Npv Excel Template

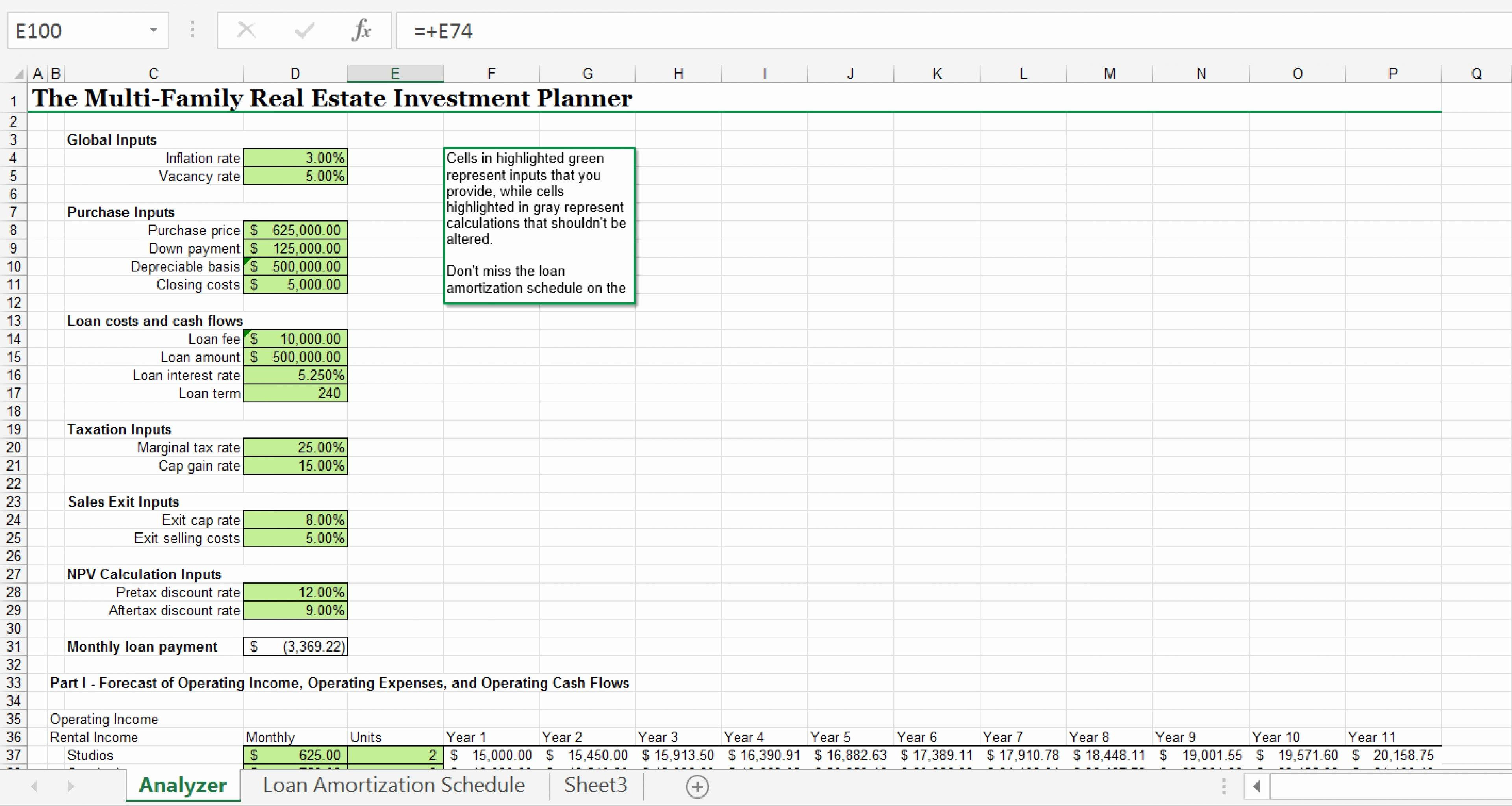

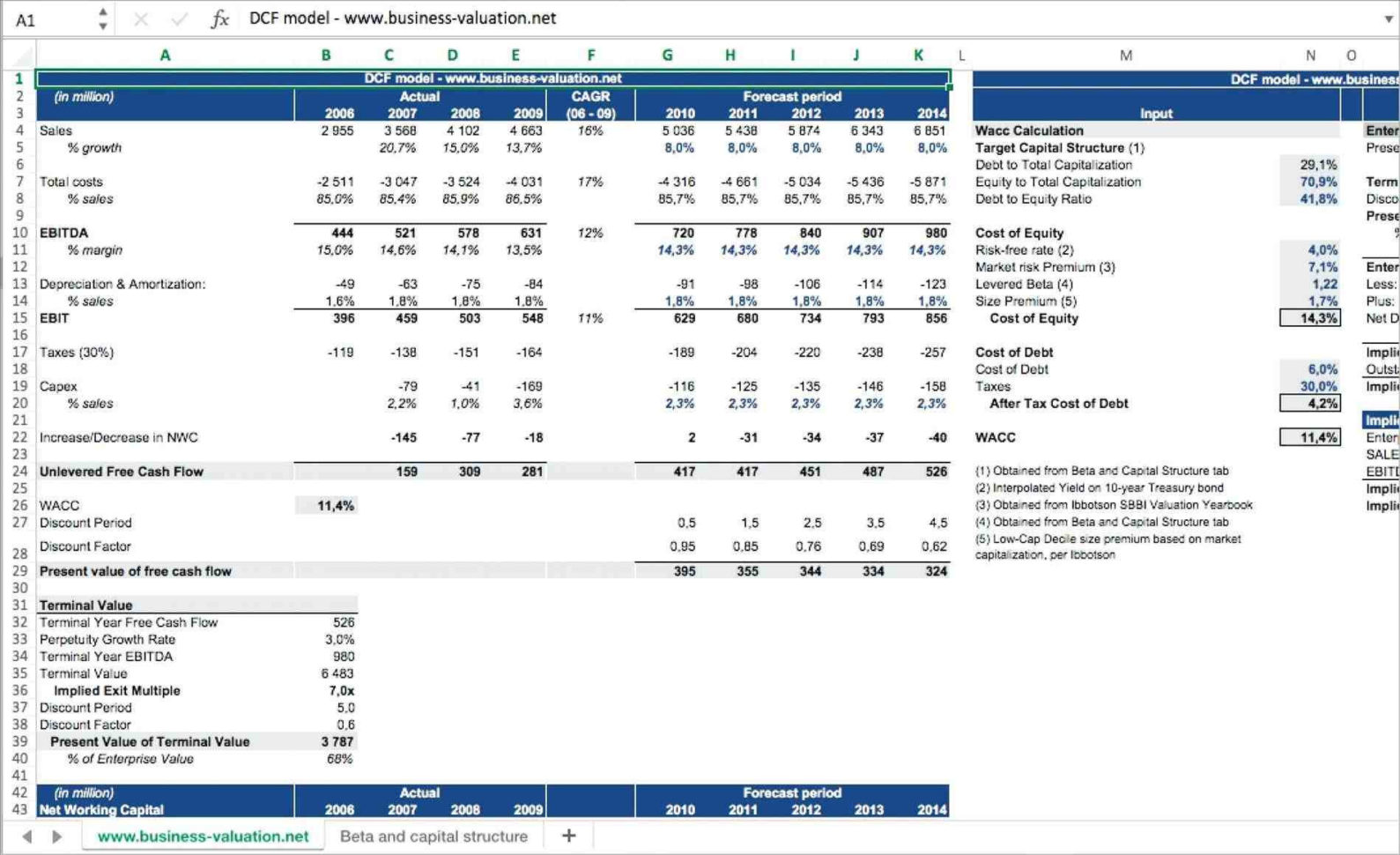

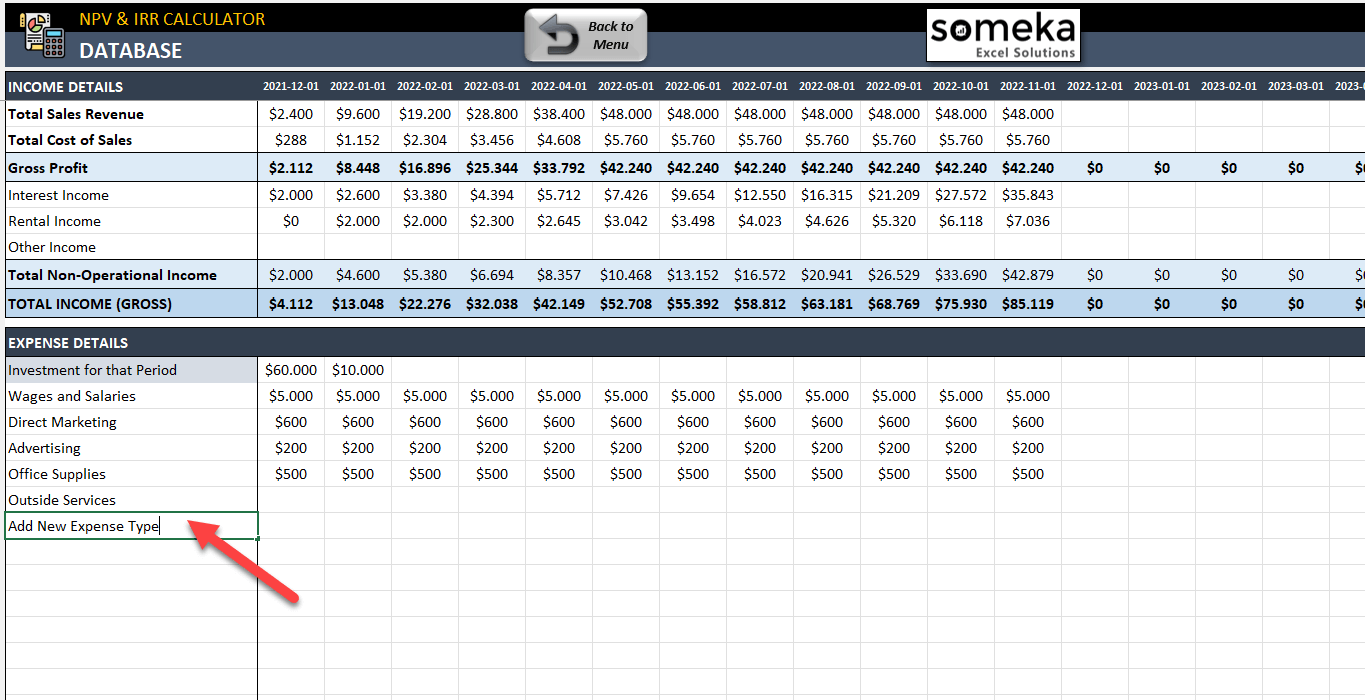

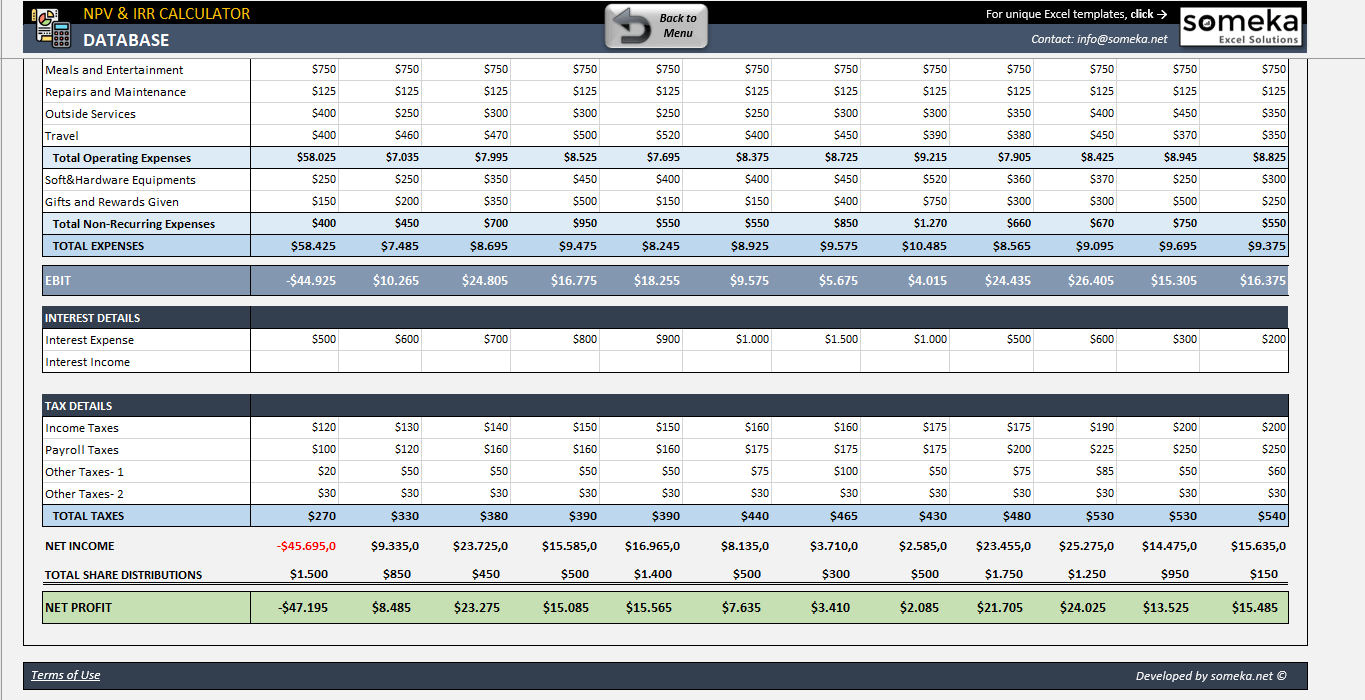

Npv Excel Template - Web how to calculate npv using excel. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Get powerful, streamlined insights into your company’s finances. Web here’s the net present value formula (when cash arrivals are even): First, we have to calculate the present value the output will be: Similarly, we have to calculate it for other values. Npv (net present value) is a financial formula used to discount future cash flows. Most financial analysts don’t calculate the net present value with a calculator; Web use of npv formula in excel. Web the net present value (npv) excel template is a powerful tool that helps business owners and financial analysts calculate the present value of a series of cash. Npv analysis is a form of intrinsic valuation and is. It's important to understand exactly how the npv formula works in excel and the math behind it. Web how to calculate npv using excel. Let’s say that you have the following cash flow data (in column c). Where, x t = total cash inflow for period t. Npv analysis is a form of intrinsic valuation and is. Get powerful, streamlined insights into your company’s finances. Web we walk through the process of how calculating net present value & irr to analyze three example investments. Web a useful tool for bankers, investment professionals, and corporate finance practitioners to calculate the net present value (npv) of an investment. Most. Also included is a downloadable template of the. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. First, we have to calculate the present value the output will be: Where, x t = total cash inflow for period t. Npv analysis is a form of intrinsic valuation and is. Npv (net present value) is a financial formula used to discount future cash flows. Web we walk through the process of how calculating net present value & irr to analyze three example investments. Find out the formula, syntax, and. Web use of npv formula in excel. Web the net present value (npv) excel template is a powerful tool that helps. Npv analysis is a form of intrinsic valuation and is. Web learn how to use excel functions to calculate net present value (npv) and internal rate of return (irr) for your business investment projects. Find out the formula, syntax, and. Similarly, we have to calculate it for other values. Web the net present value (npv) excel template is a powerful. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Calculates the net present value of an investment by using a discount rate. Web learn how to use excel functions to calculate net present value (npv) and internal rate of return (irr) for your business investment projects. In cells c3:c8,. Also included is a downloadable template of the. Npv (net present value) is a financial formula used to discount future cash flows. Web a guide to the npv formula in excel when performing financial analysis. Calculates the net present value of an investment by using a discount rate. Let’s say that you have the following cash flow data (in column. Web a useful tool for bankers, investment professionals, and corporate finance practitioners to calculate the net present value (npv) of an investment. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web the net present value (npv) excel template is a powerful tool that helps business owners and financial. Web a guide to the npv formula in excel when performing financial analysis. Also included is a downloadable template of the. In cells c3:c8, we have the future. Calculates the net present value of an investment by using a discount rate. X o = net initial investment. Instead, they use the npv function. Where, x t = total cash inflow for period t. Learn how to calculate npv (net present value) using excel. Web we walk through the process of how calculating net present value & irr to analyze three example investments. Calculates the net present value of an investment by using a discount rate. In cells c3:c8, we have the future. Web use of npv formula in excel. Calculates the net present value of an investment by using a discount rate. It's important to understand exactly how the npv formula works in excel and the math behind it. Net present value is calculated using. Web how to calculate npv using excel. Learn how to calculate npv (net present value) using excel. Web the template allows the user to calculate the net present value (npv), internal rate of return (irr) and payback period from simple cash flow stream with. Let’s say that you have the following cash flow data (in column c). The template is an open. Web learn how to use excel functions to calculate net present value (npv) and internal rate of return (irr) for your business investment projects. X o = net initial investment. Web we walk through the process of how calculating net present value & irr to analyze three example investments. Web a useful tool for bankers, investment professionals, and corporate finance practitioners to calculate the net present value (npv) of an investment. Most financial analysts don’t calculate the net present value with a calculator; Web here’s the net present value formula (when cash arrivals are even): First, we have to calculate the present value the output will be: Negative) on the topic of capital budgeting, the general rules of thumb to follow for interpreting the net present value (npv) of a project or investment is as follows. Web series 1 series 2 series 3 series 4 npv: Get powerful, streamlined insights into your company’s finances.Npv Excel Spreadsheet Template —

How To Determine Npv In Excel Haiper

Net Present Value Calculator Excel Templates

8 Npv Calculator Excel Template Excel Templates

Download free Excel examples

10 Npv Irr Excel Template Excel Templates

Npv Excel Spreadsheet Template —

Net Present Value Formula Examples With Excel Template

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Related Post: