Excel Depreciation Template

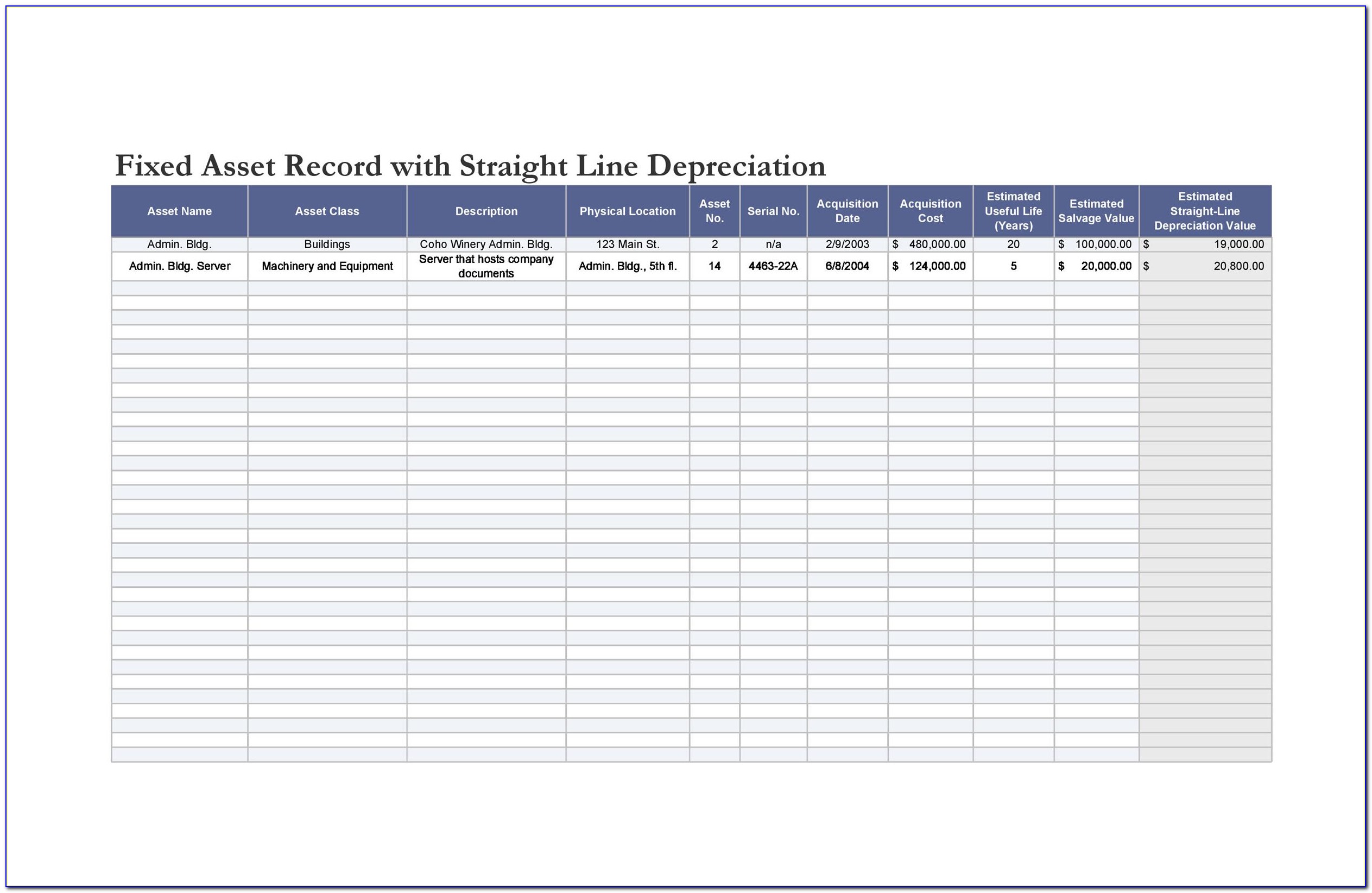

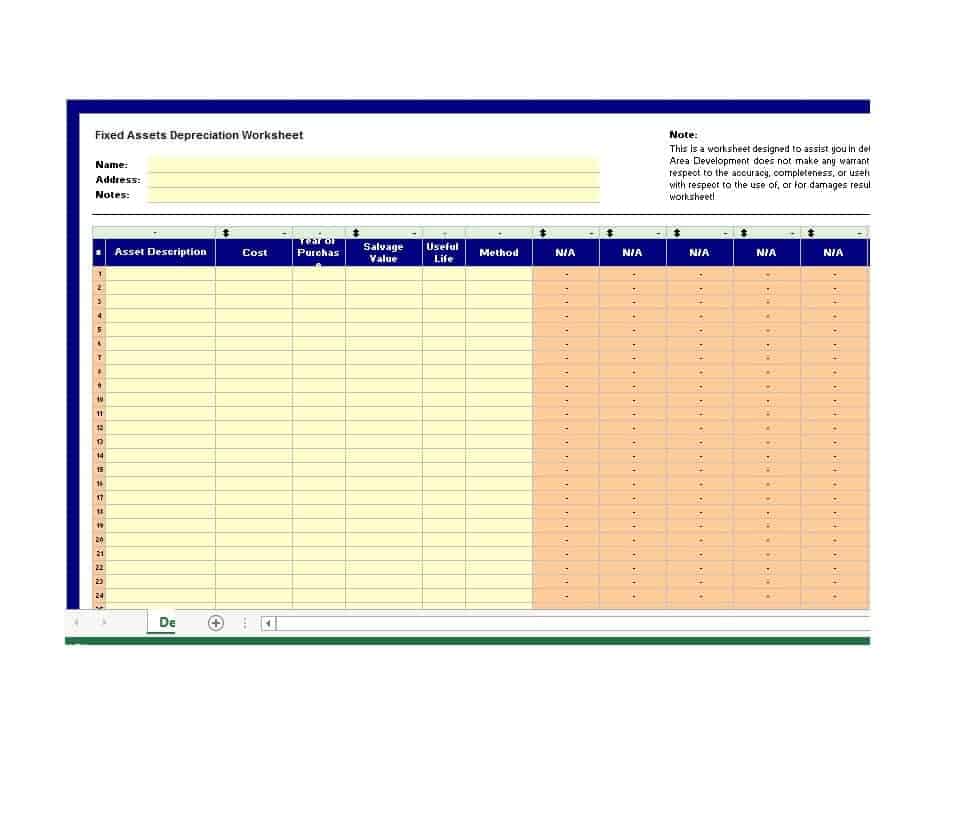

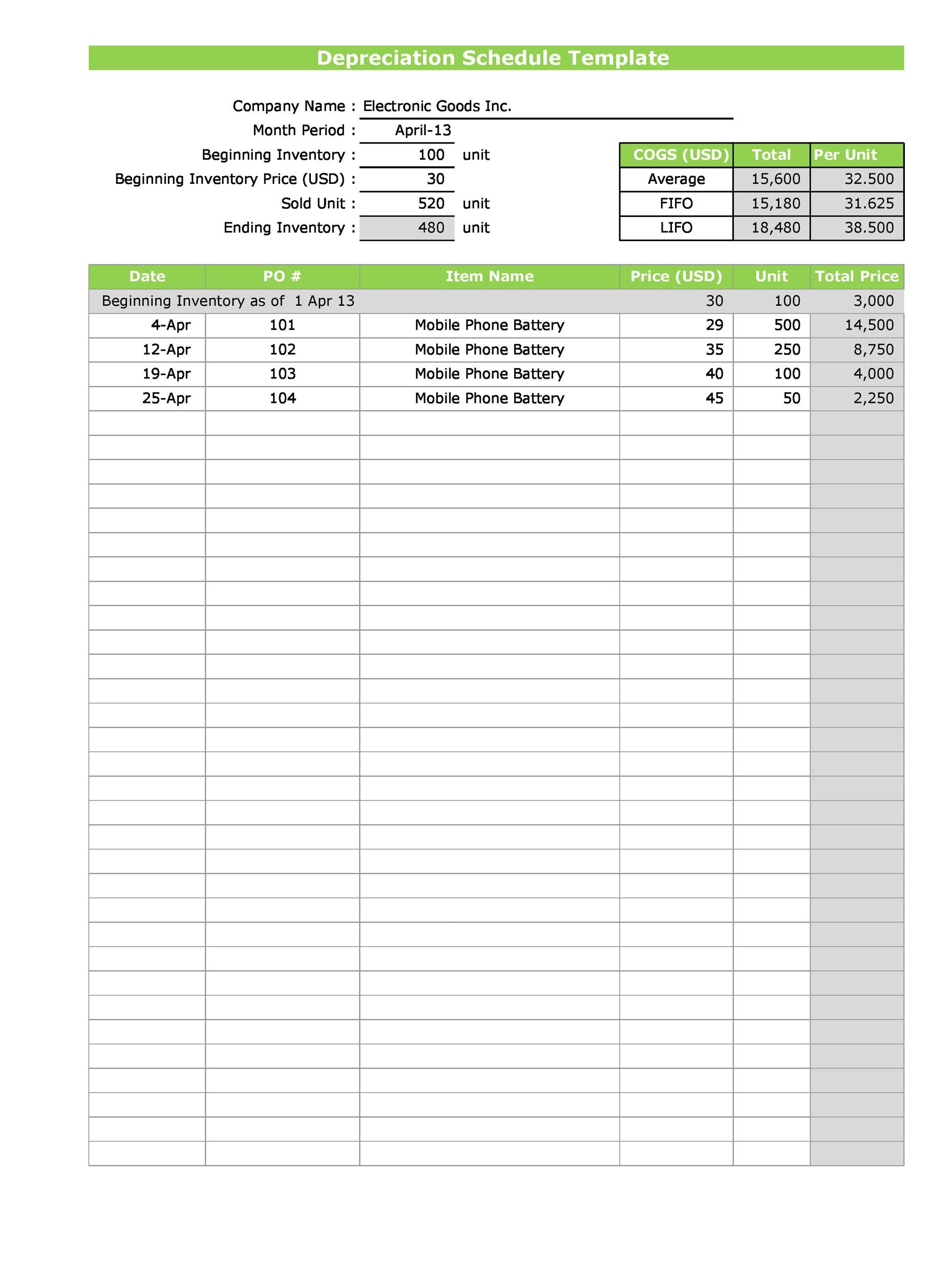

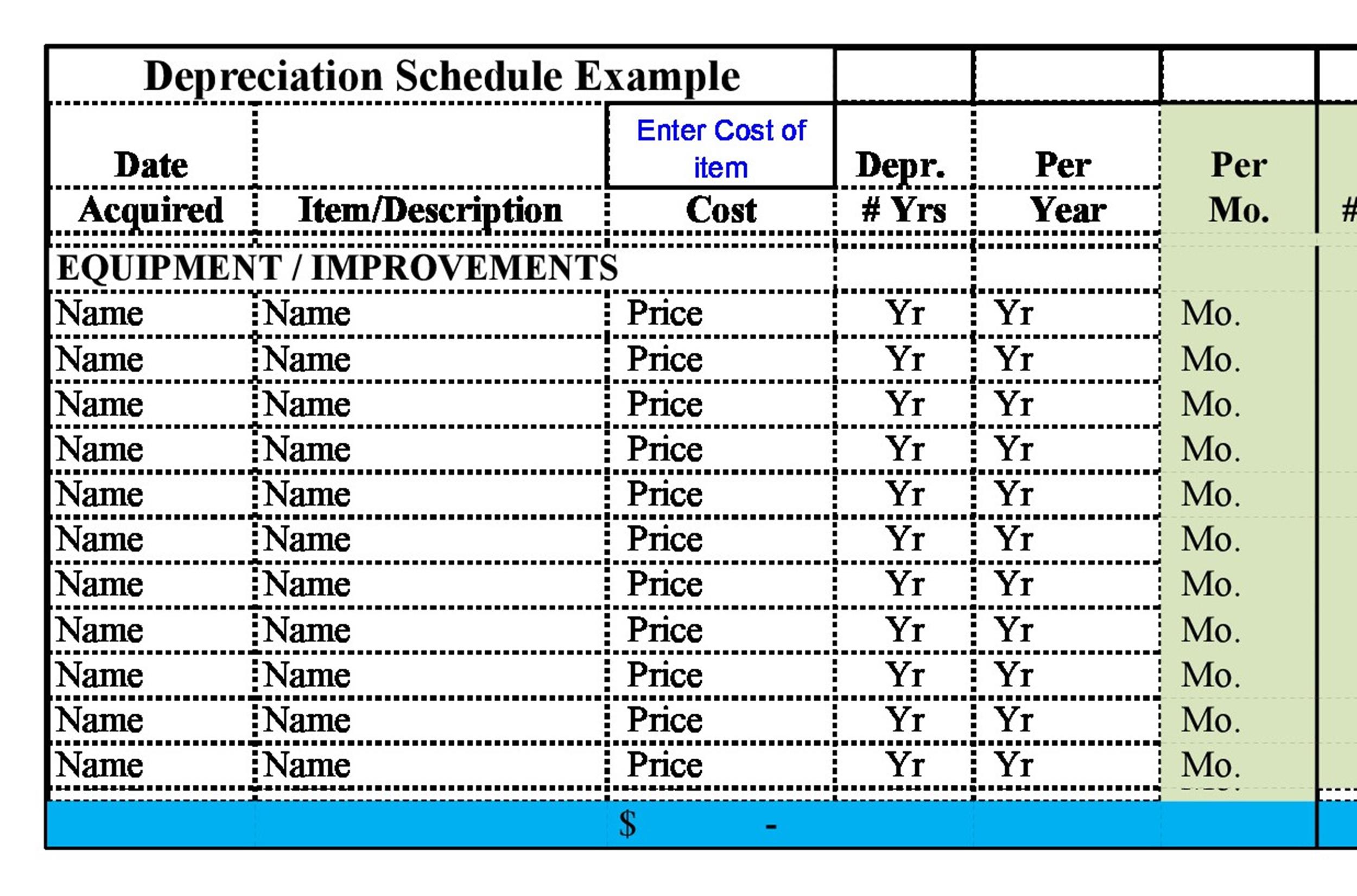

Excel Depreciation Template - Web syd (cost, salvage, life, per) for an asset with an initial cost of $20,000, a useful life of 5 years, and a salvage value of $4,000, the formula for the 2nd year should be as the following: Many deprecation form templates are available for use; How to calculate the double declining balance Here is a preview of the template: Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: However, this article will discuss the top 10 with links and pictures. These eight depreciation methods are discussed in two sections, each with an. Straight line depreciation straight line depreciation is the most basic type of depreciation. Web download depreciation calculator excel template. Depreciation value period 1 = 10,000 * 0.206 = 2,060.00. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: Web this double declining balance depreciation template will help you find depreciation expense using one of the. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: Web this accumulated depreciation calculator will help you compute the period accumulated depreciation, given the purchase price, useful life, and salvage value of the equipment. Web to calculate depreciation, the ddb function uses. However, this article will discuss the top 10 with links and pictures. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. For the previous step, you can divide 2 (not 1.5) by the expected year for the double declining balance method. Ddb uses. Web then use the market value to subtract the value from the previous year to get the depreciation value. Ddb uses the following formula to calculate depreciation for a period: Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. Web download depreciation calculator excel. Straight line depreciation straight line depreciation is the most basic type of depreciation. Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Here is what the accumulated depreciation calculator looks like: You can change factor to another value to influence the. Web this accumulated depreciation calculator will help. =syd (20000,4000,5,2) click here to learn more about the syd function. Here is a preview of the template: These eight depreciation methods are discussed in two sections, each with an. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated, using: Web this double. Enter your name and email in the form below and download the free template now! For the previous step, you can divide 2 (not 1.5) by the expected year for the double declining balance method. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting. This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation methods. Web download the free template. Here is a preview of the template: Enter your name and email in the form below and download the free template. Web download a fixed asset tracking template with depreciation schedule for excel | google. Enter your name and email in the form below and download the free template now! Many deprecation form templates are available for use; Depreciation value period 1 = 10,000 * 0.206 = 2,060.00. Web it uses a fixed rate to calculate the depreciation values. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple. Web then use the market value to subtract the value from the previous year to get the depreciation value. Depreciation value period 1 = 10,000 * 0.206 = 2,060.00. Many deprecation form templates are available for use; Web it uses a fixed rate to calculate the depreciation values. For the previous step, you can divide 2 (not 1.5) by the. Web to calculate depreciation, the ddb function uses the following formula: Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Enter your name and email in the form below and download the free template now! How to calculate the double declining balance Web this accumulated depreciation calculator will help you compute the period accumulated depreciation, given the purchase price, useful life, and salvage value of the equipment. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. Simply enter the asset details like the initial value, salvage value, useful life, and its productive capacity on the top section, and below you. Web this double declining balance depreciation template will help you find depreciation expense using one of the most common depreciation methods. Depreciation value period 1 = 10,000 * 0.206 = 2,060.00. Web depreciation is highest in the first period and decreases in successive periods. The different depreciation methods, and the associated excel functions, are discussed below. Web download a fixed asset tracking template with depreciation schedule for excel | google sheets. These formulas can help you quickly and accurately calculate the value of your assets over time, saving your business time and money. Web create infographics that show what categories are included in your budget and the types of factors that incorporate each category. You can change factor to another value to influence the. For the previous step, you can divide 2 (not 1.5) by the expected year for the double declining balance method. However, this article will discuss the top 10 with links and pictures. Web for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Web in this excel template, i used three most common depreciation methods, those are :How to prepare depreciation schedule in excel YouTube

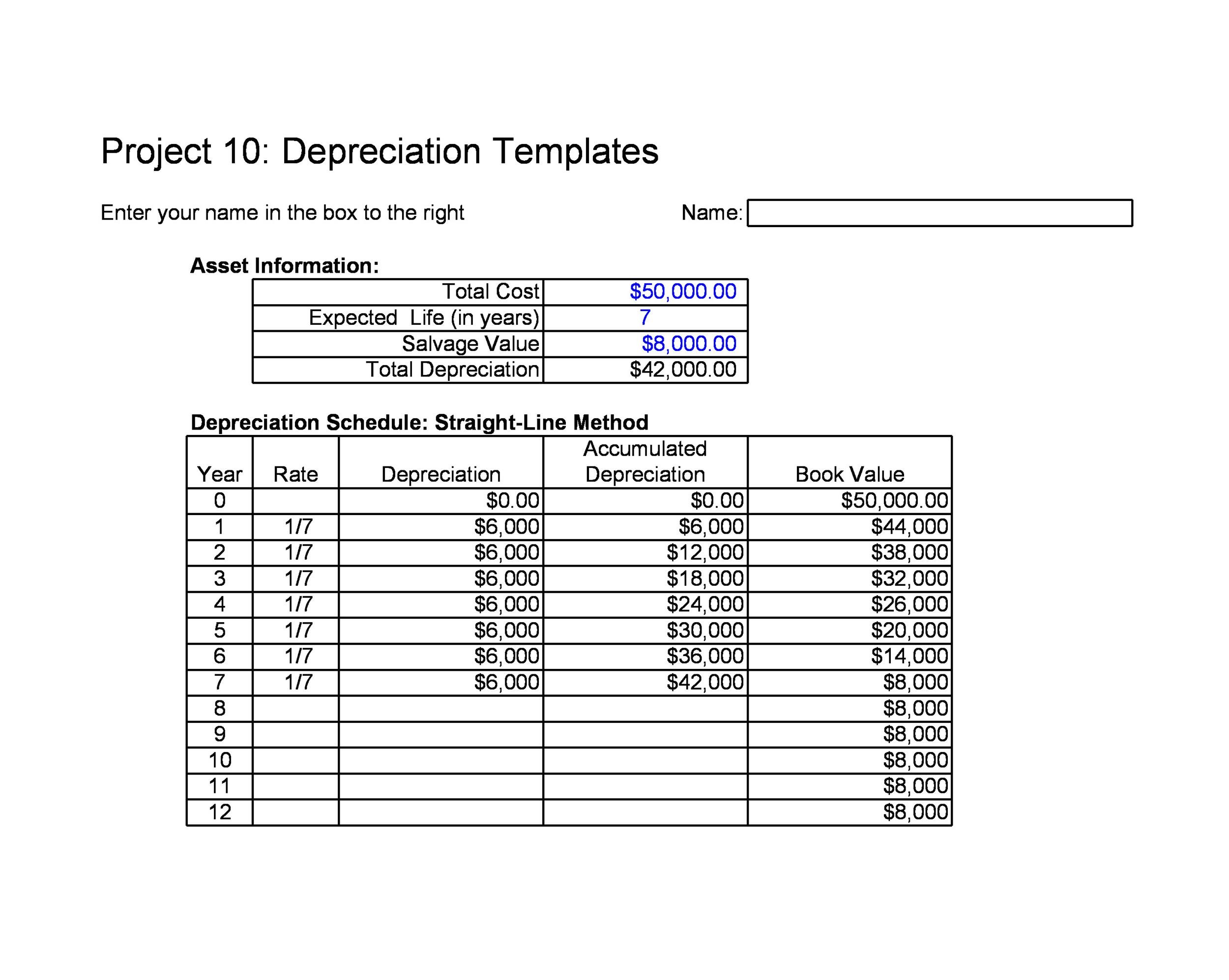

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Schedule Template Excel Free Printable Templates

13+ Depreciation Schedule Templates Free Word Excel Templates

Depreciation Excel Template Database

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Straight Line Depreciation Schedule Excel Template For Your Needs

7 Excel Depreciation Template Excel Templates

Depreciation Calculator Excel Templates

Straight Line Depreciation Schedule Excel Template For Your Needs

Related Post: