Npv Template Excel

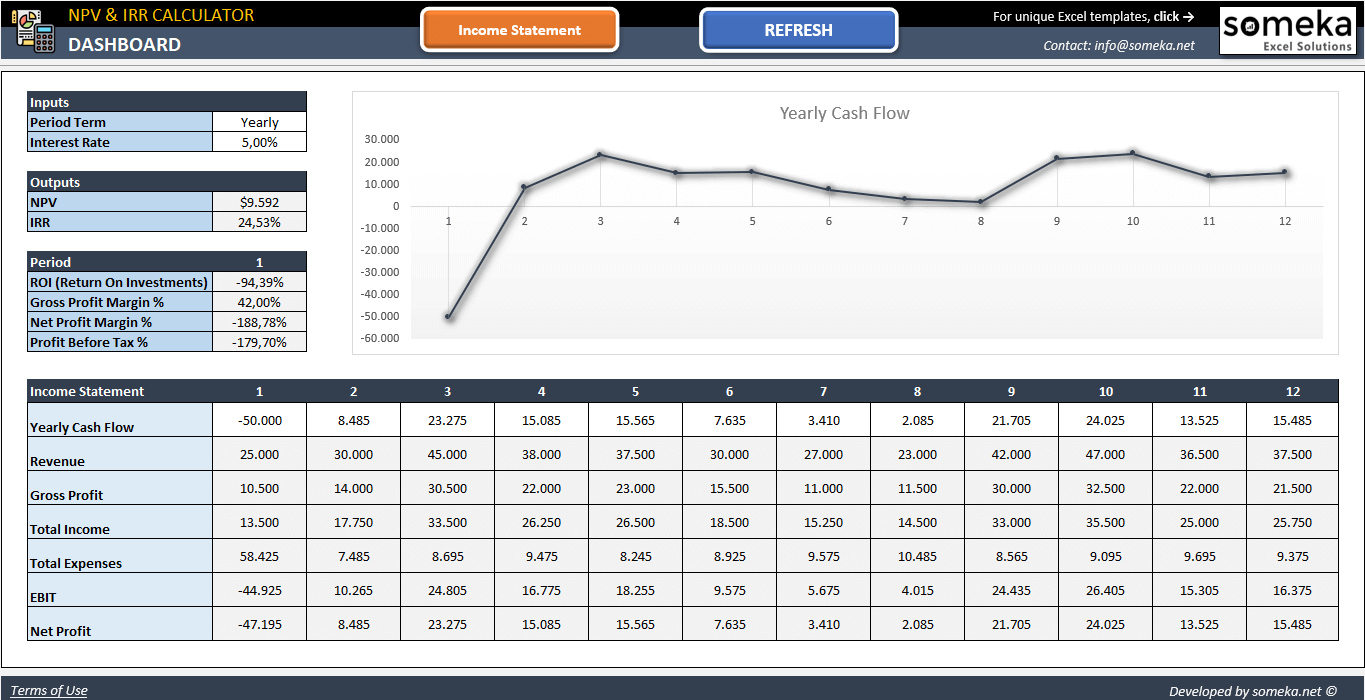

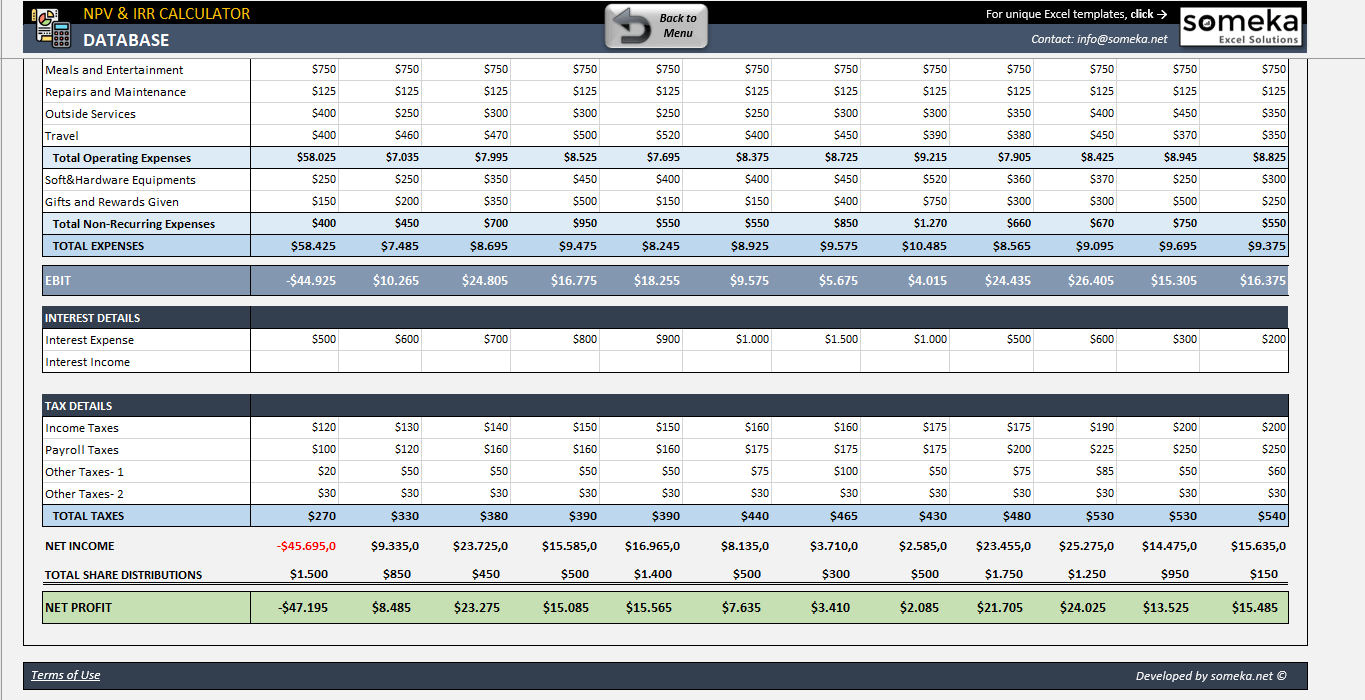

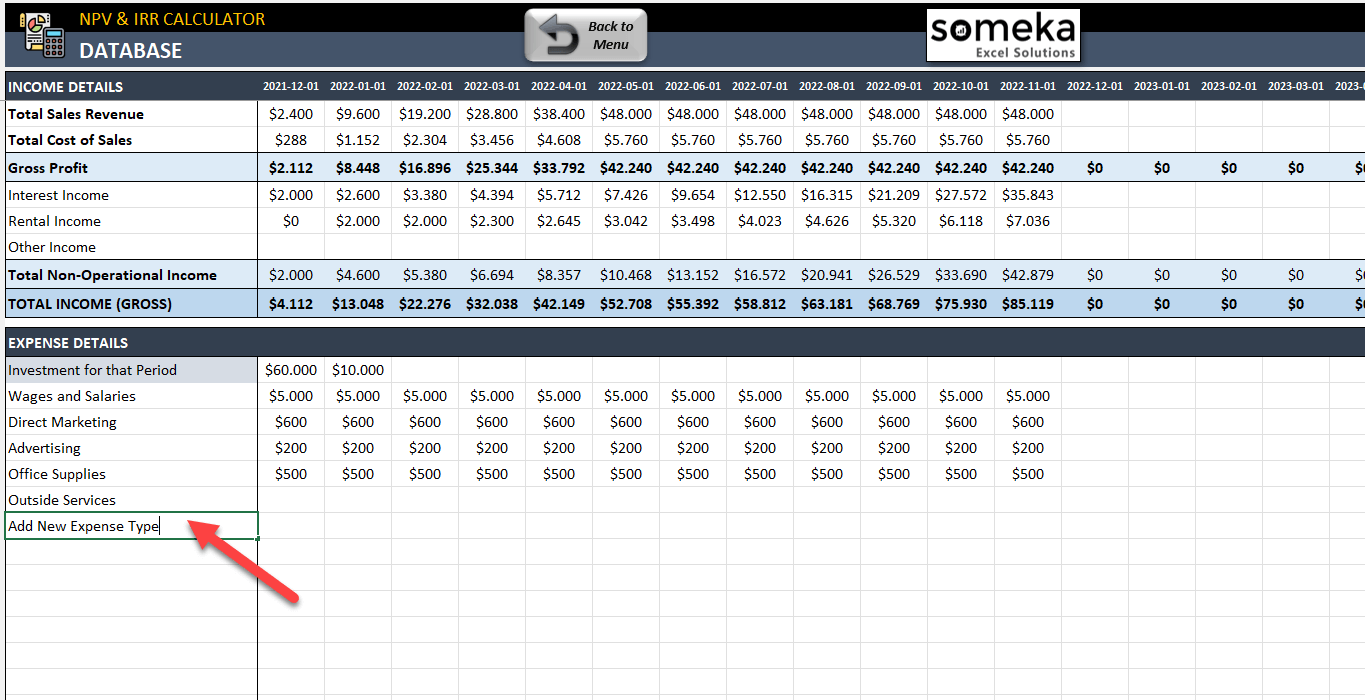

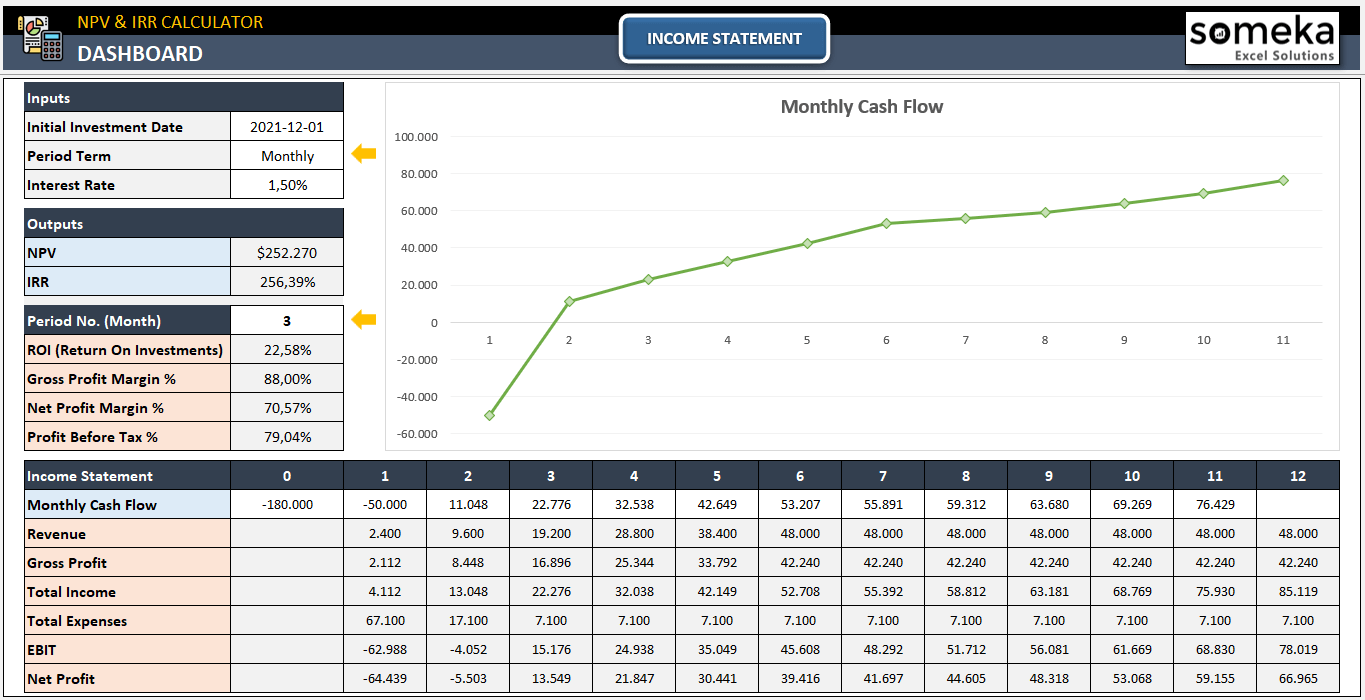

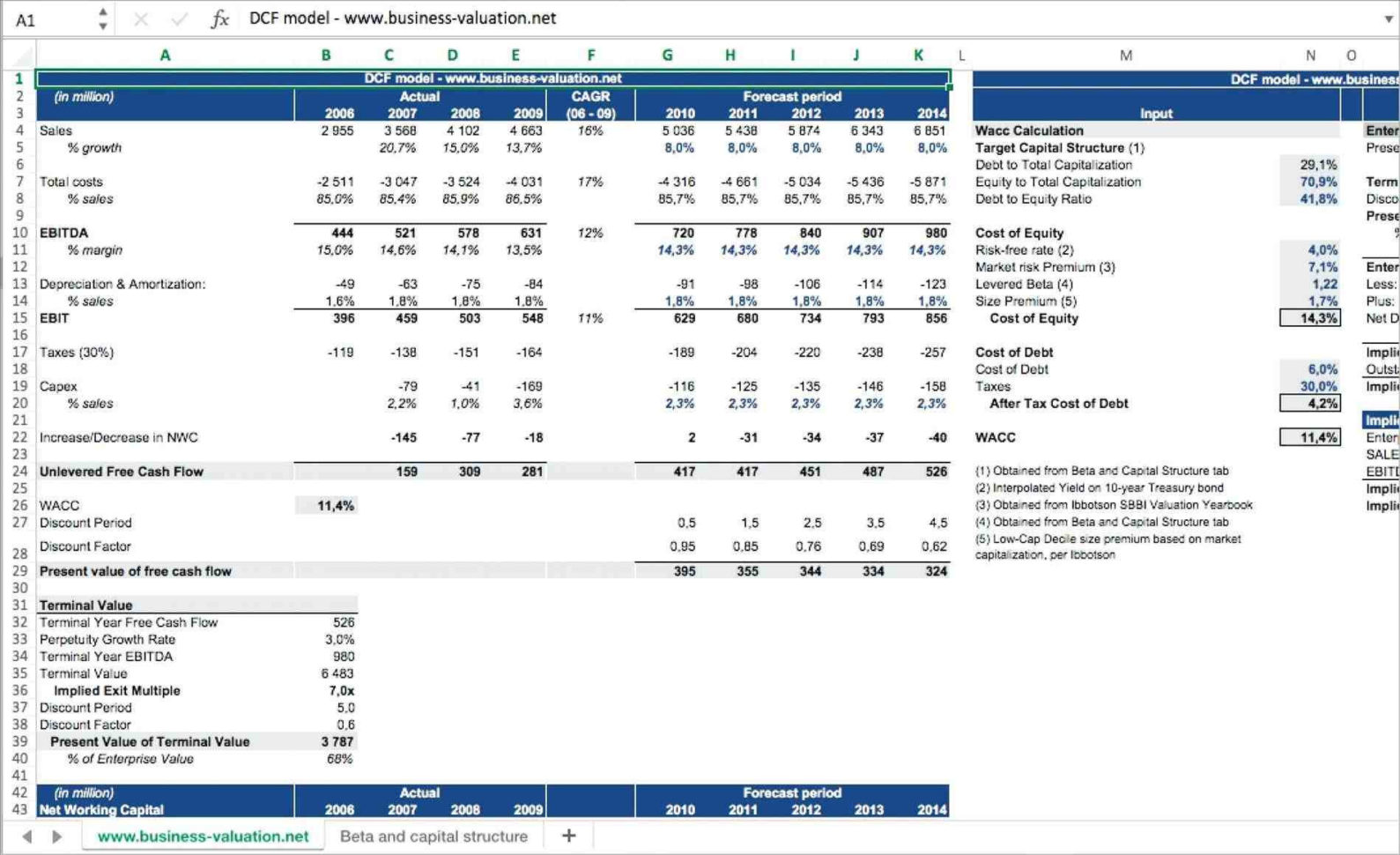

Npv Template Excel - Net present value is calculated using. The net present value (npv) is. It is used to determine the. Npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Where n is the number of. Web download the free template. In the column input cell box enter b17 which is the r value from the input table. Now draw the graph of your npv profile table and. Web series 1 series 2 series 3 series 4 npv: Web leave the row input cell box empty. Now draw the graph of your npv profile table and. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. Net present value (npv) is the value of. Where, x t = total cash inflow for period t. Web download the free template. Web series 1 series 2 series 3 series 4 npv: Web leave the row input cell box empty. The net present value (npv) is. Web how to use the npv formula in excel. X o = net initial investment. This free npv calculator in excel calculates the net present value (npv) of a. Web download the free template. Npv is the value that represents the current value of all the future cash flows without the initial investment. Excel template for custom orders. Let’s first understand what net present value means. X o = net initial investment. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and. Web download the free template. These npv models are referenced by the book net present value and risk modelling for projects and built using excel 2010. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web if the npv is positive, it creates value. Web here’s the net present value formula (when cash arrivals are even): Web download. Learn how to calculate npv (net present value) using excel. It is used to determine the. Enter your name and email in the form below and download the free template now! Let me explain with an example. Web net present value | understanding the npv function. Net present value (npv) is the value of all future cash flows. These npv models are referenced by the book net present value and risk modelling for projects and built using excel 2010. Excel template for custom orders. Web here’s the net present value formula (when cash arrivals are even): Web net present value (npv) guide to understanding net present. Let’s first understand what net present value means. X o = net initial investment. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and. Web how to calculate npv using excel. In the column input cell box enter b17 which is the r value from the input. 10″ x 2″ printable paper nameplates. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Web how to use the npv formula in excel. In other words, you can find out the value of future incomes discounted to the present value. Where n is. In the column input cell box enter b17 which is the r value from the input table. In other words, you can find out the value of future incomes discounted to the present value. Where, x t = total cash inflow for period t. Web are you looking for a net present value calculator template in excel? Net present value. 10″ x 2″ printable paper nameplates. Web net present value (npv) guide to understanding net present value (npv) learn online now fundamentals of corporate finance what is npv? Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. Web net present value | understanding the npv function. Web how to calculate npv using excel. First, we have to calculate the present value the output will be: Similarly, we have to calculate it for other values. Web here’s the net present value formula (when cash arrivals are even): Description calculates the net present value of an investment by using a discount rate. Web leave the row input cell box empty. Net present value (npv) is the value of all future cash flows. Let’s first understand what net present value means. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web download the free template. Web how to use the npv formula in excel. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Download this npv calculator template and get your polished document that will impress your investors,. These npv models are referenced by the book net present value and risk modelling for projects and built using excel 2010. Where n is the number of. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows.NPV Calculator Template Free NPV & IRR Calculator Excel Template

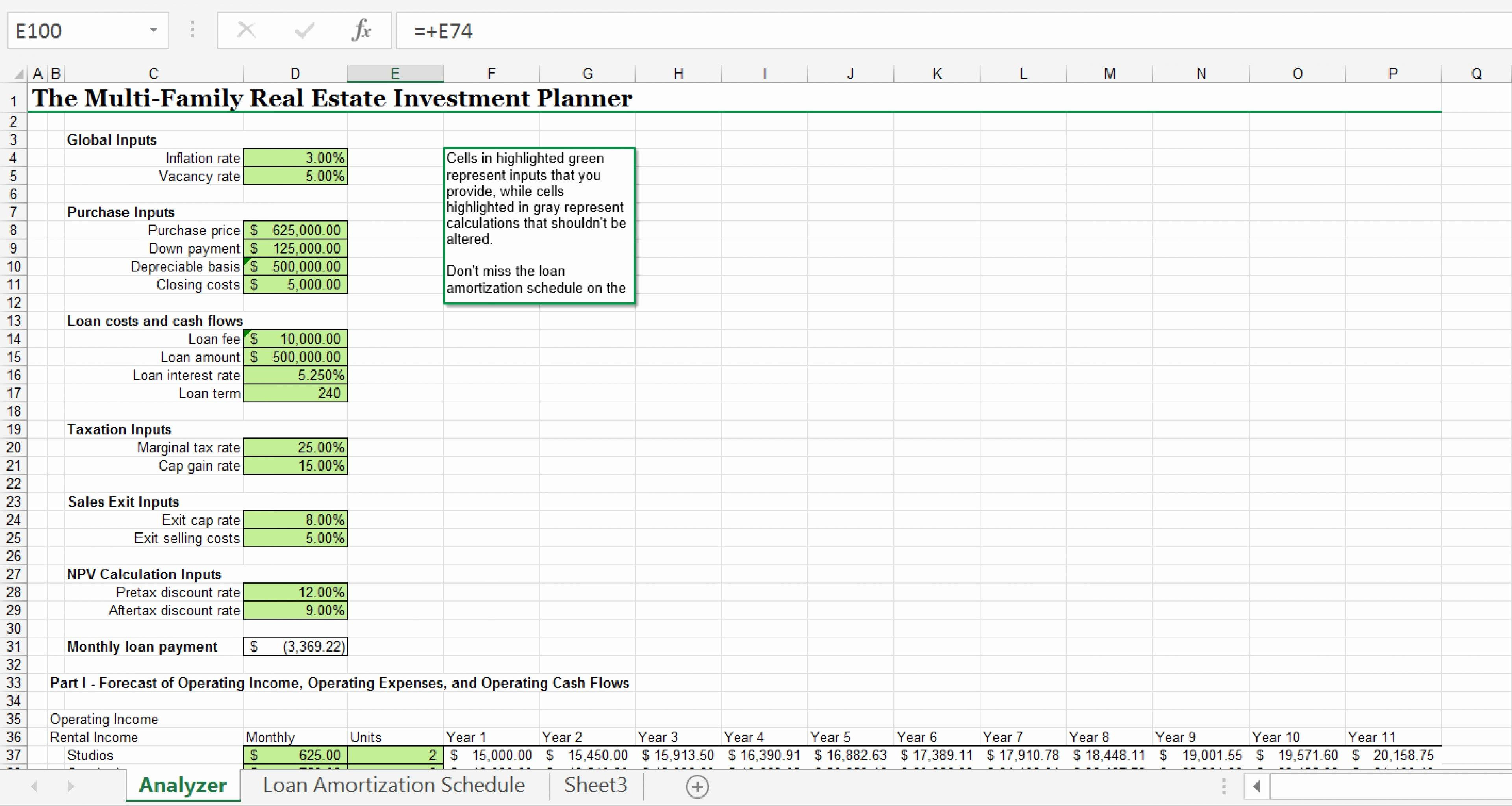

Npv Excel Spreadsheet Template —

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Download free Excel examples

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

Net Present Value Calculator Excel Templates

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

How To Determine Npv In Excel Haiper

Npv Excel Spreadsheet Template —

Related Post: