M&A Model Template

M&A Model Template - Web welcome to cfi’s advanced financial modeling course on mergers and acquisitions (m&a). Merger models are constructed to simulate the impact of two companies merging, or one company taking over the other. This course is designed for professionals working in investment banking, corporate. Check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web mergers & acquisitions (m&a) financial model. Web m&a tools & templates. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Web m&a strategy & plan templates. Advanced financial model presenting a potential merger & acquisition (m&a) transaction between two companies. Web this checklist template provides a framework for integration requests, tailored specifically for m&a transactions. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Web mergers and acquisition (m&a) financial model. Web get started fast with ready to use templates for specific use cases, job functions, and industries. Web the mergers & acquisition (m&a) model provides a projection for a company looking to. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Web m&a tools & templates. Initial requests help prompt basic information for an overview of. Web we begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer. Web mergers and acquisition (m&a) financial model. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web we begin our m&a model by plugging into the spreadsheet some basic market data. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Web it includes the key documents required for a financial due diligence (e.g., a financial fact book, ev to equity bridge, completion accounts closing balance sheet and net working. In a merger model, you combine the financial statements of. Web m&a tools & templates. Merger models are constructed to simulate the impact of two companies merging, or one company taking over the other. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Discounted cash flow (dcf) model. Calculate the value of an m&a synergy with this m&a. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web welcome to cfi’s advanced financial modeling course on mergers and acquisitions (m&a). Web get started fast with ready to use templates. Calculate the value of an m&a synergy with this m&a synergy analysis template. Discounted cash flow (dcf) model. Merger models are constructed to simulate the impact of two companies merging, or one company taking over the other. Choose from over 200 starting points for project and task management, crm,. Merger and acquisition model template consists of an excel model which. Web we begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Web september 17, 2021 what is a “merger model”? Web mergers & acquisitions (m&a) financial model. Calculate the value of an m&a synergy with this m&a synergy analysis template. Advanced financial model presenting a potential. Web m&a tools & templates. Initial requests help prompt basic information for an overview of. Web within m&a, one of the core models investment banking analysts and associates have to build when analyzing an acquisition is the accretion/dilution model. Web mergers and acquisition (m&a) financial model. Choose from over 200 starting points for project and task management, crm,. This course is designed for professionals working in investment banking, corporate. Summary the macabacus discounted cash flow template implements key concepts and best practices related to. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Web get started fast with ready to use templates for specific use cases,. Web within m&a, one of the core models investment banking analysts and associates have to build when analyzing an acquisition is the accretion/dilution model. Web this checklist template provides a framework for integration requests, tailored specifically for m&a transactions. Calculate the value of an m&a synergy with this m&a synergy analysis template. Merger models are constructed to simulate the impact of two companies merging, or one company taking over the other. Summary the macabacus discounted cash flow template implements key concepts and best practices related to. Advanced financial model presenting a potential merger & acquisition (m&a) transaction between two companies. In a merger model, you combine the financial statements of the buyer and seller in an acquisition, reflect the effects of the acquisition, such as interest. Web get started fast with ready to use templates for specific use cases, job functions, and industries. Web it includes the key documents required for a financial due diligence (e.g., a financial fact book, ev to equity bridge, completion accounts closing balance sheet and net working. Web we begin our m&a model by plugging into the spreadsheet some basic market data and corporate information about the target (“targetco”) and acquirer (“buyerco”). Check out our library of free strategy and planning templates including acquisition evaluation, acquisition strategy, roles and. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Web mergers & acquisitions (m&a) financial model. Discounted cash flow (dcf) model. Merger and acquisition model template consists of an excel model which assists the user to assess the financial viability of the. Web mergers and acquisition (m&a) financial model. Web welcome to cfi’s advanced financial modeling course on mergers and acquisitions (m&a). Initial requests help prompt basic information for an overview of. Web m&a tools & templates. Web m&a strategy & plan templates.Software Tools Drive Increased M&A Success M&A Leadership Council

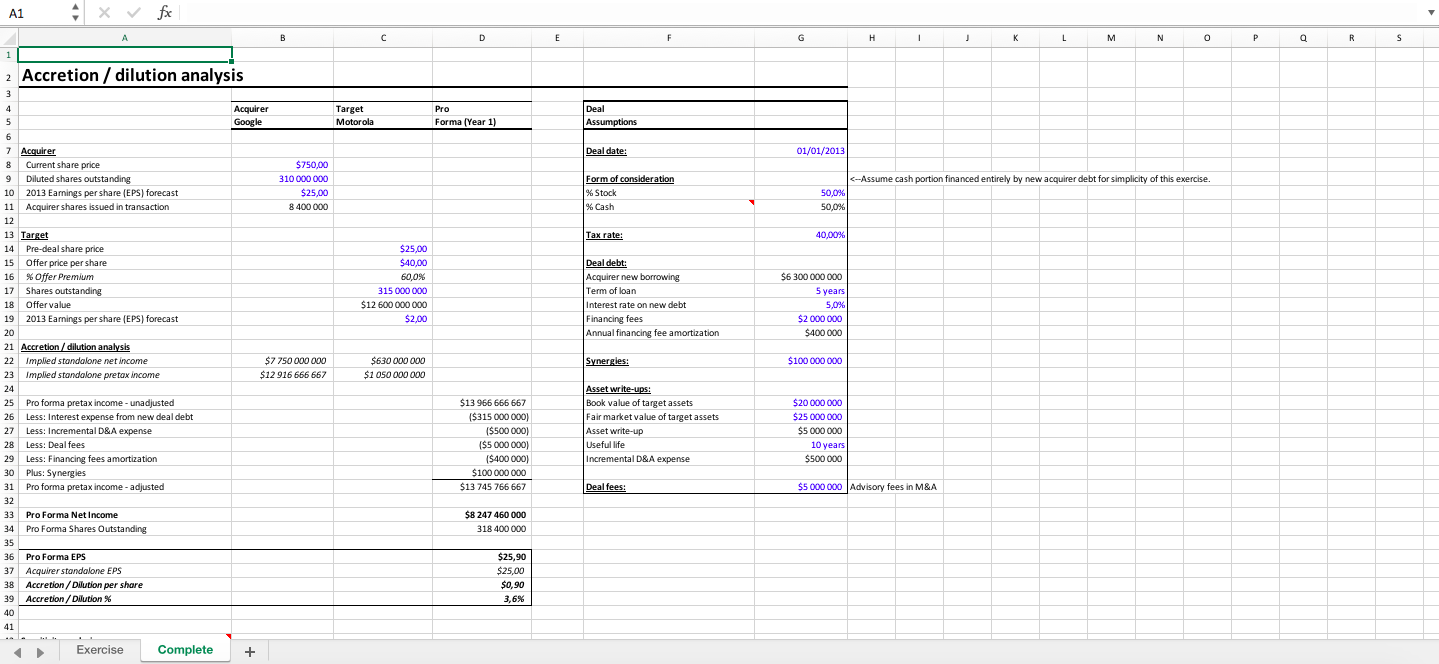

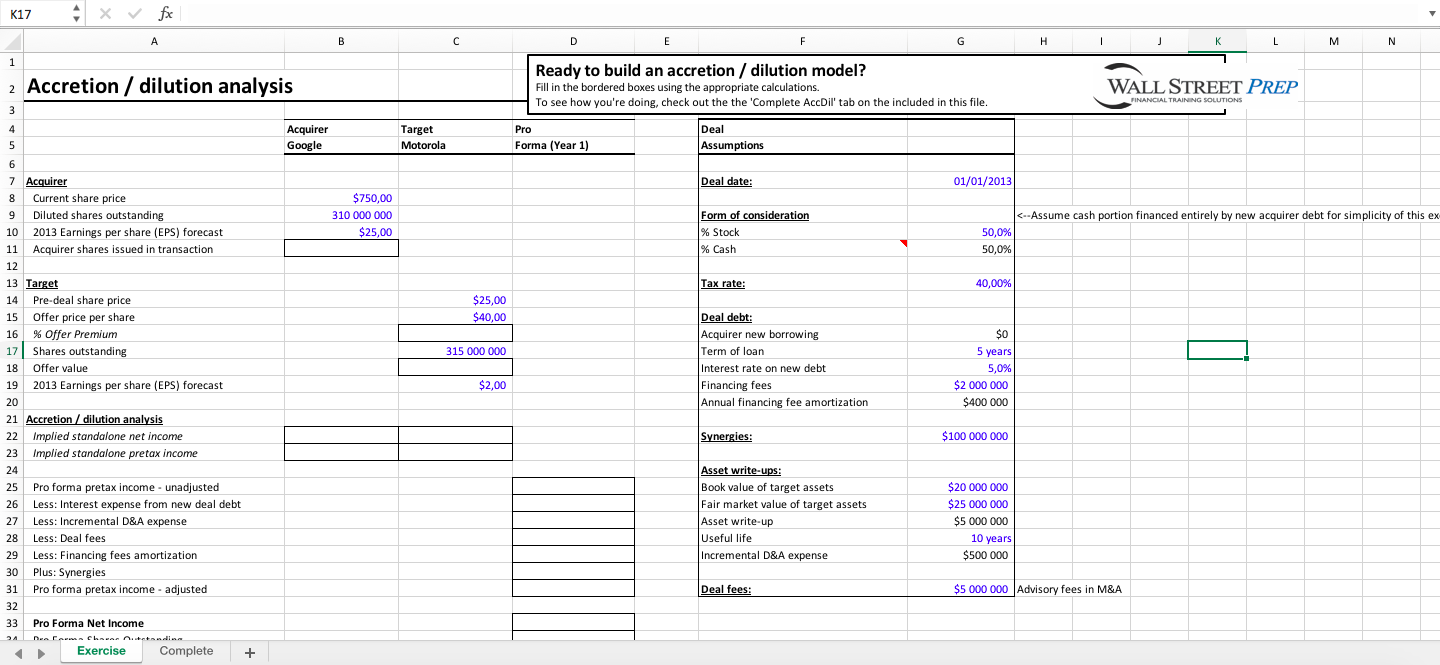

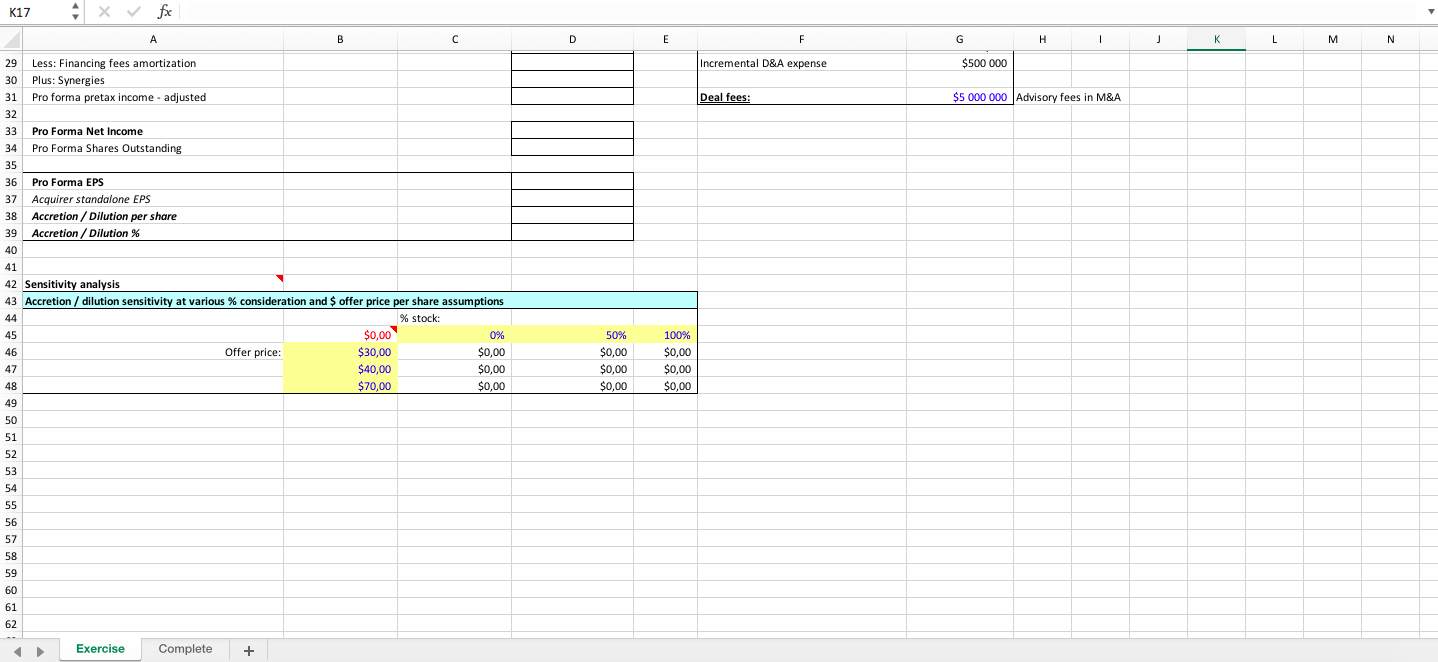

M&A Model Accretion Dilution Excel Model Template + Instructions

Mergers and Acquisitions M&A Model YouTube

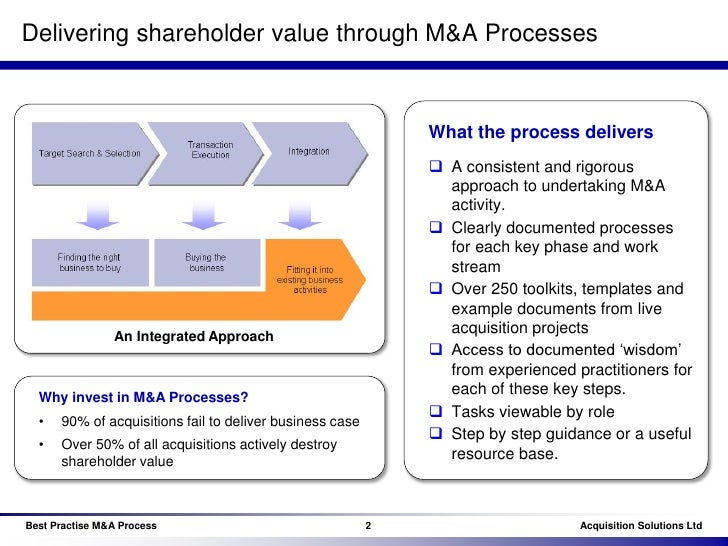

M&A Process Model

M&A Model Accretion Dilution Excel Model Template + Instructions

The M&A evaluation and prioritization model. M&A mergers and

M&A Process Model

M&A Model Accretion Dilution Excel Model Template + Instructions

Corporate Finance Institute

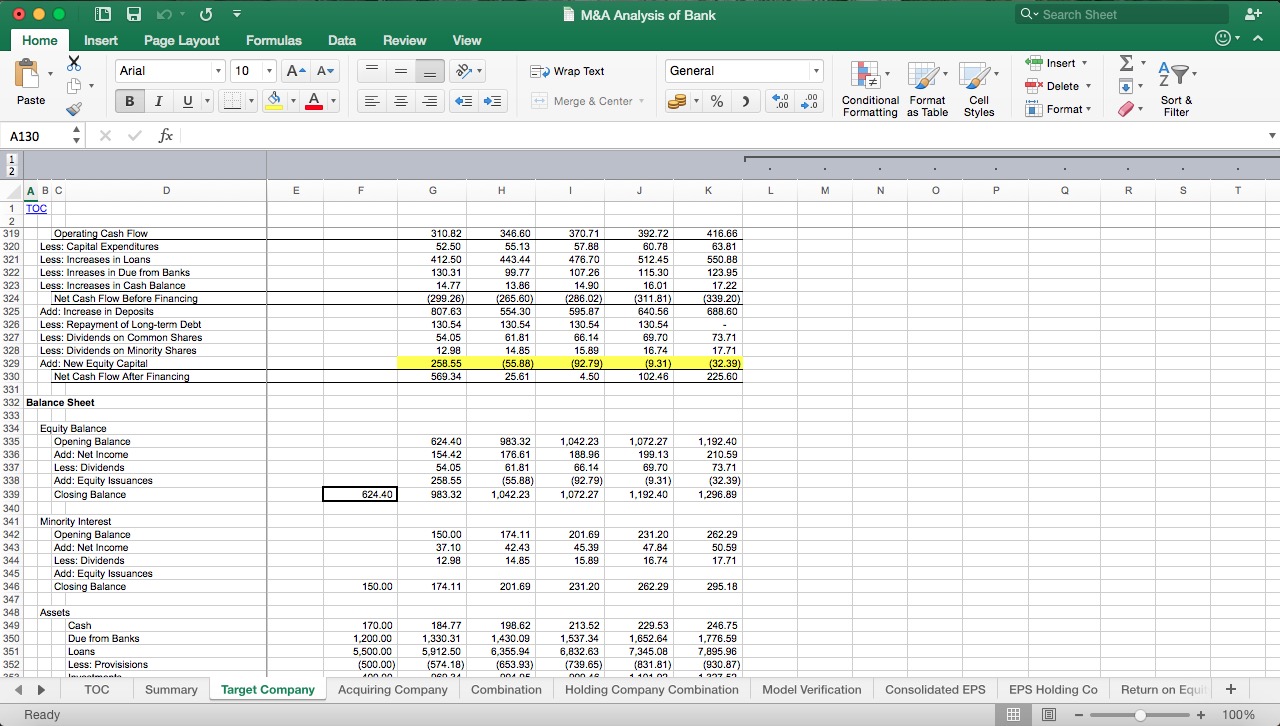

M&A Analysis Bank Excel Model Eloquens

Related Post: