In-Kind Donation Acknowledgement Letter Template

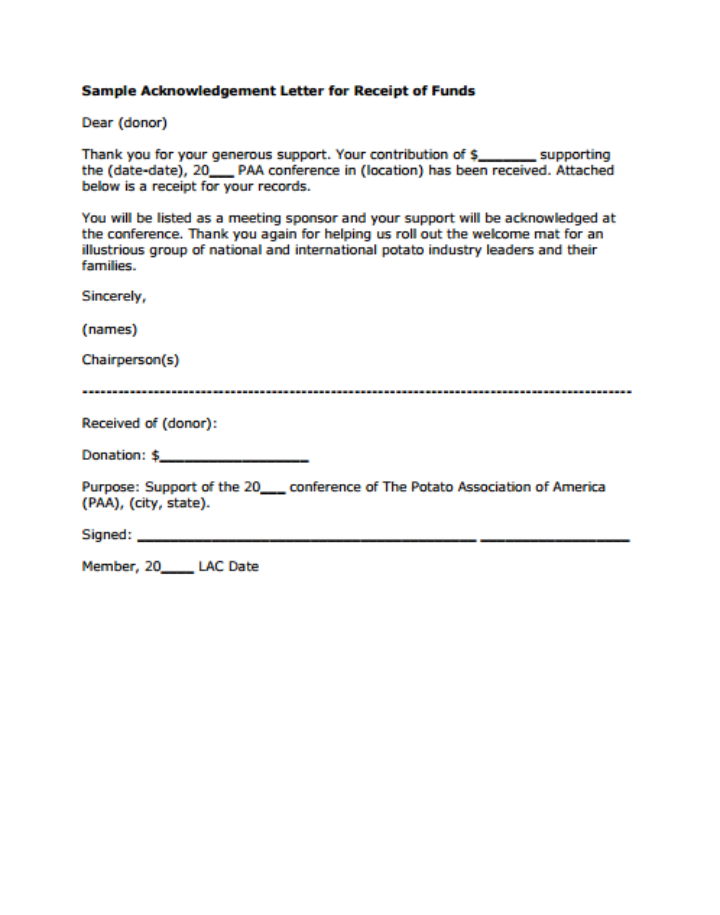

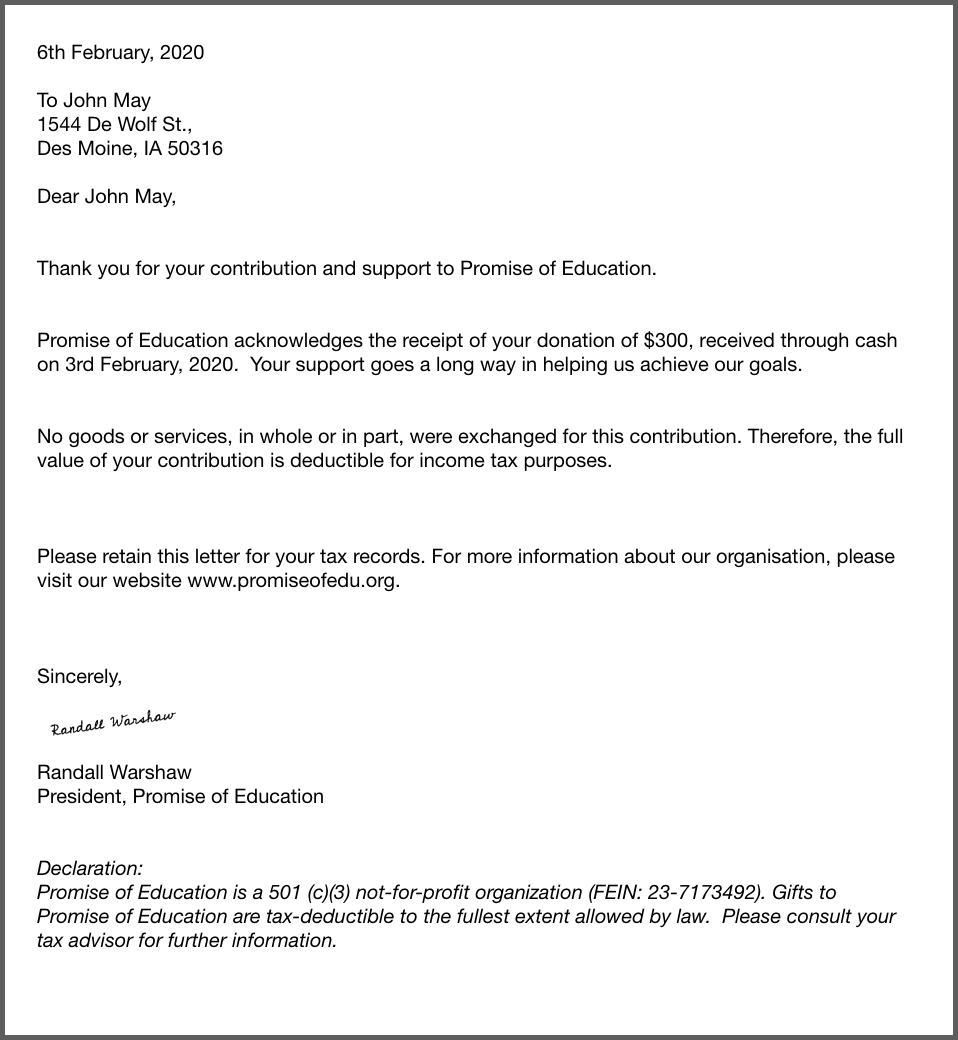

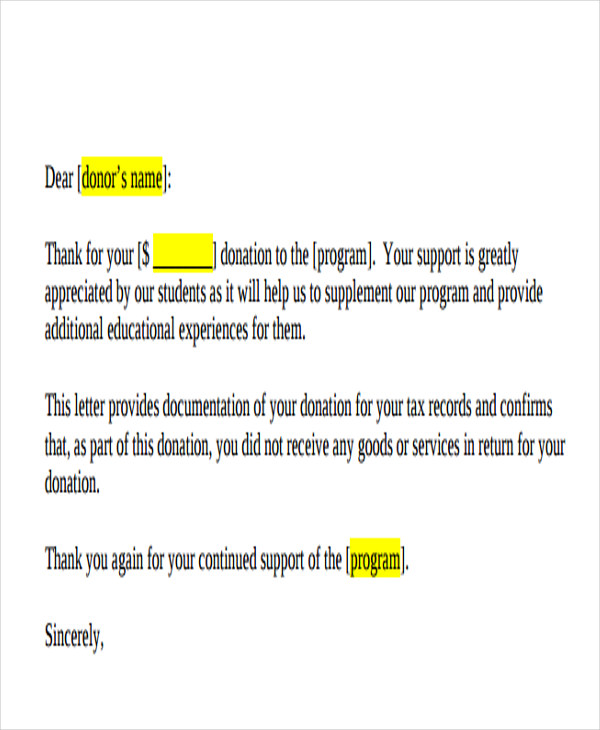

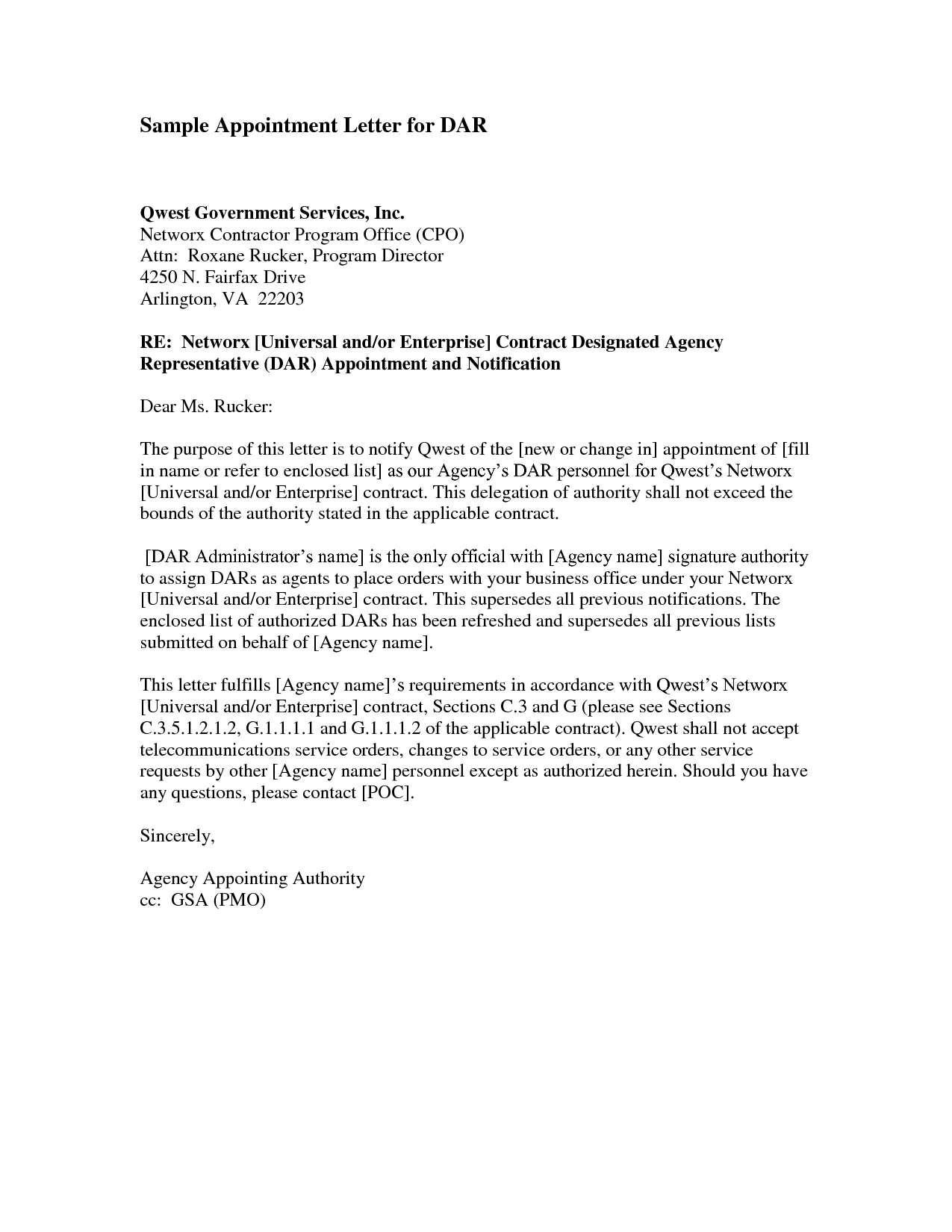

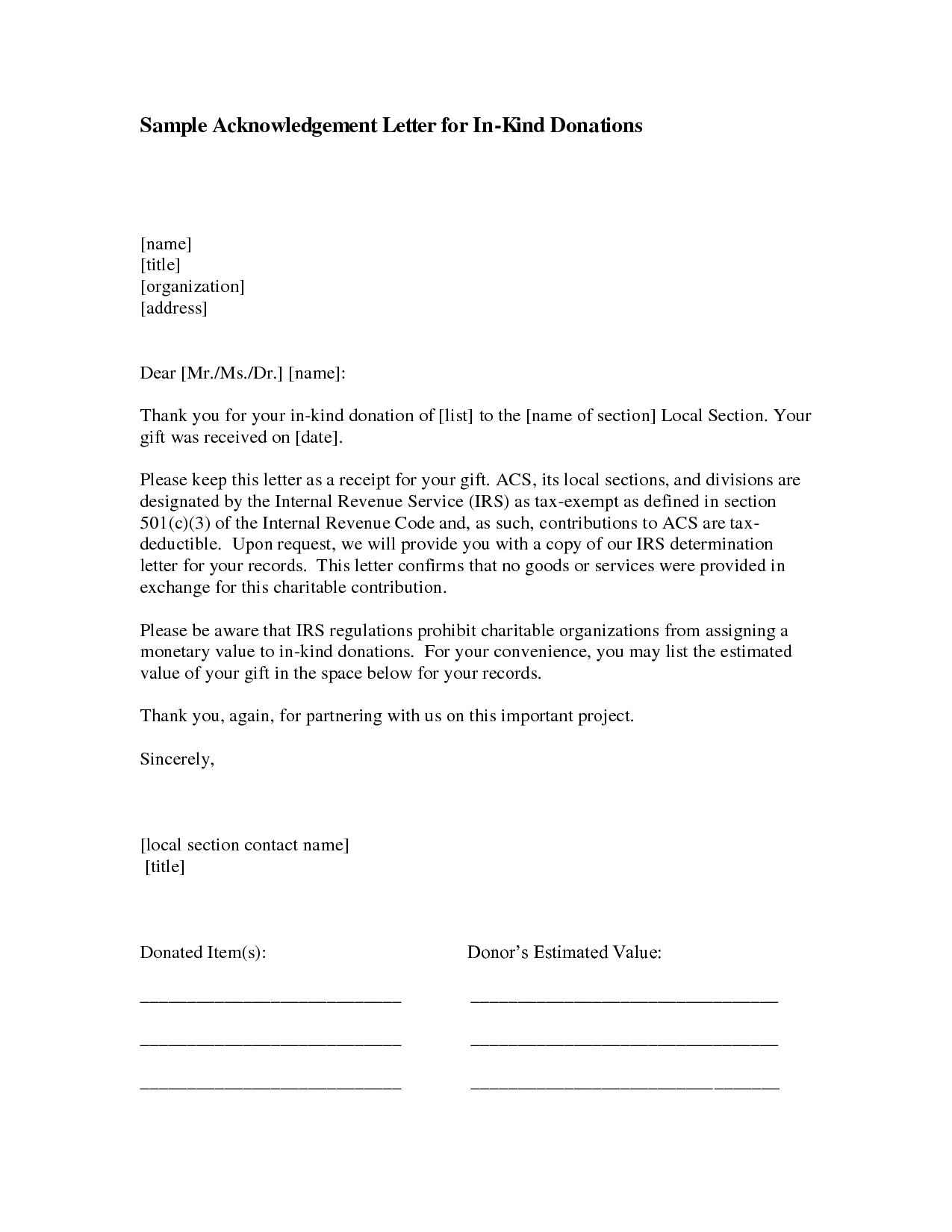

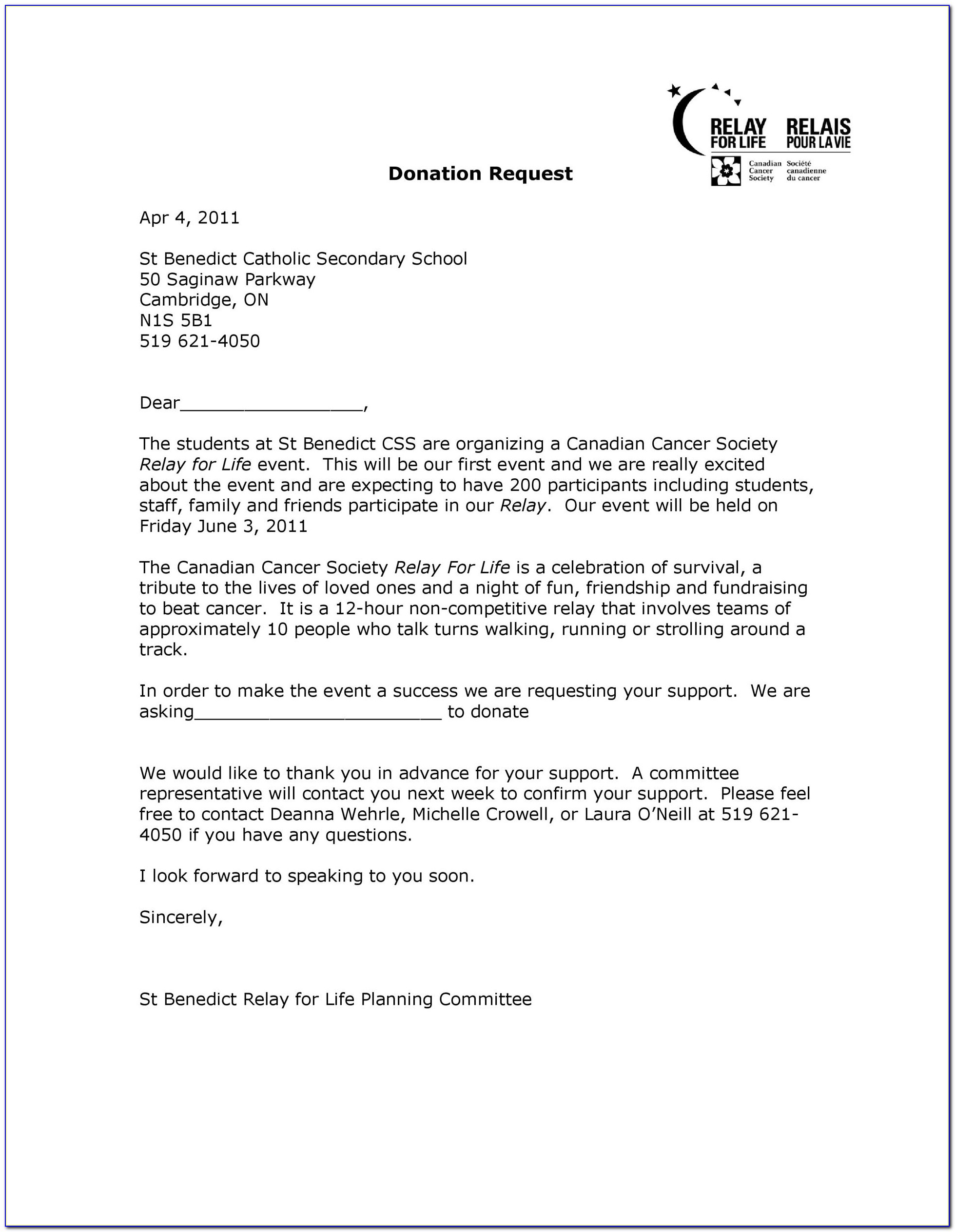

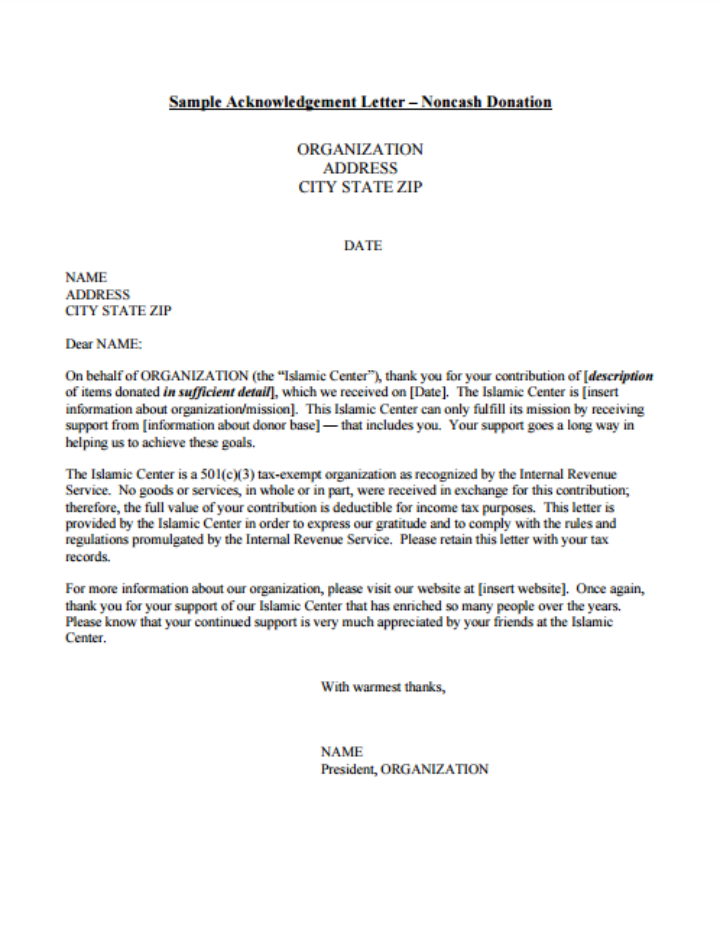

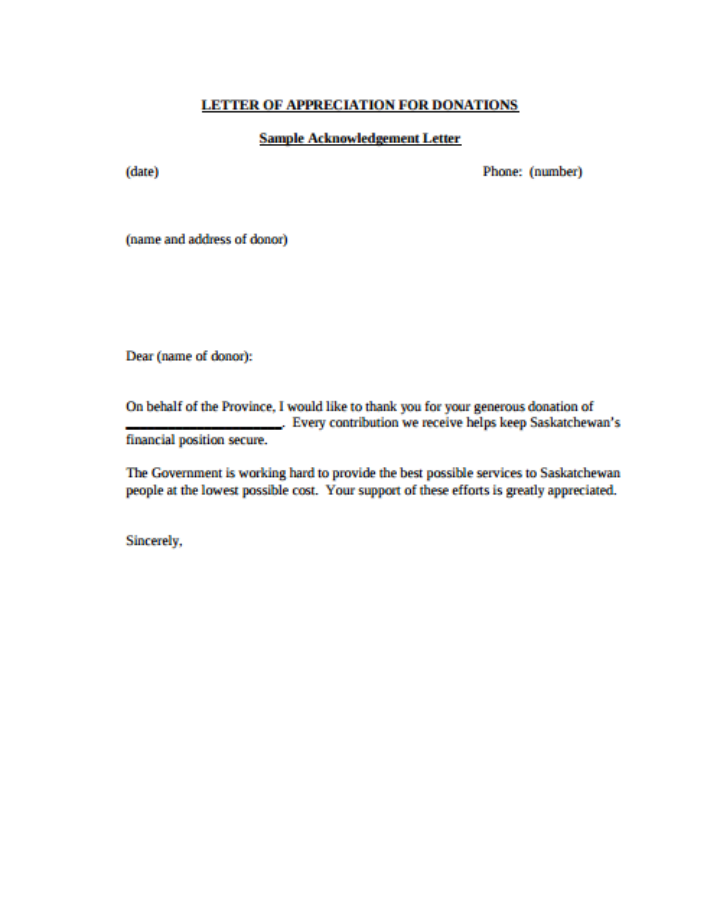

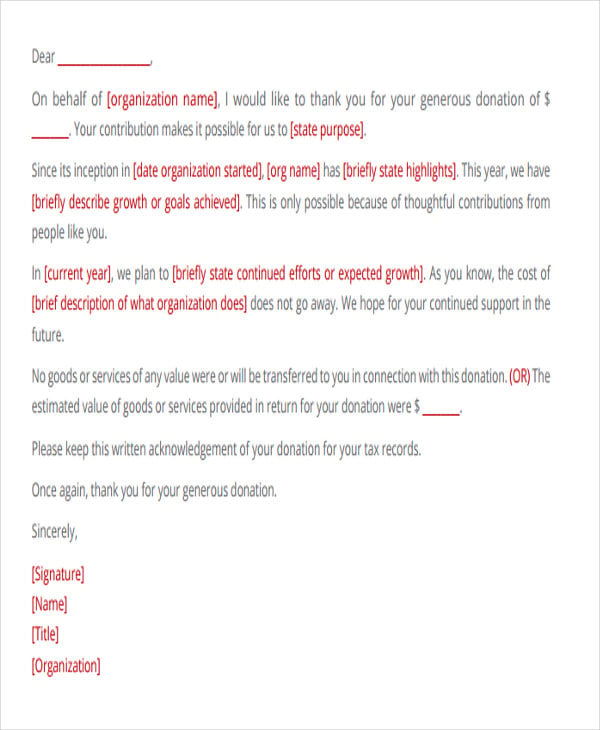

In-Kind Donation Acknowledgement Letter Template - Introduce your organization and its representative. The best prospects for future support are current donors, and thanking. Why should your nonprofit send donor acknowledgment. Web our letters ensure that your appreciation is conveyed in a heartfelt and meaningful manner, reinforcing connections and partnerships. If yes, an acknowledgment is not required by the irs; Is the donation for less than $250? Web if a donor wants to claim a contribution of $250 or more, the irs requires public charities to send written acknowledgements that must contain the following information:. Web donation acknowledgement letter template. Web donor acknowledgement letters should be sent out asap (48 hours) ideally, you should be thanking your donors as soon as possible. Attach a relevant image to make the appeal stand. To [recipient name] dear, [recipient name] on behalf of [name of. Web download gift in kind acknowledgement letter (word doc) the letter serves as a thank you and required written acknowledgment, and should include specific language from. What is a donor acknowledgment letter? The best prospects for future support are current donors, and thanking. Web if a donor wants to. Express gratitude effortlessly with our ai. The best prospects for future support are current donors, and thanking. Is the donation for less than $250? Web i suggest that your letter of acknowledgment be crafted in the way i cite in my article above—that the generous donation of space “saves your organization from spending. To [recipient name] dear, [recipient name] on. What is a donor acknowledgment letter? Express gratitude effortlessly with our ai. Web if a donor wants to claim a contribution of $250 or more, the irs requires public charities to send written acknowledgements that must contain the following information:. Web donor acknowledgement letters should be sent out asap (48 hours) ideally, you should be thanking your donors as soon. If possible you should aim to. Web donation acknowledgement letter template. To [recipient name] dear, [recipient name] on behalf of [name of. Prompt and thoughtful gift acknowledgments are central to effective fundraising. Web i suggest that your letter of acknowledgment be crafted in the way i cite in my article above—that the generous donation of space “saves your organization from. Web our letters ensure that your appreciation is conveyed in a heartfelt and meaningful manner, reinforcing connections and partnerships. But it’s always a good idea to thank donors and you may want to send an. Thank you for your generous gift of ________ (full description)________ which we received on ____ (date)____. Introduce your organization and its representative. Web download gift. The written acknowledgment required to substantiate a charitable contribution of $250 or more. Is the donation for less than $250? To [recipient name] dear, [recipient name] on behalf of [name of. If possible you should aim to. Web a donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Introduce your organization and its representative. Web donation acknowledgement letter template. What is a donor acknowledgment letter? Web if a donor wants to claim a contribution of $250 or more, the irs requires public charities to send written acknowledgements that must contain the following information:. Prompt and thoughtful gift acknowledgments are central to effective fundraising. Web our letters ensure that your appreciation is conveyed in a heartfelt and meaningful manner, reinforcing connections and partnerships. What is a donor acknowledgment letter? If yes, an acknowledgment is not required by the irs; Show how the donation can help solve an issue. Thank you for your generous gift of ________ (full description)________ which we received on ____ (date)____. But it’s always a good idea to thank donors and you may want to send an. Web our letters ensure that your appreciation is conveyed in a heartfelt and meaningful manner, reinforcing connections and partnerships. Is the donation for less than $250? Why should your nonprofit send donor acknowledgment. To [recipient name] dear, [recipient name] on behalf of [name of. Attach a relevant image to make the appeal stand. Web if a donor wants to claim a contribution of $250 or more, the irs requires public charities to send written acknowledgements that must contain the following information:. Introduce your organization and its representative. Express gratitude effortlessly with our ai. Web a donation acknowledgment letter is a type of donor letter. Show how the donation can help solve an issue. Web i suggest that your letter of acknowledgment be crafted in the way i cite in my article above—that the generous donation of space “saves your organization from spending. Web a donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. What is a donor acknowledgment letter? If yes, an acknowledgment is not required by the irs; Introduce your organization and its representative. Express gratitude effortlessly with our ai. Why should your nonprofit send donor acknowledgment. If possible you should aim to. To [recipient name] dear, [recipient name] on behalf of [name of. Thank you for your generous gift of ________ (full description)________ which we received on ____ (date)____. The written acknowledgment required to substantiate a charitable contribution of $250 or more. Attach a relevant image to make the appeal stand. Is the donation for less than $250? Prompt and thoughtful gift acknowledgments are central to effective fundraising. Web if a donor wants to claim a contribution of $250 or more, the irs requires public charities to send written acknowledgements that must contain the following information:. But it’s always a good idea to thank donors and you may want to send an. Web donor acknowledgement letters should be sent out asap (48 hours) ideally, you should be thanking your donors as soon as possible. Web download gift in kind acknowledgement letter (word doc) the letter serves as a thank you and required written acknowledgment, and should include specific language from. Web our letters ensure that your appreciation is conveyed in a heartfelt and meaningful manner, reinforcing connections and partnerships.11+ Donor Acknowledgement Letter Templates PDF, DOC

Donor Acknowledgment Letter Tips to Make Them Memorable

Non Profit In Kind Donation Letter Template Templates2 Resume Examples

11+ Donor Acknowledgement Letter Templates PDF, DOC

In Kind Donation Acknowledgement Letter Template Collection Letter

In Kind Donation Acknowledgement Letter Template Collection Letter

Fantastic In Kind Donation Acknowledgement Letter Template

11+ Donor Acknowledgement Letter Templates PDF, DOC

11+ Donor Acknowledgement Letter Templates PDF, DOC

8+ Donation Acknowledgement Letter Templates Free Word, PDF Format

Related Post: