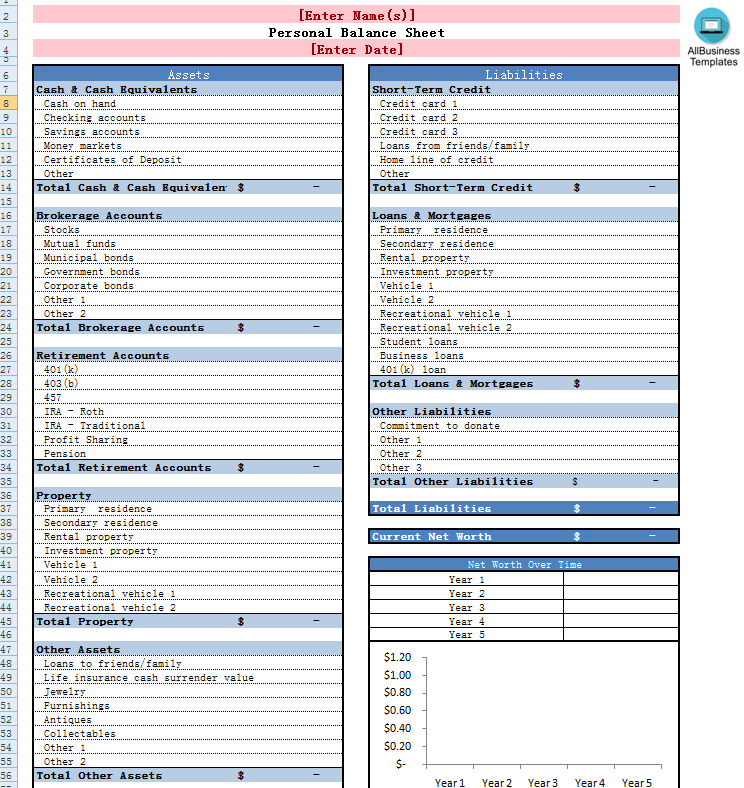

Personal Balance Sheet Excel Template

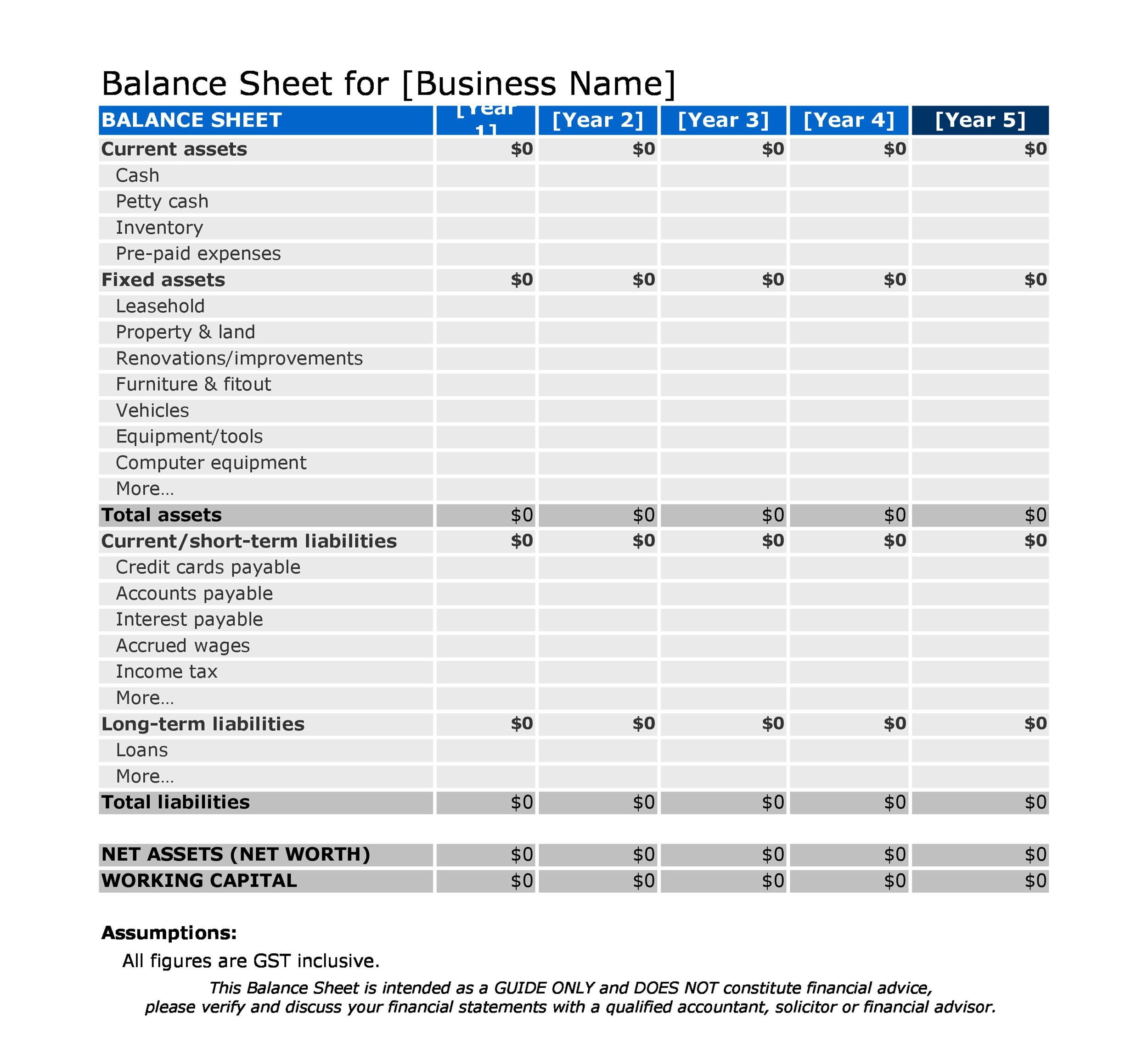

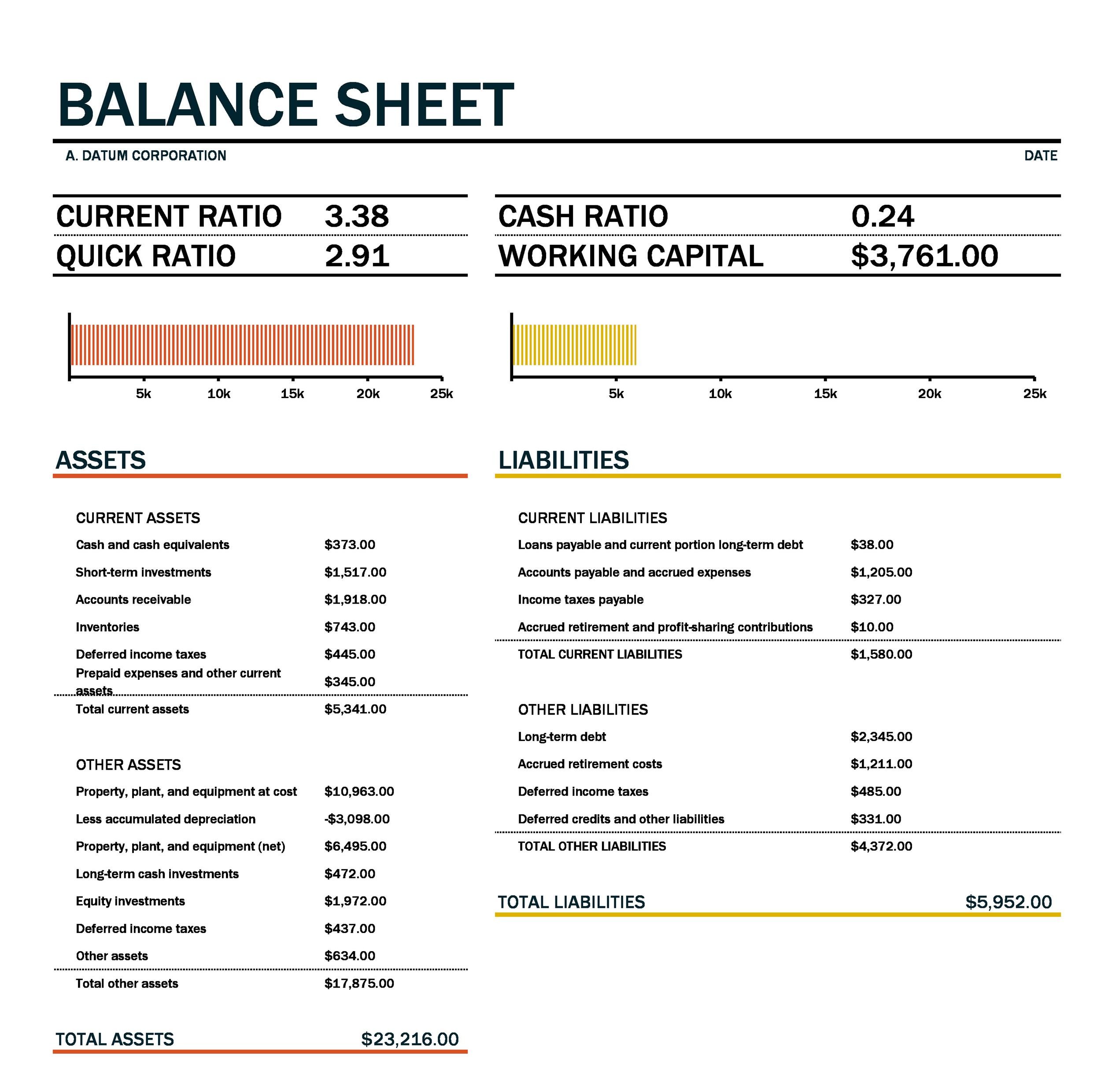

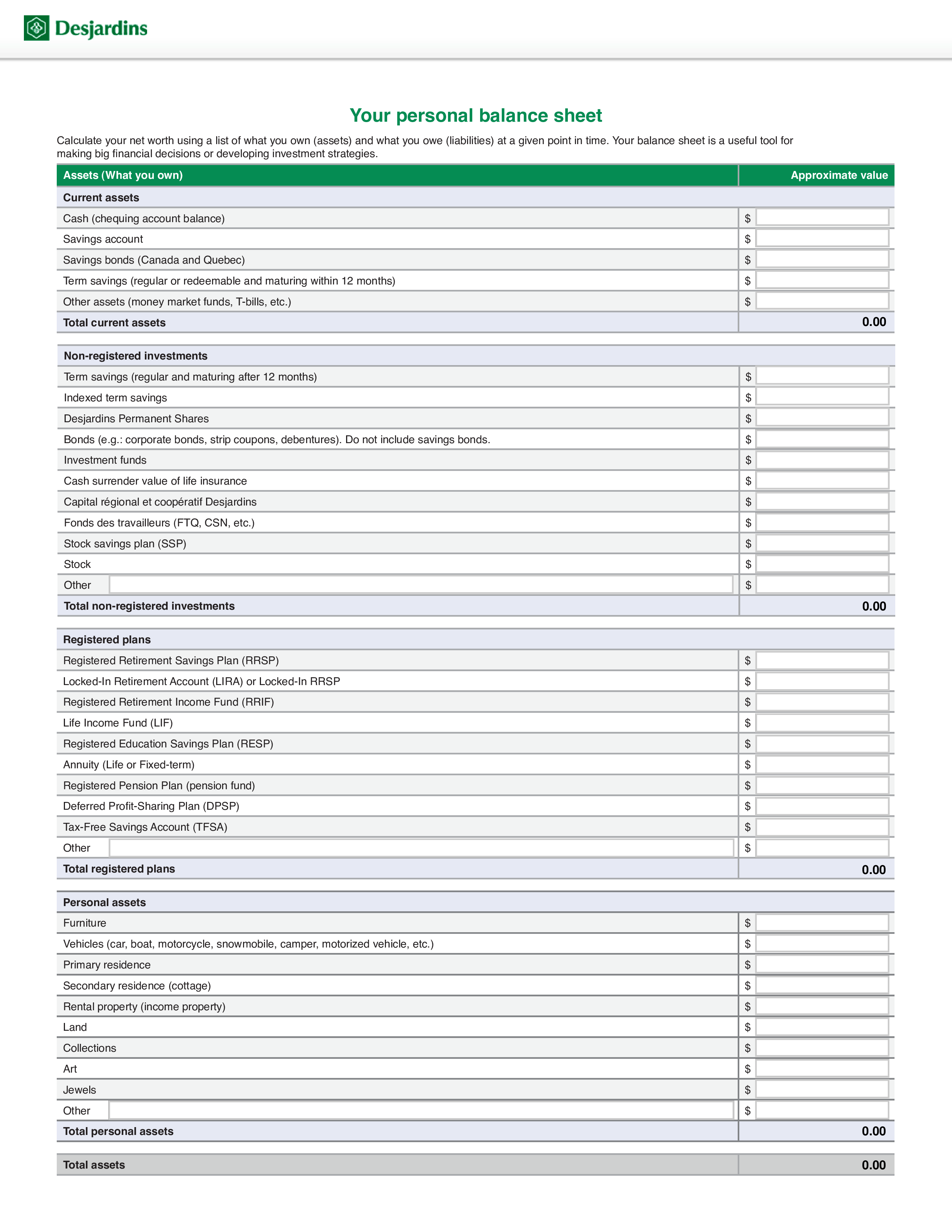

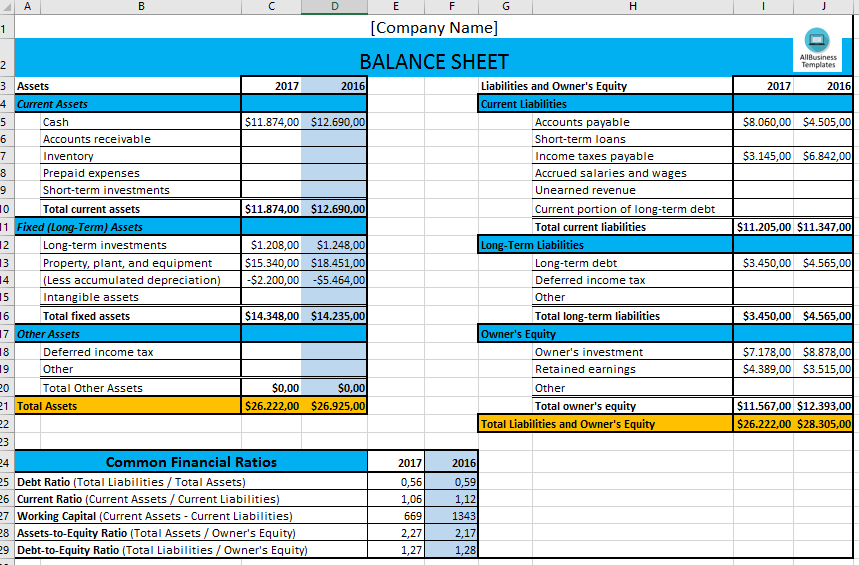

Personal Balance Sheet Excel Template - You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. The first step is to fill out the personal balance sheet. Stay on track for your personal and business goals by evaluating your income and expenses. Web free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. This is what the personal financial statement template looks like: To complete this sheet you will need to compile a list of all financial assets, these are things that maintain an exchange value like cash holdings, bank account balances, and real estate. Download the free template enter your name and email in the form below and download the free template now! Money management template when you've got a mortgage, children, a car payment, and other expenses to keep track of, it's hard to balance your budget and avoid overspending. Next, you will create a list of all liabilities, including any debts and unpaid bills. To get your net worth, subtract liabilities from assets. Download free financial statements for your business including balance sheets, income statements, profit and loss statements, budgets, and break even analysis templates. You need a level of financial awareness that most people do not possess. Next, you will create a list of all liabilities, including any debts and unpaid bills. To get your net worth, subtract liabilities from assets. Stay. The first step is to fill out the personal balance sheet. Web free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Web a personal financial statement is a snapshot of your personal financial position. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. The first step is to fill out the personal balance sheet. To complete this sheet you will need to compile a list of all financial assets, these are things that maintain an exchange value like cash holdings, bank account. You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. Web a personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. Stay on track for your personal and business goals by evaluating. Web having a personal balance sheet template is a great way to keep track of everything you owe and own. You need a level of financial awareness that most people do not possess. It lists your assets (what you own), your liabilities (what you owe), and your net worth. The first step is to fill out the personal balance sheet.. Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. Web this personal financial statement template is a great tool to keep track of your personal assets, liabilities, income, and expenses. With this information, you can make adjustments that could either increase your assets or make sure you. Web a personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. Web free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators,. You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. Web a personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. Download the free template enter your name and email in the. The first step is to fill out the personal balance sheet. You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. Money management template when you've got a mortgage, children, a car payment, and other expenses to keep track of, it's hard to balance your budget and. Manage your finances using excel templates. Web a personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. Download free financial statements for your business including balance sheets, income statements, profit and loss statements, budgets, and break even analysis templates. The first step is to fill. Web having a personal balance sheet template is a great way to keep track of everything you owe and own. Manage your finances using excel templates. You need a level of financial awareness that most people do not possess. Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. To complete this sheet you will need to compile a list of all financial assets, these are things that maintain an exchange value like cash holdings, bank account balances, and real estate. You can use this information in tandem with your cash flow statement to help you create a budget and pay down your debt. Next, you will create a list of all liabilities, including any debts and unpaid bills. The first step is to fill out the personal balance sheet. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. Stay on track for your personal and business goals by evaluating your income and expenses. Or, you could just fire up excel. Web budget your personal and business finances using these templates. Web a personal financial statement is a snapshot of your personal financial position at a specific point in time. Web free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. To get your net worth, subtract liabilities from assets. Download the free template enter your name and email in the form below and download the free template now! Download free financial statements for your business including balance sheets, income statements, profit and loss statements, budgets, and break even analysis templates. Web a personal balance sheet helps you reflect on your net worth, whether positive or negative, and identify areas where you can work to improve it. Web this personal financial statement template is a great tool to keep track of your personal assets, liabilities, income, and expenses. Money management template when you've got a mortgage, children, a car payment, and other expenses to keep track of, it's hard to balance your budget and avoid overspending.Balance Sheet Templates 15+ Free Printable Docs, Xlsx & PDF Formats

38 Free Balance Sheet Templates & Examples Template Lab

Free Excel Template to Calculate Your Net Worth

Personal Balance Sheet example Templates at

Basic Excel Balance Sheet Templates at

10 Personal Balance Sheet Template Excel Perfect Template Ideas

38 Free Balance Sheet Templates & Examples Template Lab

How To Create A Balance Sheet In Excel Excel Templates

10+ Balance Sheet Template Free Word, Excel, PDF Formats

Télécharger Gratuit Personal Balance Sheet Excel Template

Related Post: