Irs Mandated Wisp Template

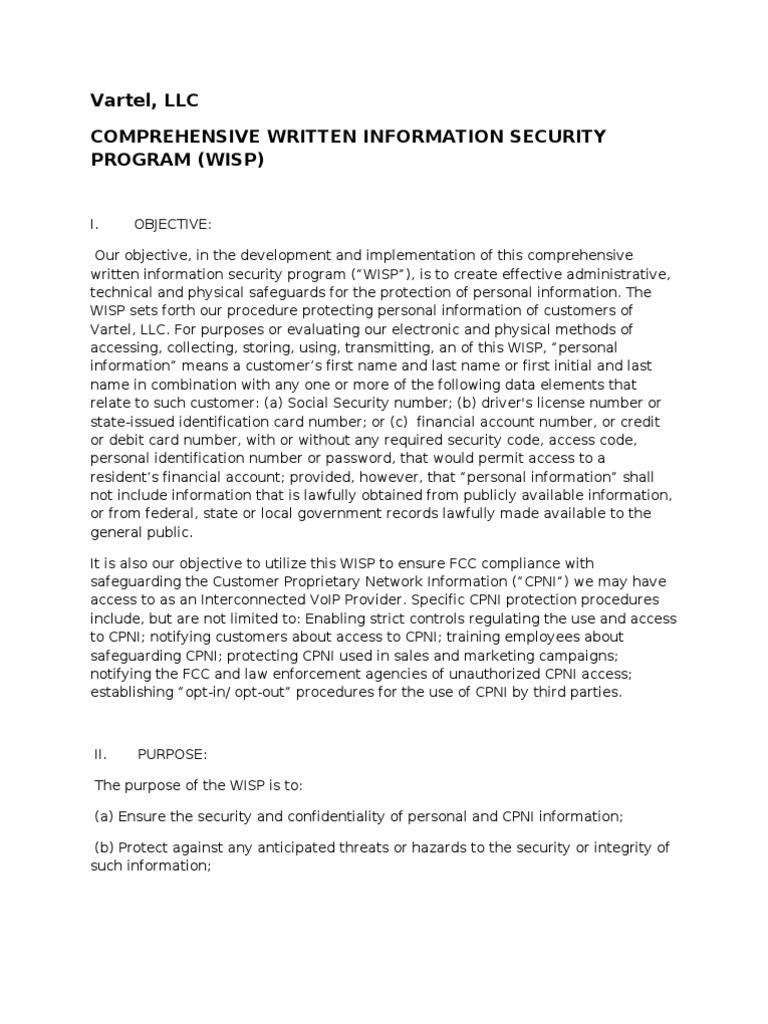

Irs Mandated Wisp Template - Up to 5 years in prison. Identify all pii that could be at risk. What exactly is an irs wisp? Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and information. Failure to do so may result in a federal trade commission (ftc) investigation. Although the glba, also known as the financial services. The first step for tax professionals involved deploying the “security six” basic steps to protect computers and email. This document is for general distribution and is available to all employees. Don't let the irs intimidate you. A wisp is a written information security plan that is required for certain businesses, such as tax professionals. A good resource is the ftc's data breach response guide pdf. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Web $100,000 fine for a data breach. Don't let the irs intimidate you. This document is available to clients by request and with consent of the. Ad download our free template today! Law that requires financial institutions to. Written information security plan (wisp) for. Steps to take in the case of a data breach. This document is available to clients by request and with consent of the firm’s data security coordinator. Web what is a wisp and how do i create one? Get free, competing quotes from leading irs tax relief experts. The irs is forcing all tax preparers to have a data security plan. Last modified/reviewed january 27,2023 [should review and update at. While the ftc safeguards rule designed to protect financial and pii (personally identifiable information) has been around. Ad do you owe the irs money? Free to use and modify to fit your needs. Get free, competing quotes from leading irs tax relief experts. Steps to take in the case of a data breach. In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. Free to use and modify to fit your needs. The wisp template is required for tax professionals by the irs and helps to ensure that important records are accurate and available, allowing the person filing their taxes the best knowledge and information needed. And 5) periodically evaluating and adjusting the plan, as necessary, in light of relevant changes in technology,. In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. As a part of the plan, the ftc requires each firm to: All tax and accounting firms should do the following: Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s. Web posted on january 26, 2021 by david lineman. Get free, competing quotes from leading irs tax relief experts. Up to 5 years in prison. Detecting and managing system failures. Web developing a wisp. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and information. Web irs written information security plan (wisp). While the ftc safeguards rule designed to protect financial and pii (personally identifiable information) has been around for decades, as of june 9, 2023, compliance of various. Web developing a wisp. Practice management & professional standards. Ad do you owe the irs money? Web are required to comply with this information security plan, and monitoring such providers for compliance herewith; A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer data it handles. Get free, competing quotes from leading irs tax relief experts. Free to use and modify to fit your needs. Developing a wisp a good wisp should identify the risks of data loss for the types of information. Get free, competing quotes from leading irs tax relief experts. In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for their firm. Web posted on january 26, 2021 by david lineman. Don't let the irs intimidate you. Up to 5 years in prison. “there’s no way around it for anyone running a tax business. The irs is forcing all tax preparers to have a data security plan. Law that requires financial institutions to. Look up glba for more details. Designate one or more employees to coordinate its. Written information security plan (wisp) for. And 5) periodically evaluating and adjusting the plan, as necessary, in light of relevant changes in technology, sensitivity of customer information, reasonably foreseeable internal or external threats to customer All tax and accounting firms should do the following: Web are required to comply with this information security plan, and monitoring such providers for compliance herewith; Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from: For months our customers have asked us to provide a quality solution that (1) addresses key irs cyber security requirements and (2) is affordable for a small office. Ad do you owe the irs money? How much does the template cost? While the ftc safeguards rule designed to protect financial and pii (personally identifiable information) has been around for decades, as of june 9, 2023, compliance of various. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations.Irs Wisp Template

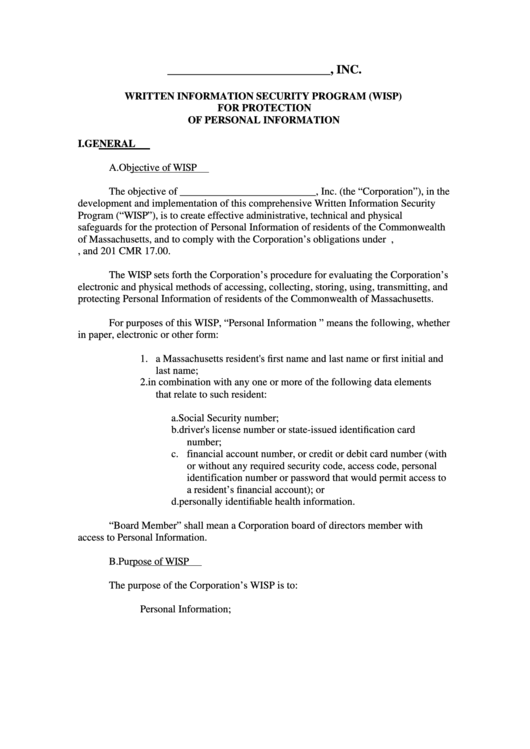

W 2 Form 2012 Printable Printable Word Searches

Wisp Template For Tax Professionals Printable Templates

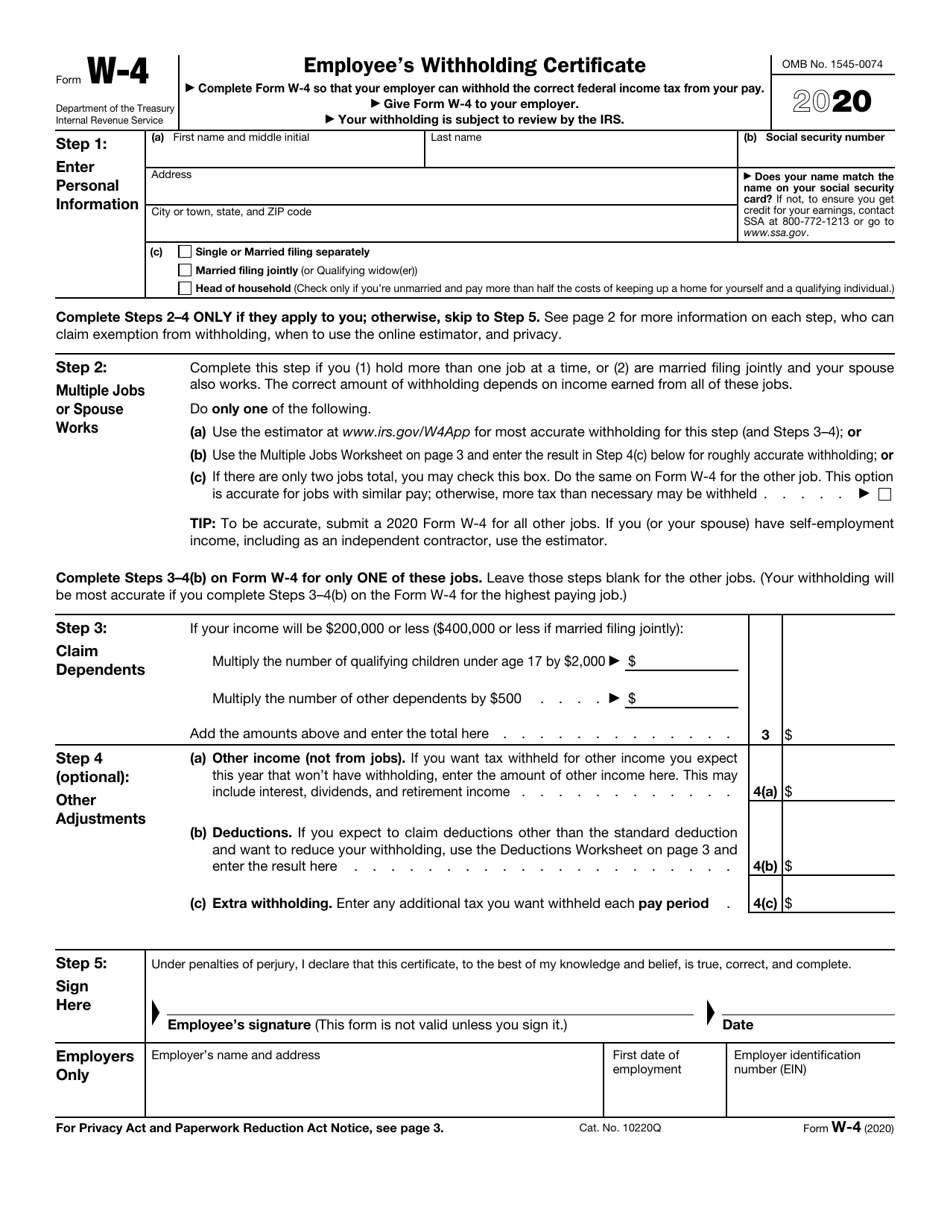

IRS Form W4 Download Fillable PDF or Fill Online Employee's

Irs Wisp Template

IRS W8BEN Form Template Fill & Download Online [+ Free PDF]

Wisp Template For Tax Professionals Printable Templates

Wisp Template For Tax Professionals Printable Templates

Irs Wisp Template

Wisp Template For Tax Professionals Printable Templates

Related Post:

![IRS W8BEN Form Template Fill & Download Online [+ Free PDF]](https://www.pandadoc.com/app/uploads/form-w-8ben.png)