M&A Target Screening Template

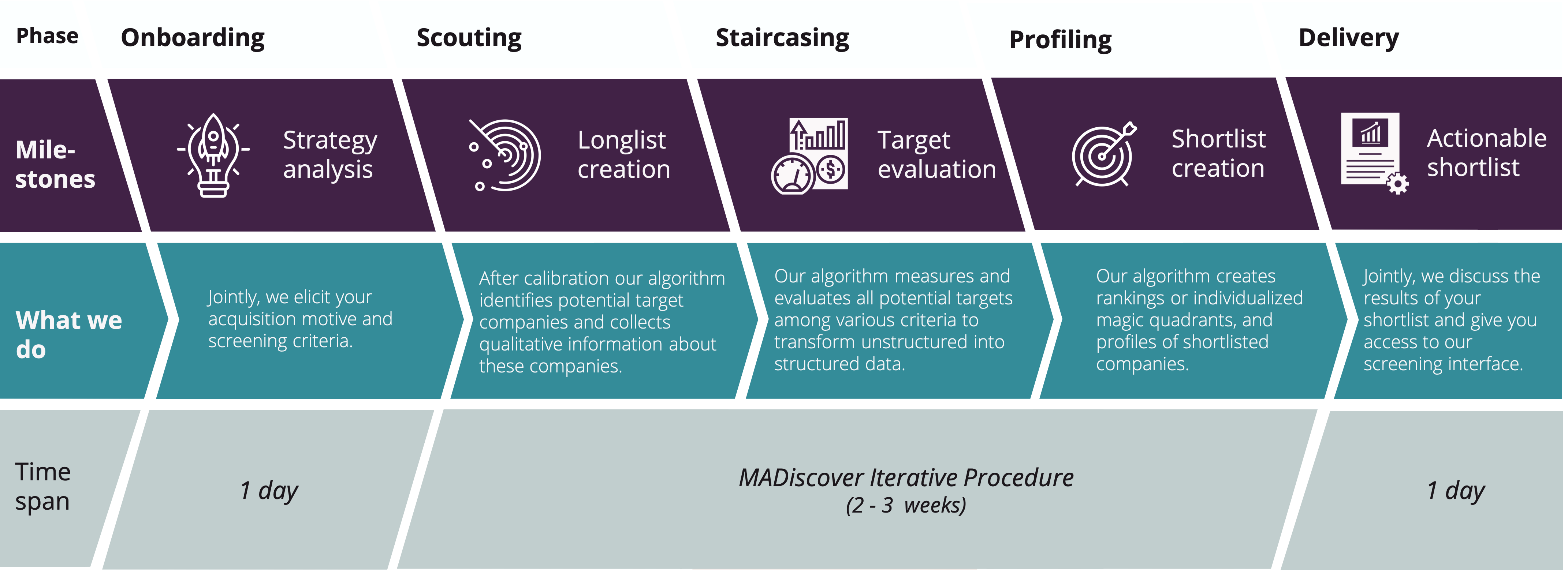

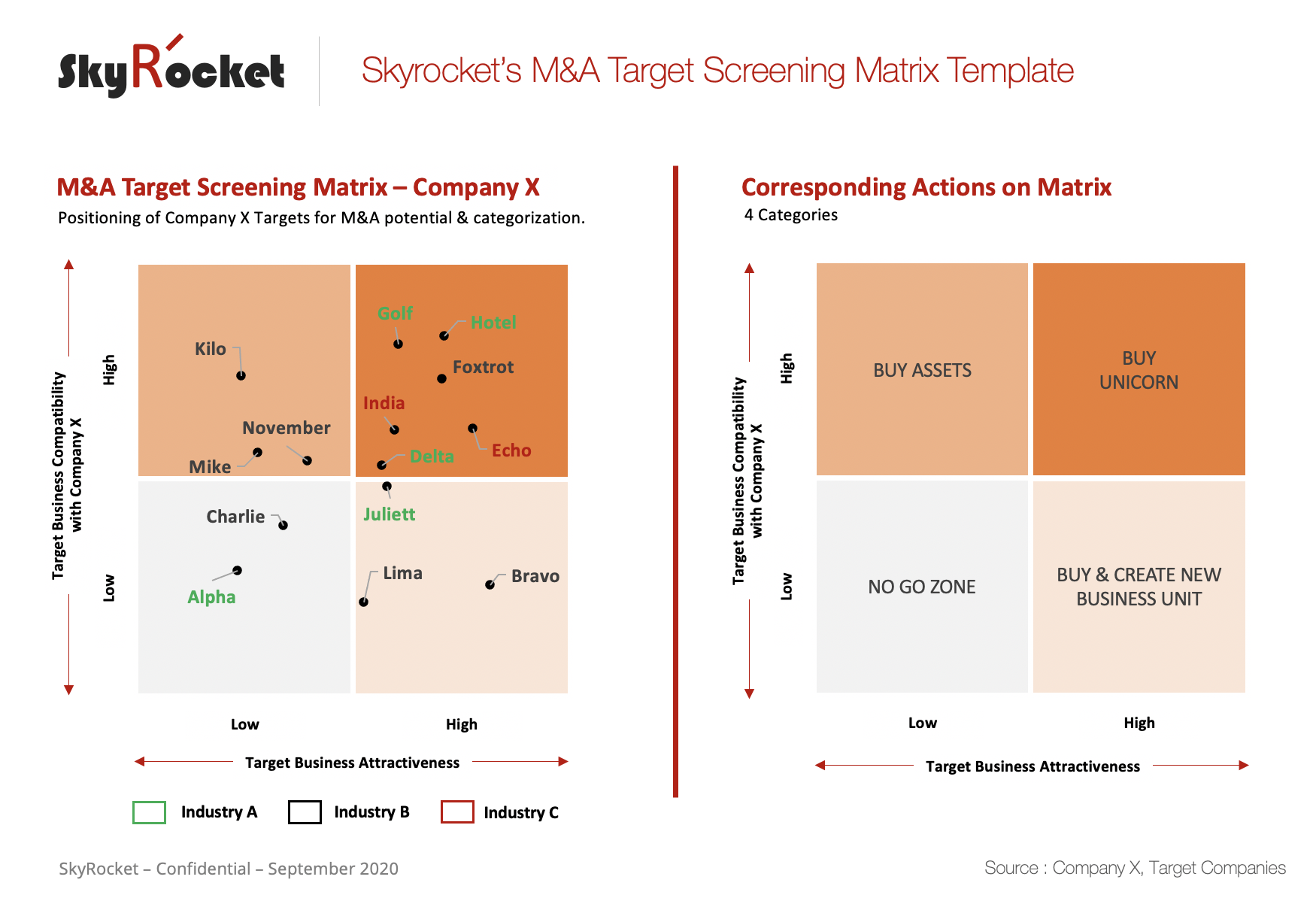

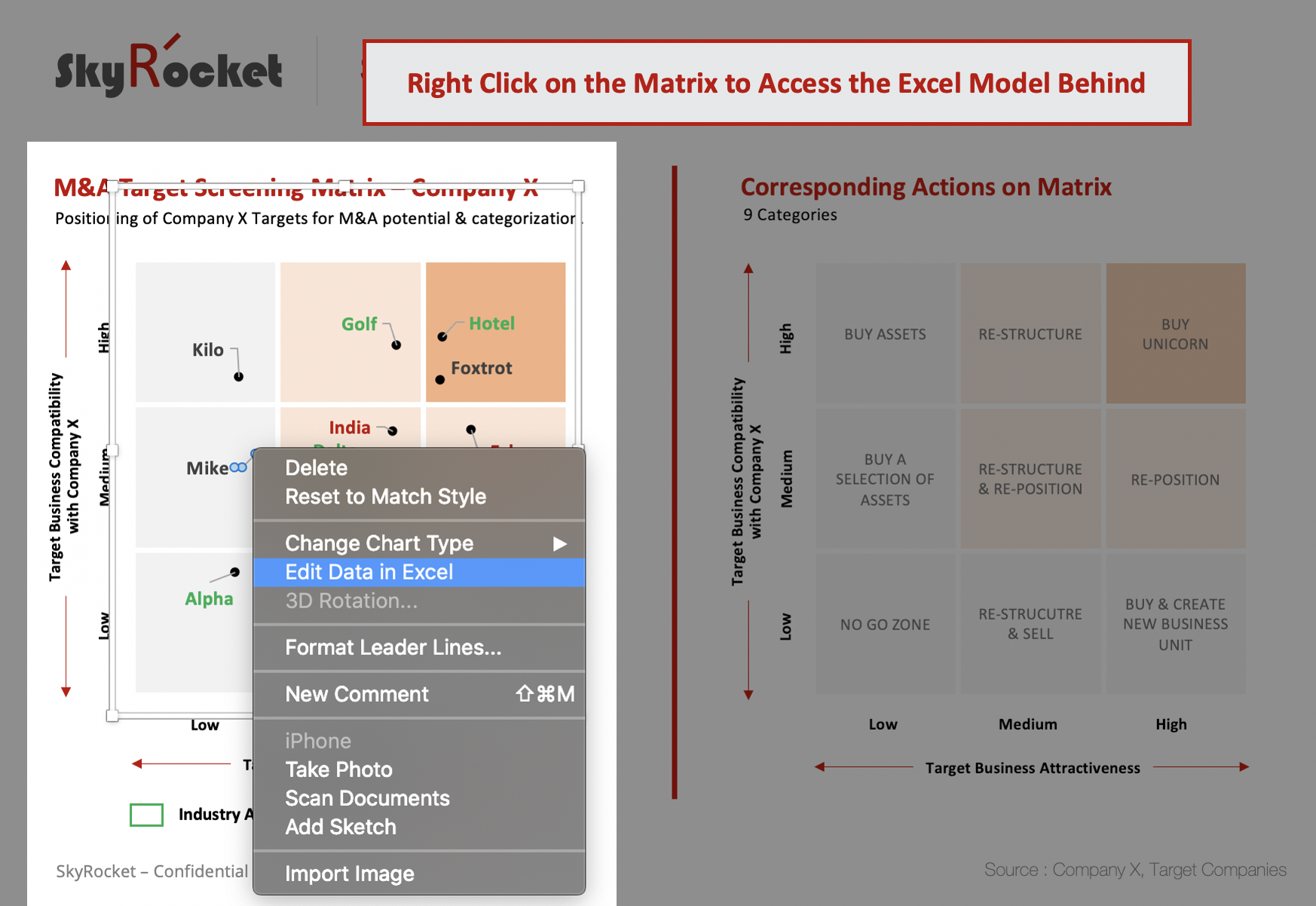

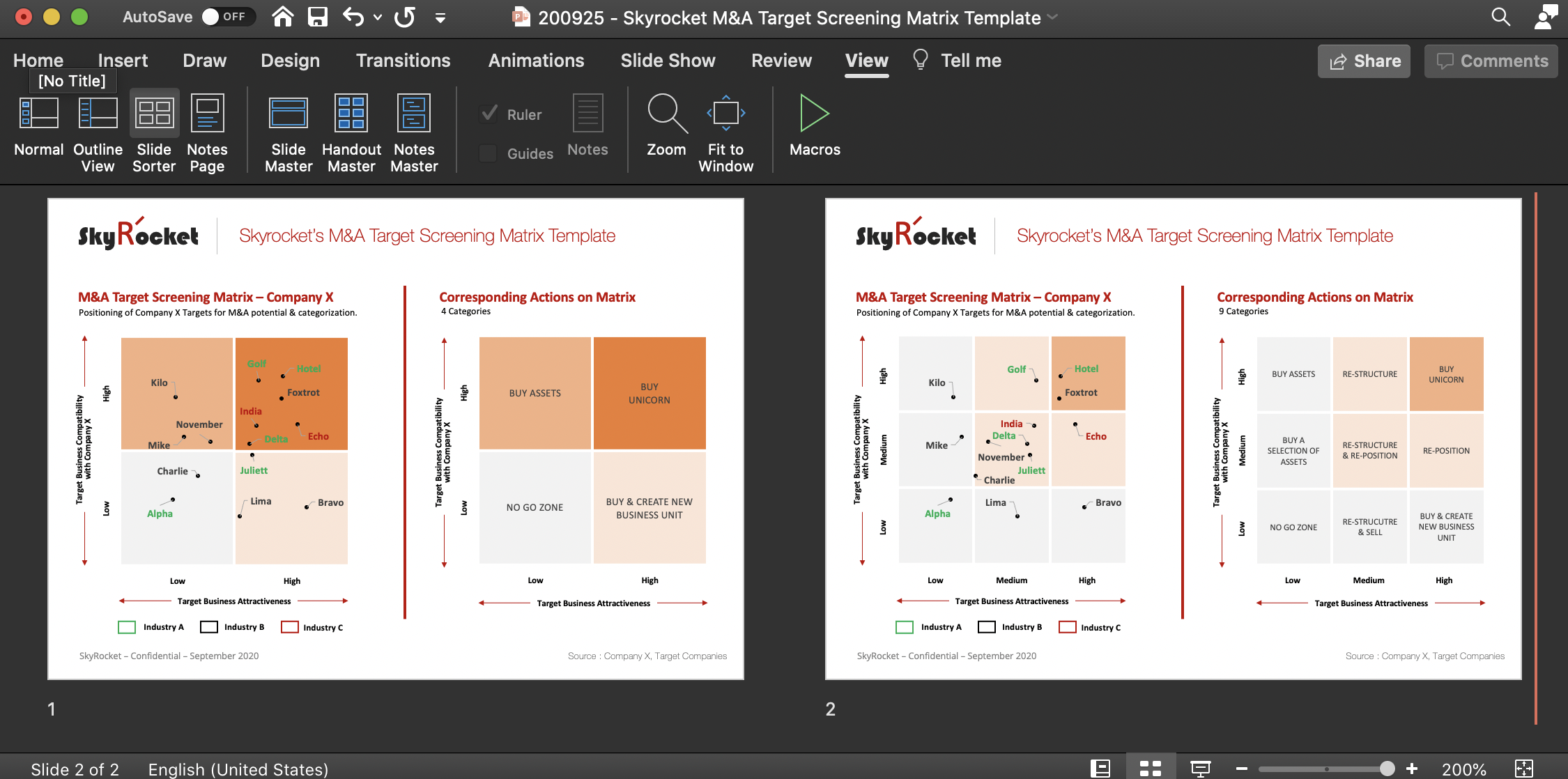

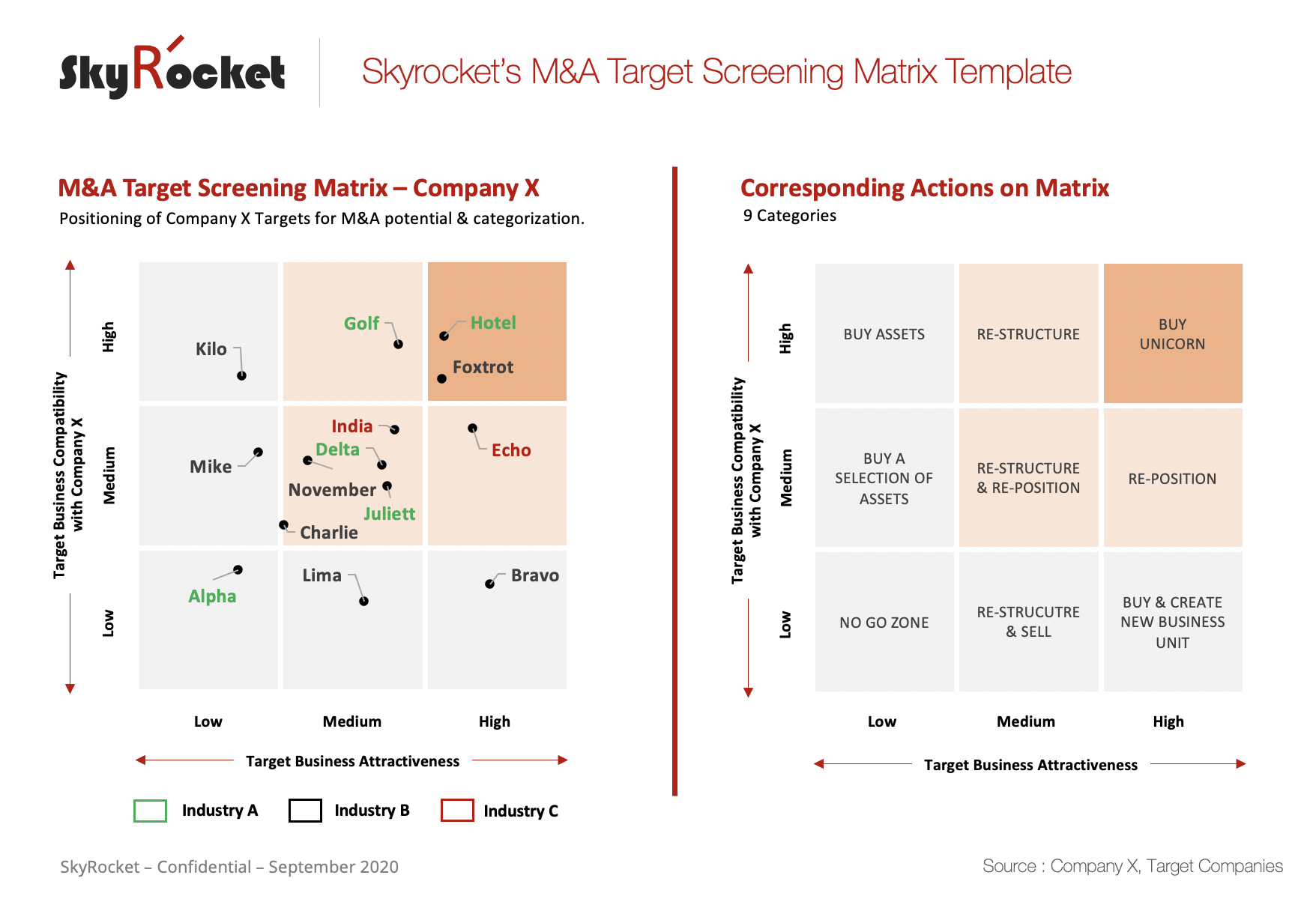

M&A Target Screening Template - Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. Web what are the key factors that make a company an attractive m&a target? The creation of an acquisition strategy the most. This is a merger and acquisition process ppt sample. Web critical steps in m&a target screening. This slide introduces mergers and acquisitions framework.state your company name and begin. A proactive, structured screening process helps organizations. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Valuing the target on a standalone basis and valuing the. Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. Web dynamic work & collaboration software | smartsheet a platform for. The. Most of the deals look absolutely lucrative in further on companies’ integration but from the other hand majority deals declare. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. Web presenting a merger and acquisition process ppt sample. Web developing a screening process. Web abstract m&a deal market is growing every year. How do buyers assess the value and potential of a target? When you hear about one company acquiring another, it seems like the process is over in a blink of an. Find out in this comprehensive study by. This is a five stage process. Web abstract m&a deal market is growing every year. Web web m&a screening as a service target screening algorithm for m&a managers, consultants and other agents within the. This slide introduces mergers and acquisitions framework.state your company name and begin. This usually involves two steps: Web what are the key factors that make a company an attractive m&a target? A “gold standard” m&a blueprint is detailed and. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. Web what are the key factors that make a company an attractive m&a target? Web target. How do buyers assess the value and potential of a target? Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. The creation of an acquisition strategy the most. Web dynamic work & collaboration. To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. When you hear about one company acquiring another, it seems like the process is over in a blink of an. We provide insights into dealsourcing, deal origination and. Web what are the key factors that make a company. Web dynamic work & collaboration software | smartsheet a platform for. This usually involves two steps: Ideas from investment banks would typically flow into the long list or be. This is a five stage process. The following presents a great rank and outline for building a potential. A proactive, structured screening process helps organizations. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web presenting a merger and acquisition process ppt sample. This usually involves two steps: Most of the deals look absolutely lucrative in further on companies’ integration but from the other hand majority deals declare. This is a five stage process. Web collect screening data from entire universe of potential targets, and apply the acquisition criteria to evaluate potential fit prioritize initial acquisition candidates and develop profiles. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening. Target screening was traditionally conducted using a funnel approach in which acquirers would create a long list, narrow it down to a short list based on defined screening criteria and then proceed with further target profiling. Ideas from investment banks would typically flow into the long list or be. The stages in this process are target. This is a five stage process. We provide insights into dealsourcing, deal origination and. How do buyers assess the value and potential of a target? Web target screening algorithm for m&a managers, consultants and other agents within the field of merger & acquisition. This usually involves two steps: To to this, i have created a target screening matrix template enabling to strategically position a large number of targets from multiple. Web what are the key factors that make a company an attractive m&a target? Find out in this comprehensive study by. This slide introduces mergers and acquisitions framework.state your company name and begin. Valuing the target on a standalone basis and valuing the. Web developing a screening process for m&a targets is a critical step in the execution of an effective m&a strategy. A proactive, structured screening process helps organizations. Web presenting a merger and acquisition process ppt sample. Web one of the biggest steps in the m&a process is analyzing and valuing acquisition targets. Web systematic target screening a formal screening process will help to ensure m&a activities remain closely linked to overall strategic priorities and provide for flexibility. A “gold standard” m&a blueprint is detailed and. Web abstract m&a deal market is growing every year.M&A Target Screening

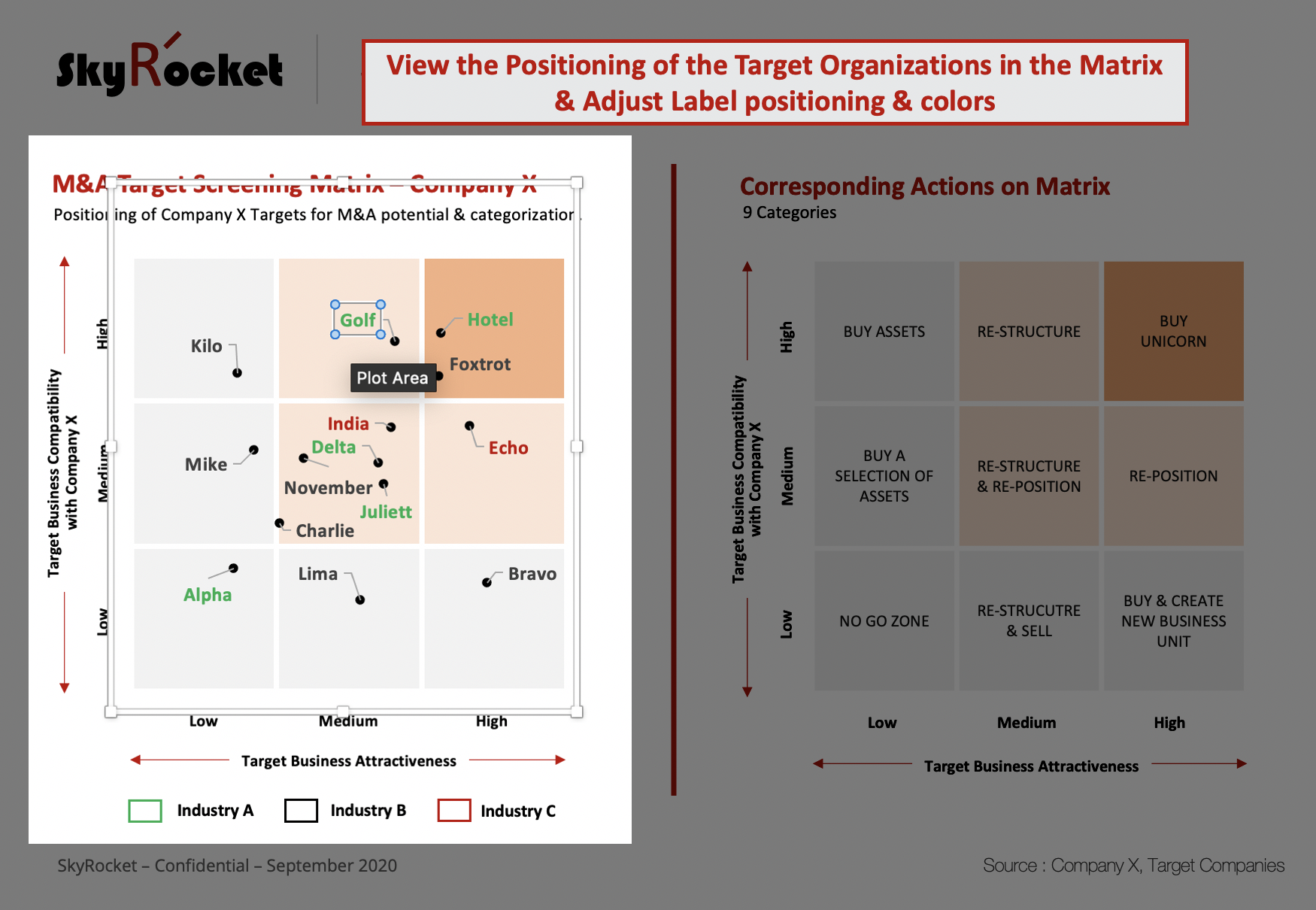

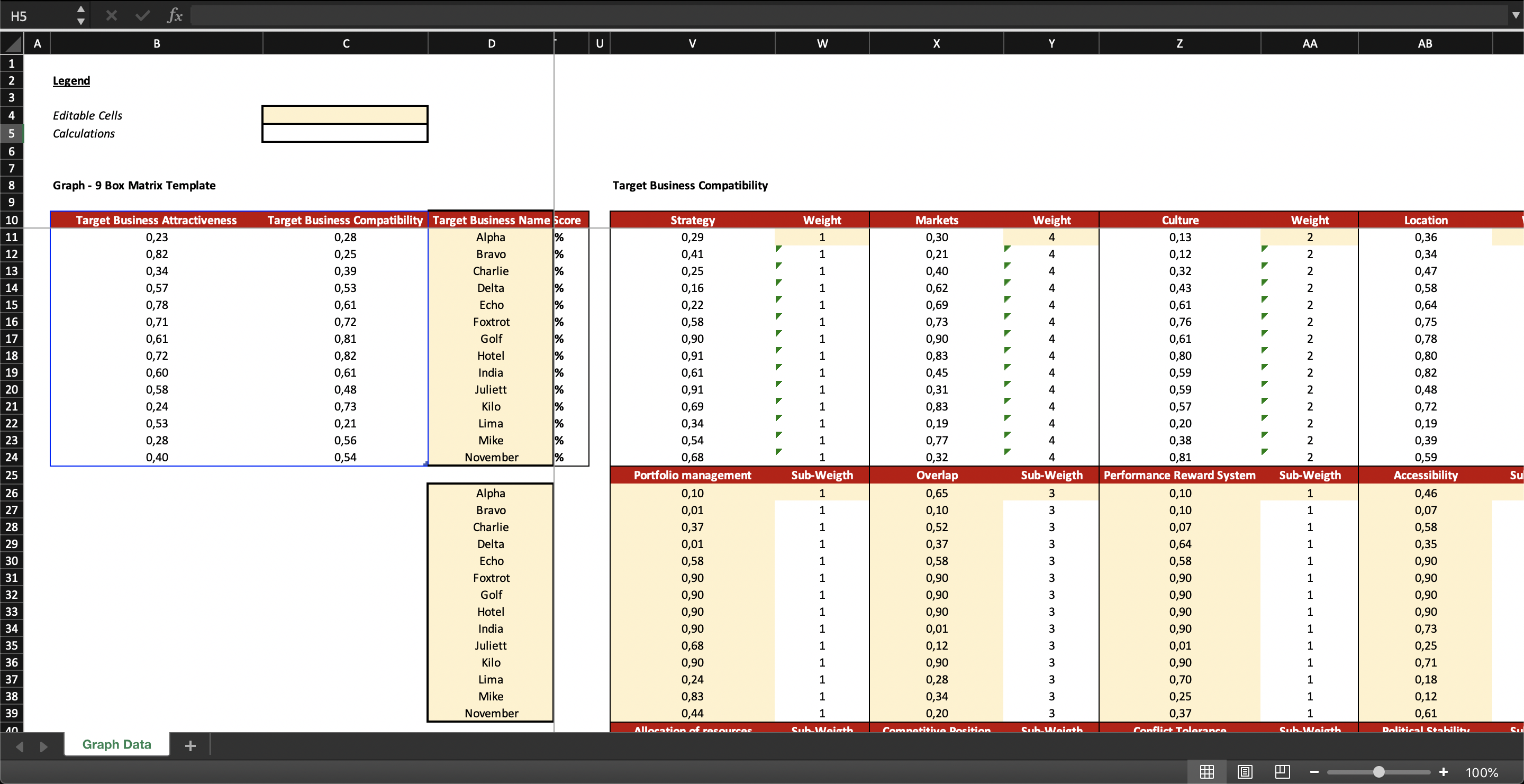

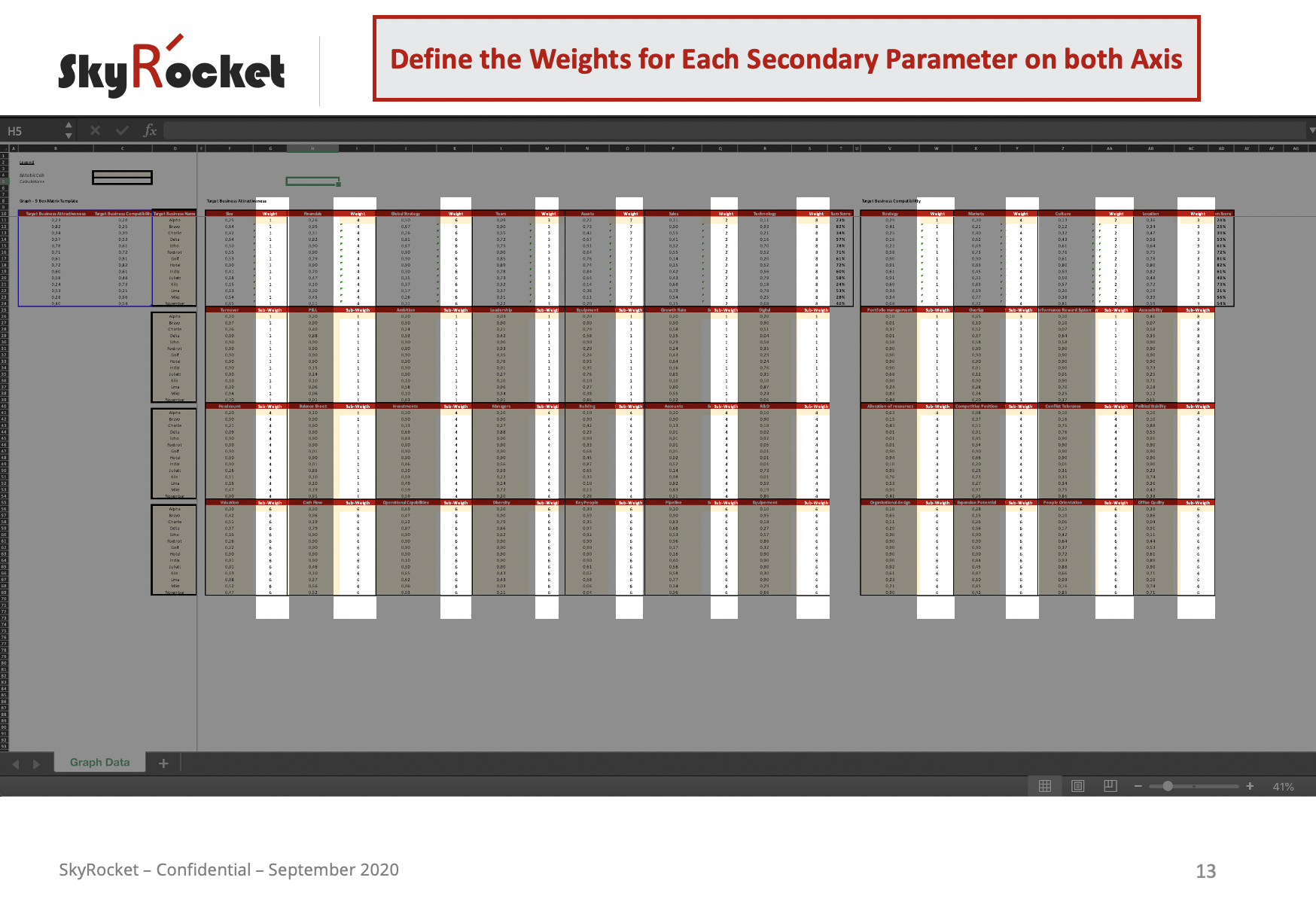

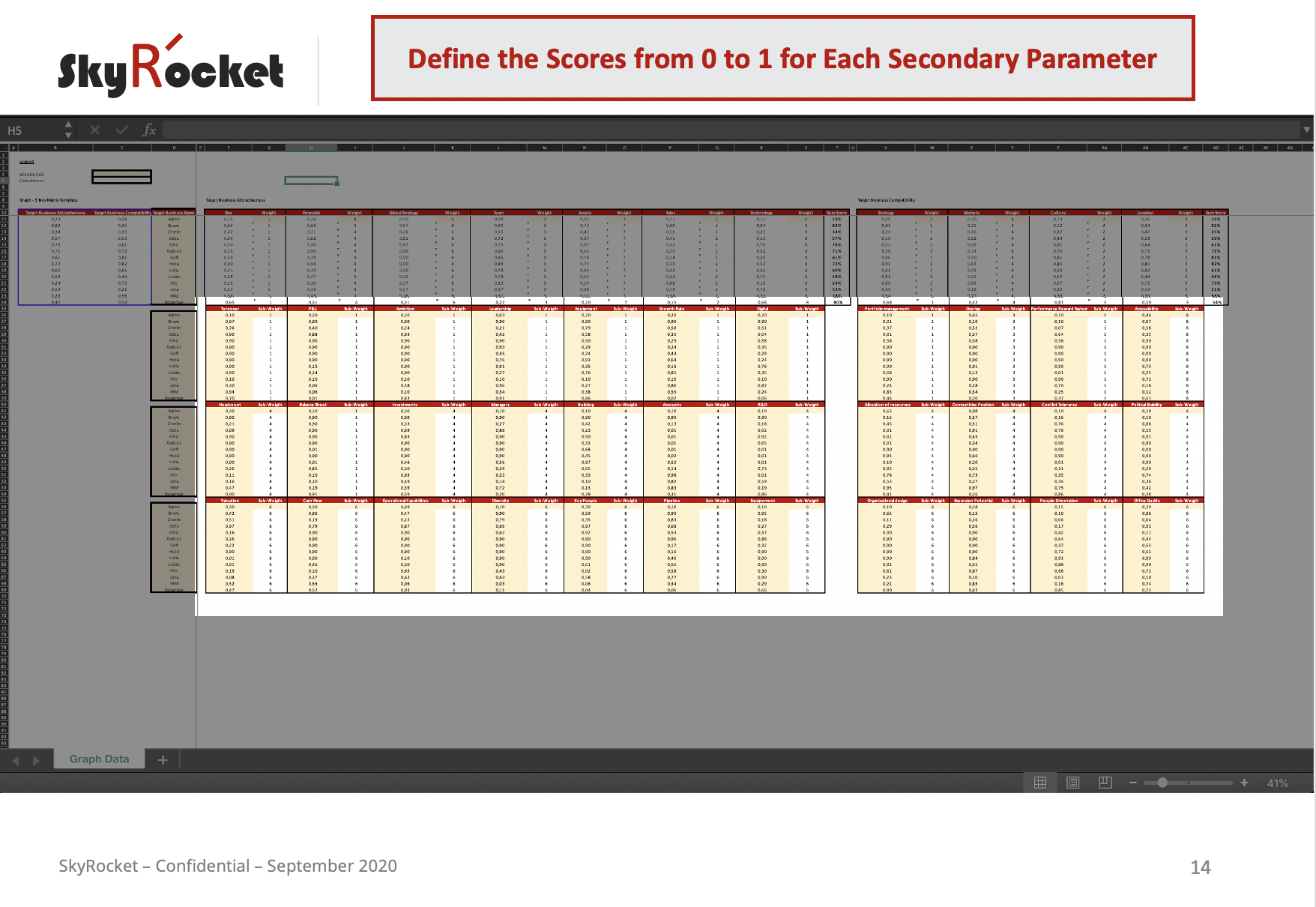

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

M&A BuySide Target Screening NineBox Matrix PowerPoint & Excel

Related Post: