Printable 501C3 Donation Receipt Template

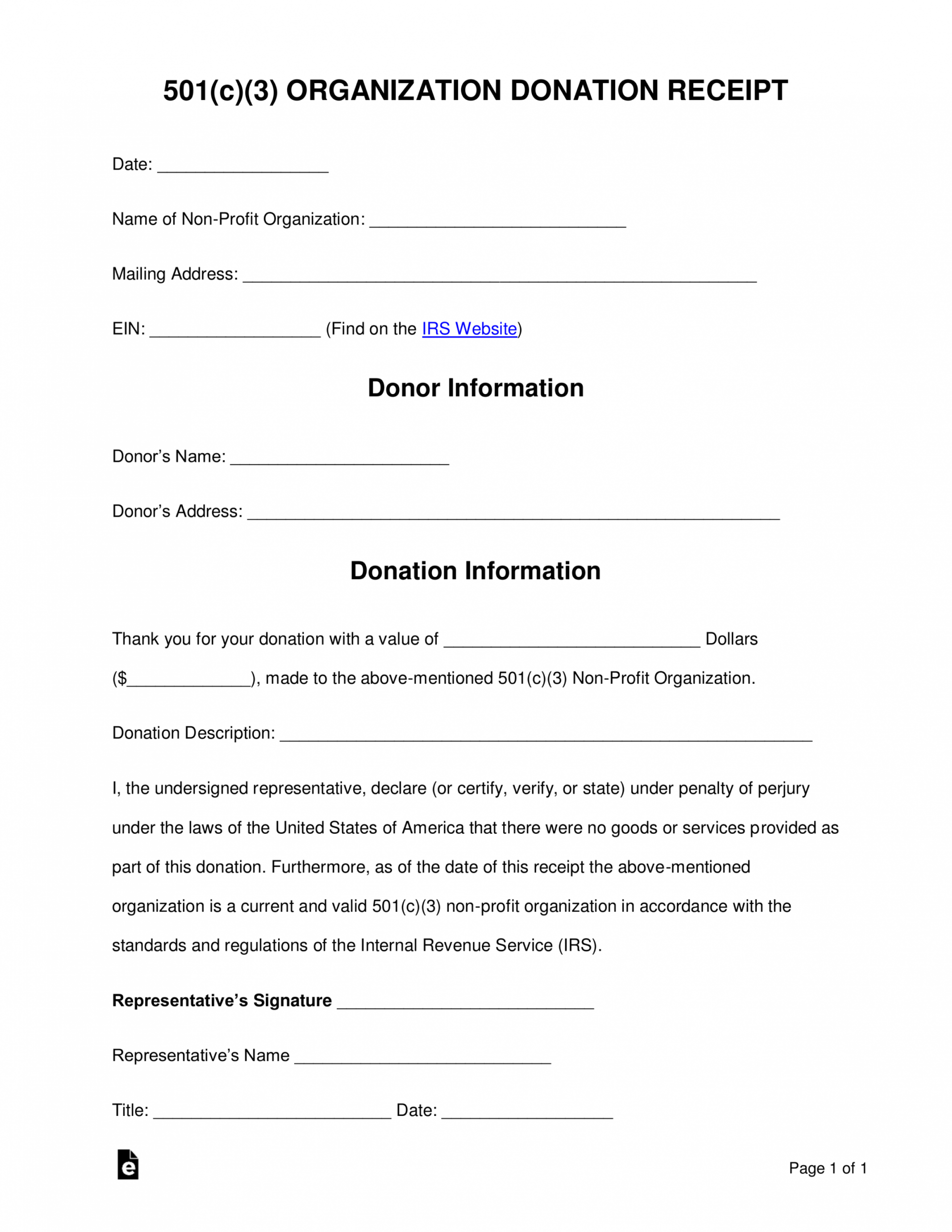

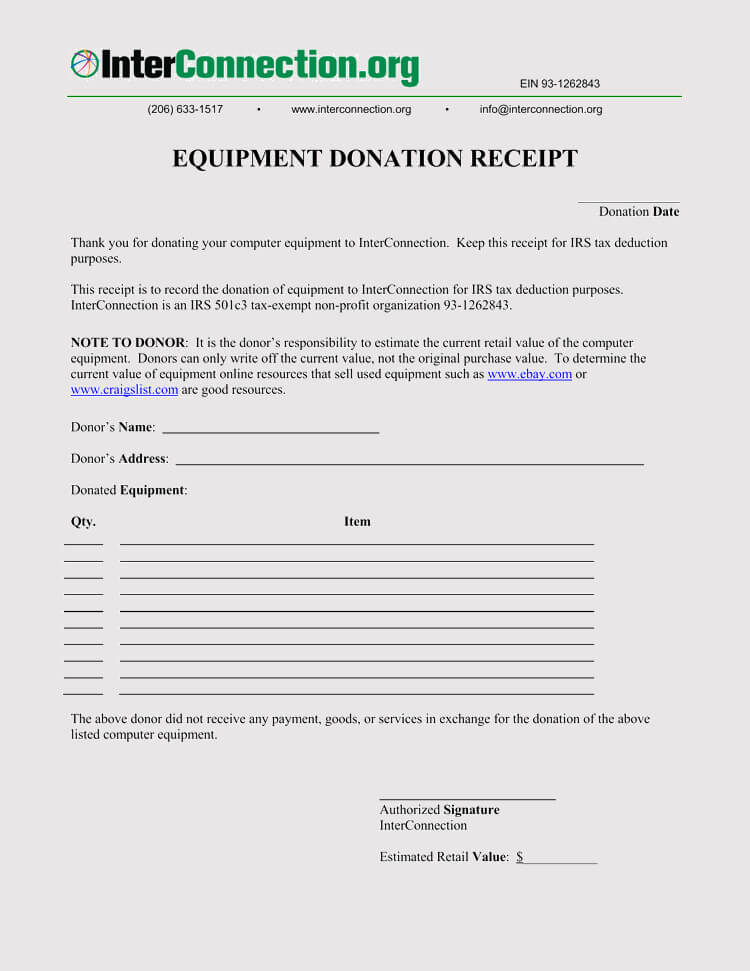

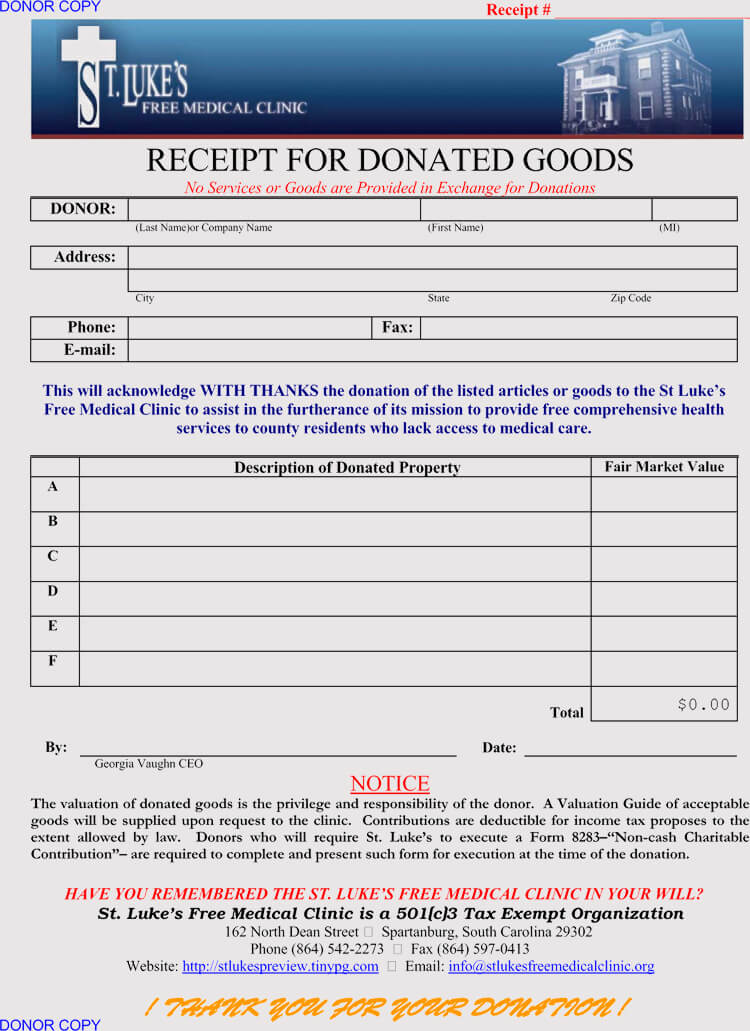

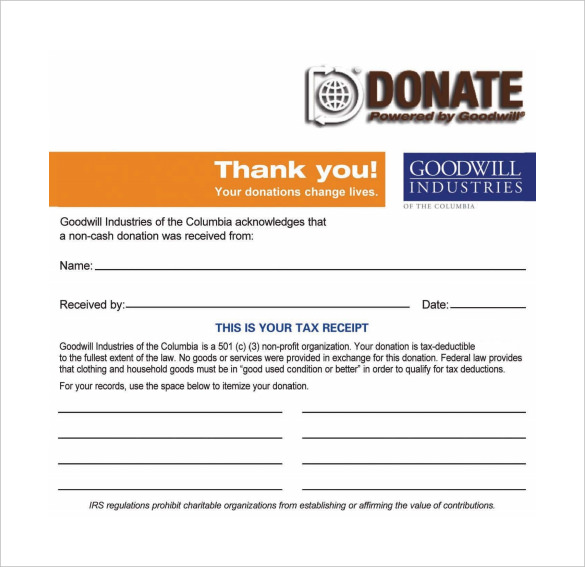

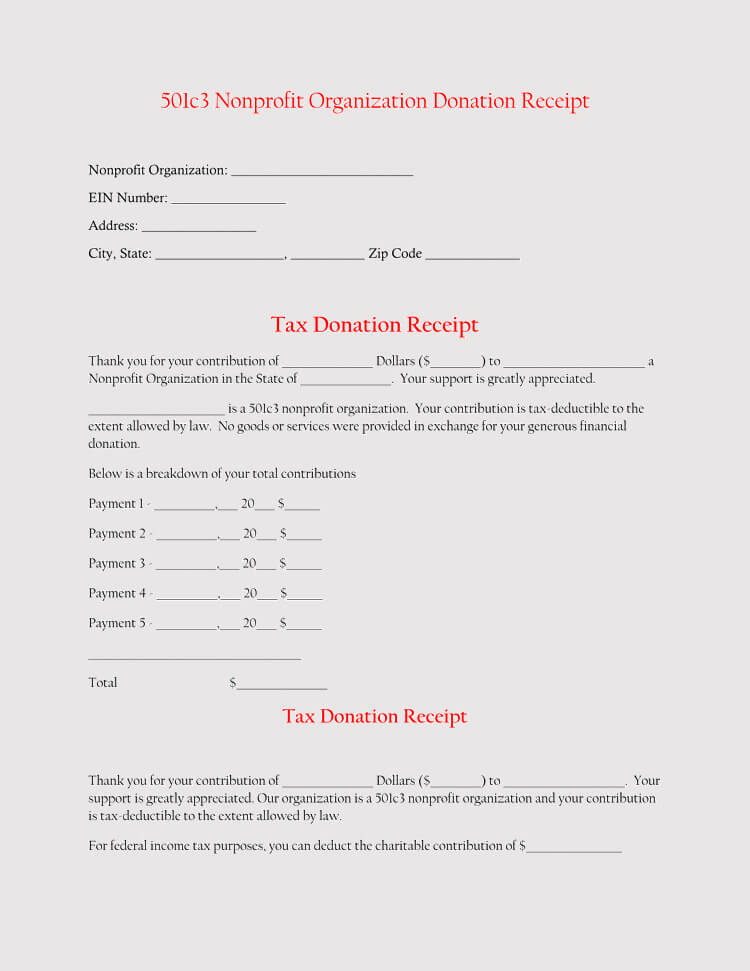

Printable 501C3 Donation Receipt Template - Ad create professional, legal documents for starting & running your business. The receipt shows that a charitable contribution was made to your organization by the individual or business. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Furthermore, as of the date of this receipt the above. A 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. The irs requires a donation receipt if the donation made is more than $250 regardless of whether the. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. Therefore, to help you use a template as a reference, we’ve created a downloadable donation receipt sample for cash contributions. Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. The organization must be exempt at the time of the. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good. Furthermore, as of the date of this receipt the above. Downloadable excel invoice templates here’s our collection of donation receipt templates. Web these are examples of tax donation receipts that a 501c3. The receipt shows that a charitable contribution was made to your organization by the individual or business. The #1 website for free legal forms and documents. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the. When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: The irs requires a donation receipt if the donation made is more than $250 regardless of whether. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. The template should include the legal name, address, and contact details of the nonprofit organization. This offer ends in. The template should include the legal name, address, and contact details of the nonprofit organization. The organization must be exempt at the time of the. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. The irs requires a donation receipt if the donation made is more than $250 regardless of whether the.. The #1 website for free legal forms and documents. Furthermore, as of the date of this receipt the above. While looking at the description of such a donation receipt. Web blank 501c3 donation receipt in pdf & word. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Ad finalize transactions in mins w/ our receipt templates. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Web donation receipt templates download “donation receipt template 02” (19.27 kb) download “donation receipt template 03” (12.86 kb) download “donation receipt template 04” (86.50 kb) download “donation receipt template 05” (94.00 kb). The receipt. Feel free to download, modify and use any you like. This offer ends in 0 days : Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web a donation receipt is. In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable. Web i, the undersigned representative, declare (or certify, verify, or state) under penalty of perjury under the laws of the united states of america that there were no goods or services provided as part of this donation. Ad. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Web 501(c)(3) organization donation receipt date: When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can. This information helps identify the organization and establishes its legitimacy. Web 501(c)(3) organization donation receipt date: Therefore, to help you use a template as a reference, we’ve created a downloadable donation receipt sample for cash contributions. Web a 501c3 donation receipt template is issued only by registered charitable organizations and allows users to claim tax benefits based on their donations. You should include the dollar value of the item received. Charities are only required to submit 501c3 donation receipts for amounts greater than $250, but it is good. Web these are examples of tax donation receipts that a 501c3 organization should provide to its donors. The organization must be exempt at the time of the. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. The receipt shows that a charitable contribution was made to your organization by the individual or business. Web these email and letter templates will help you create compelling donation receipts without taking your time away from your donors: Access legal documents to help you invoice clients, hire employees, gain funding & more. Feel free to download, modify and use any you like. While looking at the description of such a donation receipt. Ad create professional, legal documents for starting & running your business. Web blank 501c3 donation receipt in pdf & word. Web donation receipt templates download “donation receipt template 02” (19.27 kb) download “donation receipt template 03” (12.86 kb) download “donation receipt template 04” (86.50 kb) download “donation receipt template 05” (94.00 kb). The #1 website for free legal forms and documents. Furthermore, as of the date of this receipt the above. The irs requires a donation receipt if the donation made is more than $250 regardless of whether the.Free 501C3 Donation Receipt Template Sample Pdf Charity Donation Form

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

501c3 donation receipt template addictionary free donation receipt

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

501c3 Donation Receipt Template printable receipt template

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

Printable 501c3 Donation Receipt Template Printable Templates

Printable Form Section 501c3 Printable Forms Free Online

501c3 Form Sample

Related Post: