Non Profit Tax Deductible Receipt Template

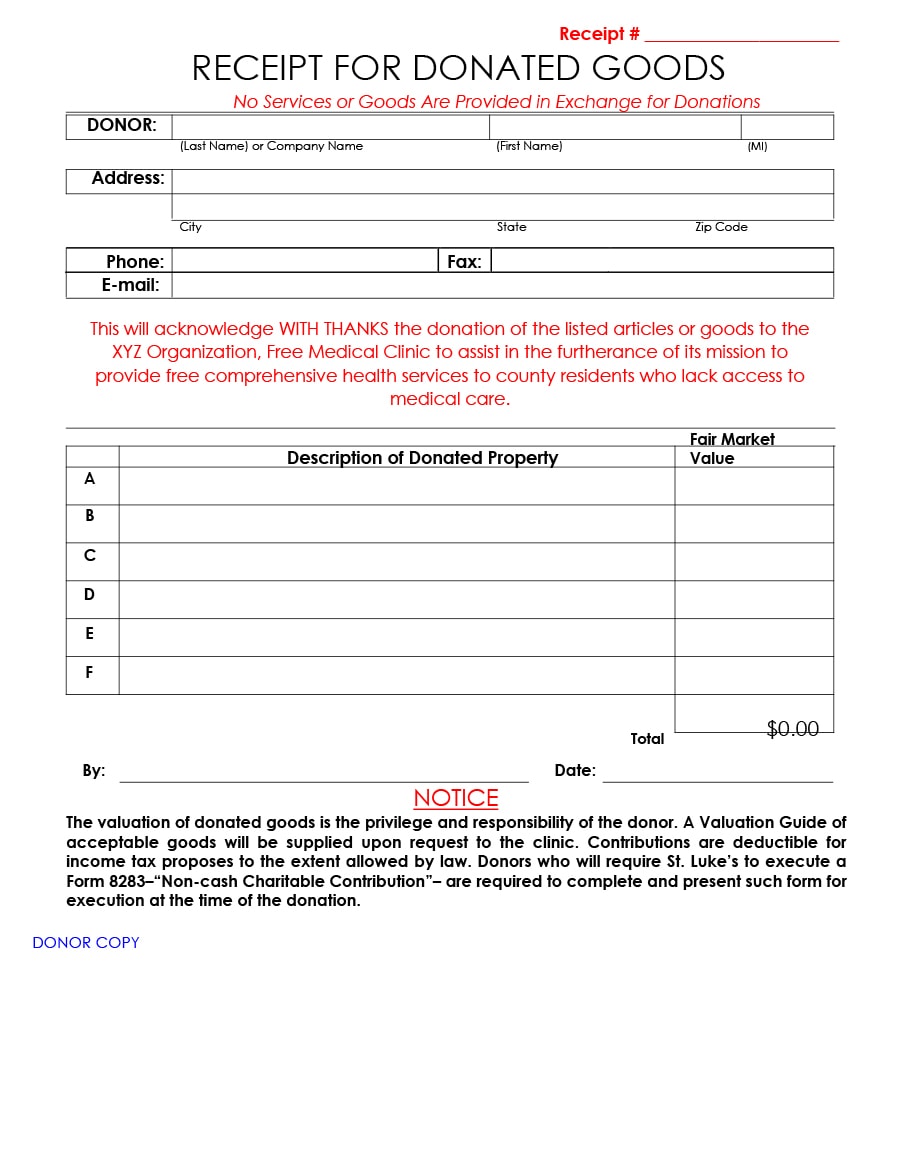

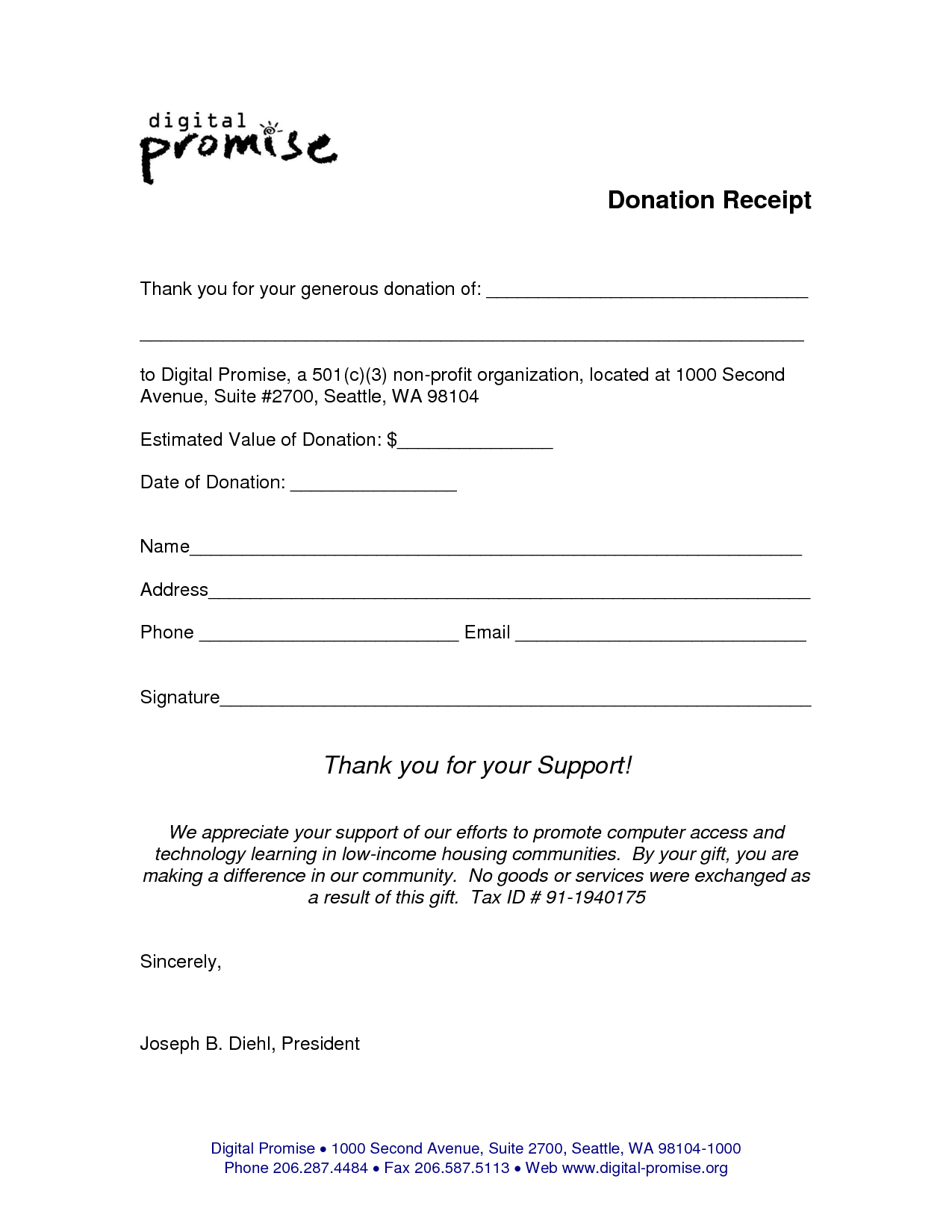

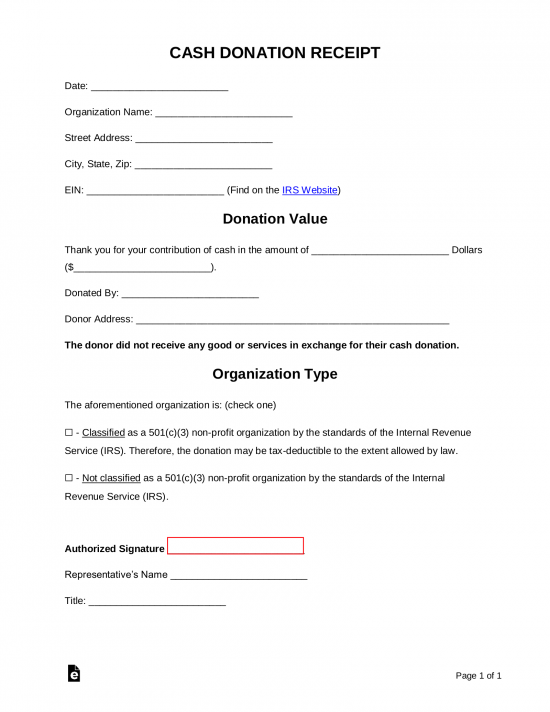

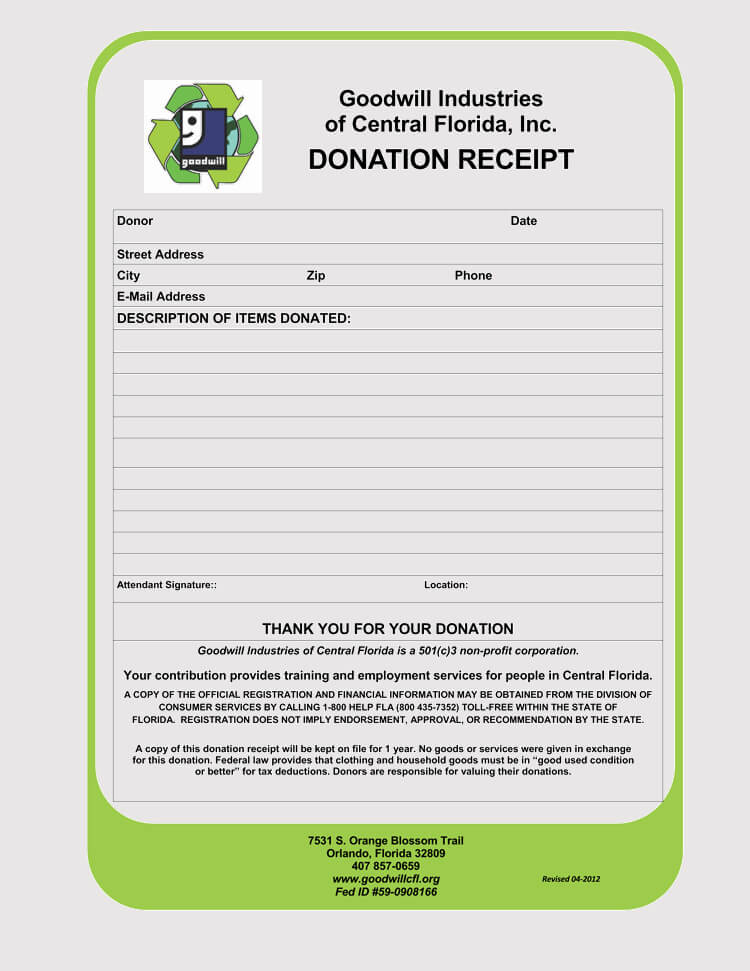

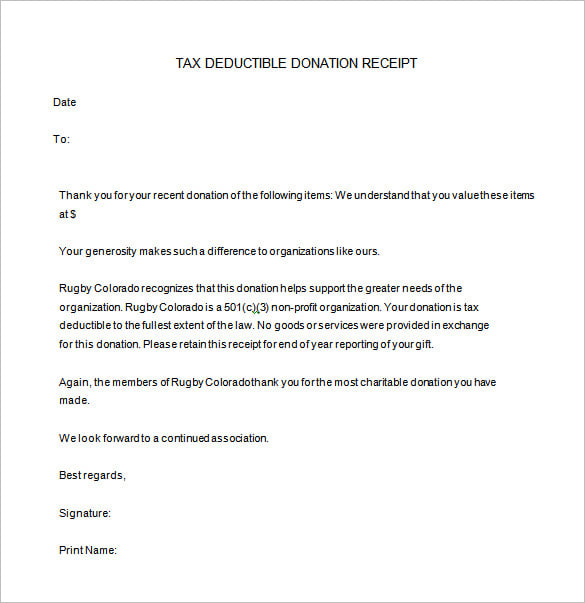

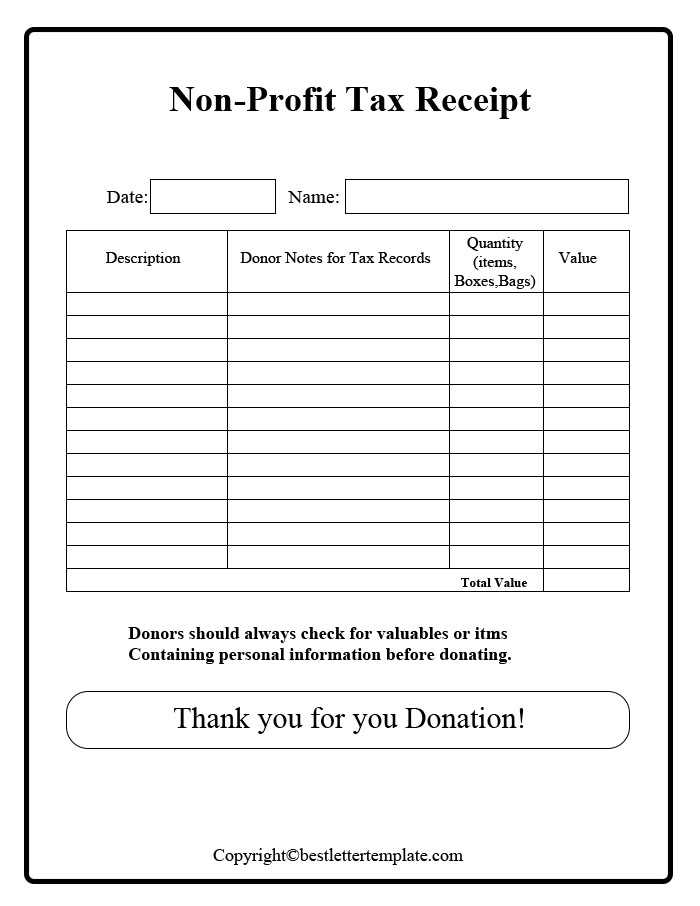

Non Profit Tax Deductible Receipt Template - Add your organization’s branding, such as logo, colors and font. Add your charity number if not retrieved automatically from the. These are examples of tax donation receipts that a 501c3. Find the campaign for the receipts template that you want to. Web primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Web find forms and check if the group you contributed to qualifies as a charitable organization for the deduction. Configure a text to fit the irs donation receipts requirements. Web the tax deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows: Add your name, your organization’s name (if. Web nonprofit donation receipt template is required by an organization that accepts donation. It contains the details of the donor’s contributions. This donation receipt will act as official proof of the. In addition to showing donor appreciation, these messages. Web primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Log into your donorbox dashboard. Tax information, tools, and resources for. Log into your donorbox dashboard. Web primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. These are examples of tax donation receipts that a 501c3. This donation receipt will act as official proof of the. Add your organization’s branding, such as logo, colors and font. Find the campaign for the receipts template that you want to. Tax information, tools, and resources for. Add your charity number if not retrieved automatically from the. Web the tax deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows: Web a 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party (an individual or. Add your organization’s branding, such as logo, colors and font. Configure a text to fit the irs donation receipts requirements. These templates offer a convenient way to generate professional. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Add your charity number if not retrieved automatically from the. Log into your donorbox dashboard. These templates offer a convenient way to generate professional receipts. These are examples of tax donation receipts that a 501c3. Add your organization’s branding, such as logo, colors and font. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. Web nonprofit donation receipt template is required by an organization that accepts donation. Add your name, your organization’s name (if. In addition to showing donor appreciation, these messages. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. Add your charity number if not retrieved automatically from the. Web find forms and check if the group you contributed to qualifies as a charitable organization for the deduction. In this article, you’ll discover some do’s and don’ts to keep in mind. Configure a text to. Add your organization’s branding, such as logo, colors and font. Charitable contributions to qualified organizations may be deductible if. Log into your donorbox dashboard. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. These templates offer a convenient way to generate professional receipts. Tax information, tools, and resources for. Web the tax deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows: Add your charity number if not retrieved automatically from the. Web page 1 of 3. It contains the details of the donor’s contributions. Find the campaign for the receipts template that you want to. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Web find forms and check if the group you contributed to qualifies as a charitable organization for the deduction. Add your name, your organization’s name (if. Charitable contributions to qualified organizations may. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. Web find forms and check if the group you contributed to qualifies as a charitable organization for the deduction. Log into your donorbox dashboard. In addition to showing donor appreciation, these messages. Web a donation receipt is a written acknowledgment to your donor of their contribution to your cause. Find the campaign for the receipts template that you want to. These templates offer a convenient way to generate professional receipts. Web primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. In this article, you’ll discover some do’s and don’ts to keep in mind. Charitable contributions to qualified organizations may be deductible if. Add your name, your organization’s name (if. Web a 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party (an individual or. Tax information, tools, and resources for. Web page 1 of 3. Add your charity number if not retrieved automatically from the. Add your organization’s branding, such as logo, colors and font. Web nonprofit donation receipt template is required by an organization that accepts donation. Configure a text to fit the irs donation receipts requirements. Web the tax deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows: This donation receipt will act as official proof of the.Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Non Profit Donation Receipt Template printable receipt template

Free Cash Donation Receipt PDF Word eForms

Donation Receipt Template 12 Free Samples in Word and Excel

Non Profit Tax Receipt Template Excel Templates

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

Non Profit Tax Receipt Template Excel Templates

Free Blank Printable Tax Receipt Template with Example in PDF

Non Profit Donation Receipt Templates at

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-34.jpg)