Excel Portfolio Optimization Template

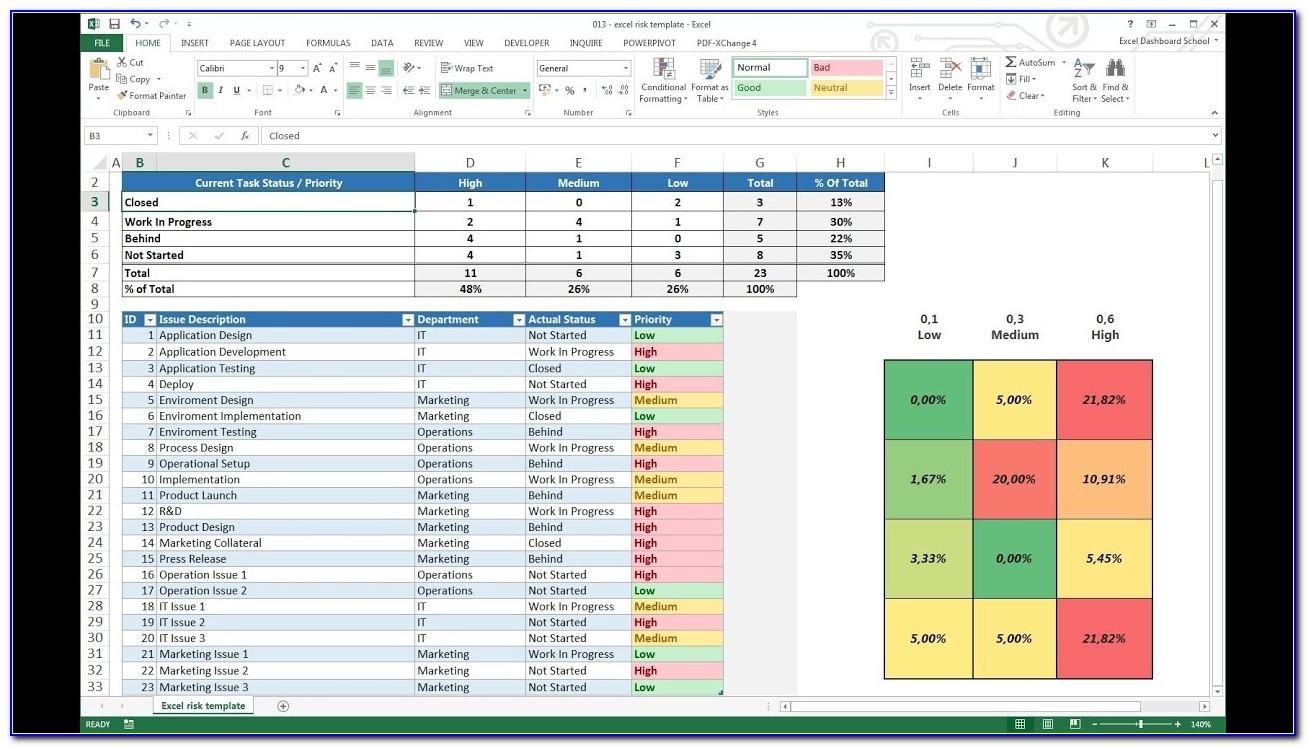

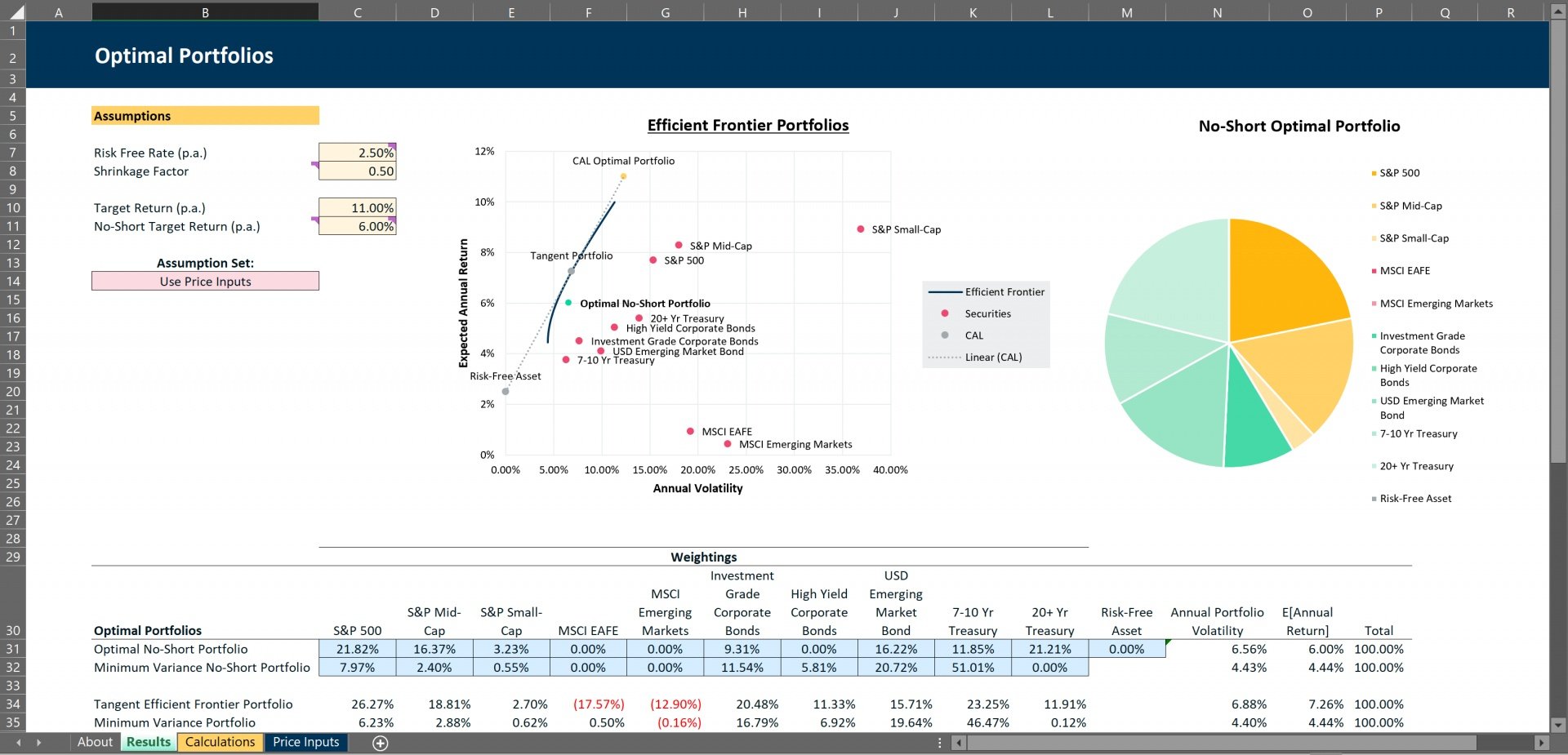

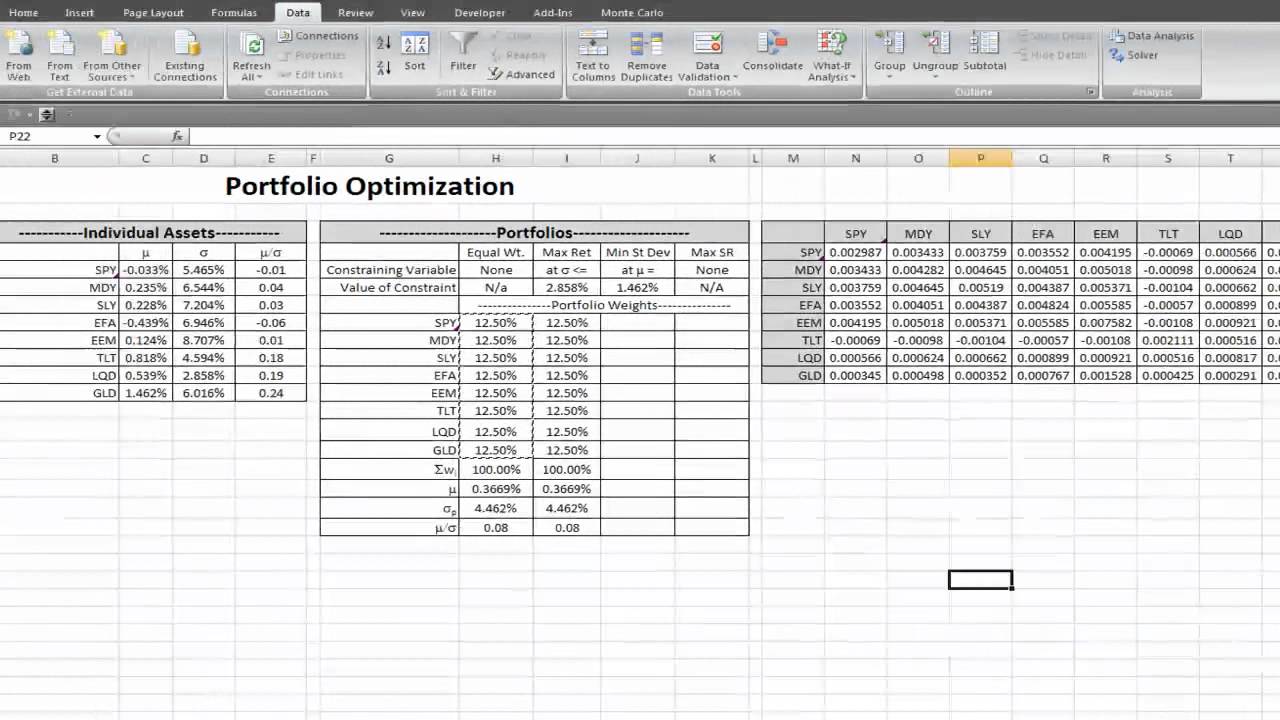

Excel Portfolio Optimization Template - This gives us the basic idea of diversification in investing. Web an excel spreadsheet for optimization of portfolios with three assets is freely available from the author for noncommercial use. Download free, customizable ppm templates in microsoft excel, powerpoint, and google sheets formats. Correlation plays an important role in the choice of the portfolio. Web download free templates to support your product portfolio management strategies, including a bcg matrix and other product portfolio analysis templates, multiple roadmaps, and a flowchart for planning the portfolio management process. Behavioral factors include the investor’s risk outlook and risk aversion as well as the choices they make on the investment horizon and instruments. Calculating the optimal portfolio in excel | portfolio optimization by ryan o'connell, cfa frm. Web free project portfolio management templates try smartsheet for free by kate eby | july 27, 2021 (updated september 28, 2023) we’ve compiled the top templates for strategic project portfolio management (ppm). Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. Web the video tutorial below demonstrates two methods of portfolio optimization in excel. Although the process involves a number of complex calculations, the process itself can be broken down into six simple steps. His works have a great impact on modern finance and have led to the development of the capital asset pricing model by william sharpe, linter and mossin. This gives us the basic idea of diversification in investing. Web the video. Four optimization scenarios are applied to a portfolio. Download our free portfolio template Web portfolio optimization in excel. Correlation plays an important role in the choice of the portfolio. Web in this demonstration, we are going to use 5 years of monthly stock price data for 5 companies such as mcd, sbux, pfe, amgn, and axp. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Calculating the optimal portfolio in excel | portfolio optimization by ryan o'connell, cfa frm. The first example covers the classic textbook example of the two security case. Web building a portfolio optimization model in excel can provide traders. Correlation plays an important role in the choice of the portfolio. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Although the process involves a number of complex calculations, the process itself can be broken down into six simple steps. This gives us the basic idea of. Web sticky nav links drive portfolio optimization easily model different portfolio scenarios to determine the best strategic path. His works have a great impact on modern finance and have led to the development of the capital asset pricing model by william sharpe, linter and mossin. Download our free portfolio template Web the video tutorial below demonstrates two methods of portfolio. Behavioral factors include the investor’s risk outlook and risk aversion as well as the choices they make on the investment horizon and instruments. Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the least risk. This gives us the basic idea of diversification in investing. The tutorial. In this post, we’ll dive into 10 templates to improve your project portfolio management process. Download free, customizable ppm templates in microsoft excel, powerpoint, and google sheets formats. Web the video tutorial below demonstrates two methods of portfolio optimization in excel. If you understand the process, you can do the same exercise. Interested in building, analyzing and managing portfolios in. Web 29k views 2 years ago dallas. This gives us the basic idea of diversification in investing. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. His works have a great impact on modern finance and have led to the development of the capital asset pricing model. Web download free templates to support your product portfolio management strategies, including a bcg matrix and other product portfolio analysis templates, multiple roadmaps, and a flowchart for planning the portfolio management process. It optimizes asset allocation by finding the stock distribution that minimizes the standard deviation of the portfolio while maintaining the desired return. #excel #optimization #solverportfolio optimization in excel*solver. Three stocks are used for this project. The tutorial discusses how the optimal wieghts are determined graphically and mathematically. Web enter your name and email in the form below and download the free template now! Web building a portfolio optimization model in excel can provide traders with a powerful quantitative tool for identifying the ideal weight of various assets within. Web portfolio optimization in excel. Weigh project proposals against strategic business drivers and consider the cost and resource constraints. Interested in building, analyzing and managing portfolios in excel? Web there are several factors that can affect portfolio optimization such as the following: Web the excel portfolio optimization model calculates the optimal capital weightings for portfolios of financial or business investments that maximizes return for the least risk. Web the solver is an excel add‐in created by frontline systems (www.solver.com) that can be used to solve general optimization problems that may be subject to certain kinds of constraints. Web free portfolio optimization background in 1952, harry markowitz published a paper on portfolio selection and the effects of diversification on security returns. Web an excel spreadsheet for optimization of portfolios with three assets is freely available from the author for noncommercial use. Four optimization scenarios are applied to a portfolio. Web download free templates to support your product portfolio management strategies, including a bcg matrix and other product portfolio analysis templates, multiple roadmaps, and a flowchart for planning the portfolio management process. Behavioral factors include the investor’s risk outlook and risk aversion as well as the choices they make on the investment horizon and instruments. The goal of the optimization exercise is to choose portfolio weights that maximize. His works have a great impact on modern finance and have led to the development of the capital asset pricing model by william sharpe, linter and mossin. The objective of this project is to learn how the nobel prize winning, optimal portfolio theory (by harry markowitz), works in practice. Although the process involves a number of complex calculations, the process itself can be broken down into six simple steps. The first example covers the classic textbook example of the two security case. This gives us the basic idea of diversification in investing. If you understand the process, you can do the same exercise. And with project portfolio management templates, you’ll have the tools to visualize, manage, and optimize multiple projects at once. Download free, customizable ppm templates in microsoft excel, powerpoint, and google sheets formats.Portfolioanalyse Excel Vorlage Hübsch Portfolio Slicer Vorlage Ideen

Portfolio Optimization with higher moments in Excel (subtitles) YouTube

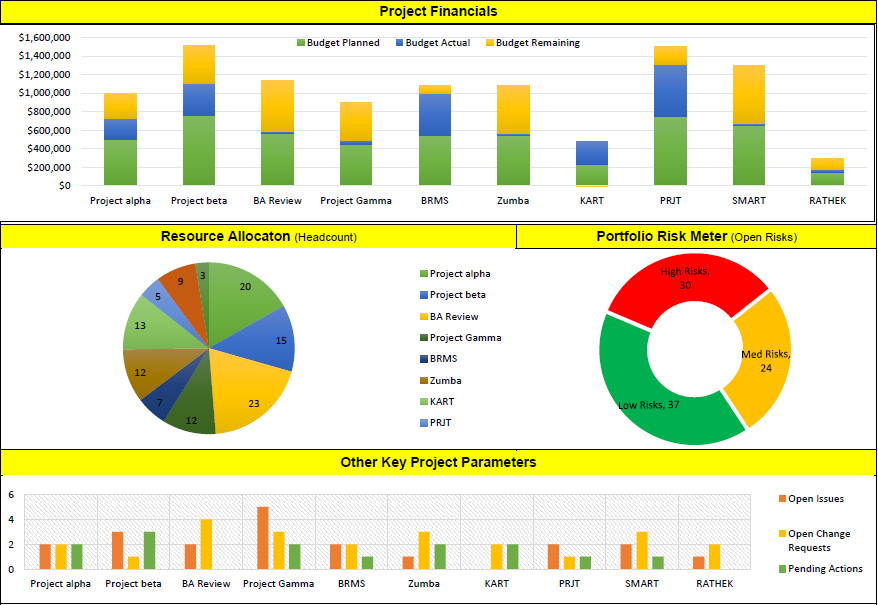

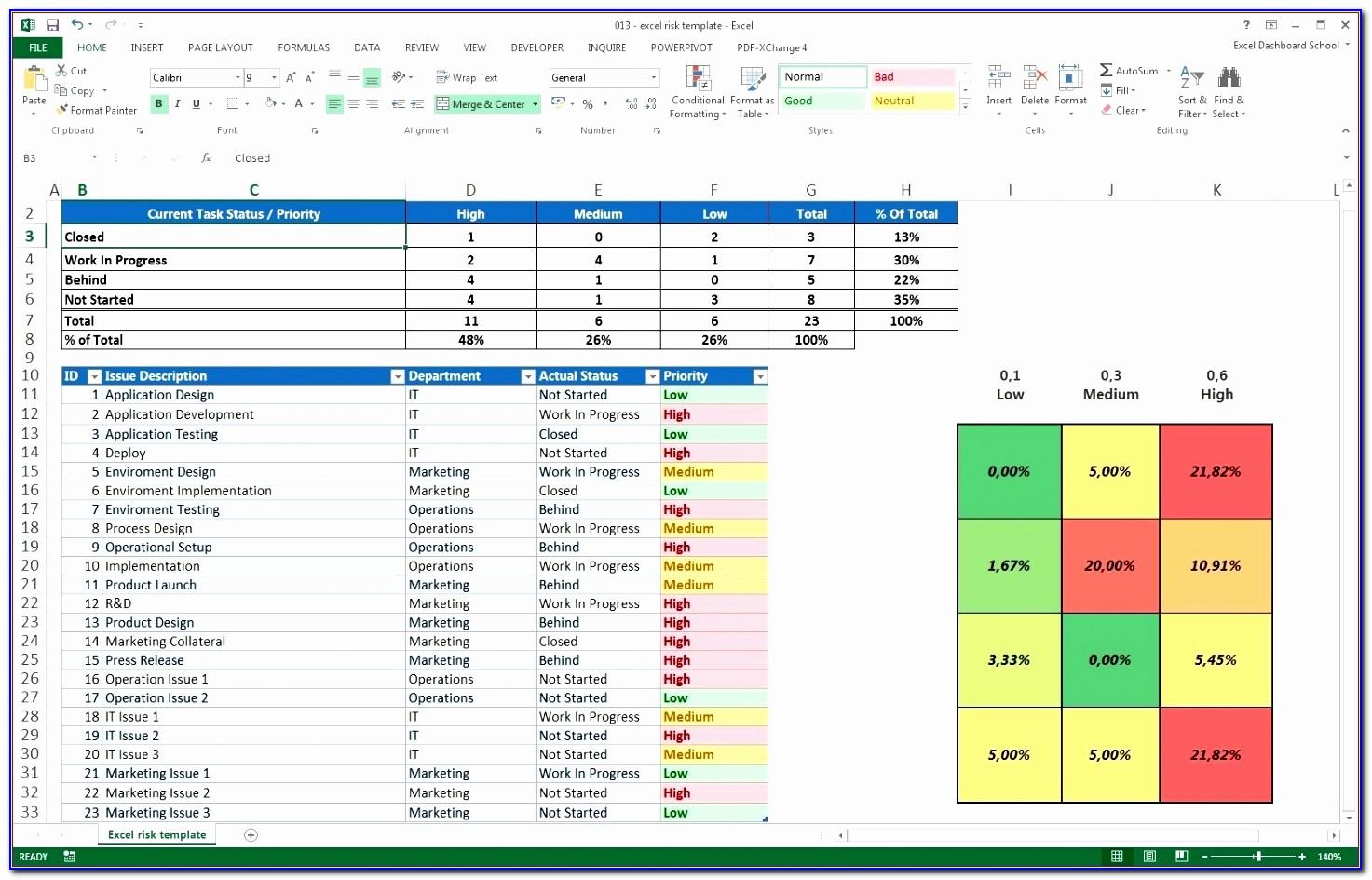

Project Portfolio Management Dashboard Excel Template

Project Portfolio Management Excel Template

Project Portfolio Template Excel Free Download Free Project

Markowitz Portfolio Selection with Excel Solver YouTube

Excel Portfolio Optimization Template Portfolio, Portfolio management

Portfolio Optimization Excel Model with Harry Markowitz's Modern

Portfolio Optimization in Excel.mp4 YouTube

Project Portfolio Dashboard Excel Template Free

Related Post: