M&A Deal Sheet Template

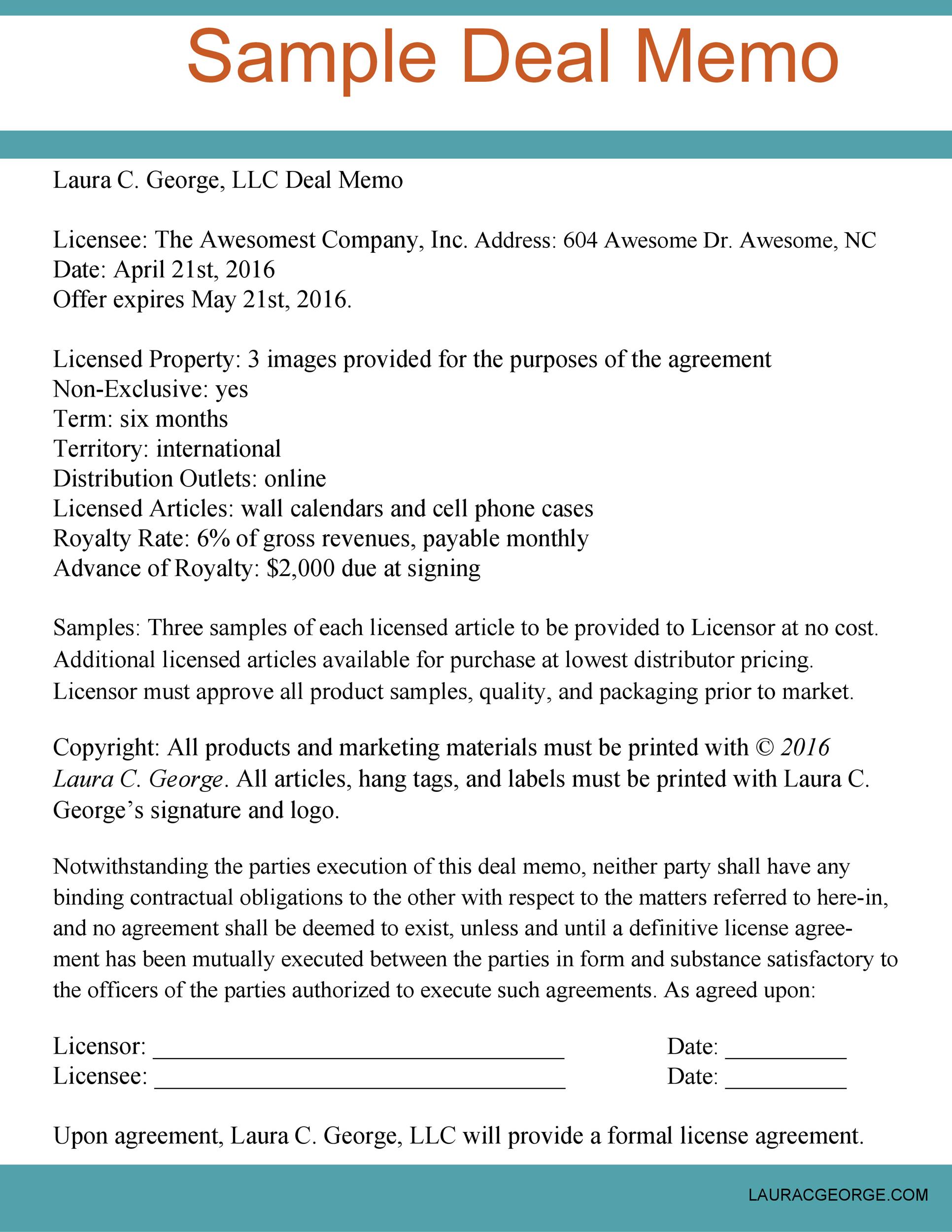

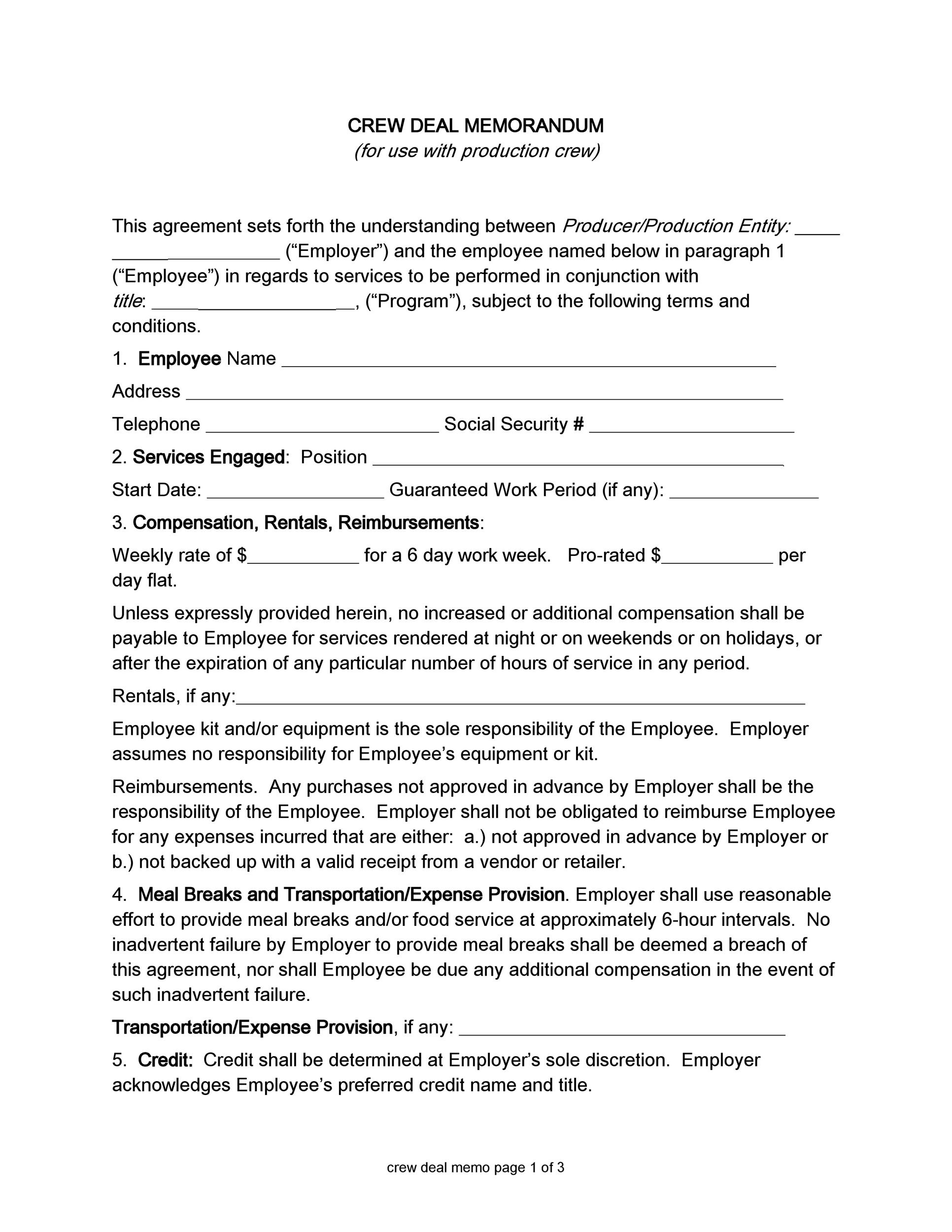

M&A Deal Sheet Template - Free cash flow statement, capex overview, monthly net working capital. Dss are essential for job seekers, especially in. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. It doesn’t matter if you’re a. Capital employed balance sheet, inventory breakdown, trade payable and trade receivable aging analyses. You should start collecting your important documents ahead of a deal. This is the general foundation for companies. These templates are free for you to download and can be used within minutes. This model runs through different. Web sample deal sheet representative matters corporate finance represented jpmorgan in connection with a $150 million p&a facility to mgm. It doesn’t matter if you’re a. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Log every detail of every deal in your pipeline with the deals sheet, including. We cover a wide variety of templates. Web balance sheet section (bs): The deal requires a special and complicated structure to avoid the debt covenant breach under its existing corporate facility agreement. We cover a wide variety of templates. This is the general foundation for companies. Dss are essential for job seekers, especially in. Collect documents for due diligence well in advance. This is the general foundation for companies. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. This model runs through different. Web sample deal sheet representative matters corporate finance represented jpmorgan in connection with a $150. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due.. Web balance sheet section (bs): Web the following structures are sometimes combined and altered to achieve the best outcome for stakeholders and a modern economy. We cover a wide variety of templates. Welcome to wall street prep! These templates are free for you to download and can be used within minutes. The acquisition integration project plan tools and templates are organized in these categories: Web m&a tools & templates. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. This model runs through different. These templates are free. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. You should start collecting your important documents ahead of a deal. The acquisition integration project plan tools and templates are organized in these categories: Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a). Welcome to wall street prep! Web sample deal sheet representative matters corporate finance represented jpmorgan in connection with a $150 million p&a facility to mgm. These templates are free for you to download and can be used within minutes. The acquisition integration project plan tools and templates are organized in these categories: This is the general foundation for companies. This is the general foundation for companies. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. This model runs through different. The deal requires a special and complicated structure to avoid the debt covenant breach under. It doesn’t matter if you’re a. Dss are essential for job seekers, especially in. Web the mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. We cover a wide variety of templates. These templates are free for you to download and can be used within minutes. You should start collecting your important documents ahead of a deal. The term is an abbreviation for mergers and acquisitions. These templates are free for you to download and can be used within minutes. Dss are essential for job seekers, especially in. Collect documents for due diligence well in advance. Web a deal sheet (ds) records completed deals or projects in a fiscal year, highlighting a candidate's experience and value. What does m&a stand for? It doesn’t matter if you’re a. The deal requires a special and complicated structure to avoid the debt covenant breach under its existing corporate facility agreement. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. We cover a wide variety of templates. Capital employed balance sheet, inventory breakdown, trade payable and trade receivable aging analyses. Web the term sheet is a short bullet list of the key points of the transaction, such as the selling price, earnest money deposit, down payment, financing terms, length of time for due. Free cash flow statement, capex overview, monthly net working capital. This is the general foundation for companies. Manage all of your ongoing mergers and acquisitions with this m&a deal pipeline template. Welcome to wall street prep! Web the following structures are sometimes combined and altered to achieve the best outcome for stakeholders and a modern economy. The acquisition integration project plan tools and templates are organized in these categories: Web m&a tools & templates.50 Simple Deal Memo Templates (& Layouts) ᐅ TemplateLab

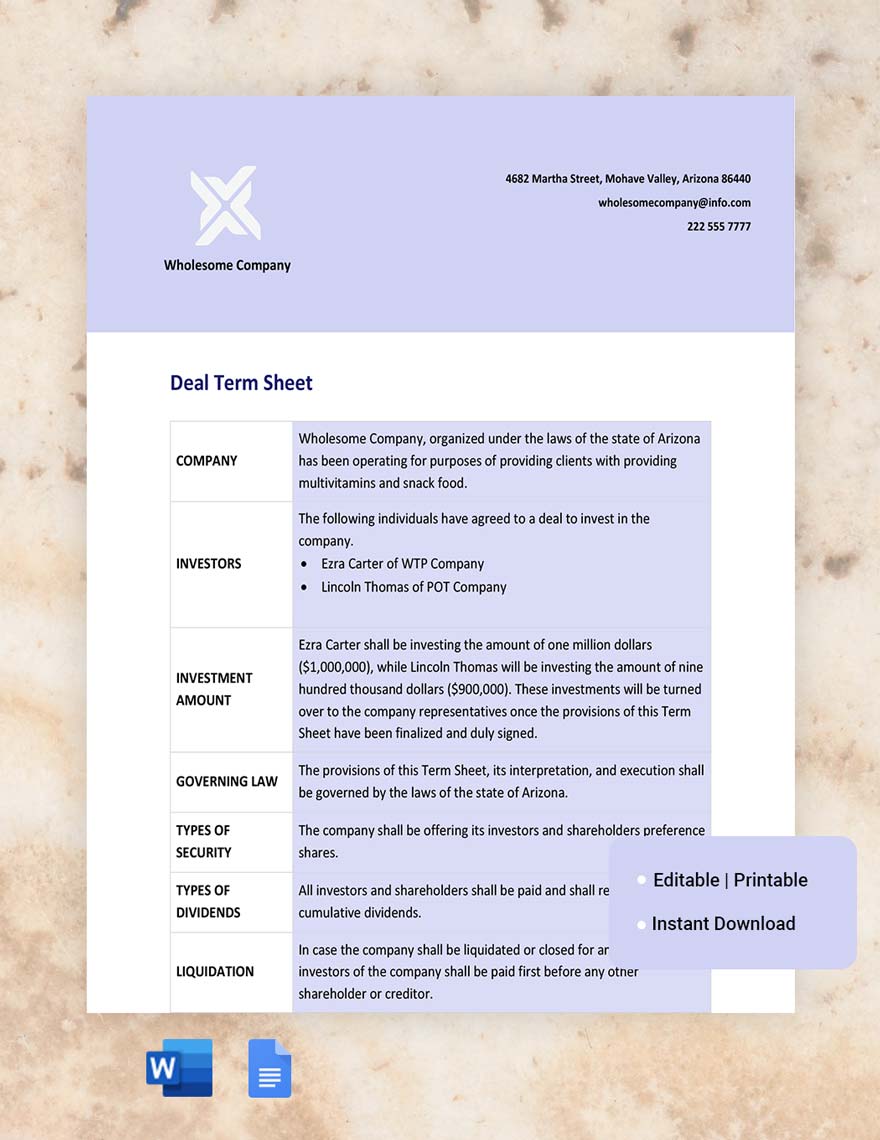

47 Simple Term Sheet Templates [Word] ᐅ TemplateLab

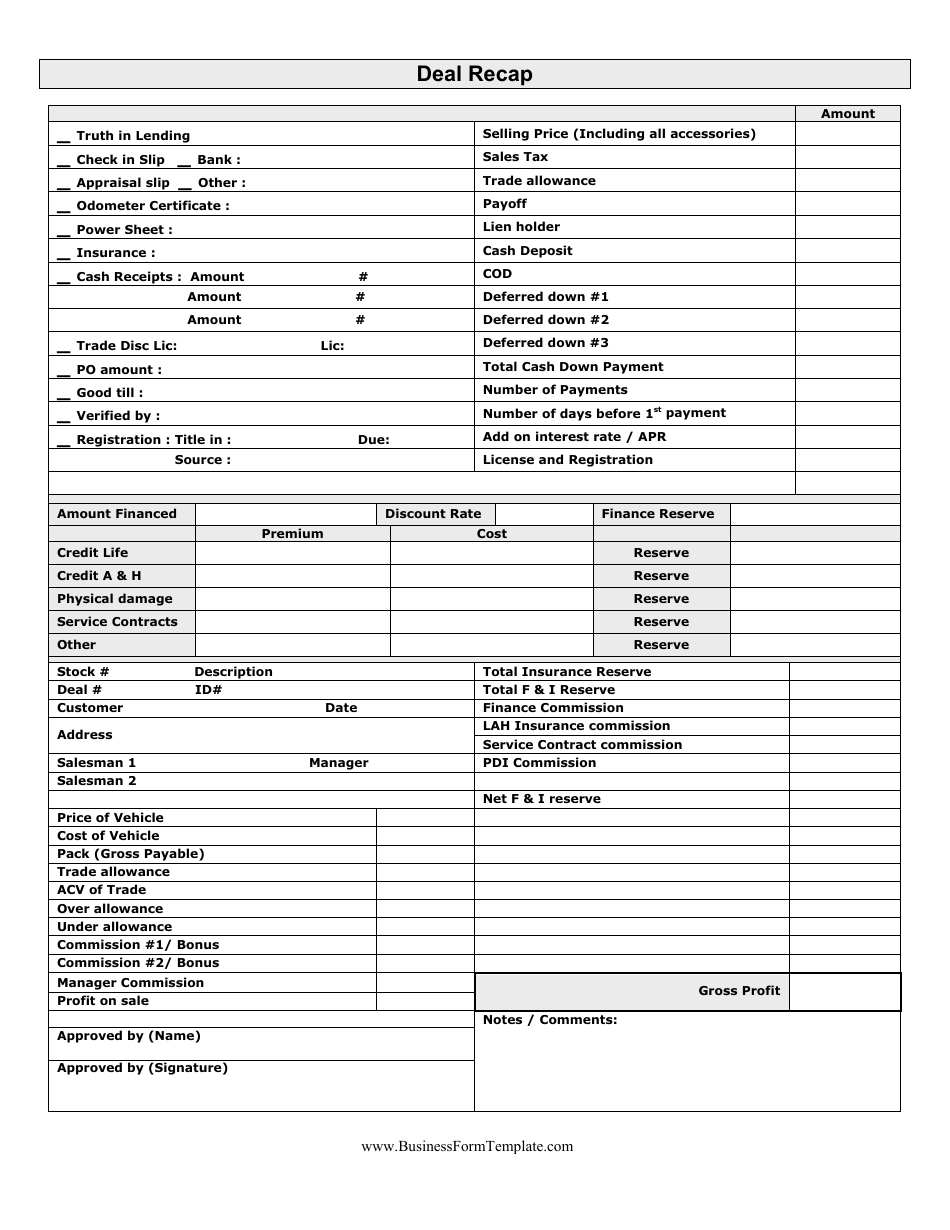

Deal Recap Template Download Printable PDF Templateroller

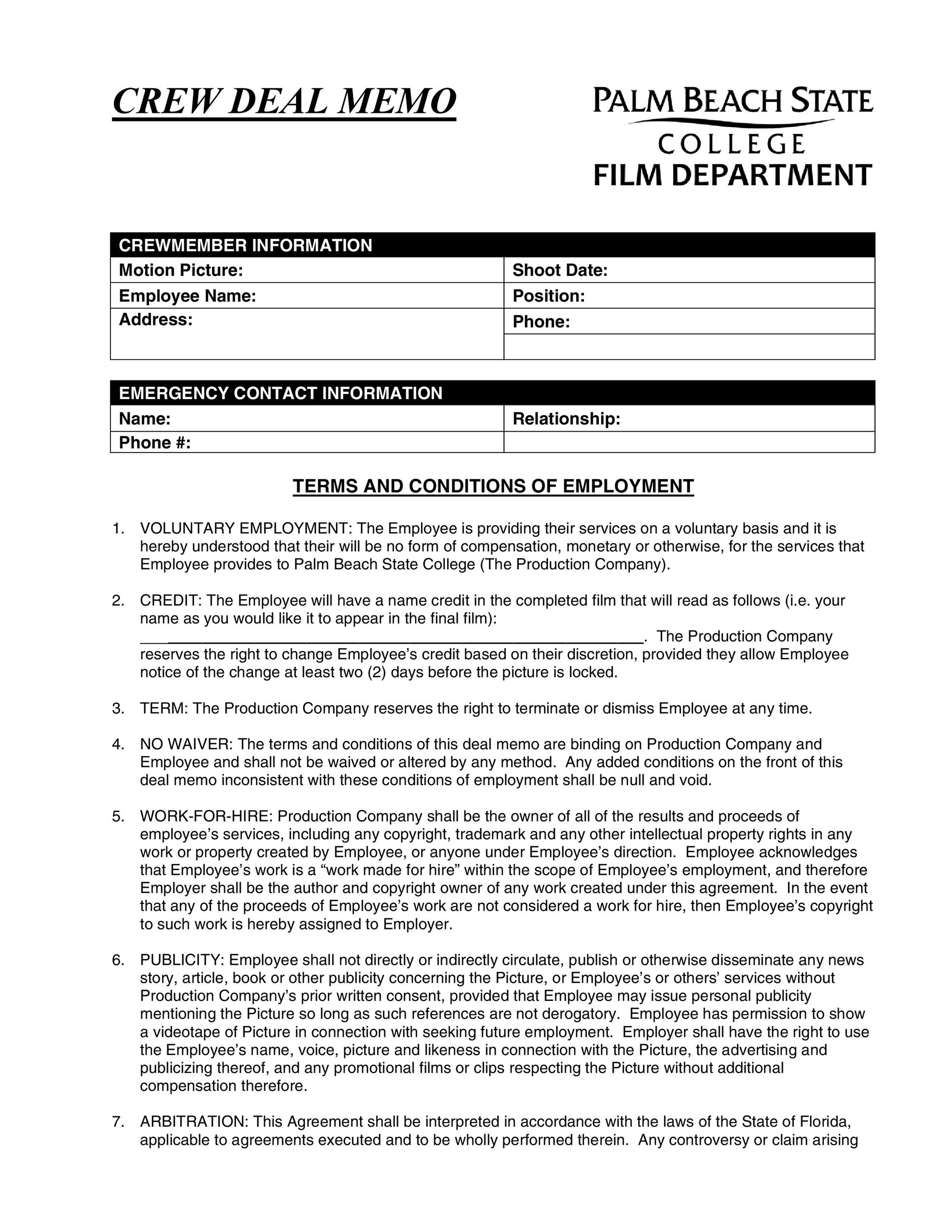

50 Simple Deal Memo Templates (& Layouts) ᐅ TemplateLab

47 Simple Term Sheet Templates [Word] ᐅ TemplateLab

Term Sheets Definition, What's Included, Examples, and Key Terms

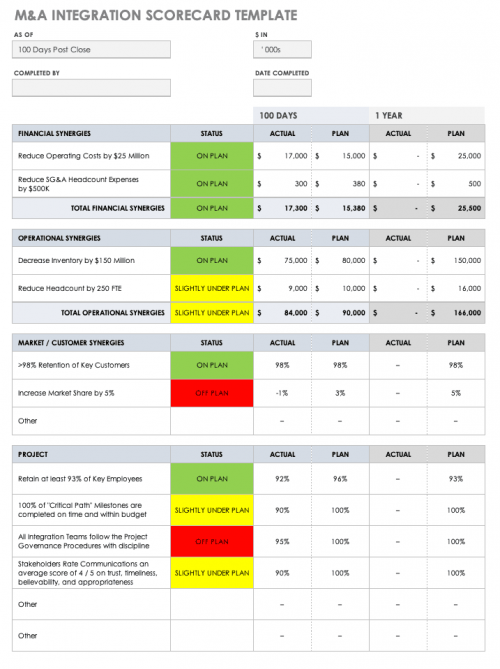

Download Free M&A Templates Smartsheet

50 Simple Deal Memo Templates (& Layouts) ᐅ TemplateLab

M&A Term Sheet Template Tagua

Deal Term Sheet Template Download in Word, Google Docs

Related Post:

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/term-sheet-template-31.jpg)

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/04/term-sheet-template-46.jpg)