Irs Abatement Letter Template

Irs Abatement Letter Template - Don't let the irs intimidate you. Web an irs letter template for abatement is a standardized letter provided by the internal revenue service (irs) to taxpayers who have received a penalty or notice of penalty. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. The template is available free to. Ad you don't have to face the irs alone. Avoid penalties and interest by getting your taxes forgiven today These two templates can help you write a letter based on your current. Web form 843, claim for refund and request for abatement pdf or a signed letter requesting that we reduce or adjust the overcharged interest. Internal revenue service (use the address provided in your tax bill) re: Understand penalty abatement criteria before you begin writing your letter, familiarize yourself with the criteria that the irs considers for penalty. Get free, competing quotes from tax relief experts. Web three steps to take before drafting a penalty abatement letter. Web form 843, claim for refund and request for abatement pdf or a signed letter requesting that we reduce or adjust the overcharged interest. Ad need tax lien relief? Web find out about the irs first time penalty abatement policy and. Web here is a sample of how to write a letter to the irs to request irs penalty abatement. Choose this template start by clicking on fill out the template 2. Ad you don't have to face the irs alone. Internal revenue service (use the address provided in your tax bill) re: Ad need tax lien relief? The first step is to obtain historical tax records, both from the taxpayer's personal papers and from the irs. 1040, 1065, etc, and the tax period] re: Don't let the irs intimidate you. Understand penalty abatement criteria before you begin writing your letter, familiarize yourself with the criteria that the irs considers for penalty. Ad you don't have to face. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Don't let the irs intimidate you. Web this template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed with their penalty abatement letter.. Internal revenue service (use the address provided in your tax bill) re: 1040, 1065, etc, and the tax period] re: Web this template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed with their penalty abatement letter. The first step is to obtain historical tax records, both from the taxpayer's. Web here is a sample of how to write a letter to the irs to request irs penalty abatement. These two templates can help you write a letter based on your current. Web taxpayers, if they qualify, should call the irs and request abatement of any ftf or ftp penalty that qualifies for fta. Web this template for a penalty. The template is available free to. Web first, you need to have already filed your return. The first step is to obtain historical tax records, both from the taxpayer's personal papers and from the irs. Web taxpayers, if they qualify, should call the irs and request abatement of any ftf or ftp penalty that qualifies for fta. Web here is. 1040, 1065, etc, and the tax period] re: Web here is a simplified irs letter template that you can use when writing to the irs: Ÿÿf¢ 1 [content_types].xml ¢ ( ´•moâ@ †ï&þ‡f¯†.x0æpøqt 1ñºìnaã~ew@ù÷n)4f ± ’²3ïûtšv†·ÿödkˆi{w°aþg 8é•v³‚½n {×,k(œ æ;(ø » ÿ '«)£n— 6g 7œ'9 +rî 8:)}´ é2îx. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re. Get free, competing quotes from leading irs relief experts. Avoid penalties and interest by getting your taxes forgiven today Web here is a simplified irs letter template that you can use when writing to the irs: Web an irs letter template for abatement is a standardized letter provided by the internal revenue service (irs) to taxpayers who have received a. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Ad need tax lien relief? Ad you don't have to face the irs alone. Next, you should try contacting the irs directly before sending in a letter—sometimes they’re willing to work. Get free, competing quotes from tax. These two templates can help you write a letter based on your current. Ÿÿf¢ 1 [content_types].xml ¢ ( ´•moâ@ †ï&þ‡f¯†.x0æpøqt 1ñºìnaã~ew@ù÷n)4f ± ’²3ïûtšv†·ÿödkˆi{w°aþg 8é•v³‚½n {×,k(œ æ;(ø » ÿ '«)£n— 6g 7œ'9 +rî 8:)}´ é2îx. Next, you should try contacting the irs directly before sending in a letter—sometimes they’re willing to work. Complete the document answer a few questions and your document is created. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits for failure to file penalties for certain. Avoid penalties and interest by getting your taxes forgiven today Get free, competing quotes from tax relief experts. The first step is to obtain historical tax records, both from the taxpayer's personal papers and from the irs. Ad you don't have to face the irs alone. Web here is a sample of how to write a letter to the irs to request irs penalty abatement. Web here is a simplified irs letter template that you can use when writing to the irs: A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your circumstances. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a penalty. Ad need tax lien relief? Understand penalty abatement criteria before you begin writing your letter, familiarize yourself with the criteria that the irs considers for penalty. Get free, competing quotes from leading irs relief experts. 1040, 1065, etc, and the tax period] re: You should also include a detailed. Web this template for a penalty abatement letter can serve as a guide for taxpayers the have no idea how to proceed with their penalty abatement letter. Web an irs letter template for abatement is a standardized letter provided by the internal revenue service (irs) to taxpayers who have received a penalty or notice of penalty.Irs Penalty Abatement Request Letter Example

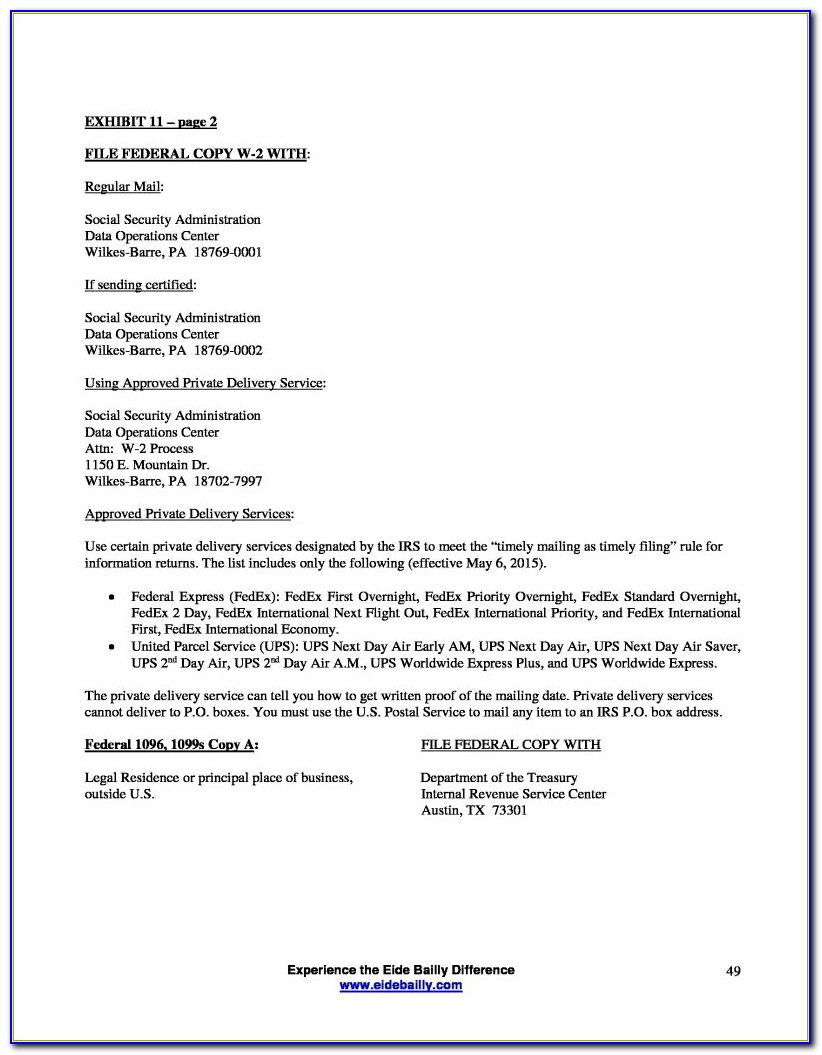

Free Response to IRS Penalty Rocket Lawyer

50 Irs First Time Penalty Abatement Letter Example Ig2s Letter

Irs Penalty Abatement Letter Partnership

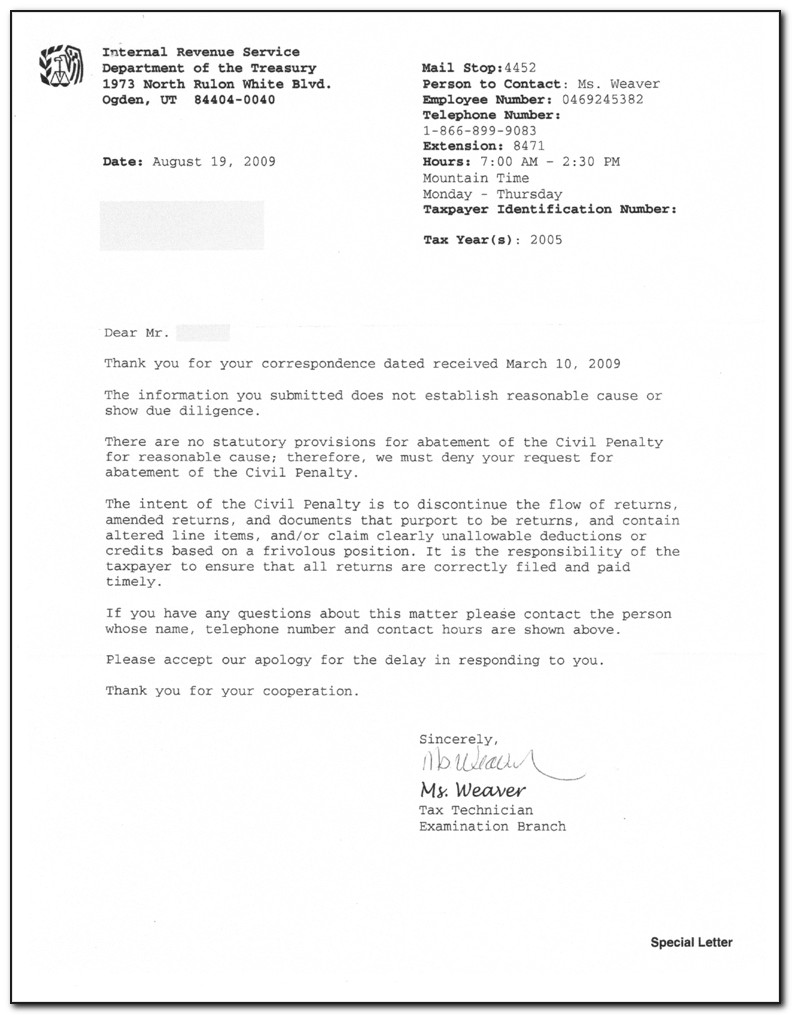

IRS Letter 1277 Penalty Abatement Denied H&R Block

How To Write An Abatement Letter LIESSE

Writing a IRS Penalty Abatement Request Letter (with Sample

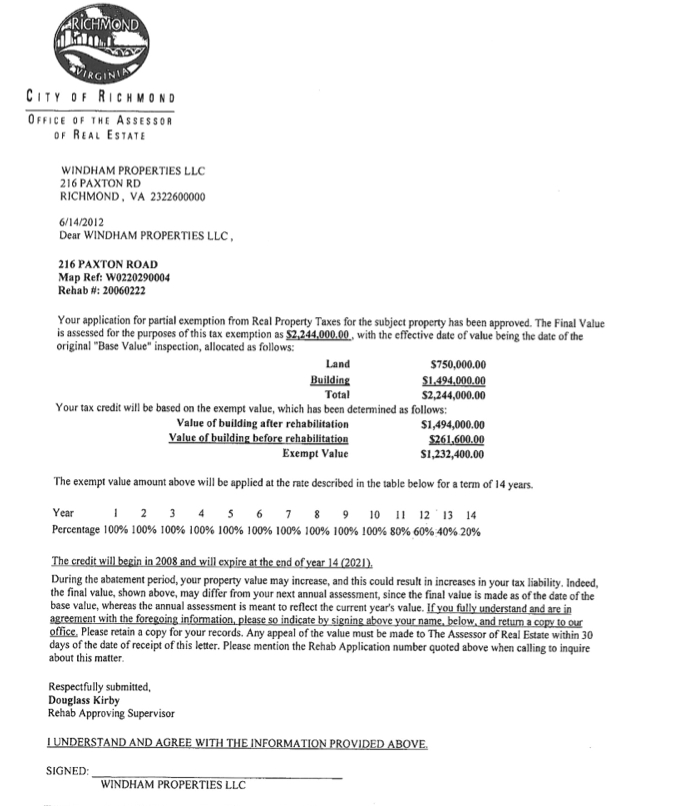

Tax Abatement in Richmond, Virginia Significant Properties in

Sample Letter To Irs Requesting Penalty Waiver

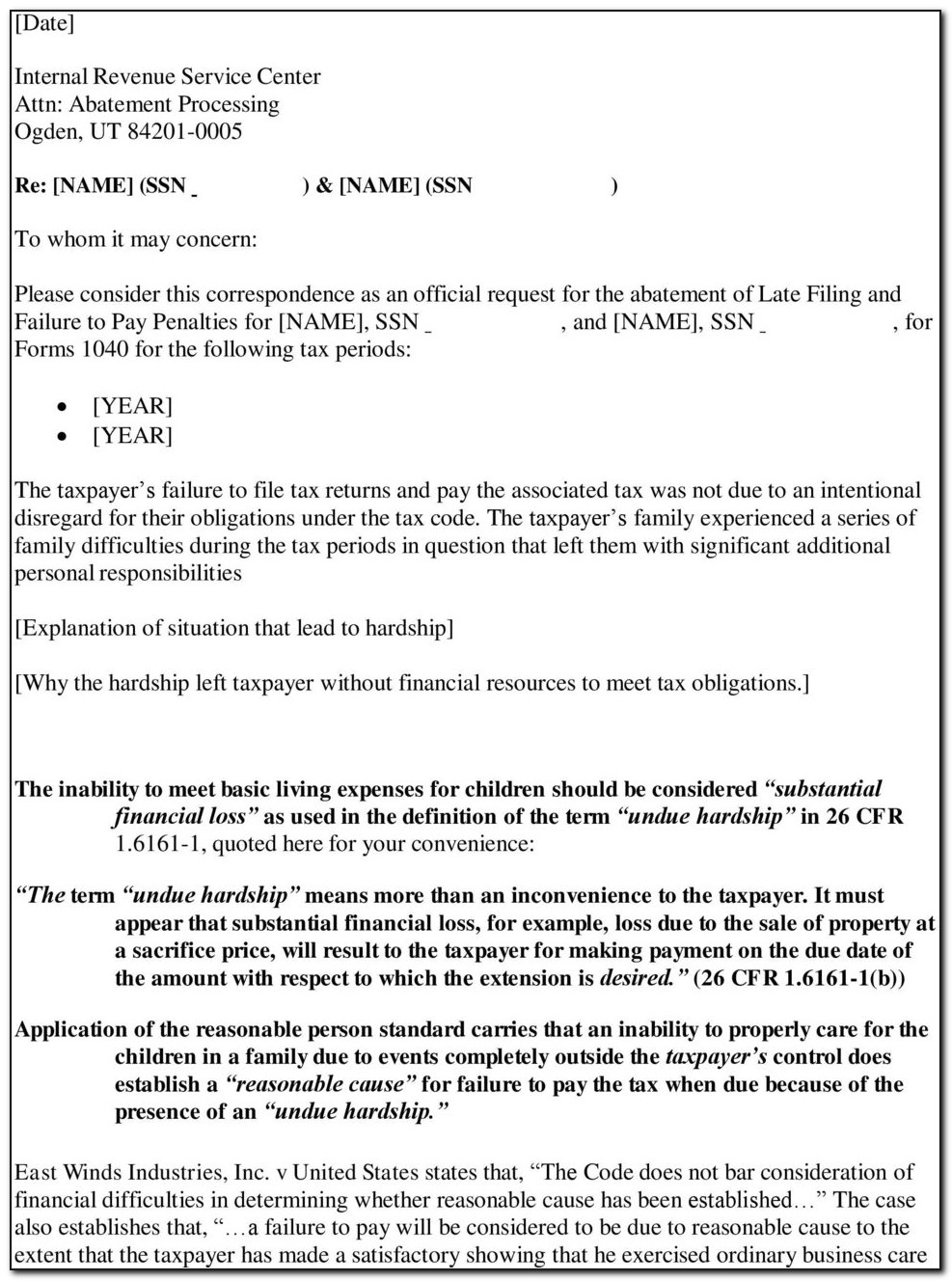

Letter For Abatement of Penalty Word

Related Post: