Irs Conflict Of Interest Policy Template

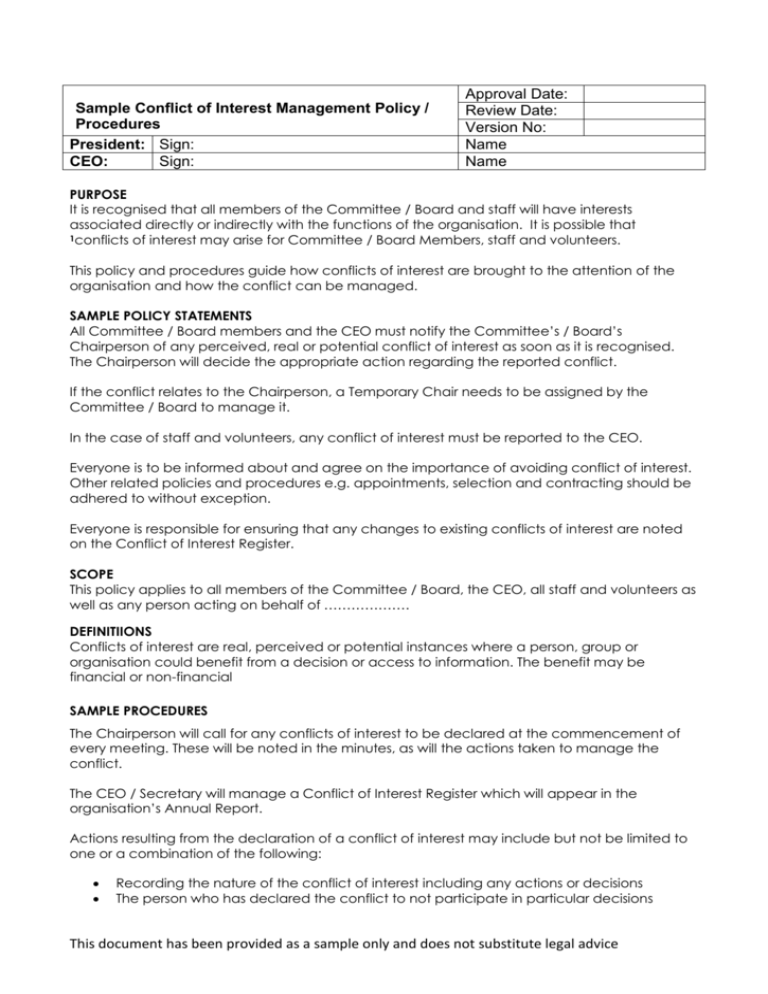

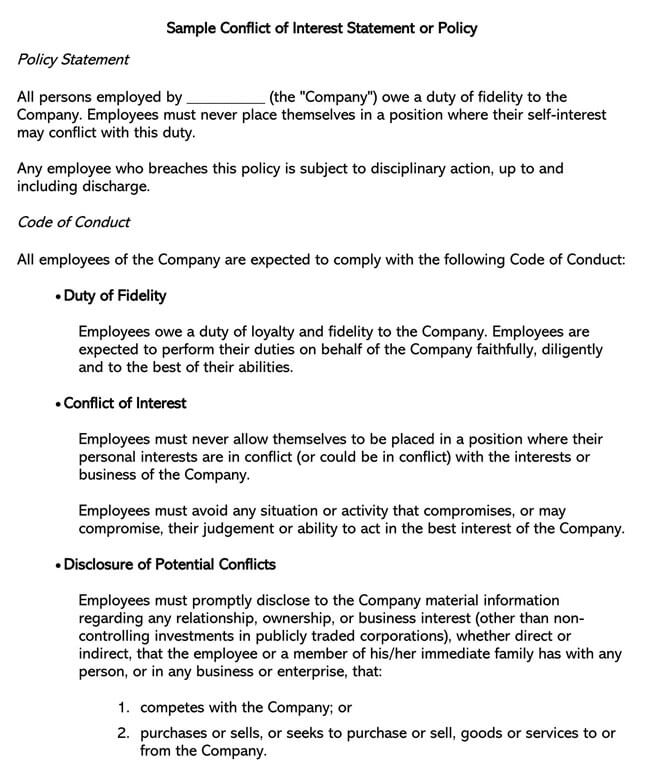

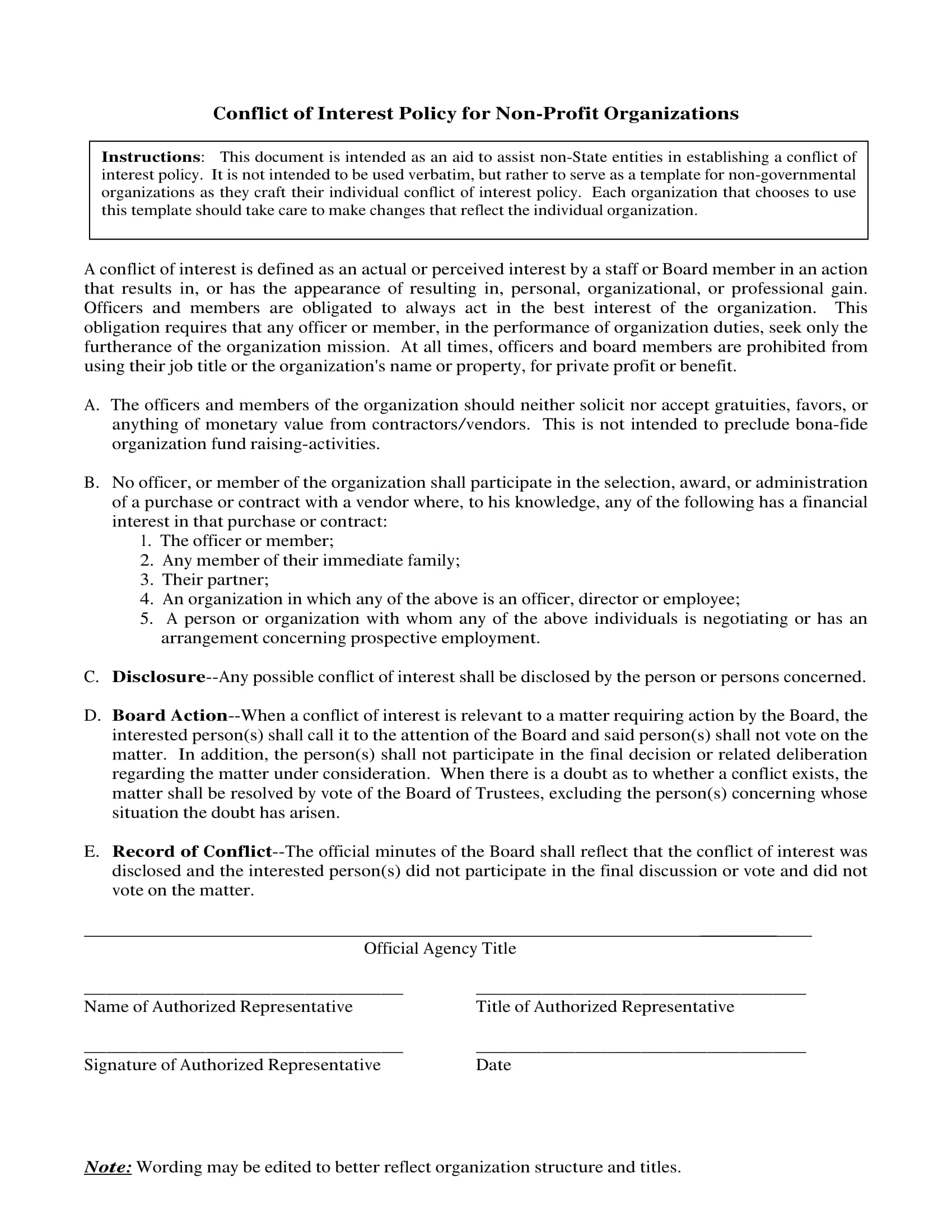

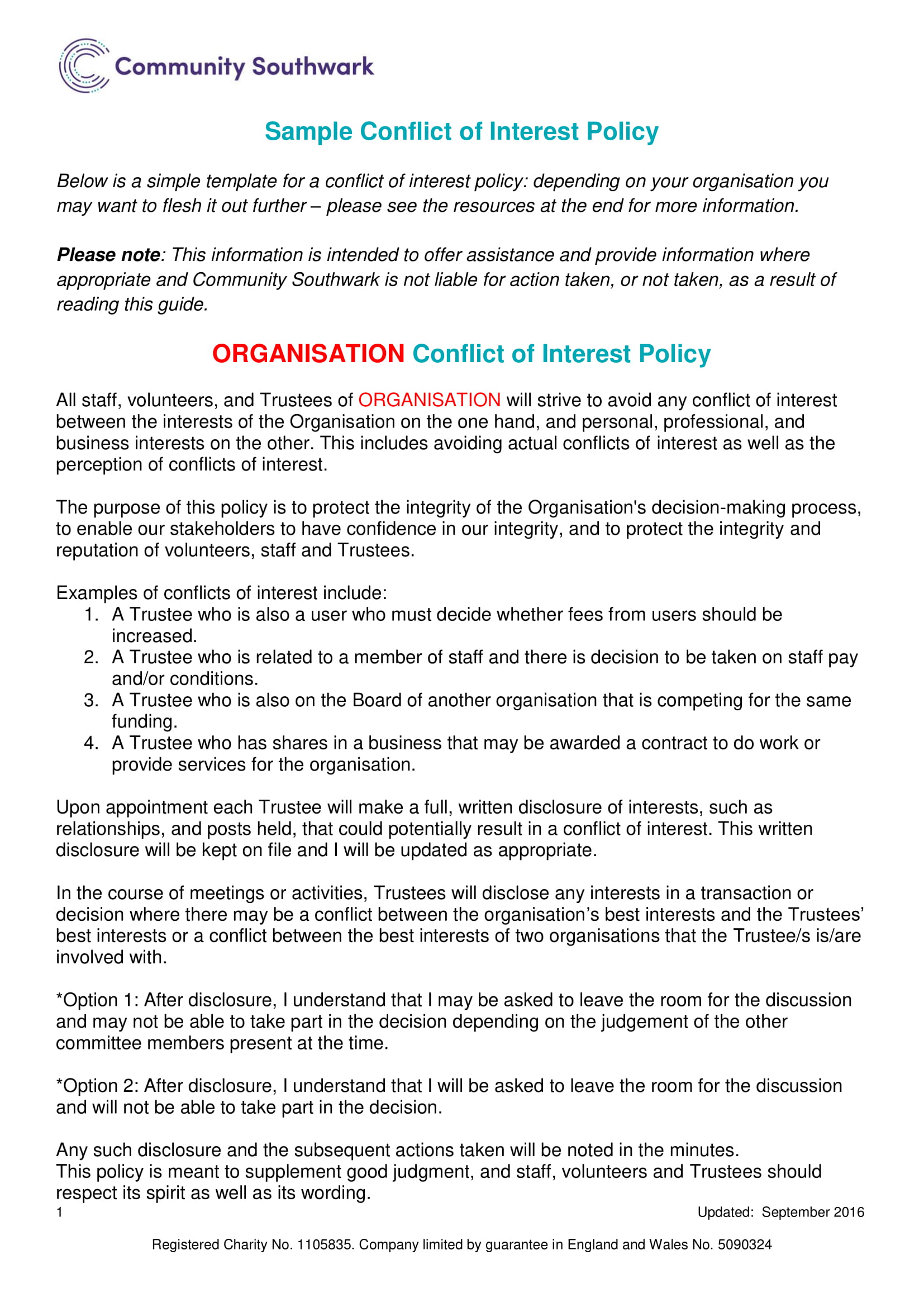

Irs Conflict Of Interest Policy Template - Sample conflict of interest statement from the irs, to include in your bylaws or adopt before filing irs. Web this conflict of interest policy is designed to help directors, officers, employees and volunteers of the [name of nonprofit] identify situations that present potential conflicts of. Web 1 this policy is based on the irs model conflict of interest policy, which is an attachment to form 1023. Web up to 40% cash back you may use our free conflict of interest policy template as a starting point for your nonprofit’s policy. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Enjoy smart fillable fields and interactivity. Web how to fill out and sign irs conflict of interest policy online? Web a conflict of interest arises when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she. A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation. It adds information needed to allow spca to assess director. Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. It adds information needed to allow spca to assess director. Web if the filing organization is controlled by an organization with a conflicts of interest policy, whistleblower policy, and document retention. Web how to fill out and sign irs conflict of interest policy online? Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit. Sample conflict of interest statement from the irs, to include in your bylaws or adopt before filing irs.. As with your bylaws, when you pursue federal tax exemption,. Web this conflict of interest policy is designed to help directors, officers, employees and volunteers of the [name of nonprofit] identify situations that present potential conflicts of. This sample is complete, proven and. Sample conflict of interest statement from the irs, to include in your bylaws or adopt before filing. Web the purpose of the conflicts of interest policy is to protect the corporation's interest when it is contemplating entering into a transaction or arrangement that might benefit the. Get your online template and fill it in using progressive features. Web in particular, the duty of loyalty requires a director to avoid conflicts of interest that are detrimental to the. Web how to fill out and sign irs conflict of interest policy online? Web the purpose of the conflicts of interest policy is to protect the corporation's interest when it is contemplating entering into a transaction or arrangement that might benefit the. Web the following is a nonprofit conflict of interest policy template that you can use as is for. Sample conflict of interest statement from the irs, to include in your bylaws or adopt before filing irs. It adds information needed to allow spca to assess director. Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status. A conflict of interest policy is intended to help. Web in particular, the duty of loyalty requires a director to avoid conflicts of interest that are detrimental to the charity. Web a conflict of interest arises when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she. Web 1 this policy is based. Web a conflict of interest arises when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. Web a person has a financial interest, directly or indirectly,. A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation. Many charities have adopted a written. Web a policy on conflicts of interest should (a) require. Enjoy smart fillable fields and interactivity. As with your bylaws, when you pursue federal tax exemption,. Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status. A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization. Enjoy smart fillable fields and interactivity. Web a policy on conflicts of interest should (a) require those with a conflict (or who think they may have a conflict) to disclose the conflict/potential conflict, and (b) prohibit. Web the following is a nonprofit conflict of interest policy template that you can use as is for applying for 501c3 exemption status. It adds information needed to allow spca to assess director. Many charities have adopted a written. Sample conflict of interest statement from the irs, to include in your bylaws or adopt before filing irs. Web 1 this policy is based on the irs model conflict of interest policy, which is an attachment to form 1023. Web this conflict of interest policy is designed to help directors, officers, employees and volunteers of the [name of nonprofit] identify situations that present potential conflicts of. Web in particular, the duty of loyalty requires a director to avoid conflicts of interest that are detrimental to the charity. Web if the filing organization is controlled by an organization with a conflicts of interest policy, whistleblower policy, and document retention and destruction policy,. A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation. Web a conflict of interest arises when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she. Web a person has a financial interest, directly or indirectly, through business, investment, or family, if the person has an actual or potential ownership or investment interest in any. Web the purpose of the conflicts of interest policy is to protect the corporation's interest when it is contemplating entering into a transaction or arrangement that might benefit the. This sample is complete, proven and. As with your bylaws, when you pursue federal tax exemption,. Web up to 40% cash back you may use our free conflict of interest policy template as a starting point for your nonprofit’s policy. Get your online template and fill it in using progressive features. Web how to fill out and sign irs conflict of interest policy online? Web the irs form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit.Sample Conflict of Interest Policy

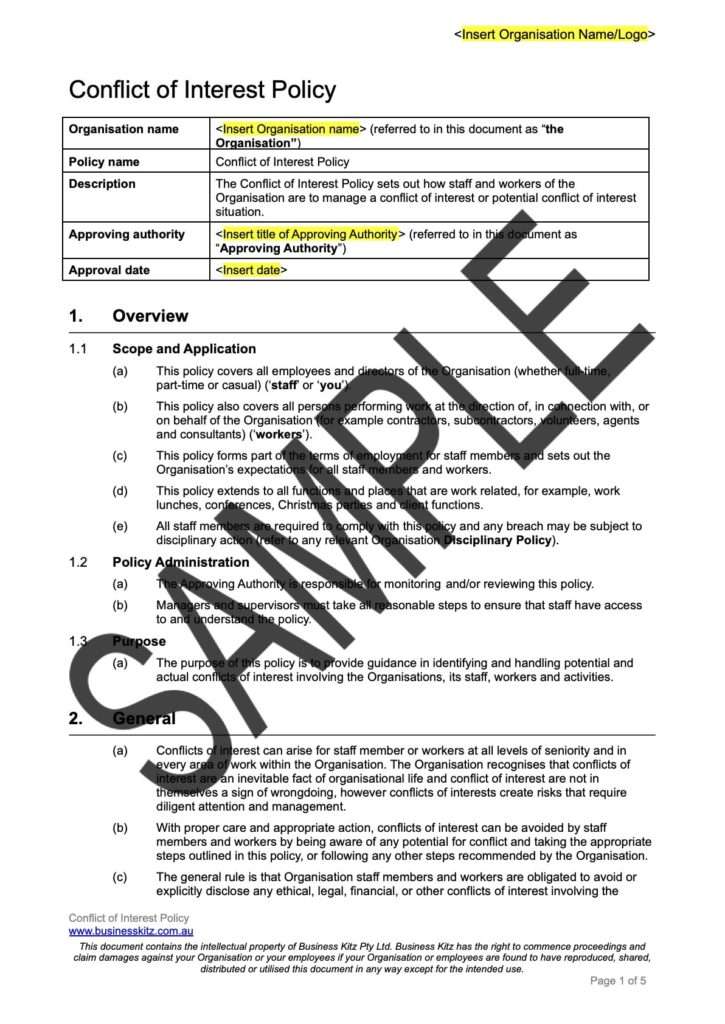

Conflict of Interest Policy Template Business Kitz

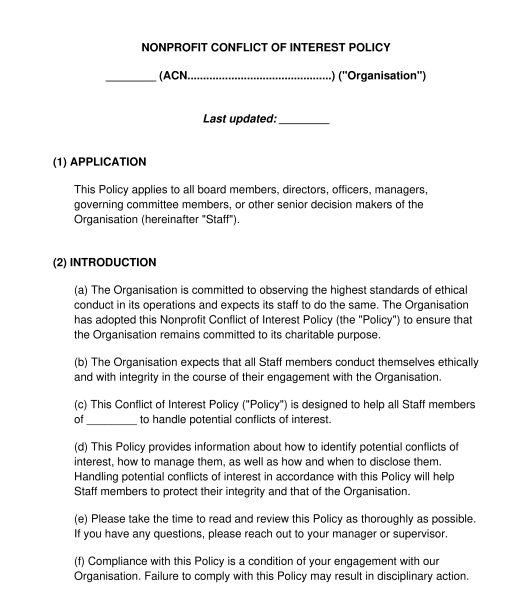

Conflict of Interest Policy for Nonprofit Template

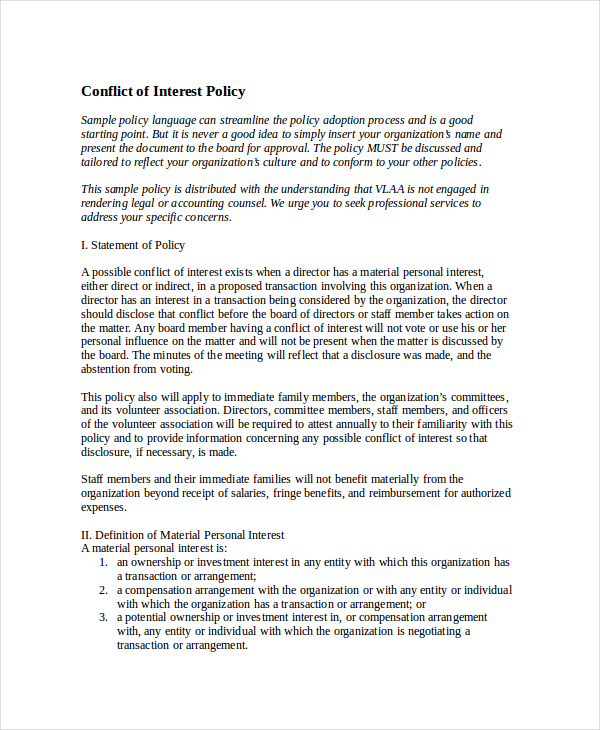

Nonprofit Conflict Of Interest Policy Template Master of

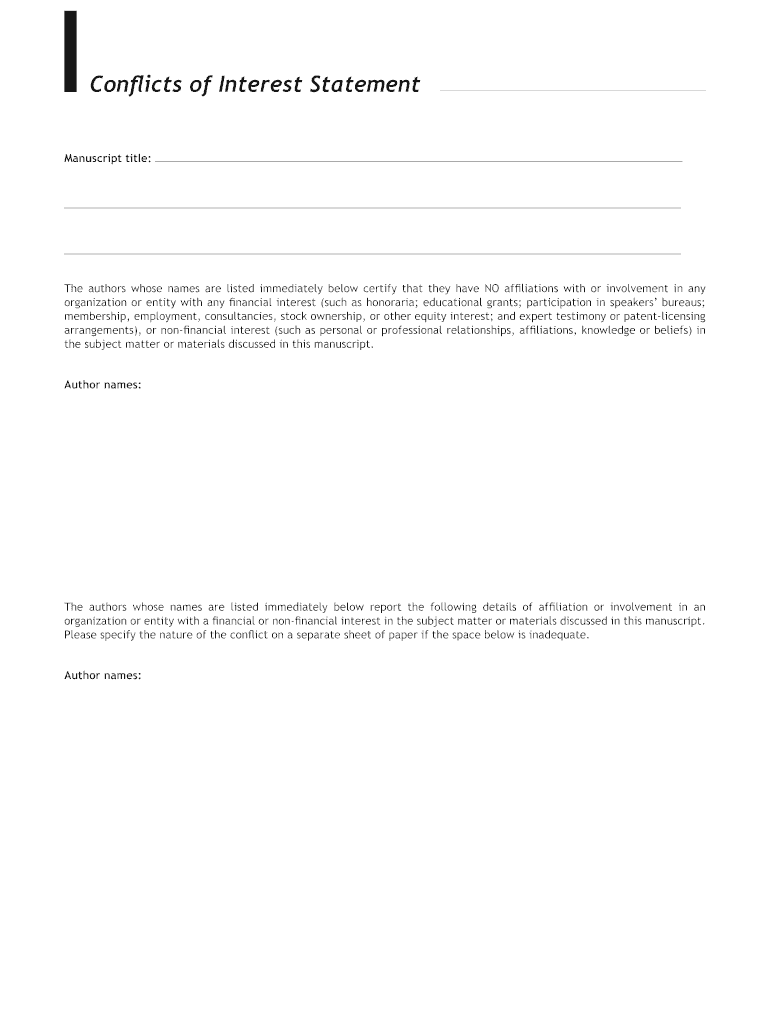

Conflict of Interest Form Fill Out and Sign Printable PDF Template

Conflict of Interest Policy Sample Free Download

Employee Conflict of Interest Policy Templates Word PDF

Conflict of Interest Policy 15+ Examples, Format, Pdf Examples

Conflict of Interest Policy 15+ Examples, Format, Pdf Examples

Sample Conflict of Interest Policy Free Download

Related Post: