Foreign Grantor Trust Template

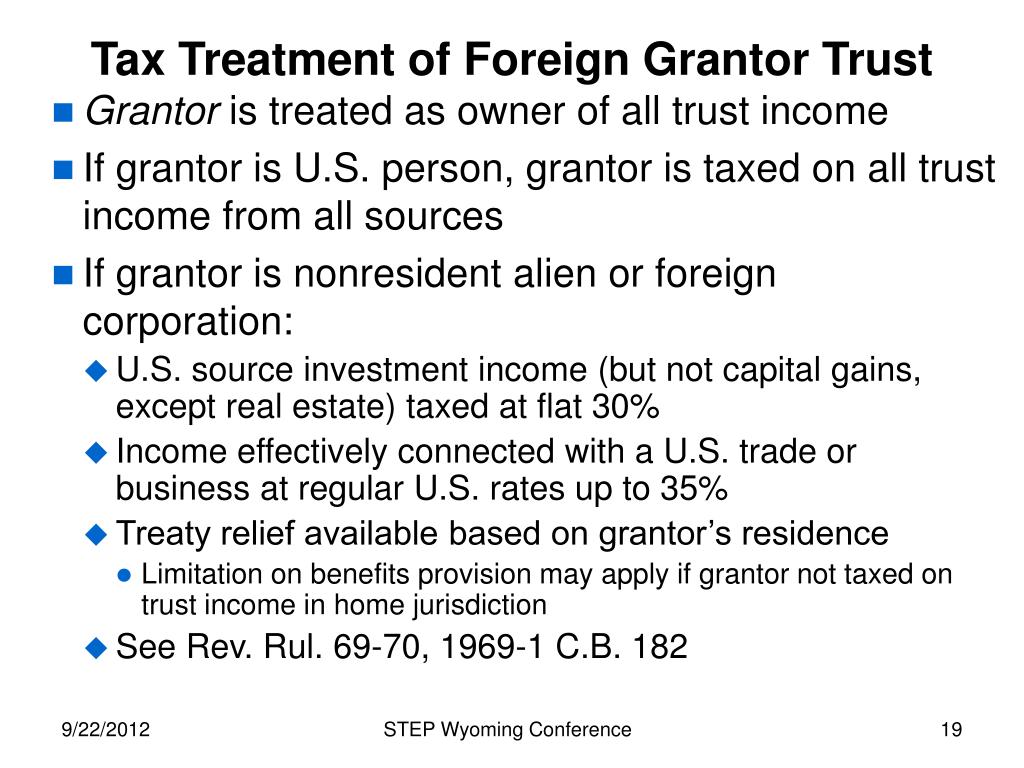

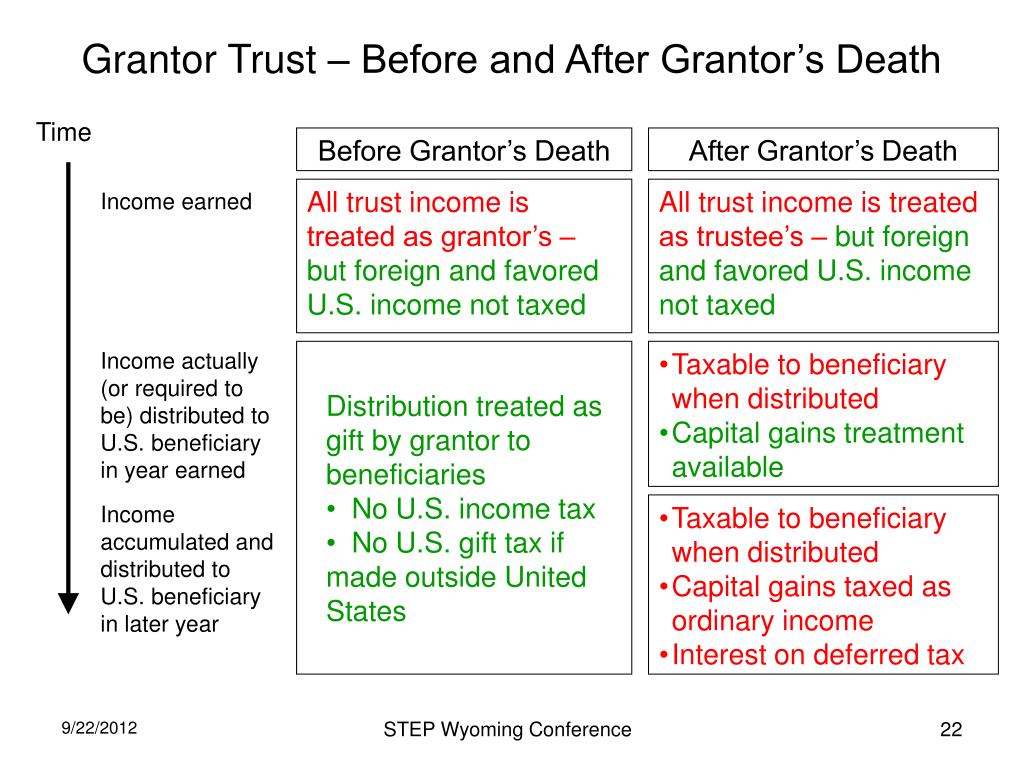

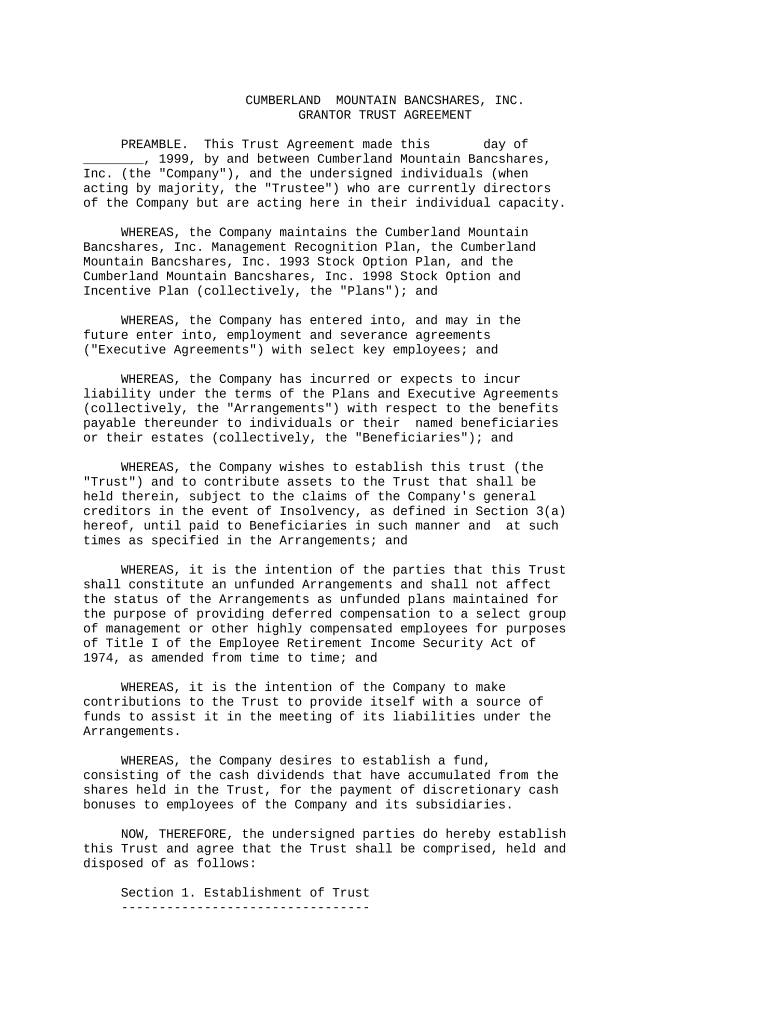

Foreign Grantor Trust Template - Its complex rules are a dangerous minefield that should be. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. Initial return final returnamended return b check box that applies to person filing return: Web a trust that satisfies both tests is a us domestic trust; A foreign trust with a u.s. The form’s reach, however, is slightly broader, as it is also used to report. Term meaning that a trust satisfies a particular tax status under the u.s. The trustees and administration of the trust. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as belonging to the grantor and not subject to u.s. Individualpartnership corporationtrust executor c check if any. Web what is a “foreign grantor trust”? Real estate, family law, estate planning, business forms and power of attorney forms. The term “foreign grantor trust” is a u.s. With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as belonging to the grantor and not subject to u.s. Term meaning. Web a trust that satisfies both tests is a us domestic trust; Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such times, for such prices, and upon such terms and conditions as the trustees may deem. (a). A foreign trust with a u.s. Web beneficiary how does the irs define a trust? Domestic trust, so neither the. Click download, then print the template to fill it out or upload it to an online editor. The term 'grantor trust' is used to. A grantor trust is a trust that is treated as owned by its grantor under code §671. Ad get access to the largest online library of legal forms for any state. Person transfers (which includes gifts or loans) property directly or indirectly to a foreign trust and the trust has one or more. (a) the grantor reserves the right to. Web select pdf or docx file format for your grantor trust agreement foreign grantor. Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such times, for such prices, and upon such terms and conditions as the trustees may. The form’s reach, however, is slightly broader, as it is also used to report. A foreign trust with a u.s. Initial return final returnamended return b check box that applies to person filing return: Real estate, family law, estate planning, business forms and power of attorney forms. Ad get access to the largest online library of legal forms for any. (a) the grantor reserves the right to revoke the trust alone or with the consent of a related party, or (b) the grantor (and spouse, if any) is the sole trust beneficiary during the grantor's lifetime. The artificial son of the living man known as “patrick devine” and this american trustee is protected by the united states of america and. Income from a foreign grantor trust is generally taxed to the trust’s grantor, rather than to the trust itself or to the trust’s beneficiaries. Ad get access to the largest online library of legal forms for any state. Term meaning that a trust satisfies a particular tax status under the u.s. The process is even easier for existing users of. The first 3 goals can be achieved by grantor trust status. The trustees and administration of the trust. Individualpartnership corporationtrust executor c check if any. Ad get access to the largest online library of legal forms for any state. Owner to satisfy its annual information reporting requirements under section. Real estate, family law, estate planning, business forms and power of attorney forms. A trust that fails one or both tests is a foreign trust. Domestic trust, so neither the. The term 'grantor trust' is used to. The process is even easier for existing users of the us legal forms library. Web select pdf or docx file format for your grantor trust agreement foreign grantor. A grantor trust, whether foreign or domestic, pays no u.s. Initial return final returnamended return b check box that applies to person filing return: With a foreign revocable grantor trust, all income and appreciation that occurs while the grantor is still alive is treated as belonging to the grantor and not subject to u.s. Persons to report (1) certain transactions that have occurred with respect to foreign trusts and (2) the receipt of gifts from foreign persons. The process is even easier for existing users of the us legal forms library. Person transfers (which includes gifts or loans) property directly or indirectly to a foreign trust and the trust has one or more. Specific situations where a trust may be classified as a foreign grantor trust are set out below: Owner to satisfy its annual information reporting requirements under section. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: The regulations define a “trust” as an arrangement created either by a will or by an inter vivos declaration whereby trustees take title to property for the purpose of protecting or conserving it for. Web beneficiary how does the irs define a trust? Web to sell, transfer, exchange, convert or otherwise dispose of, or grant options with respect to, such property, at public or private sale, with or without security, in such manner, at such times, for such prices, and upon such terms and conditions as the trustees may deem. The artificial son of the living man known as “patrick devine” and this american trustee is protected by the united states of america and individual state constitutions. Real estate, family law, estate planning, business forms and power of attorney forms. A trust that fails one or both tests is a foreign trust. Web types of foreign trusts the us income taxation of a foreign trust depends on whether the trust is a grantor or nongrantor trust. (a) the grantor reserves the right to revoke the trust alone or with the consent of a related party, or (b) the grantor (and spouse, if any) is the sole trust beneficiary during the grantor's lifetime. Web as the title suggests, form 3520 is used by u.s. Ad get access to the largest online library of legal forms for any state.PPT Fundamentals of United States Taxation of Foreign Trusts

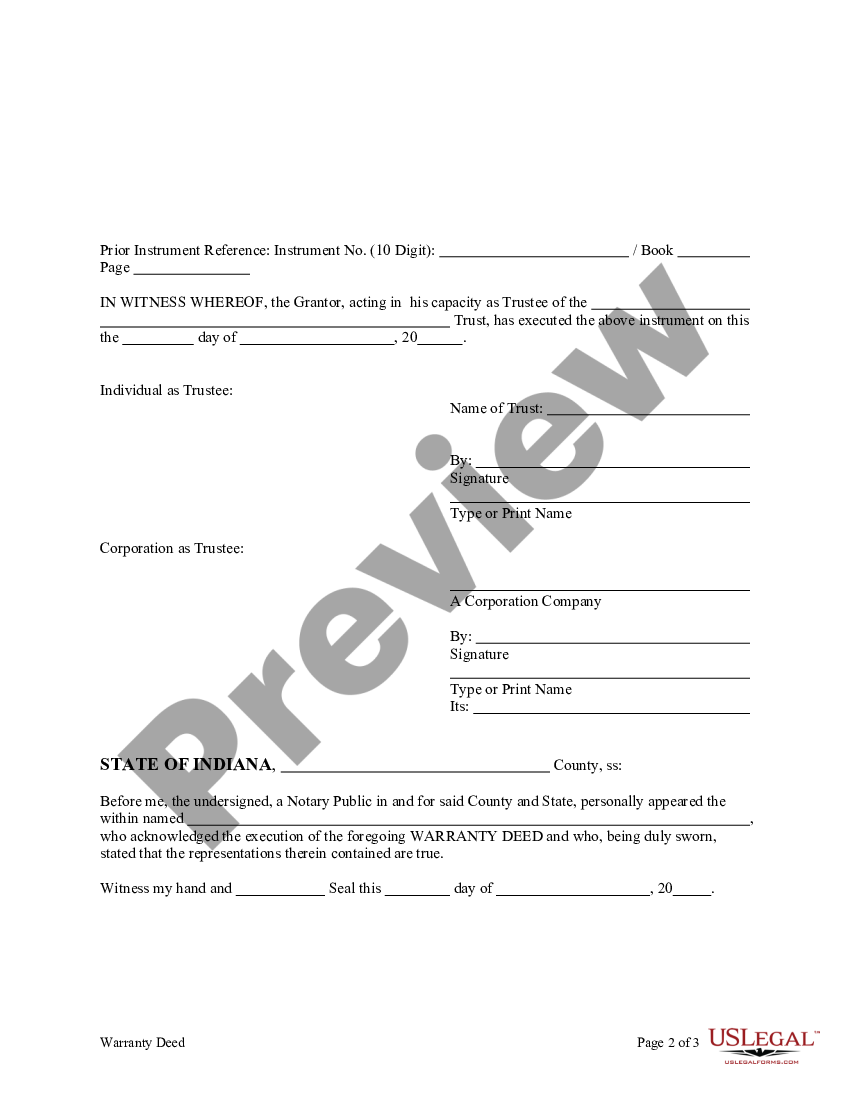

Grantor Trust Form Without Adequate Security US Legal Forms

PPT Fundamentals of United States Taxation of Foreign Trusts

Grantor Trust Agreement Foreign Beneficiary US Legal Forms

Foreign Grantor Trust Bridgeford Trust Company

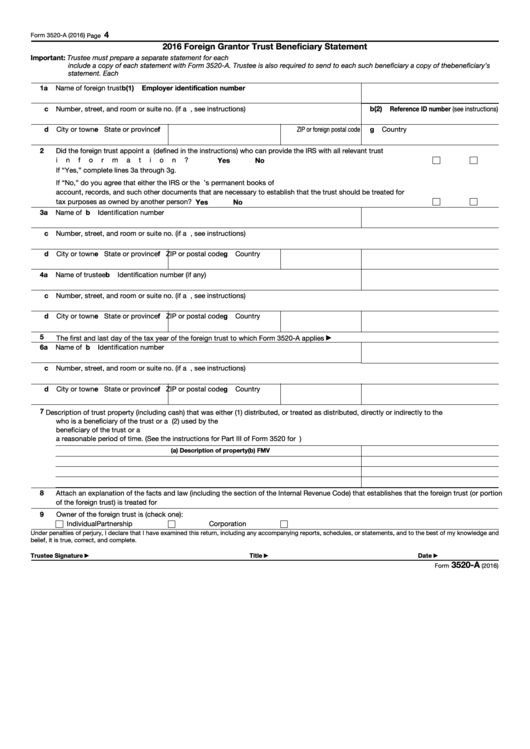

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Trust Grantor Form With Ein Filing Requirements US Legal Forms

How to set up a foreign trust for ultimate asset protection Nomad

Grantor Trust Agreement Form Fill Out and Sign Printable PDF Template

Foreign Trust Protection for Foreign Assets TaxConnections is a where

Related Post: