Ein Name Change Letter Template

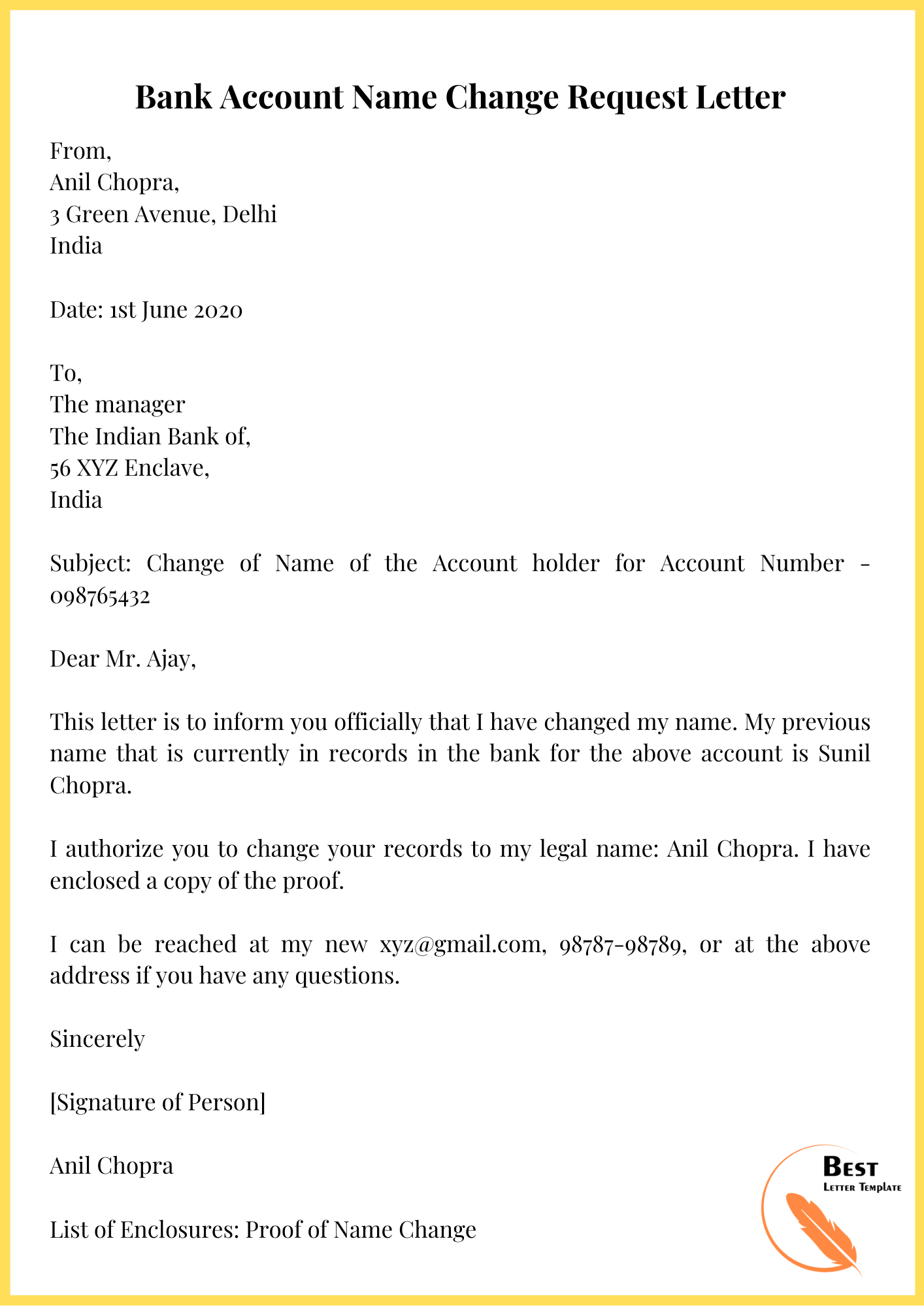

Ein Name Change Letter Template - Web the forms necessary to file the certificate of amendment are available at the secretary of state website, along with the instructions you must follow to fill them out. (i) the ein number for the business, (ii) the old business name, and. You will be required to obtain. Web the administrator, personal representative, or executor changes his/her name or address. Below is a sample letter that you can use as a template: Web the short answer to the question, “do i need a new ein if i change my name?” is, no. Begin by addressing the letter to the appropriate irs office. How to change name associated with ein. Choose this template start by clicking on fill out the template 2. Web switching a business name with the tax can be done in one of two ways. How to change name associated with ein. The specific action required may vary depending on the type. Choose this template start by clicking on fill out the template 2. You can find the mailing address on the irs website or. Web the forms necessary to file the certificate of amendment are available at the secretary of state website, along with. You will be required to obtain. Web switching a business name with the tax can be done in one of two ways. Below is a sample letter that you can use as a template: Web the main components of a sample letter to the irs for business name change include the current business name, the new business name, the taxpayer. How to change name associated with ein. Web business owners and other authorized individuals can submit a name change for their business. Web the short answer to the question, “do i need a new ein if i change my name?” is, no. Below is a sample letter that you can use as a template: Legal name of entity (or individual). Web switching a business name with the tax can be done in one of two ways. The specific action required may vary depending on the type. Below is a sample letter that you can use as a template: Web a name change can have an impact on your taxes and delay your refund. Web business owners and other authorized individuals. Trade name of business (if different from name on line 1). Web a name change can have an impact on your taxes and delay your refund. All the names on a taxpayer's tax return must match social security administration. Web business owners and other authorized individuals can submit a name change for their business. You can find the mailing address. Web you change the name of your business. All the names on a taxpayer's tax return must match social security administration. You can find the mailing address on the irs website or. Below is a sample letter that you can use as a template: Web the main components of a sample letter to the irs for business name change include. (i) the ein number for the business, (ii) the old business name, and. All the names on a taxpayer's tax return must match social security administration. You will be required to obtain. Web business owners and other authorized individuals can submit a name change for their business. Web an authorized person from your company must sign the letter. Web up to $40 cash back how to fill out an ein name change letter: Web an authorized person from your company must sign the letter. Trade name of business (if different from name on line 1). (i) the ein number for the business, (ii) the old business name, and. How to change name associated with ein. Legal name of entity (or individual) for whom the ein is being requested. You can find the mailing address on the irs website or. The specific action required may vary depending on the type. Below is a sample letter that you can use as a template: Web an authorized person from your company must sign the letter. The specific action required may vary depending on the type. You will be required to obtain. Web the main components of a sample letter to the irs for business name change include the current business name, the new business name, the taxpayer identification number. Web the forms necessary to file the certificate of amendment are available at the secretary of. Web switching a business name with the tax can be done in one of two ways. If you change the name of your partnership or corporation, you must include a copy of the. Web up to $40 cash back how to fill out an ein name change letter: Web an authorized person from your company must sign the letter. Begin by addressing the letter to the appropriate irs office. Web you change the name of your business. You will be required to obtain. All the names on a taxpayer's tax return must match social security administration. Web the main components of a sample letter to the irs for business name change include the current business name, the new business name, the taxpayer identification number. But be aware that some circumstances do warrant a new ein, though a name change is not. Web the administrator, personal representative, or executor changes his/her name or address. Corporations plus llcs can check the name change box while filing hers annual tax return over the. You can find the mailing address on the irs website or. Web while the irs does not require a specific form for this purpose, it is recommended to do so in writing. The specific action required may vary depending on the type. Complete the document answer a few questions and your document is created. You will be required to obtain a new ein if the following statements are true: Below is a sample letter that you can use as a template: Web a name change can have an impact on your taxes and delay your refund. You change your location and/or add other locations.10 Name Change Letter Template SampleTemplatess SampleTemplatess

Irs Name Change Letter Sample Free 8 Sample Business Name Change

Name Change Letter charlotte clergy coalition

Irs Name Change Letter Sample

Business Name Change Irs Sample Letter Irs Ein Name Change Form

Irs Name Change Letter Sample Can An Ein Number Be Cancelled Or

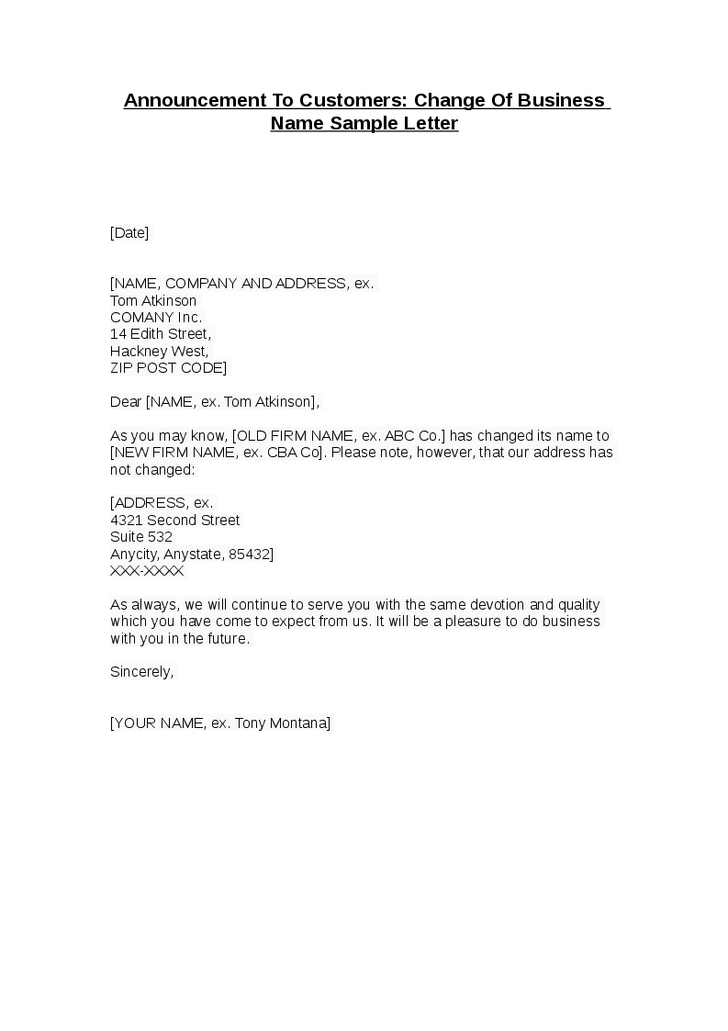

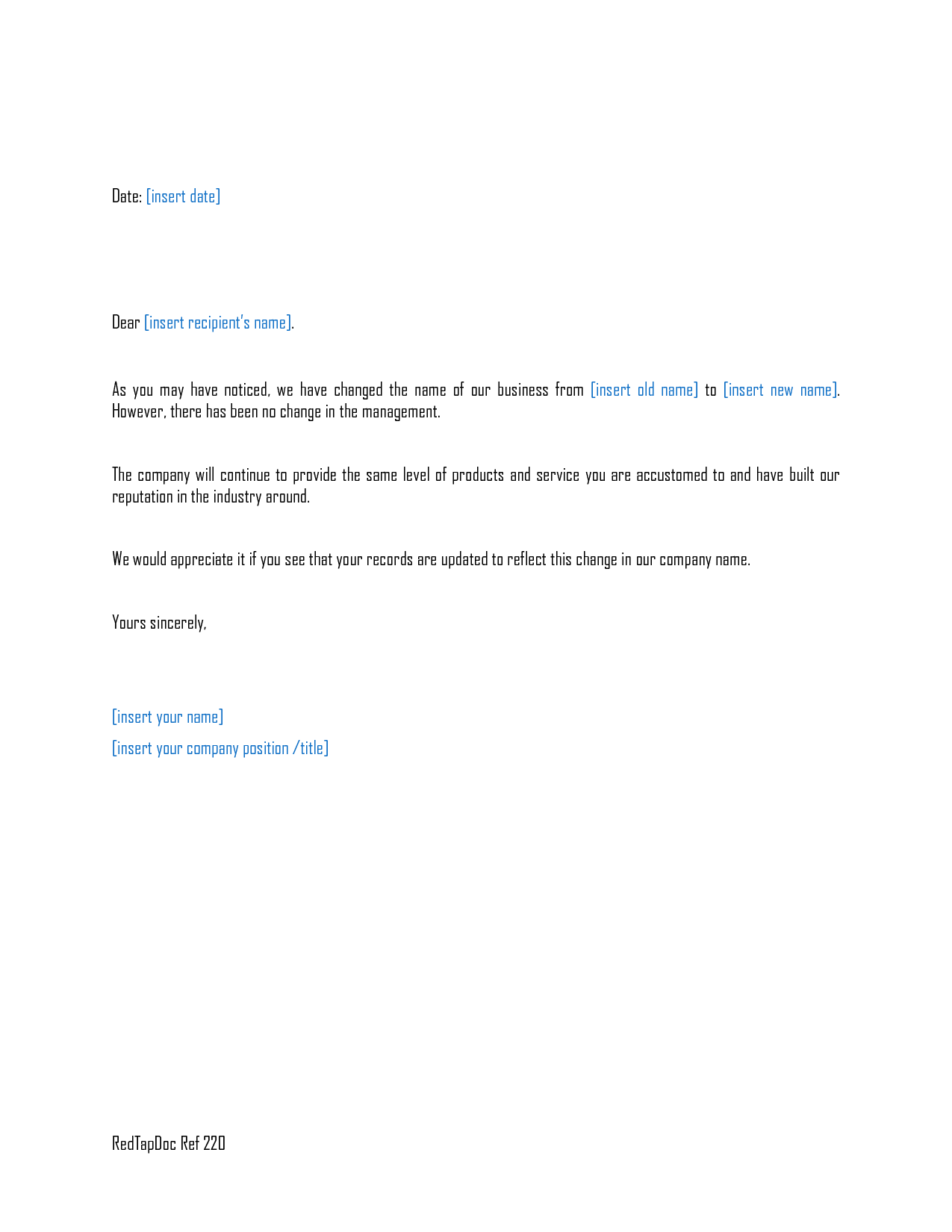

Announcement Of Business Name Change Templates at

Name Change Letter Free Printable Documents

Sample Name Change Request Letter Template

Irs Name Change Letter Sample / Ein Assignment Letter Here is an

Related Post: