Irs Notice Response Template

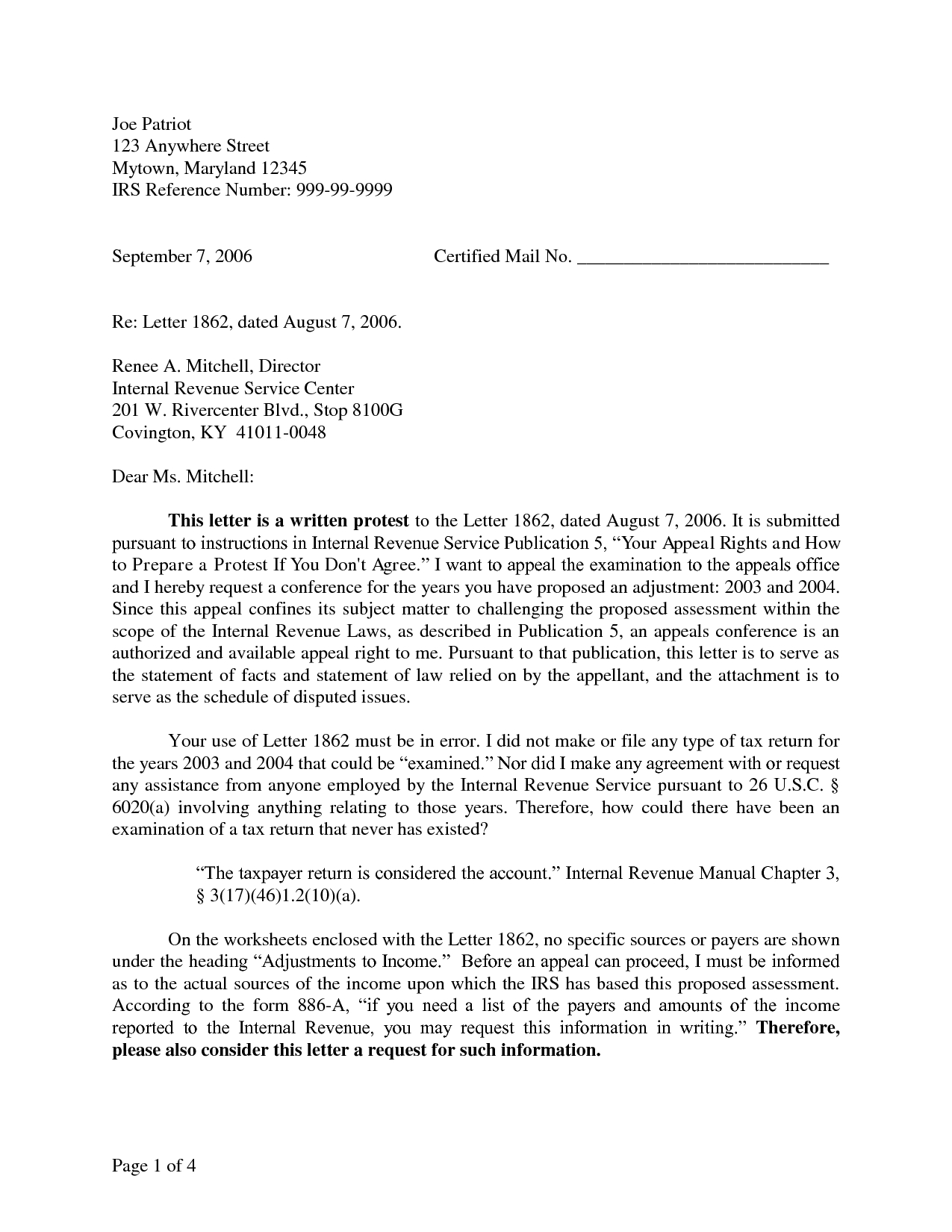

Irs Notice Response Template - February 4, 2022 letter 4383 collection due process/equivalent hearing. If the irs does give you. Normally, you can get up to 30 additional days to respond to the cp2000 notice. It also applies to any questions we need to ask you so we can complete, correct, or process your return; Keep copies of any correspondence with your tax. October 24, 2023 i got a notice from the irs the internal revenue service (irs) will send a notice or a letter for any number of. Web if one letter gets the desired result from the irs, the fee earned will dwarf the full cost. November 4, 2020 | last updated: When taxpayers disagree with the irs,. Easily customize your response to irs notice. Web how should taxpayers react, and in what order? Each notification contains a description of what the letter is for and what are the appropriate actions to take in order. It may be about a specific issue on your federal tax return or. Web the deadline to respond to the internal revenue service depends on what letter or notice you. Web if the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to: Determine if you agree or disagree. Easily customize your response to irs notice. October 24, 2023 i got a notice from the irs the internal revenue service (irs) will send a notice or a letter for any number of.. Identifying a specific issue on your federal tax return or account that needs action;. Web home > notices > notice / letter template published: Keep copies of any correspondence with your tax. Review the information on the cp2000 carefully for accuracy. Easily customize your response to irs notice. October 24, 2023 i got a notice from the irs the internal revenue service (irs) will send a notice or a letter for any number of. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Web the deadline to respond to the internal revenue service depends on what letter or notice you. Minimize additional interest and penalty charges. Web how should taxpayers react, and in what order? It may be about a specific issue on your federal tax return or. When taxpayers disagree with the irs,. Web home > notices > notice / letter template published: Web notices from the irs. The deadline is usually between 30 to 90 days. Web if one letter gets the desired result from the irs, the fee earned will dwarf the full cost. Taxpayers can contest many irs tax bills, although there are times when it is wiser not to. How to survive one (with free response template!) how to. If the irs does give you. How to survive one (with free response template!) how to survive getting an irs audit notice (with free response template!) by gina. Web below are some normal irs letters that the irs sends. Web this notice applies to tax returns and any papers filed with them. When taxpayers disagree with the irs,. The deadline is usually between 30 to 90 days. Web have your irs notice and tax return information handy when you call. When taxpayers disagree with the irs,. National director, american society of tax problem solvers. Web a response form, payment voucher, and an envelope. Review the information on the cp2000 carefully for accuracy. Web how should taxpayers react, and in what order? February 4, 2022 letter 4383 collection due process/equivalent hearing. Easily customize your response to irs notice. November 4, 2020 | last updated: Provide specific reasons why you believe the irs is mistaken, and reference your supporting documents. The deadline is usually between 30 to 90 days. Web irs audit notice: How to survive one (with free response template!) how to survive getting an irs audit notice (with free response template!) by gina. Web the irs will send a notice or a letter. Web how should taxpayers react, and in what order? Determine if you agree or disagree. Web below are some normal irs letters that the irs sends. It may be about a specific issue on your federal tax return or. Web an employer’s receipt of letter 226j from the irs means that the irs has reviewed the employer’s offer of coverage and its employees’ claim (s) (or lack thereof) for a premium. Each notification contains a description of what the letter is for and what are the appropriate actions to take in order. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Web the deadline to respond to the internal revenue service depends on what letter or notice you receive. If the irs does give you. Web draft a response letter to the irs, outlining any claims that you dispute. National director, american society of tax problem solvers. Minimize additional interest and penalty charges. Web notices from the irs. Web this notice applies to tax returns and any papers filed with them. How to survive one (with free response template!) how to survive getting an irs audit notice (with free response template!) by gina. Web home > notices > notice / letter template published: Web have your irs notice and tax return information handy when you call. The deadline is usually between 30 to 90 days. When taxpayers disagree with the irs,. Identifying a specific issue on your federal tax return or account that needs action;.Irs Response Letter Template Samples Letter Template Collection

Irs Audit Notice Free Printable Documents

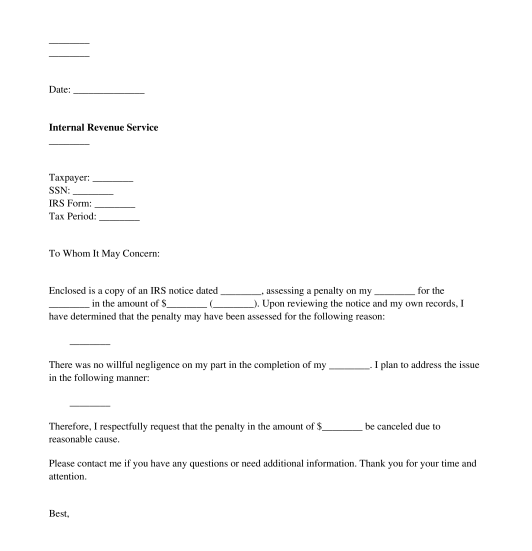

IRS Penalty Response Letter Template Word & PDF

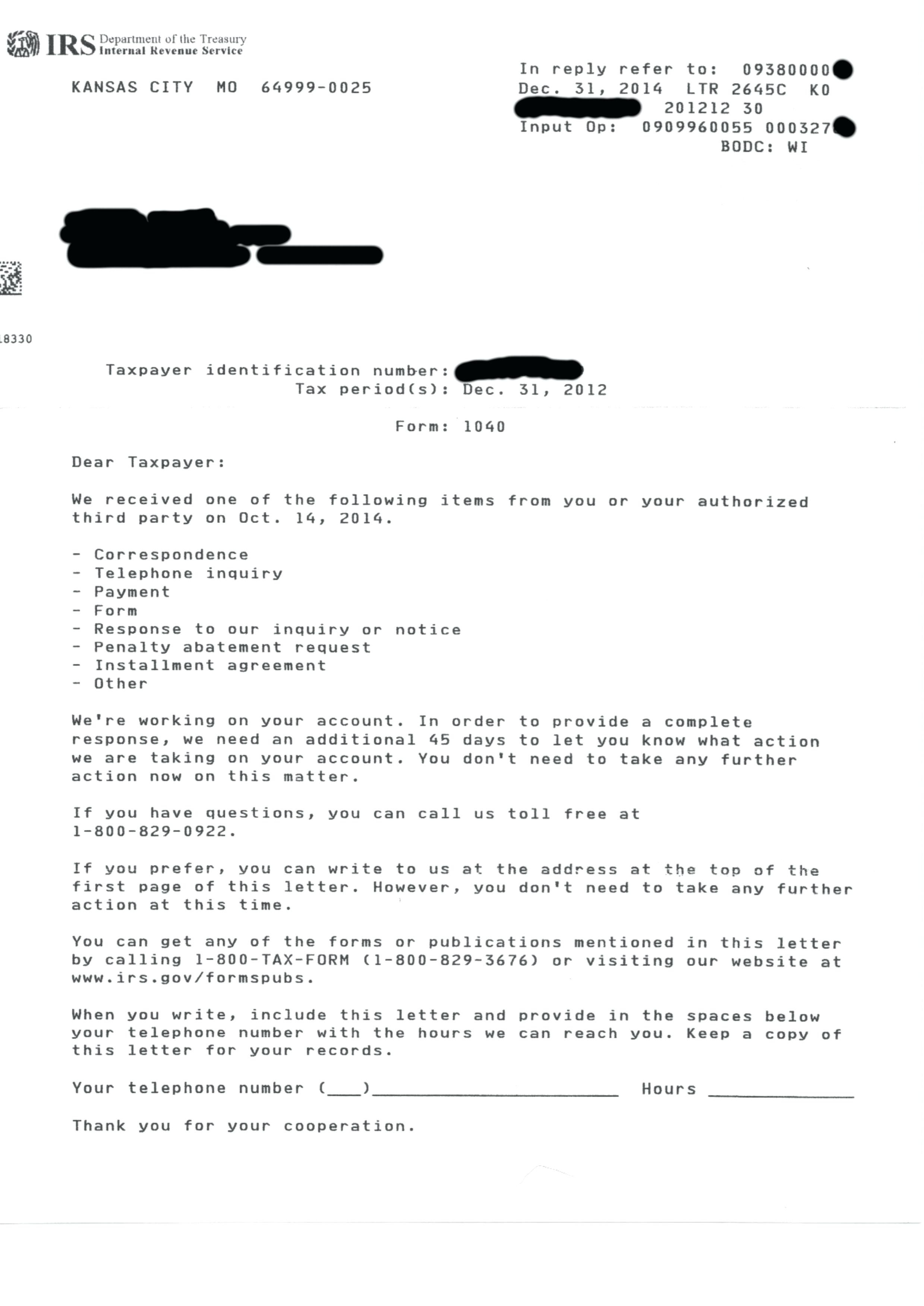

IRS Response Letter Template Federal Government Of The United States

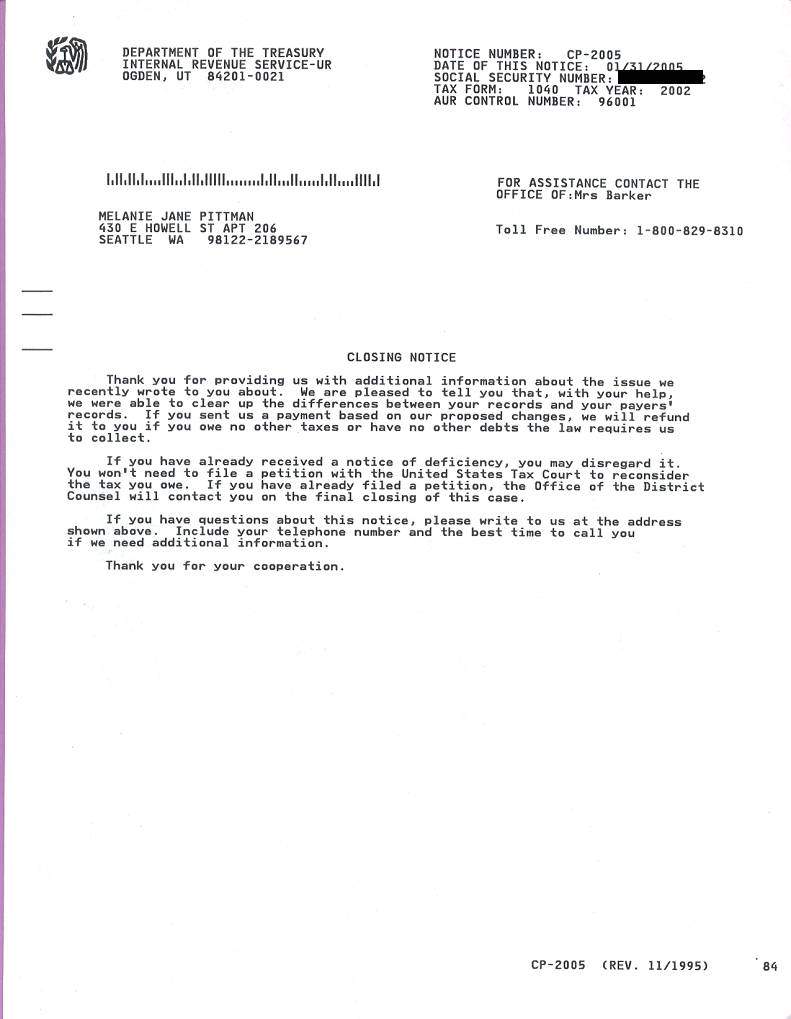

IRS Audit Letter CP2000 Sample 1

Irs Cp2000 Example Response Letter amulette

IRS Audit Letter 531T Sample 1

Irs Response Letter Template Samples Letter Template Collection

IRS response Letter Internal Revenue Service Ratification

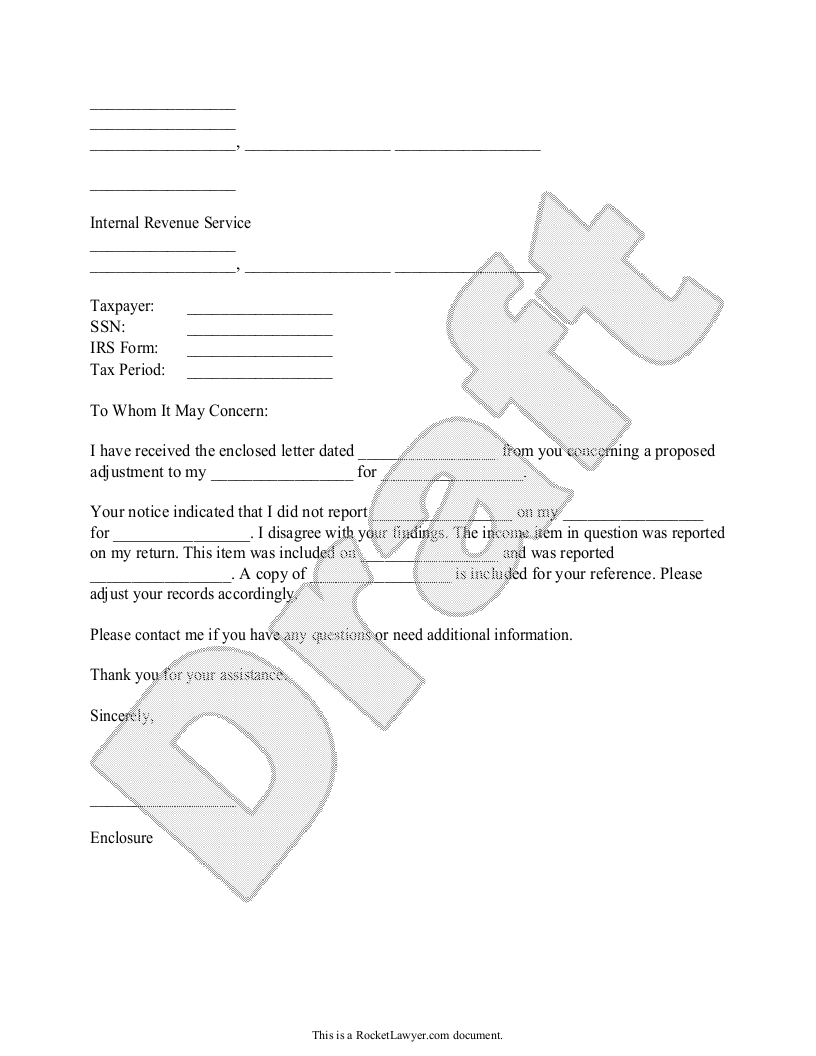

Free Response to IRS Notice Make & Download Rocket Lawyer

Related Post: