Irs Letter Response Template

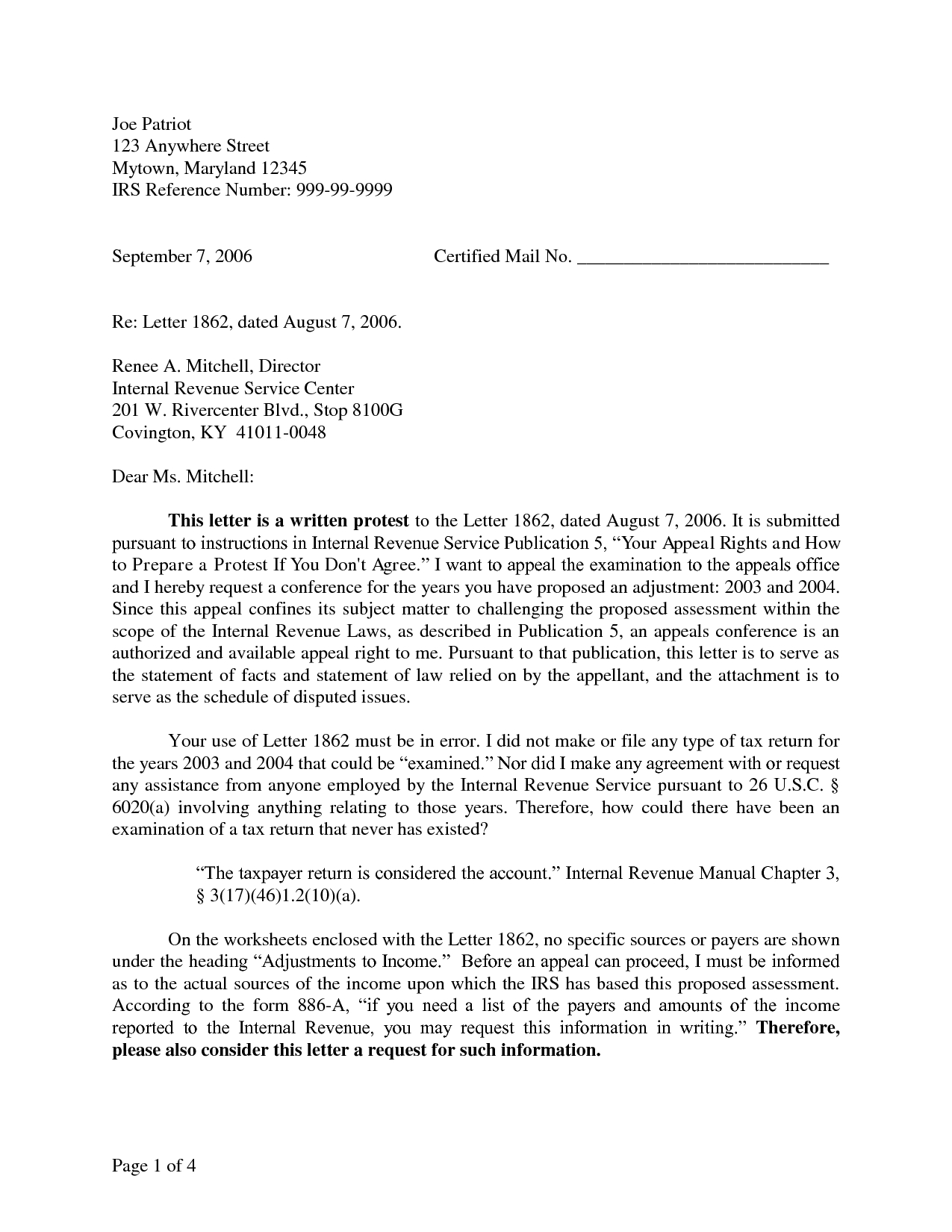

Irs Letter Response Template - Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Ad need tax lien relief? You can fax it to the number in the notice or mail it using the. Web frank gogol reviewed by rohit mittal at a glance: Review the information on the cp2000 carefully for accuracy. Get free, competing quotes from tax relief experts. Web sign and date the response form and return it by the due date. However, there are many other. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. The reason was due to [a disaster, serious medical condition, death in the family, an inability to obtain the. Web understanding your cp2000 notice understanding your cp2000 notice what this notice is about the income or payment information we received from third parties,. Web remember, there are many different types of irs tax notices. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Don't let the irs intimidate you.. Web understanding your cp2000 notice understanding your cp2000 notice what this notice is about the income or payment information we received from third parties,. Ad need tax lien relief? Determine if you agree or disagree. An explanation letter, also known as a letter of explanation, is used to clarify discrepancies or provide a. Keep copies of any correspondence with your. Web let’s take a look at a few sample irs audit letters. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’. However, there are many other. Web understanding your cp2000 notice understanding your cp2000 notice what this notice is about the income or payment information we received from third parties,. A template to help those. Get free, competing quotes from leading irs relief experts. Get free, competing quotes from tax relief experts. However, there are many other. Web a reply is needed within 20 days from the date of this letter. Web sign and date the response form and return it by the due date. Web irs.gov has resources for understanding your notice or letter. We have covered a few types of irs notices here, including a notice of deficiency. Web let’s take a look at a few sample irs audit letters. Web understanding your cp2000 notice understanding your cp2000 notice what this notice is about the income or payment information we received from third parties,. An explanation letter, also known as a letter of explanation, is used to clarify discrepancies or provide a. Review the information on the cp2000. Web understanding your cp2000 notice understanding your cp2000 notice what this notice is about the income or payment information we received from third parties,. Web a response form, payment voucher, and an envelope. Don't let the irs intimidate you. Determine if you agree or disagree. Web frank gogol reviewed by rohit mittal at a glance: Get free, competing quotes from leading irs relief experts. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Keep copies of any correspondence with your. If the irs doesn’t receive a response from you, an adjustment will be made on your. A template to help those. Get free, competing quotes from leading irs relief experts. Web most irs letters have two options: Get free, competing quotes from tax relief experts. When the irs contacts you about an audit. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Web most irs letters have two options: However, there are many other. The reason was due to [a disaster, serious medical condition, death in the family, an inability to obtain the. Get. In this first example, the irs is making contact at the start of your. We have covered a few types of irs notices here, including a notice of deficiency. Keep copies of any correspondence with your. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. An explanation letter, also known as a letter of explanation, is used to clarify discrepancies or provide a. Get free, competing quotes from leading irs relief experts. Get free, competing quotes from tax relief experts. Don't let the irs intimidate you. Web you should reply as indicated on your letter or notice that could include mail, fax, or digitally through the irs’ documentation upload tool, when available, by using. Determine if you agree or disagree. However, there are many other. Ad get your irs response letter today. The reason was due to [a disaster, serious medical condition, death in the family, an inability to obtain the. Web a reply is needed within 20 days from the date of this letter. Web irs.gov has resources for understanding your notice or letter. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Web frank gogol reviewed by rohit mittal at a glance: Review the information on the cp2000 carefully for accuracy. A template to help those. Web i acknowledge and deeply apologize for my [late filing/late payment].Cp2000 Response Letter Template Samples Letter Template Collection

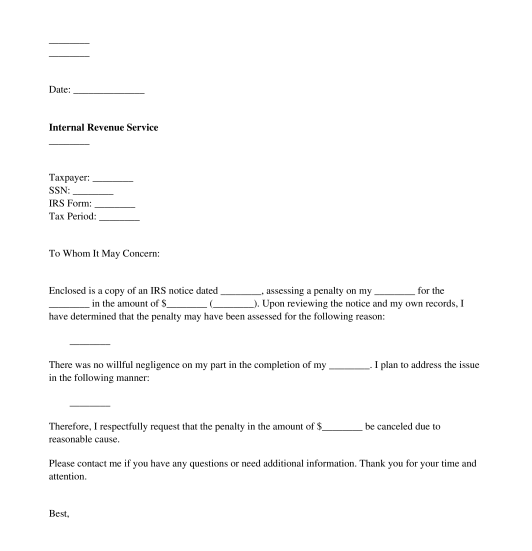

IRS Response Letter Template Federal Government Of The United States

IRS Penalty Response Letter Template Word & PDF

IRS Notice Audit Letter 3572 Understanding IRS Audit Letter 3572

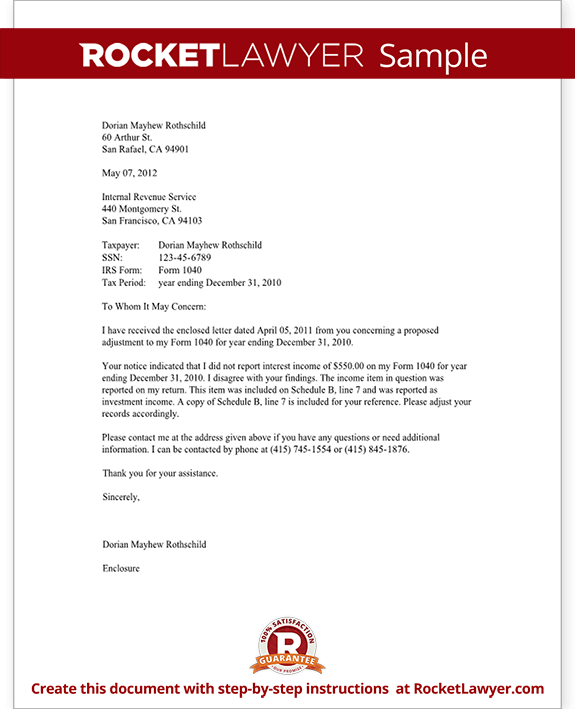

Letter to the IRS IRS Response Letter Form (with Sample)

Irs Response Letter Template Samples Letter Template Collection

Irs Response Letter Template Letter templates, Business letter

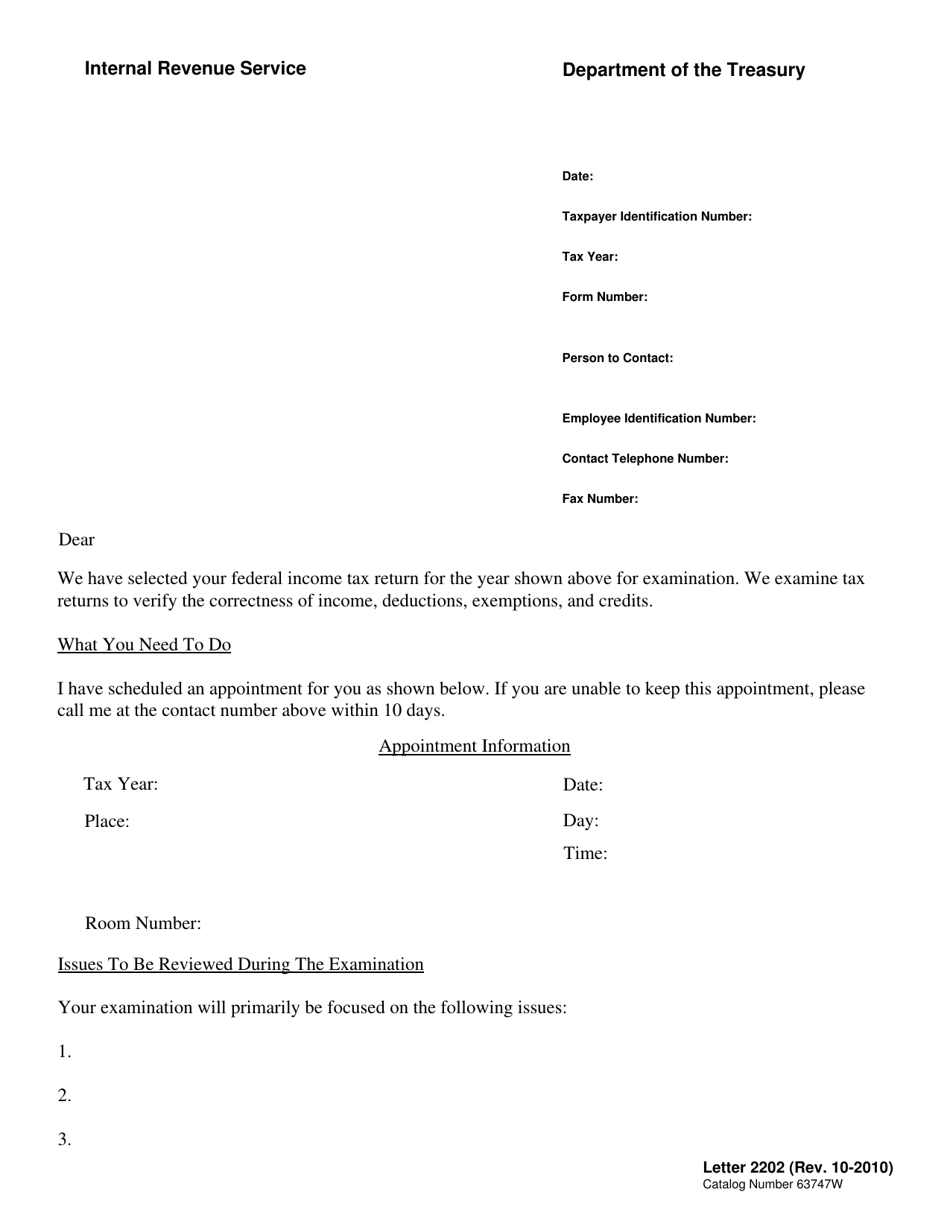

IRS Letter 2202, IRS Audit Letter Fill Out, Sign Online and Download

IRS Letter 4464C Sample 2

Irs Notice Cp49 Overpayment Applied To Taxes Owed H&R throughout

Related Post: