Merger Model Template

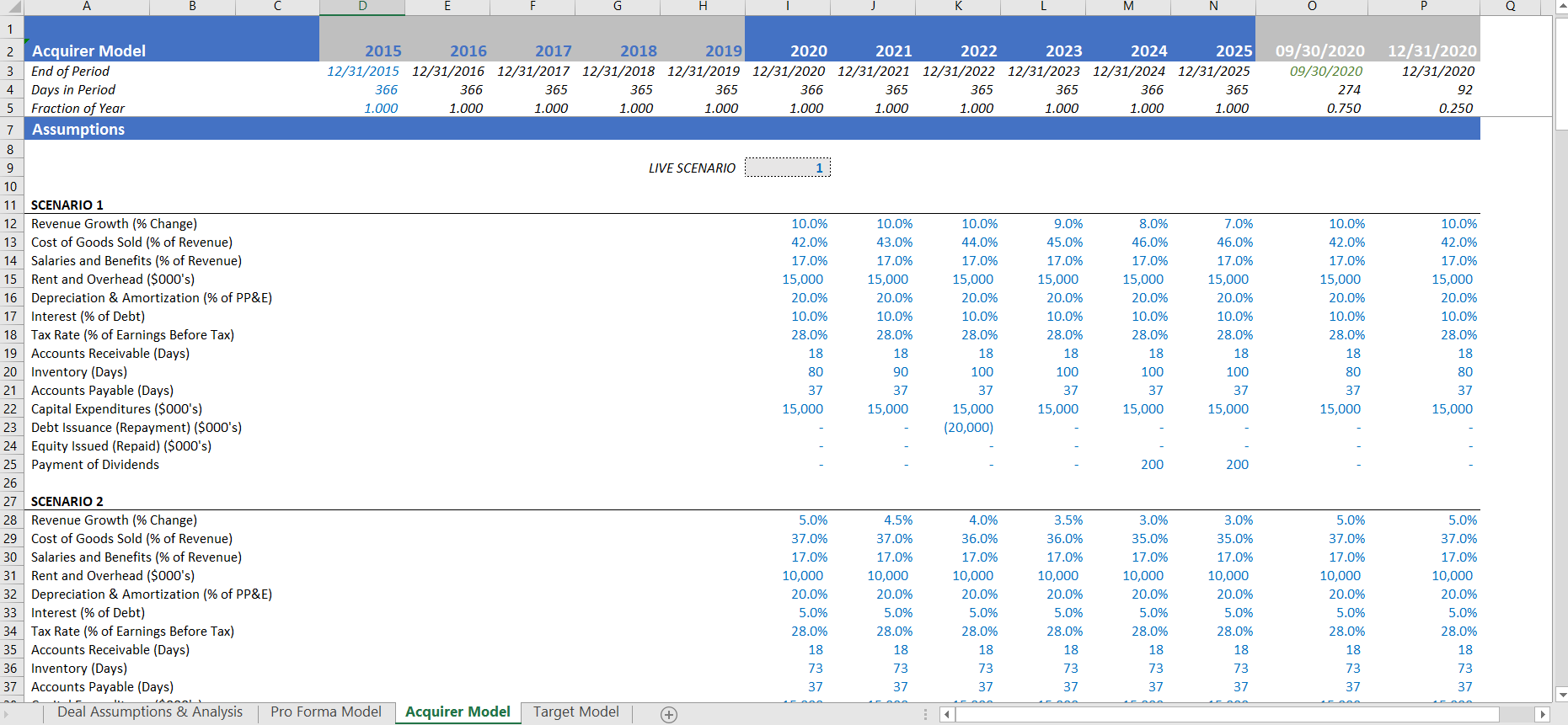

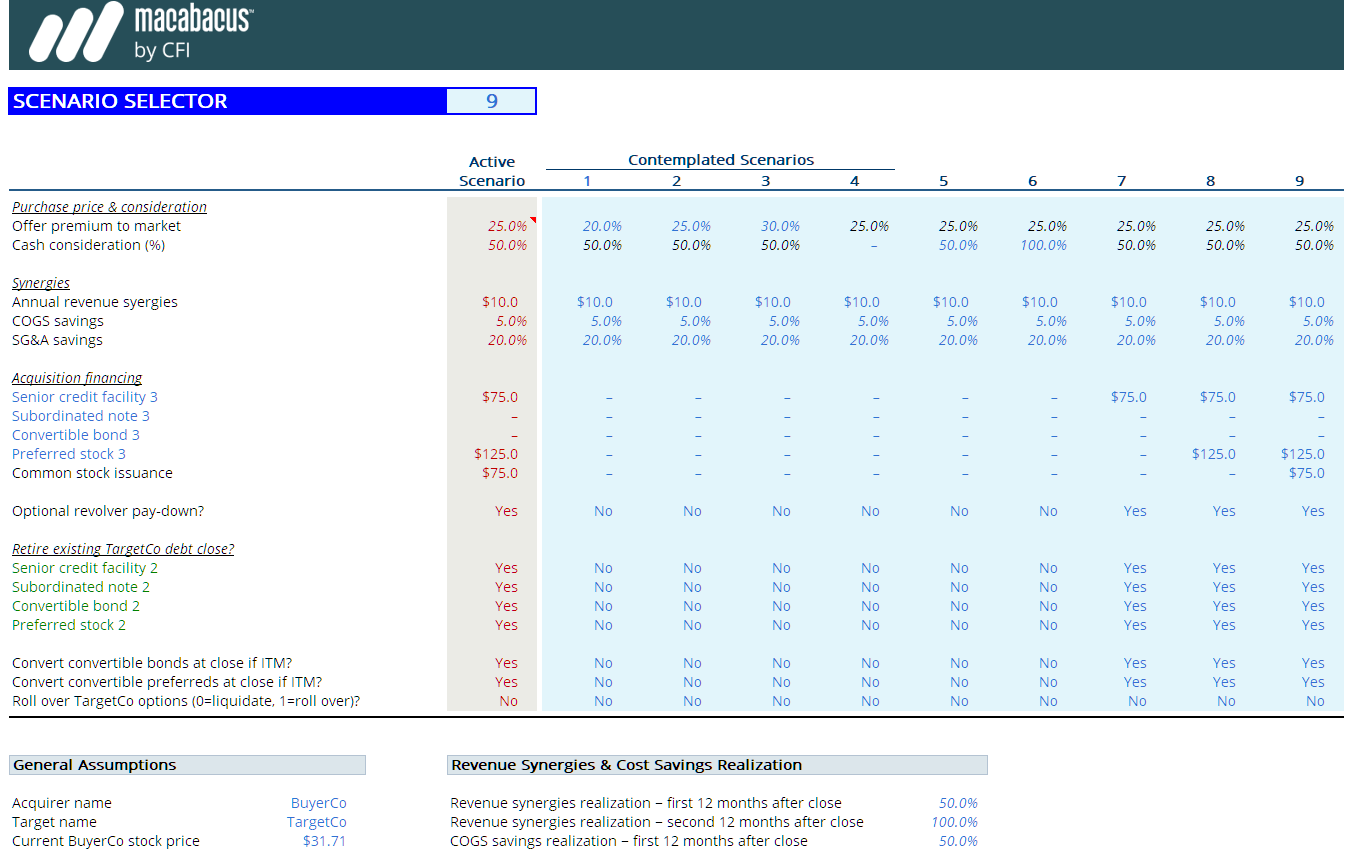

Merger Model Template - Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. Web learn how to structure an m&a model in the most efficient way; This checklist template provides a framework for integration requests, tailored specifically for m&a transactions. M&a and merger models tutorials. Web we begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Template parameters [edit template data] this template prefers block. In this tutorial, we will walk through how to build a general industry business operating model. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their. This tutorial shows how to create a merger and acquisition financial model including synergies, debt,. Step 1 → determine the offer value per share (and total offer value) 2. Web the key steps involved in building a merger model are: Step 2 → structure the purchase consideration (i.e. Step 1 → determine the offer value per share (and total offer value) 2. Web integration plan day 1 readiness checklist. Web in this section, we demonstrate how to model a merger of two public companies in excel. It is equipped with a wide range. Each topic contains a spreadsheet with which you can interact within your browser to. Web in this section, we demonstrate how to model a merger of two public companies in excel. Calculate all the necessary adjusting. Web integration plan day 1 readiness checklist. Web learn how to structure an m&a model in the most efficient way; Step 1 → determine the offer value per share (and total offer value) 2. M&a and merger models tutorials. This tutorial shows how to create a merger and acquisition financial model including synergies, debt,. Step 3 → estimate the financing fee, interest expense, number of new. Calculate all the necessary adjusting. This buildable checklist ensures that nothing is missed during the integration process. Cash, debt, and stock mix (19:58) in this merger model lesson, you’ll learn how a company might decide. Template parameters [edit template data] this template prefers block. This checklist template provides a framework for integration requests, tailored specifically for m&a transactions. Web integration plan day 1 readiness checklist. This buildable checklist ensures that nothing is missed during the integration process. Step 1 → determine the offer value per share (and total offer value) 2. Web in this section, we demonstrate how to model a merger of two public companies in excel. Calculate all the necessary adjusting. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their. Web the key steps involved in building a merger model are: Web in this section, we demonstrate how to model a merger of two public companies in excel. Step 3. Cash, debt, and stock mix (19:58) in this merger model lesson, you’ll learn how a company might decide. In this tutorial, we will walk through how to build a general industry business operating model. The process of building a merger model consists of the following steps: It is equipped with a wide range. M&a and merger models tutorials. This buildable checklist ensures that nothing is missed during the integration process. Cash, debt, and stock mix (19:58) in this merger model lesson, you’ll learn how a company might decide. The process of building a merger model consists of the following steps: Step 2 → structure the purchase consideration (i.e. This tutorial shows how to create a merger and acquisition. Step 1 → determine the offer value per share (and total offer value) 2. Web in this section, we demonstrate how to model a merger of two public companies in excel. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and. How to create a merger and acquisition model in excel. Cash, stock, or mix) 3. Each topic contains a spreadsheet with which you can interact within your browser to. Cash, debt, and stock mix (19:58) in this merger model lesson, you’ll learn how a company might decide. In this tutorial, we will walk through how to build a general industry. How to create a merger and acquisition model in excel. It includes all the typical guidelines and. This checklist template provides a framework for integration requests, tailored specifically for m&a transactions. M&a model inputs, followed by a range of m&a model assumptions, model analysis and model outputs. Web merger and acquisition model template consists of an excel model that assists the user to assess the financial viability of the resulting proforma merger of 2 companies and their. In this tutorial, we will walk through how to build a general industry business operating model. The process of building a merger model consists of the following steps: Step 2 → structure the purchase consideration (i.e. Web in this section, we demonstrate how to model a merger of two public companies in excel. It is equipped with a wide range. This buildable checklist ensures that nothing is missed during the integration process. Web in this section, we demonstrate how to model a merger of two public companies in excel. This tutorial shows how to create a merger and acquisition financial model including synergies, debt,. How to build an m&a model in excel. Web this is a hatnote template that proposes to merge the page it is applied to with one or more other pages. Web integration plan day 1 readiness checklist. M&a and merger models tutorials. Web the key steps involved in building a merger model are: Template parameters [edit template data] this template prefers block. Web we begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”).Mergers and Acquisitions PowerPoint Template SlideModel

Mergers and Acquisitions PowerPoint Template SlideModel

Post Merger Integration Toolkit Merger, Change management, Integrity

Merger Model Templates Macabacus

Merger Model, Factors affecting Merger Model, Steps in Merger Model

Merger Model M&A Acquisition Street Of Walls

M&A Integration PostMerger Integration Process Guide

Merger Model StepByStep Walkthrough [Video Tutorial]

Timeline Template of Mergers Model SlideModel

Merger and Acquisition Excel Model Template Icrest Models

Related Post:

![Merger Model StepByStep Walkthrough [Video Tutorial]](https://s3.amazonaws.com/biwsuploads-assest/biws/wp-content/uploads/2019/04/22161546/Merger-Model-Assumptions.jpg)