Net Present Value Excel Template

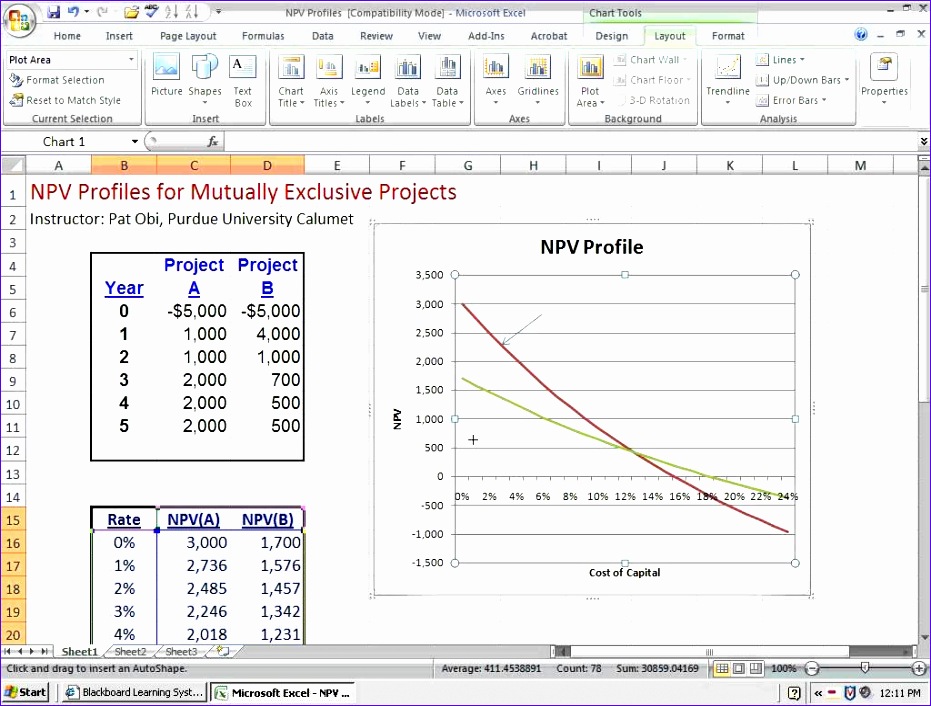

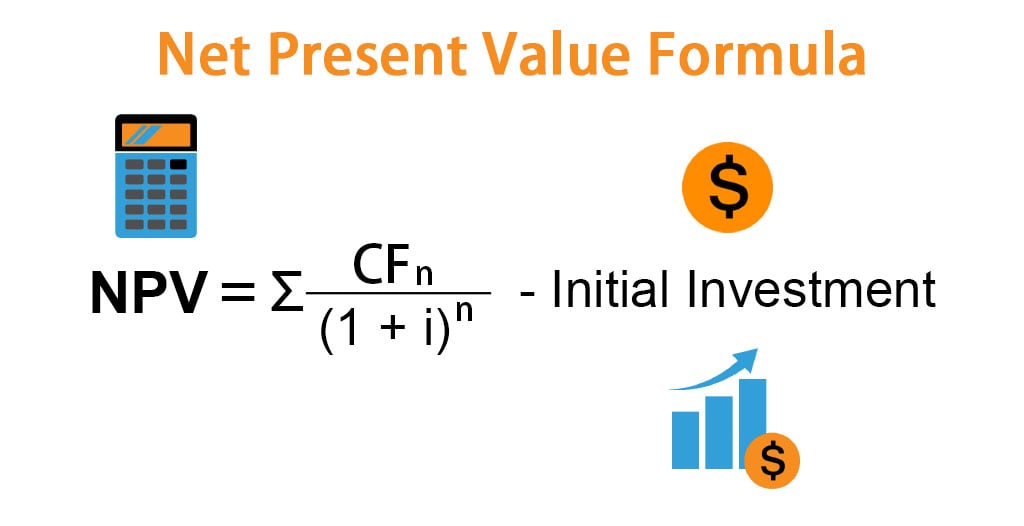

Net Present Value Excel Template - What is the net present value formula? Web how to use the npv formula in excel. The formula for npv is: Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Use this free excel template to easily calculate the npv. Web we would like to show you a description here but the site won’t allow us. Present value can be calculated. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. The present value calculator formula in b9 is: Npv = cf1 / (1 + r)^1 + cf2 / (1 + r)^2 + cf3 / (1 + r)^3. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net. Web how to use the npv formula in excel. The present value calculator formula in b9 is: Present value (pv) is the current value of an expected future stream of cash flow. Web excel offers two functions for calculating net present value: Present value can be calculated. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. The two functions use the same math formula shown above but save an analyst the time for. Where n is the number of. Present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web. Present value (pv) is the current value of an expected future stream of cash flow. Most financial analysts never calculate the net present value by hand nor with a calculator, instead, they use excel. It is commonly used to evaluate whether a project or. The formula for npv is: Npv = cf1 / (1 + r)^1 + cf2 / (1. Present value (pv) is the current value of an expected future stream of cash flow. Use this free excel template to easily calculate the npv. Web how to use the npv formula in excel. Ad enjoy great deals and discounts on an array of products from various brands. Where n is the number of. Where, n = period which takes values from 0 to the nth period till the. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. This net present value. This adjusted present value template guides you through the calculation of apv starting with the value of the unlevered project and pv of. In financial, there are some standard value measurement that usually used to measure whether a. Present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. What is the net present. Use this free excel template to easily calculate the npv. The two functions use the same math formula shown above but save an analyst the time for. Ad enjoy great deals and discounts on an array of products from various brands. Web how to calculate npv? Present value (pv)—also known as a discount value—measures the value of future cash flows. The net present value (npv) represents the discounted values of future cash inflows and outflows related to a specific investment or project. Where, n = period which takes values from 0 to the nth period till the. =pv (b2/b7, b3*b7, b4, b5, b6) assuming you make a series. Web how to calculate npv? To better understand the idea, let's dig. It is commonly used to evaluate whether a project or. Where, n = period which takes values from 0 to the nth period till the. + cfn / (1 + r)^n. In financial, there are some standard value measurement that usually used to measure whether a. Web download this template for free. For a single cash flow, present value (pv) is. Where, n = period which takes values from 0 to the nth period till the. Web net present value template. Web how to calculate npv? The present value calculator formula in b9 is: Web excel offers two functions for calculating net present value: Web adjusted present value template. Present value can be calculated. It is commonly used to evaluate whether a project or. Web how to use the npv formula in excel. Present value (pv) is the current value of an expected future stream of cash flow. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. + cfn / (1 + r)^n. Web we would like to show you a description here but the site won’t allow us. The net present value (npv) represents the discounted values of future cash inflows and outflows related to a specific investment or project. Npv = cf1 / (1 + r)^1 + cf2 / (1 + r)^2 + cf3 / (1 + r)^3. The formula for npv is: Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Learn new skills with a range of books on computers & internet available at great prices. Web download this template for free.Net Present Value Calculator »

8 Npv Calculator Excel Template Excel Templates

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator Excel Templates

6 Net Present Value Excel Template Excel Templates

10 Excel Net Present Value Template Excel Templates

10 Excel Net Present Value Template Excel Templates

Net Present Value Formula Examples With Excel Template

Net Present Value Formula Examples With Excel Template

Net Present Value Calculator Excel Template SampleTemplatess

Related Post: