Letter To The Irs Template

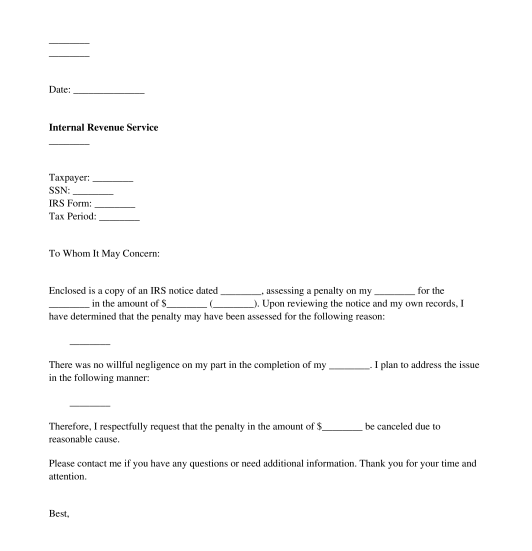

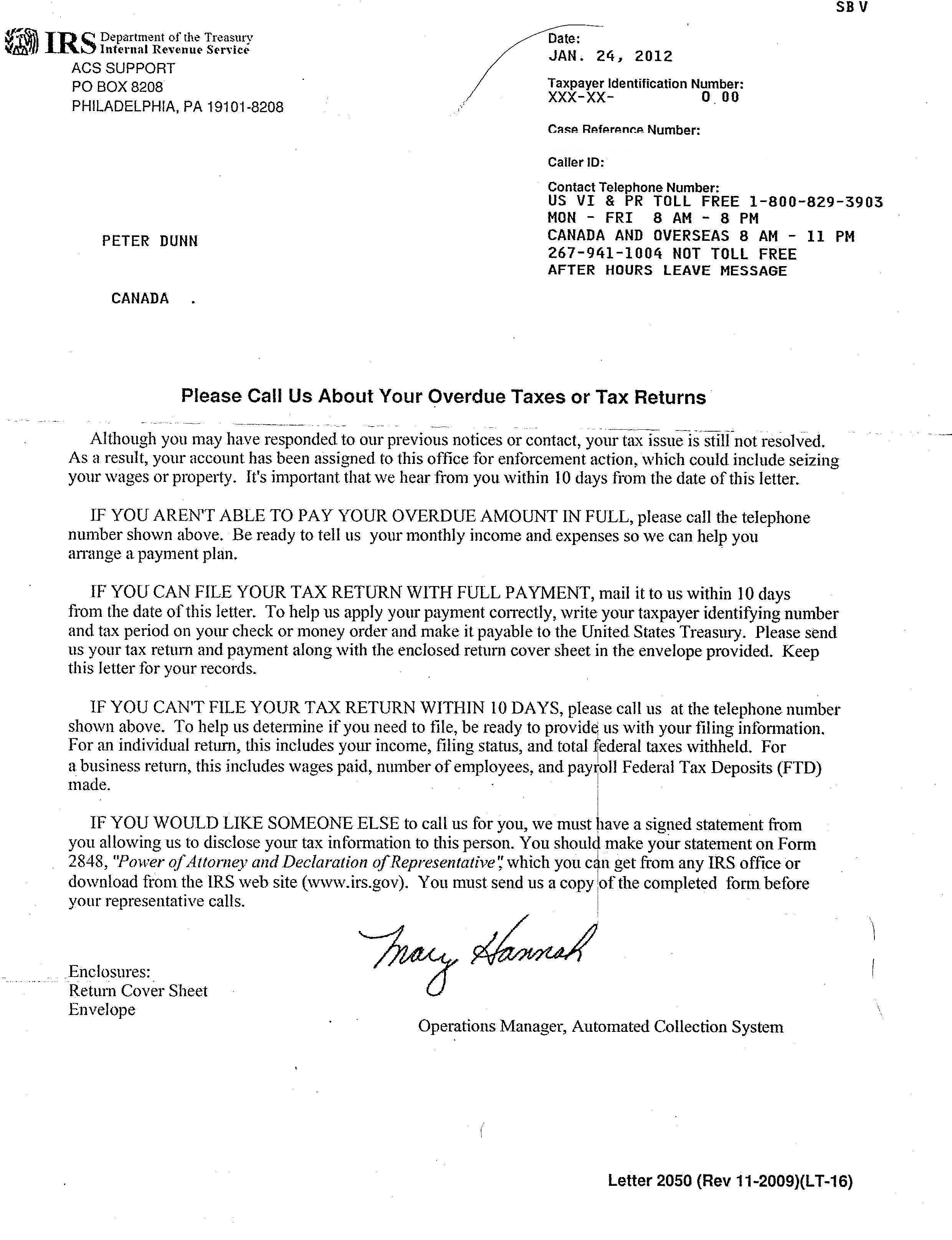

Letter To The Irs Template - Allow at least 30 days for a response from the irs. Use december 31, 2022 to request the verification letter for the correct tax. Please combine my tax records under this new number. Have a copy of your tax return and. You may learn more about these documents and prepare to communicate with tax authorities. Web a letter written to the irs for this effect of waiving a tax penalty levied against the taxpayer, therefore, is what we call a penalty abatement request letter. Einen explanation letter, also renown than a letter of annotation, belongs used to clarify discrepancies or provide a plausible explanation for unusual activity in records,. Continuing discussion of a possible recession, tight labor markets and high inflation all permeate. Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Web use form 12203, request for appeals review pdf , the form referenced in the letter you received to file your appeal or prepare a brief written statement. Web according to the irs, your letter should include the following: Web most irs letters have two options: The acceptance of digital signatures is extended. Allow at least 30 days for a response from the irs. Use december 31, 2022 to request the verification letter for the correct tax. Use december 31, 2022 to request the verification letter for the correct tax. 30, 2023 — the internal revenue service announced today that it has extended certain temporary flexibilities. Web according to the irs, your letter should include the following: The acceptance of digital signatures is extended. Taxpayer’s name, address, and contact information a statement expressing your desire to appeal. Allow at least 30 days for a response from the irs. Web most irs letters have two options: Use december 31, 2022 to request the verification letter for the correct tax. This survey will allow the irs to learn more about those. The acceptance of digital signatures is extended. Order the ultimate communicator now the letters you write on. The acceptance of digital signatures is extended. This survey will allow the irs to learn more about those. Web use form 12203, request for appeals review pdf , the form referenced in the letter you received to file your appeal or prepare a brief written statement. Web we hear from. Web am writing to notify the irs that i have been assigned a social security number. Allow at least 30 days for a response from the irs. Web if you think you’ll have trouble paying your taxes or the nftl filing will cause economic hardship, it’s helpful to know what your options are to address your tax debt. Have a. If you have questions, call the telephone number in the letter. Different formats and samples are. Web according to the irs, your letter should include the following: You may learn more about these documents and prepare to communicate with tax authorities. Web am writing to notify the irs that i have been assigned a social security number. Web an irs hardship letter is a formal statement prepared by the taxpayer and sent to the internal revenue service (irs) with the intention to describe a difficult financial situation, ask the government for leniency, and request new payment deadlines. Once again, we have faced a challenging economic year. The acceptance of digital signatures is extended. This survey will allow. If you have questions, call the telephone number in the letter. Ask for a full explanation even if you suspect the irs may be right, but you aren’t. Web if you think you’ll have trouble paying your taxes or the nftl filing will cause economic hardship, it’s helpful to know what your options are to address your tax debt. Web. If you have questions, call the telephone number in the letter. Web irs letter templates discover how quickly & painlessly you can write important irs letters! 30, 2023 — the internal revenue service announced today that it has extended certain temporary flexibilities. Taxpayer’s name, address, and contact information a statement expressing your desire to appeal. This survey will allow the. Web according to the irs, your letter should include the following: Web a letter written to the irs for this effect of waiving a tax penalty levied against the taxpayer, therefore, is what we call a penalty abatement request letter. Once again, we have faced a challenging economic year. Web an irs hardship letter is a formal statement prepared by. Taxpayer’s name, address, and contact information a statement expressing your desire to appeal. Please combine my tax records under this new number. Ask for a full explanation even if you suspect the irs may be right, but you aren’t. Web most irs letters have two options: Different formats and samples are. Web am writing to notify the irs that i have been assigned a social security number. Order the ultimate communicator now the letters you write on. My complete name is [write your full. The acceptance of digital signatures is extended. You may learn more about these documents and prepare to communicate with tax authorities. 30, 2023 — the internal revenue service announced today that it has extended certain temporary flexibilities. Web according to the irs, your letter should include the following: Web a letter written to the irs for this effect of waiving a tax penalty levied against the taxpayer, therefore, is what we call a penalty abatement request letter. Continuing discussion of a possible recession, tight labor markets and high inflation all permeate. Einen explanation letter, also renown than a letter of annotation, belongs used to clarify discrepancies or provide a plausible explanation for unusual activity in records,. This survey will allow the irs to learn more about those. Web if you think you’ll have trouble paying your taxes or the nftl filing will cause economic hardship, it’s helpful to know what your options are to address your tax debt. Web irs letter templates discover how quickly & painlessly you can write important irs letters! Agree with the changes the irs is making or send a written explanation of why the irs is wrong and you are right. Web an irs hardship letter is a formal statement prepared by the taxpayer and sent to the internal revenue service (irs) with the intention to describe a difficult financial situation, ask the government for leniency, and request new payment deadlines.Letter To Irs Business Name Change Leweter pertaining to Deed Poll

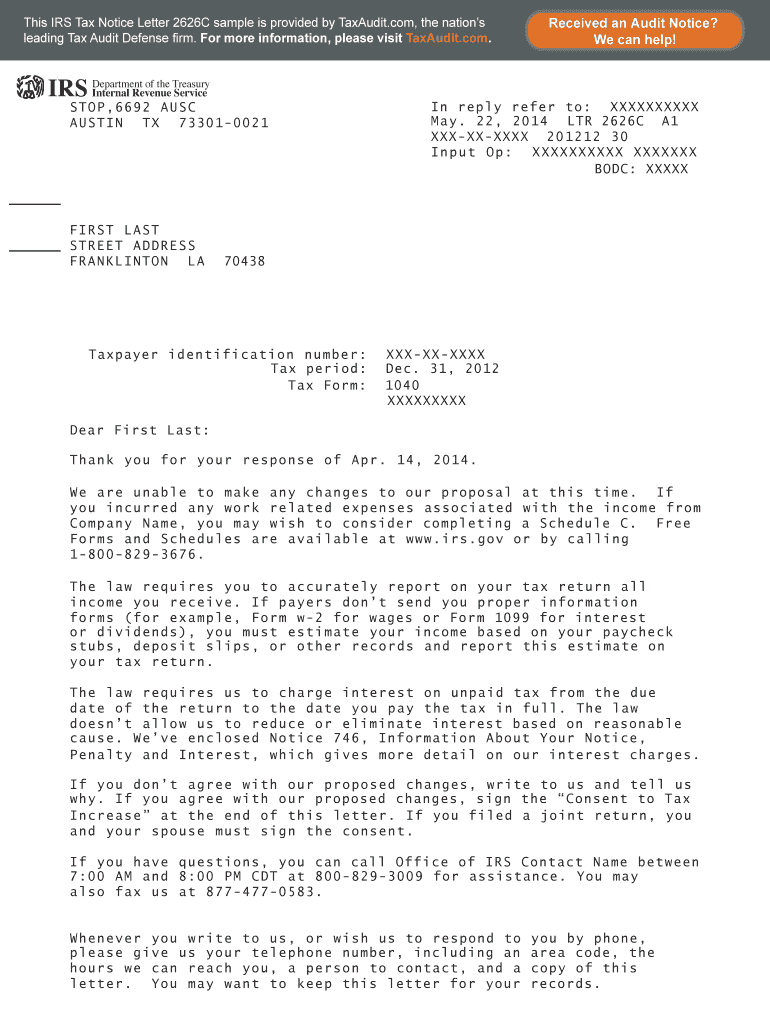

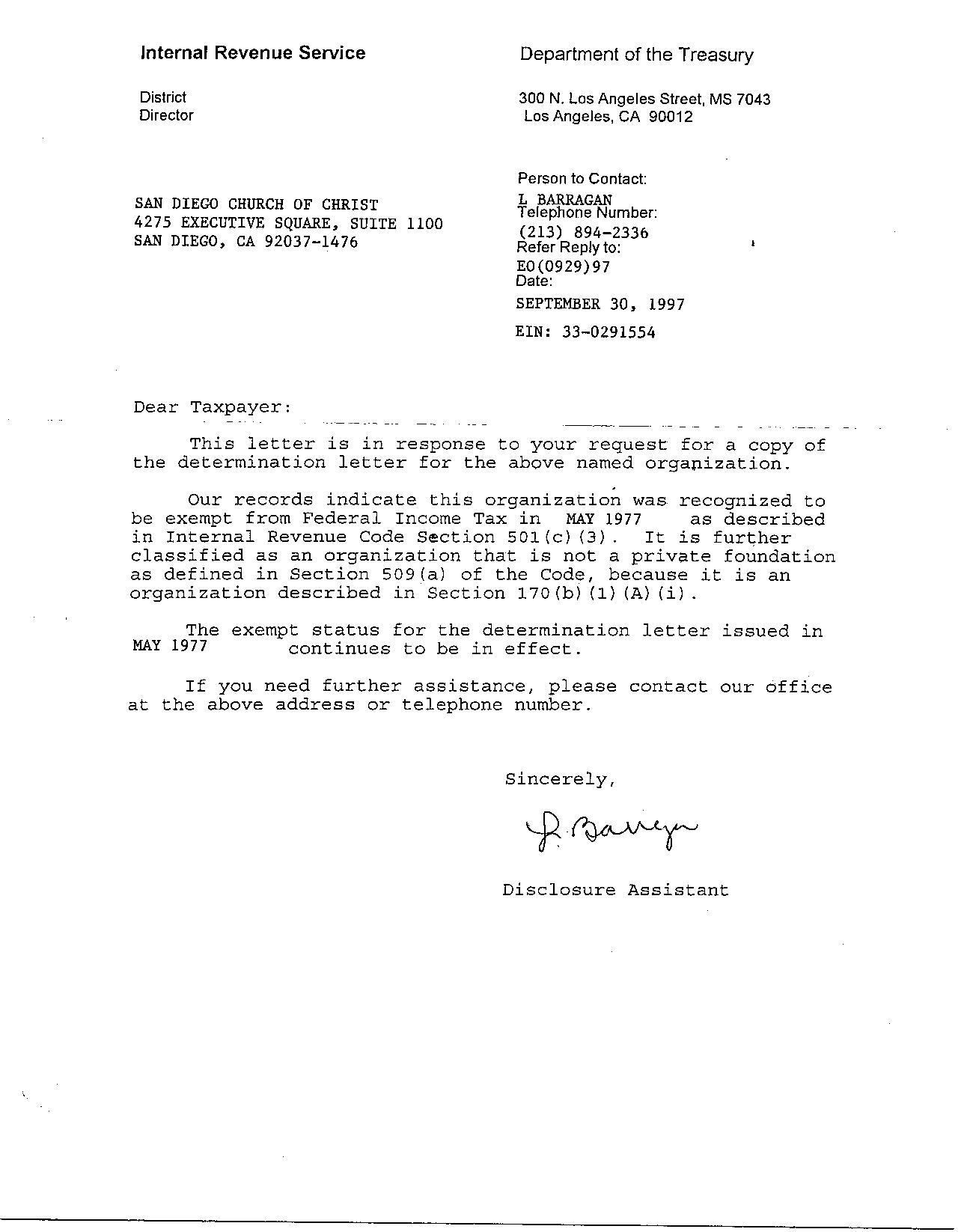

IRS Letter 4464C Sample 2

IRS Letter 2202 Sample 1

Irs Letterhead 20202022 Fill and Sign Printable Template Online US

What Does an Irs Audit Letter Look Like Form Fill Out and Sign

IRS Penalty Response Letter Template Word & PDF

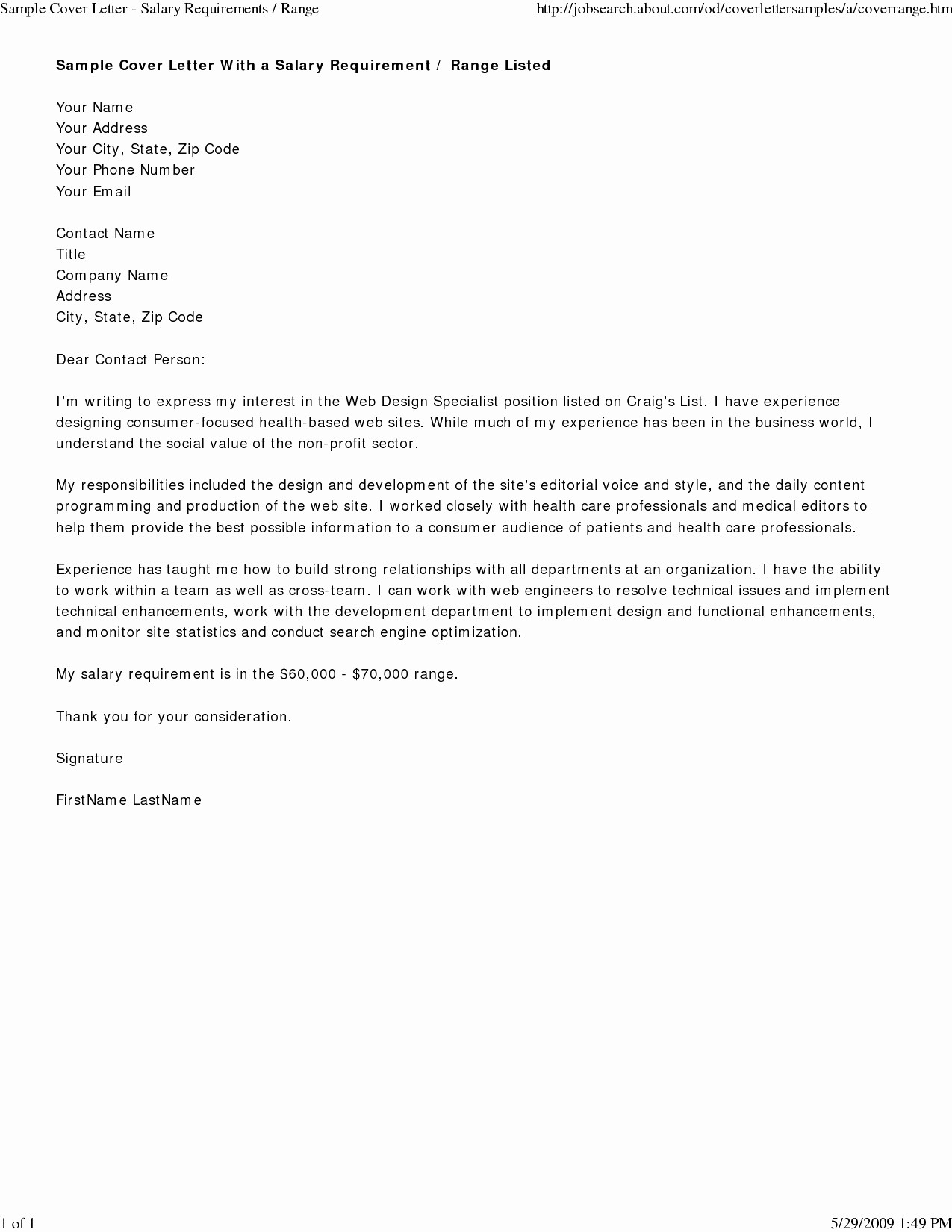

Letter To Irs Template Samples Letter Template Collection

Letter To Irs Free Printable Documents

Letter To Irs Free Printable Documents

Letter To Irs Free Printable Documents

Related Post: