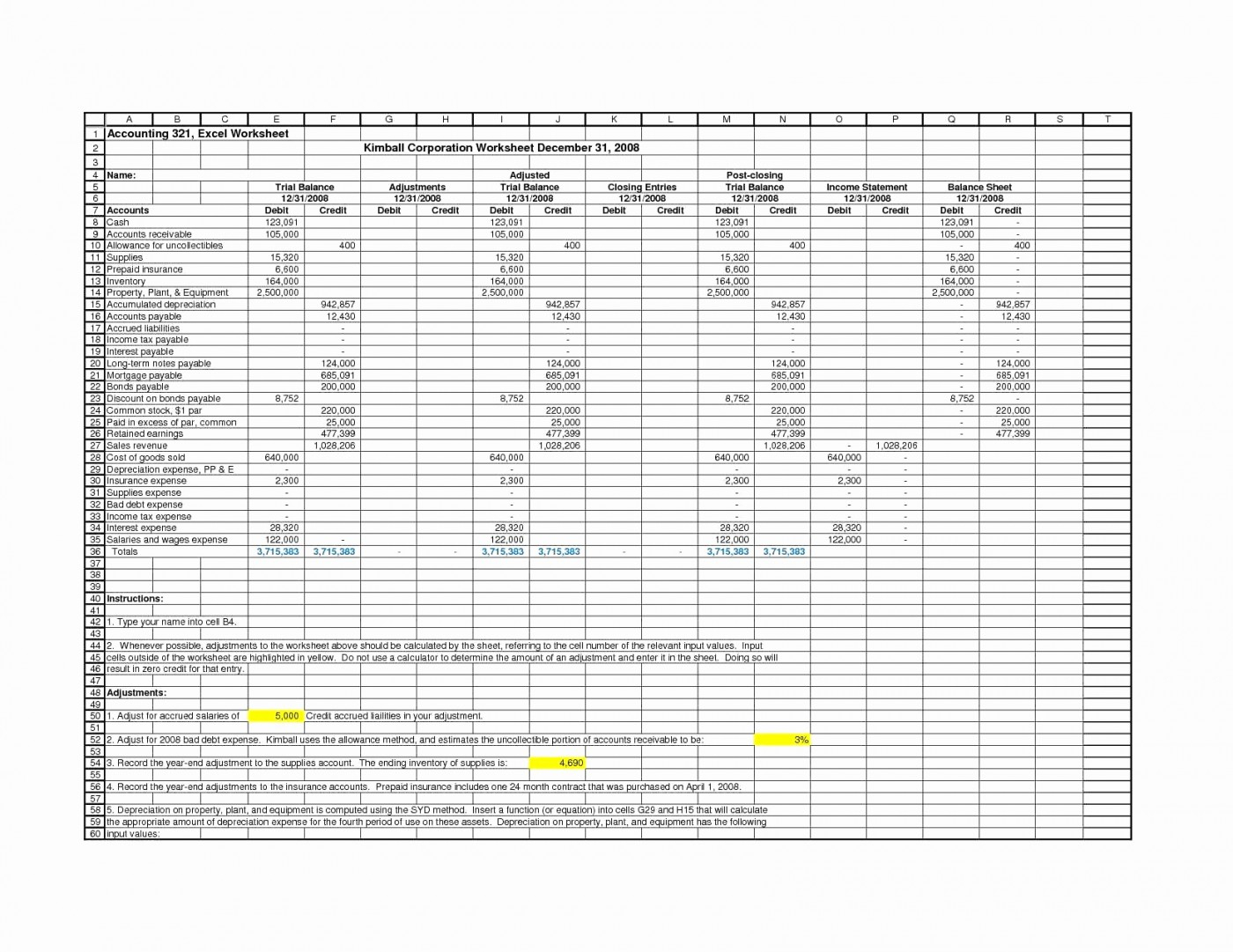

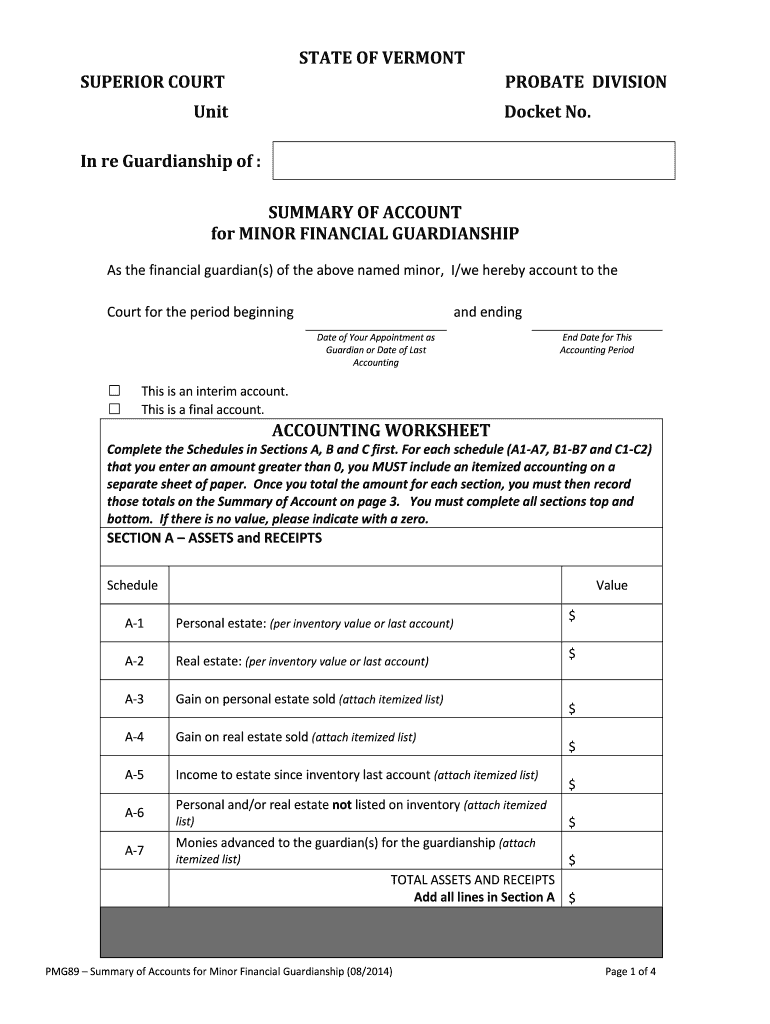

Probate Accounting Template - To use these simplified guidelines, you should. How to prepare inventory for probate. Web 11 online executor resources. 3% of the next $100,000. Track everything in one place. An accounting is a record of an estate’s assets and financial activity. Web the probate final accounting is the last step to close the estate and distribute assets to the estate heirs and pay the creditors who have filed legitimate claims. Web accounts must be signed by each of the executors, administrators or curators. Ad manage all your business expenses in one place with quickbooks®. Summarize accounting concepts for accounting for estates or trusts. Write a letter to the trustee of the trust and have it delivered certified mail. Explore the #1 accounting software for small businesses. Before inventory for probate can be filed, it must be prepared. The court accountant has prepared accounting guidelines for probate accounts. The process for the final accounting varies somewhat among the states so the required forms vary. Web lesson 2 accounting for estates and trusts completion of this lesson will enable you to: Section 16062 of the california probate code requires trustees to provide an. An account must be filed within 16 months of qualification or the date of the last account period, covering a period not exceeding 12 months. Let exceldownloads help you organize the information. Ad promote your firm's efficiency with mycase legal accounting software. Ad easily sync odoo accounting with your inventory stock and keep your valuation up to date. Serving as an executor of an estate can be challenging. Web 3 attorney answers. The process for the final accounting varies somewhat among the states so the required forms vary as well. Web 3 attorney answers. Identify the accountant’s role and describe gaap principles concerning fiduciary accounting. Write a letter to the trustee of the trust and have it delivered certified mail. What must i do to close the estate? Ad manage all your business expenses in one place with quickbooks®. Ad easily sync odoo accounting with your inventory stock and keep your valuation up to date. 2% of the next $800,000. Ad manage all your business expenses in one place with quickbooks®. Does a status report need to be filed? You may end the account on any day of a. Web up to 25% cash back 4% of the first 100,000 of the gross value of the probate estate. Summary of account—standard and simplified accounts (name):. 3% of the next $100,000. Summarize accounting concepts for accounting for estates or trusts. To use these simplified guidelines, you should. After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Does a status report need to be filed? Track everything in one place. To use these simplified guidelines, you should. Or (c) an informal accounting with receipts and. Does a status report need to be filed? Web 3 attorney answers. Section 16062 of the california probate code requires trustees to provide an. Web an estate accounting can be rendered in one of three ways: You’ll need to show the probate court and the beneficiaries that you’ve administered the estate in full compliance with the law and your fiduciary. 2% of the next $800,000. Section 16062 of the california probate code requires trustees to provide an. Does a status report need to be filed? An account must be filed within 16 months of qualification or the date of the last account period, covering a period not exceeding 12 months. (b) a decree on filing of instruments approving the accounting. As mentioned in the article closing an estate in a formal probate process, the attorney. Web up to 25% cash back 4% of the first 100,000 of the gross value of the probate estate. Posted on jan 17, 2017. The court will enter an order directing the performance of your duties in your fiduciary role as a personal representative, guardian,. Use our probate inventory template spreadsheet to record the details you need to settle an. An accounting is a record of an estate’s assets and financial activity. Web up to 25% cash back 4% of the first 100,000 of the gross value of the probate estate. Web probate accounting, also known as trust accounting, is simply an accounting of the transactions undertaken by an estate during a specific reporting period. Track everything in one place. Web accounts must be signed by each of the executors, administrators or curators. Manage your law firm with one, easy to use platform. 3% of the next $100,000. Leading accounting, bookkeeping & budgeting software for small & enterprise restaurants. Identify the accountant’s role and describe gaap principles concerning fiduciary accounting. Using this system, probating a typical. Summarize accounting concepts for accounting for estates or trusts. Professionally prepared by local firm A party may object to an accounting if they believe that it is inaccurate or misleading. An account must be filed within 16 months of qualification or the date of the last account period, covering a period not exceeding 12 months. Web download probate inventory free excel template. Luckily, there are many great online resources you can access right from your computer. A reasonable amount of anything over $25 million. Web creating an income and expense report on the estate account. Explore the #1 accounting software for small businesses.Probate Accounting Template Excel New Probate Accounting Template and

Probate Accounting Template Excel

Probate Spreadsheet Template —

Probate Accounting Spreadsheet Inspirational Spreadsheet Probate within

Probate Spreadsheet Template intended for 9 Unique Spreadsheet For

Probate Accounting Spreadsheet Google Spreadshee probate accounting

Probate Spreadsheet Template Google Spreadshee probate spreadsheet

Probate Accounting Spreadsheet Google Spreadshee probate accounting

Probate Accounting Form Fill Out and Sign Printable PDF Template

Probate Accounting Template Excel

Related Post: