Depreciation Excel Template

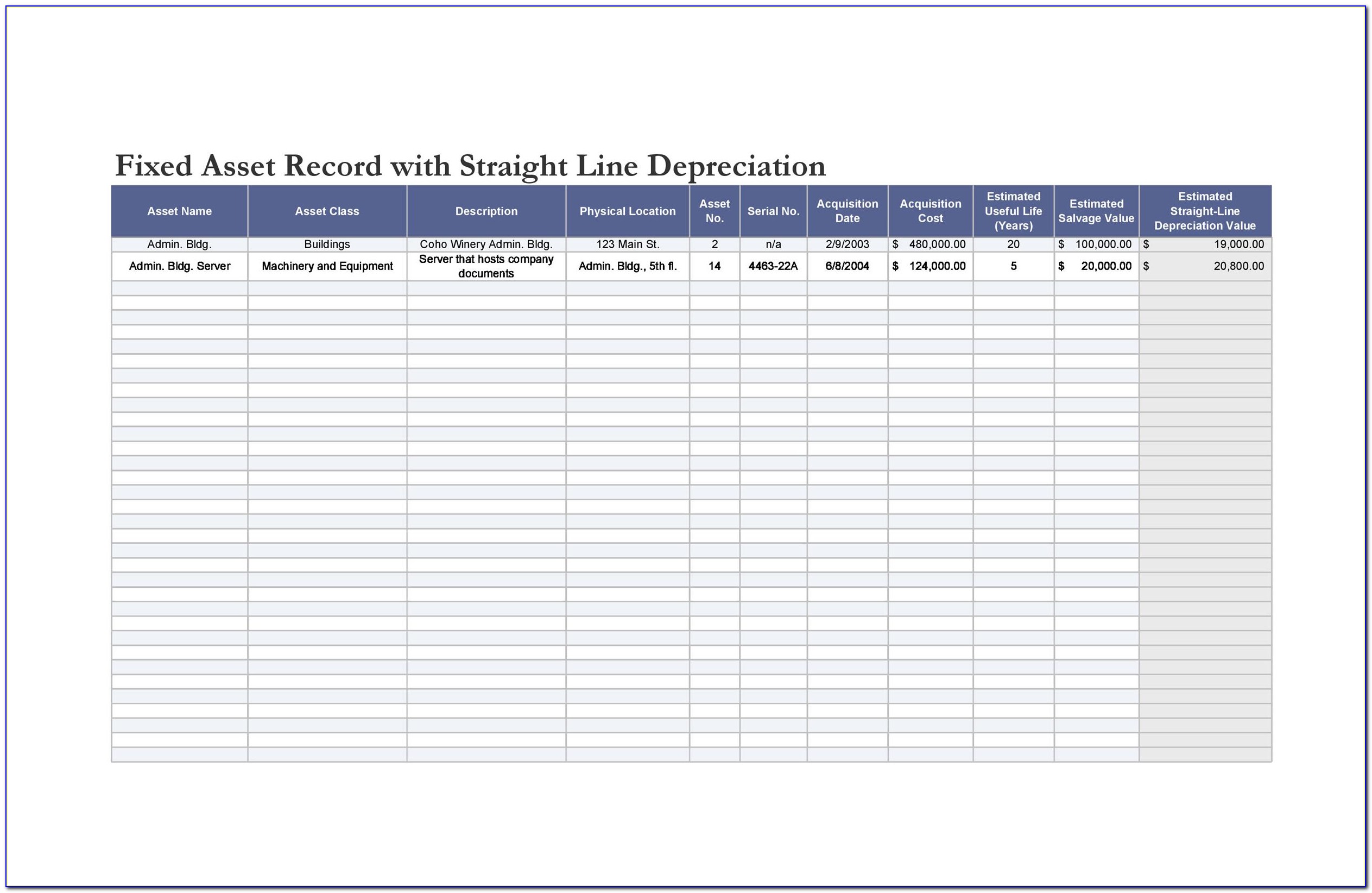

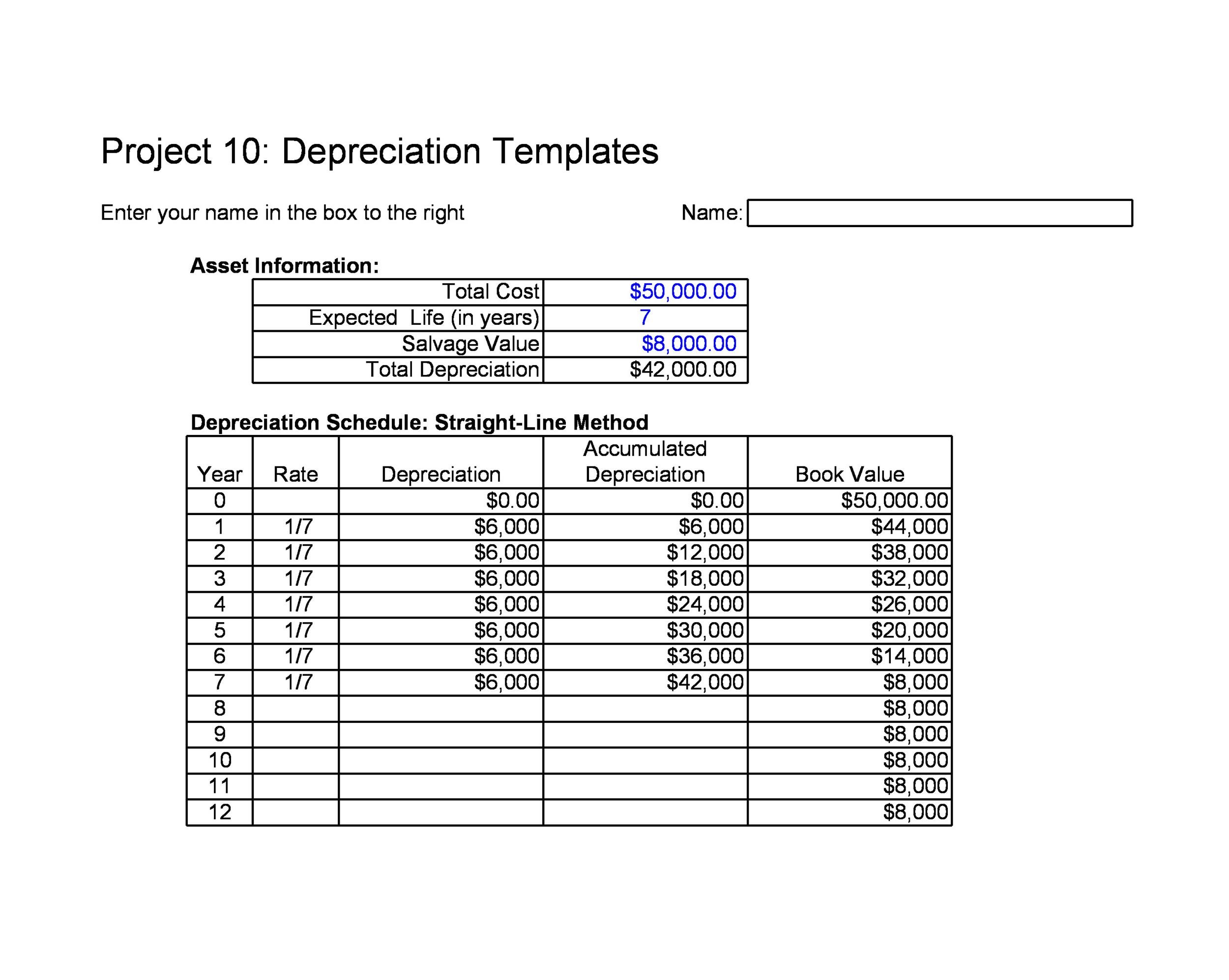

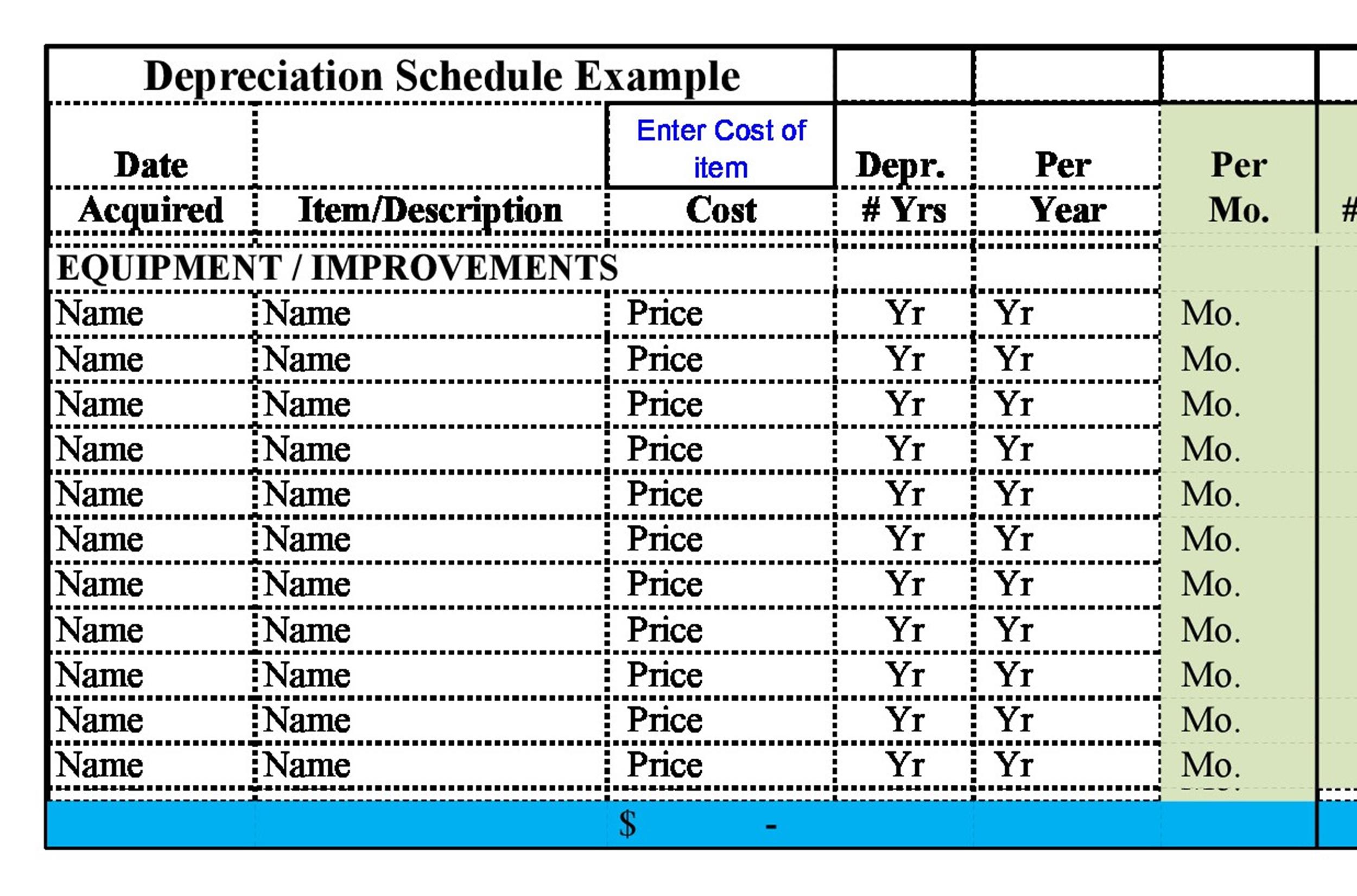

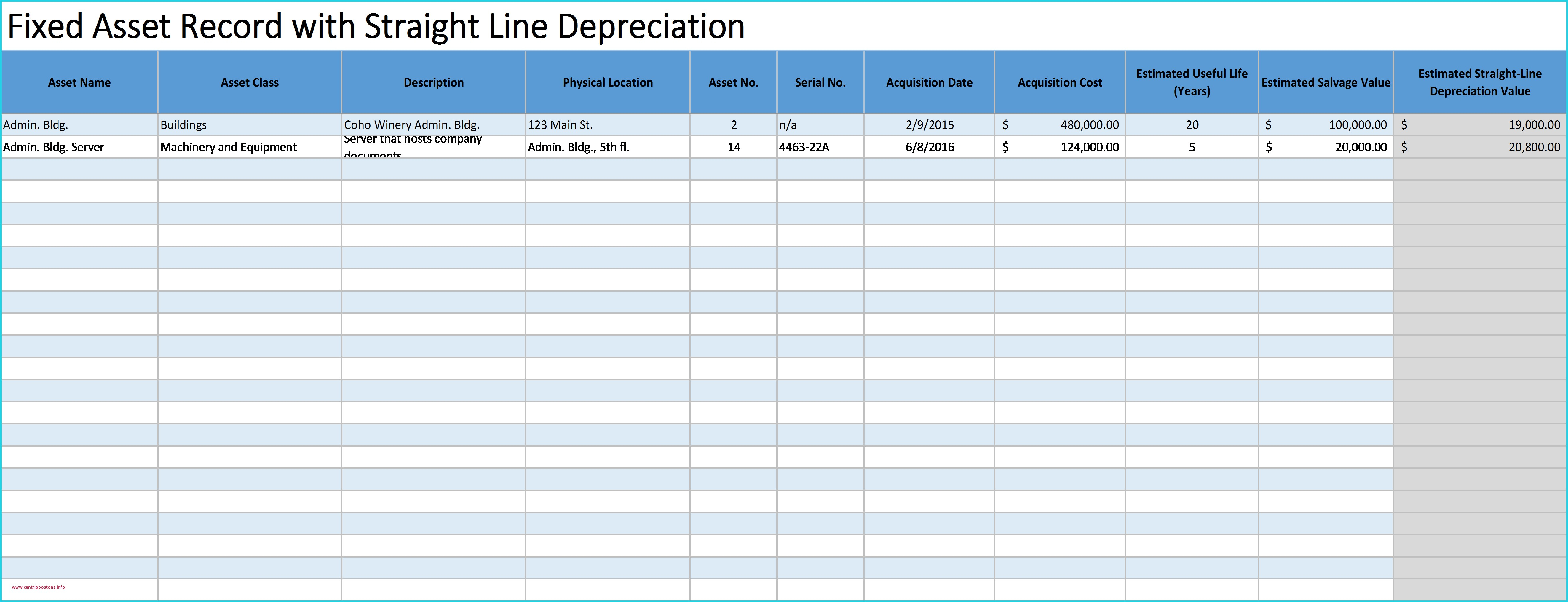

Depreciation Excel Template - Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Ad easily manage employee expenses. Cost value = purchase price of the asset + additional initial cost incurred to. Web enter your name and email in the form below and download the free template now! Web how to calculate depreciation in excel by ilker | dec 27, 2021 | excel tips & tricks excel supports various methods and formulas to calculate depreciation. Fully integrated w/ employees, invoicing, project & more. Web download depreciation calculator excel template. The schedule will list the different classes of assets, the type of depreciation method they use, and the. Web double declining balance depreciation template. Web a depreciation schedule helps to calculate the differences. Cost value = purchase price of the asset + additional initial cost incurred to. This double declining balance depreciation template will help you find depreciation expense using one of the most. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web enter your name and email in the form below and download. Share the workload between employees, managers & accountants and save time. Ours excel spreadsheet will allow it to track the calculate depreciation required up to 25 assets using the straight. Web up to 50% cash back for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time. Ad no matter your. Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. This double declining balance depreciation template will help you find depreciation expense using one of the most. This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used. Go to “file” and then “save as.” select pdf format as output and save. Easily find the depreciation software you're looking for w/ our comparison grid. This double declining balance depreciation template will help you find depreciation expense using one of the most. Web open the template using the respective software (for example, microsoft word or excel). Web depreciation is. Web this depreciation schedule template provides a simple method for calculating total yearly depreciation for multiple assets. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated,. Web depreciation is a calculation that reflects the decline in value of an asset over time due. It’s like how using a laptop too much over time makes it less. Web depreciation is a calculation that reflects the decline in value of an asset over time due to wear and tear, age, or obsolescence. Web up to 50% cash back for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive. Ad no matter your mission, get the right depreciation software to accomplish it. This double declining balance depreciation template will help you find depreciation expense using one of the most. Ad easily manage employee expenses. Ours excel spreadsheet will allow it to track the calculate depreciation required up to 25 assets using the straight. In the case of intangible assets,. Web how to calculate depreciation in excel by ilker | dec 27, 2021 | excel tips & tricks excel supports various methods and formulas to calculate depreciation. Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis (cost) and d j is the depreciation.. Web open the template using the respective software (for example, microsoft word or excel). Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. Ad no matter your mission, get the right depreciation software to accomplish it. The schedule will list the different classes of. It’s like how using a laptop too much over time makes it less. Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. Get powerful, streamlined insights into your company’s finances. Web to calculate the depreciation using the sum of the years' digits (syd) method,. Web open the template using the respective software (for example, microsoft word or excel). Web a depreciation schedule helps to calculate the differences. The different depreciation methods, and the. Fully integrated w/ employees, invoicing, project & more. The schedule will list the different classes of assets, the type of depreciation method they use, and the. Ad no matter your mission, get the right depreciation software to accomplish it. Easily find the depreciation software you're looking for w/ our comparison grid. Web depreciation is a calculation that reflects the decline in value of an asset over time due to wear and tear, age, or obsolescence. In the case of intangible assets, depreciation is. Ad easily manage employee expenses. Web to calculate depreciation and amortization in excel, you can use various formulas such as the sum function, the sumif function, and the vlookup function. Share the workload between employees, managers & accountants and save time. Cost value = purchase price of the asset + additional initial cost incurred to. Web to calculate the depreciation using the sum of the years' digits (syd) method, excel calculates a fraction by which the fixed asset should be depreciated,. Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis (cost) and d j is the depreciation. It’s like how using a laptop too much over time makes it less. Go to “file” and then “save as.” select pdf format as output and save. Web download depreciation calculator excel template. This double declining balance depreciation template will help you find depreciation expense using one of the most. Web up to 50% cash back for accounting and tax reasons, depreciation expense is calculated to write off the cost of purchasing expensive assets over time.7 Excel Depreciation Template Excel Templates

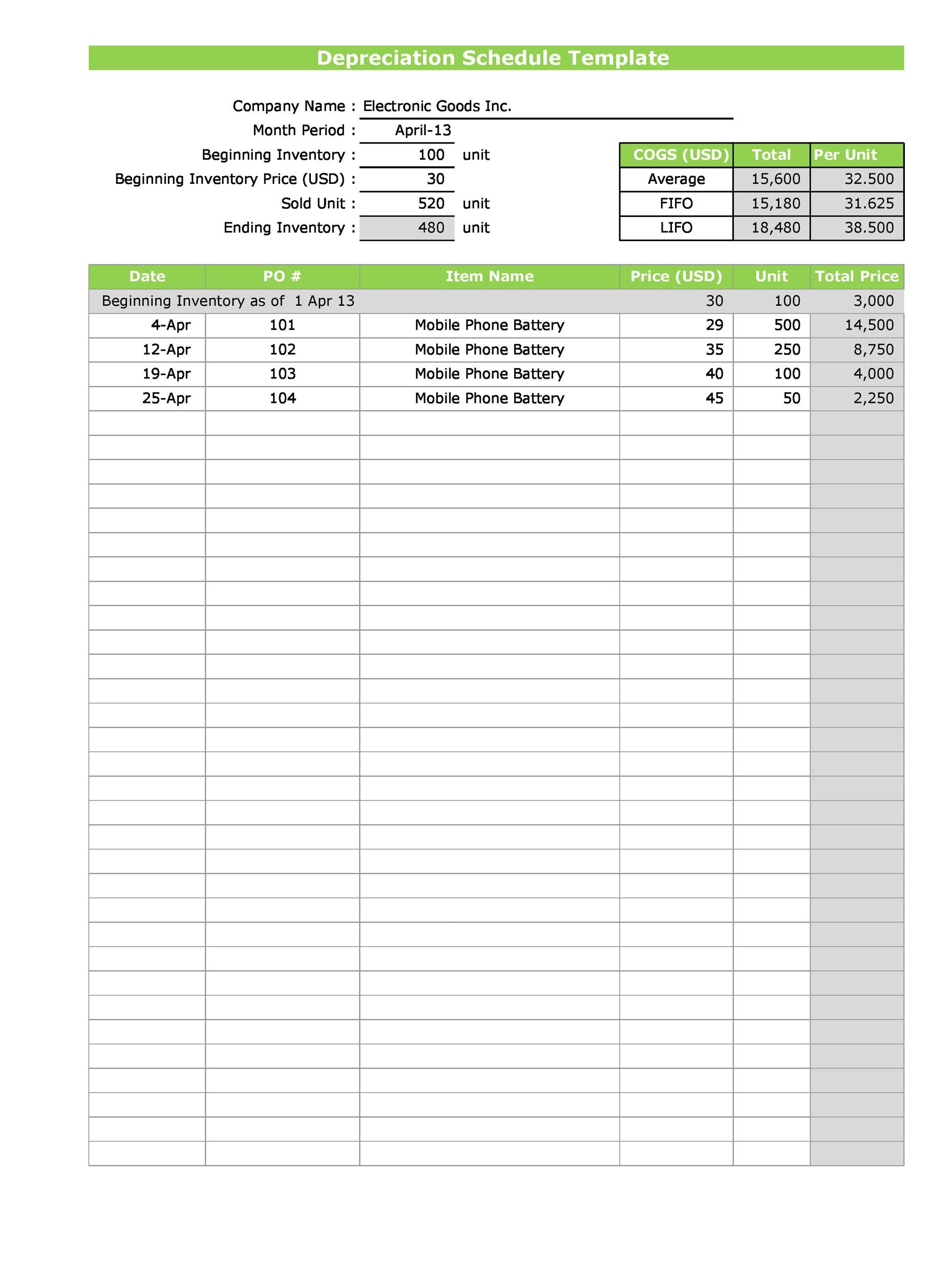

Depreciation Schedule Template Excel Free Printable Templates

Straight Line Depreciation Schedule Excel Template For Your Needs

Straight Line Depreciation Schedule Excel Template For Your Needs

Depreciation Calculator Excel Templates

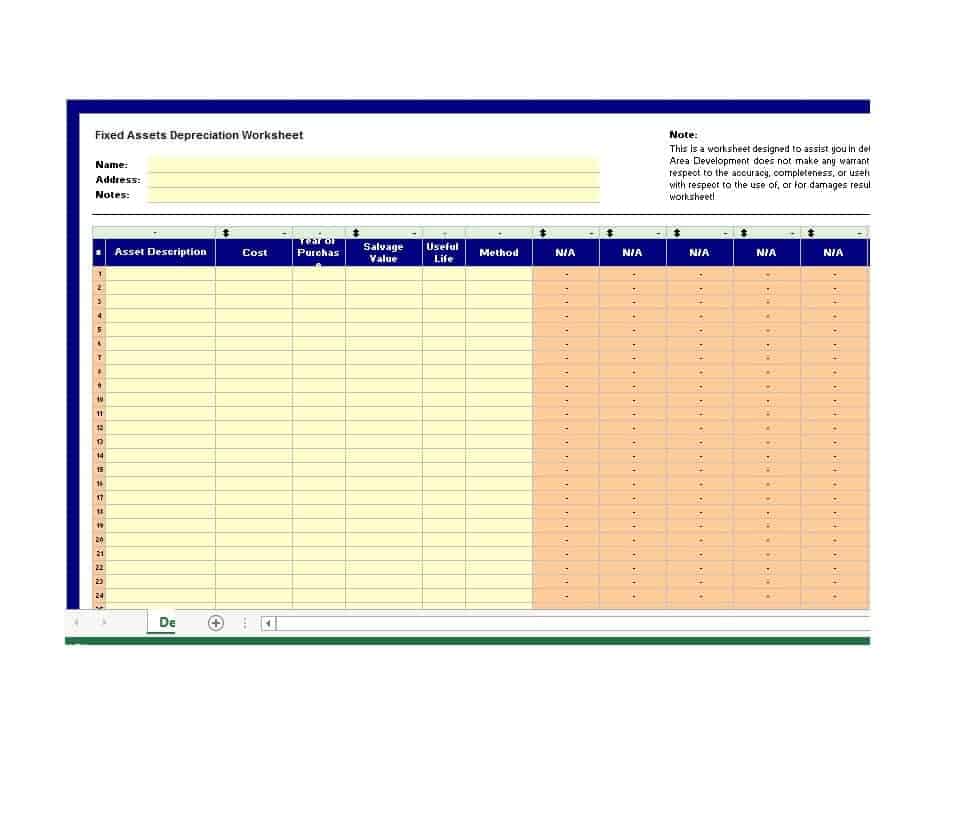

Fixed Asset Depreciation Excel Spreadsheet —

Depreciation Excel Template Database

Depreciation Schedule Template Excel Free For Your Needs

Depreciation Schedule Template Excel Free Printable Templates

9 Free Depreciation Schedule Templates in MS Word and MS Excel

Related Post: