Debt Payoff Spreadsheet Template

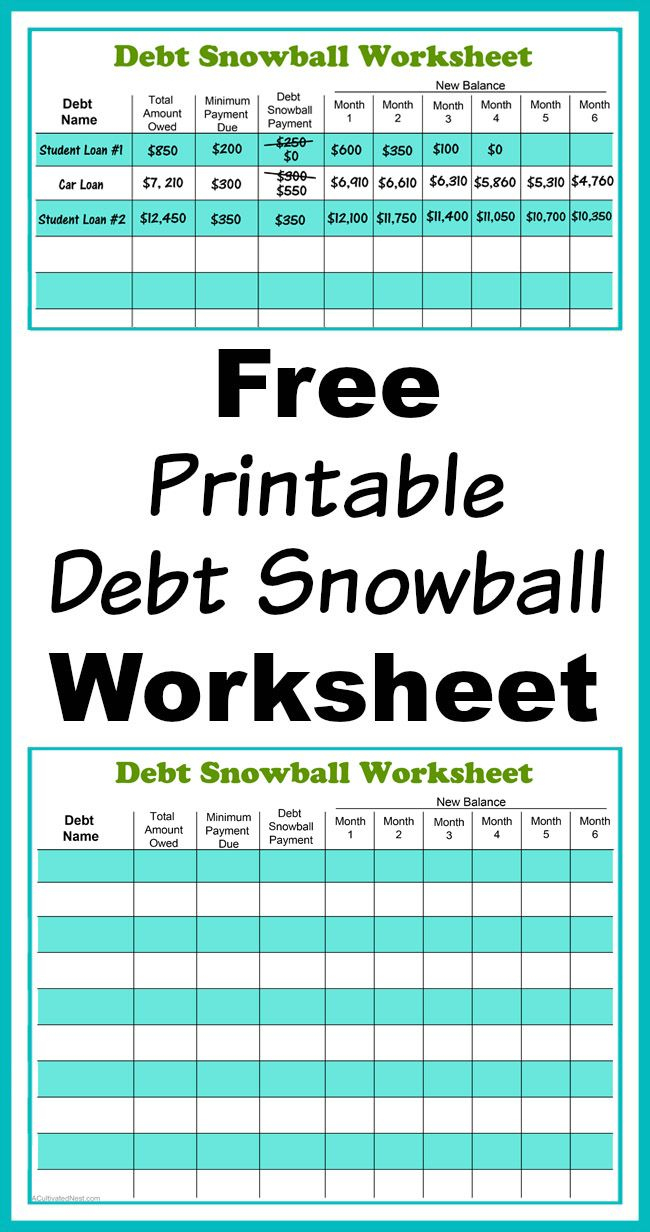

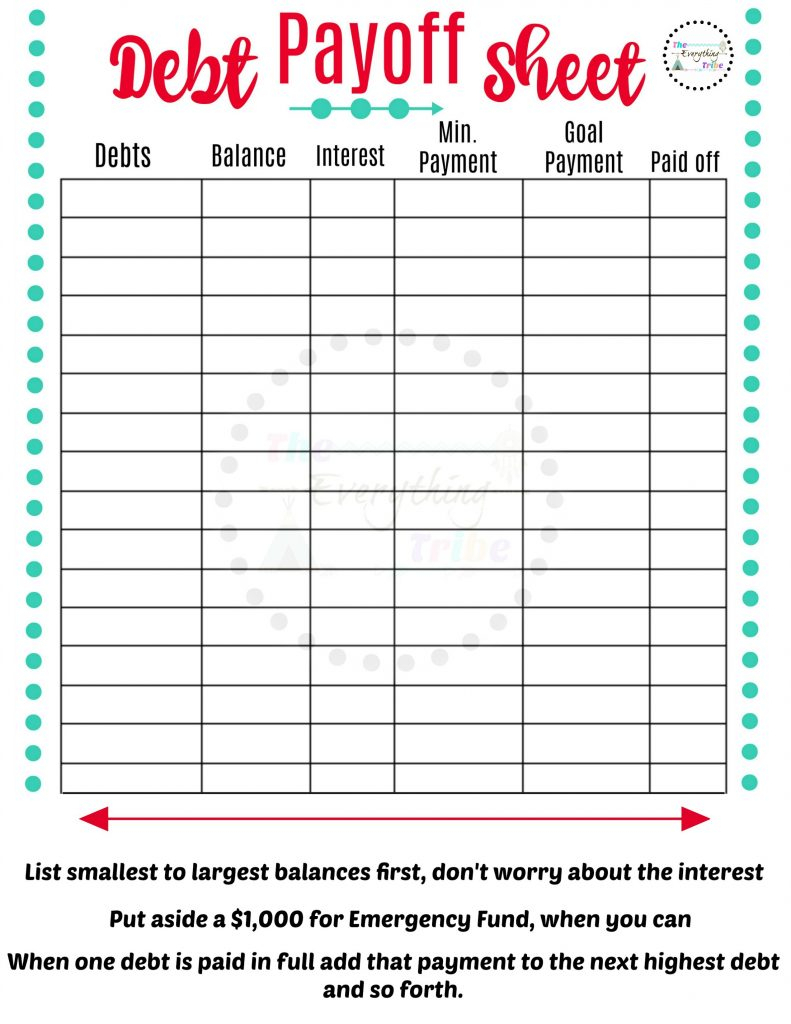

Debt Payoff Spreadsheet Template - Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. So here are some of the best free debt snowball spreadsheets for google sheets and excel. Excel 2010 or later ⤓ editable pdf license: Track your expenses, list it all in a spreadsheet, and compare the final tallies to your monthly cash inflow. You need to work out how much you can put towards this first debt while covering the minimum payments. Note that some of these help you evaluate the avalanche method as well. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Make minimum payments on all your debts except the smallest. Personal use (not for distribution or resale) description track multiple debts with a single worksheet. 100k+ visitors in the past month Fill in each section of the debt payoff printable. Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. Vertex 42 debt reduction snowball calculator and credit. Excel 2010 or later. Web best free debt snowball spreadsheet for excel to download in 2023 want total debt freedom? Web debt snowball illustration & free printable debt payoff worksheet pdf the debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. You can use these forms to list down all your debts. Web a debt snowball spreadsheet is a tool used in this popular method for paying off debt. Web download ⤓ excel (.xlsx) for: If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets. Templates include a household expense budget, holiday budget planner and event budget. Debt snowball spreadsheet from spreadsheet point for google sheets; Use snowball, avalanche, or whatever payoff strategy works best for you. You can use these forms to list down all your debts and add them to come up with the total. Web using a free template is an easy. Then you can plan out how much you’ll set aside per month for your debts. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. Fill in each section of the debt payoff printable. Track your expenses, list it all in a spreadsheet, and compare the final tallies. This is the tool that got me there. Web 1) open a blank page in google sheets or excel. Debt payoff template from medium for google sheets; Excel 2010 or later ⤓ editable pdf license: Web all you need to do is download the template and plug in a few numbers—the spreadsheet will do all the math. Debt payoff template from medium for google sheets; The avalanche method (paying the debt with the highest interest first) or the snowball method (paying the debt with the lowest balance first). The spreadsheet will do the calculations for you and help you track your progress each month, so you can see how far you’ve come and how much closer you.. Web debt avalanche tracker template the debt avalanche method of paying off your debt helps to accelerate your payoff because you are tackling debt with the highest interest first. The spreadsheet will do the calculations for you and help you track your progress each month, so you can see how far you’ve come and how much closer you. Web a. If you prefer to use a spreadsheet to track your debt payoff progress, you can grab my debt payoff toolkit here. Web using a free template is an easy way to get control of your debt. Gain control of your financial freedom with our credit card payoff calculator template at template.net. Web below are 10 debt snowball worksheets that you. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. 4) be sure to have columns for “payment amount” and “balance amount” for each debt. 100k+ visitors in the past month Excel 2010 or later ⤓ editable pdf license: Web a spreadsheet is one of the most helpful tools. Make minimum payments on all your debts except the smallest. Vertex 42 debt reduction snowball calculator and credit. Tailor it to your specific needs, track your payments, and set realistic payoff goals. The spreadsheet will do the calculations for you and help you track your progress each month, so you can see how far you’ve come and how much closer you. Pay as much as possible on your smallest debt. 2) list your debts across the top with your balance, minimum payment, and interest rates. Check it out here for a free download. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. Web 1) open a blank page in google sheets or excel. You can use these forms to list down all your debts and add them to come up with the total. Debt payoff template from medium for google sheets; To see this method in action, let’s assume that if you pay off a student loan with a minimum balance of $50 and your next smallest loan payment is $100. The avalanche method (paying the debt with the highest interest first) or the snowball method (paying the debt with the lowest balance first). Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. Web download ⤓ excel (.xlsx) for: Web track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. This process works, and you can see how effective it is on our printable guide. Collect all of your current outstanding debt that charges interest. 4) be sure to have columns for “payment amount” and “balance amount” for each debt. Debt snowball spreadsheet from spreadsheet point for google sheets;Accelerated Debt Payoff Spreadsheet ExcelTemplate

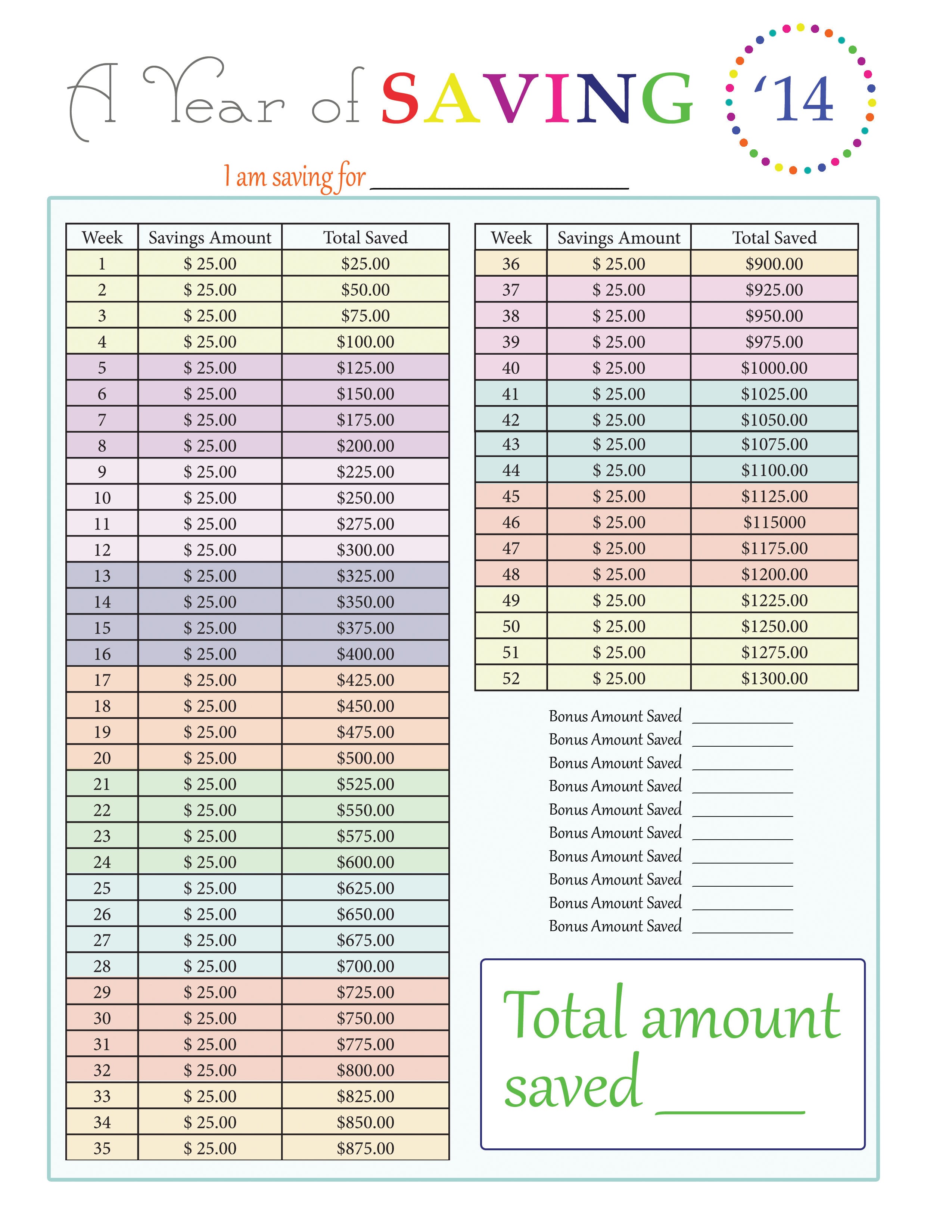

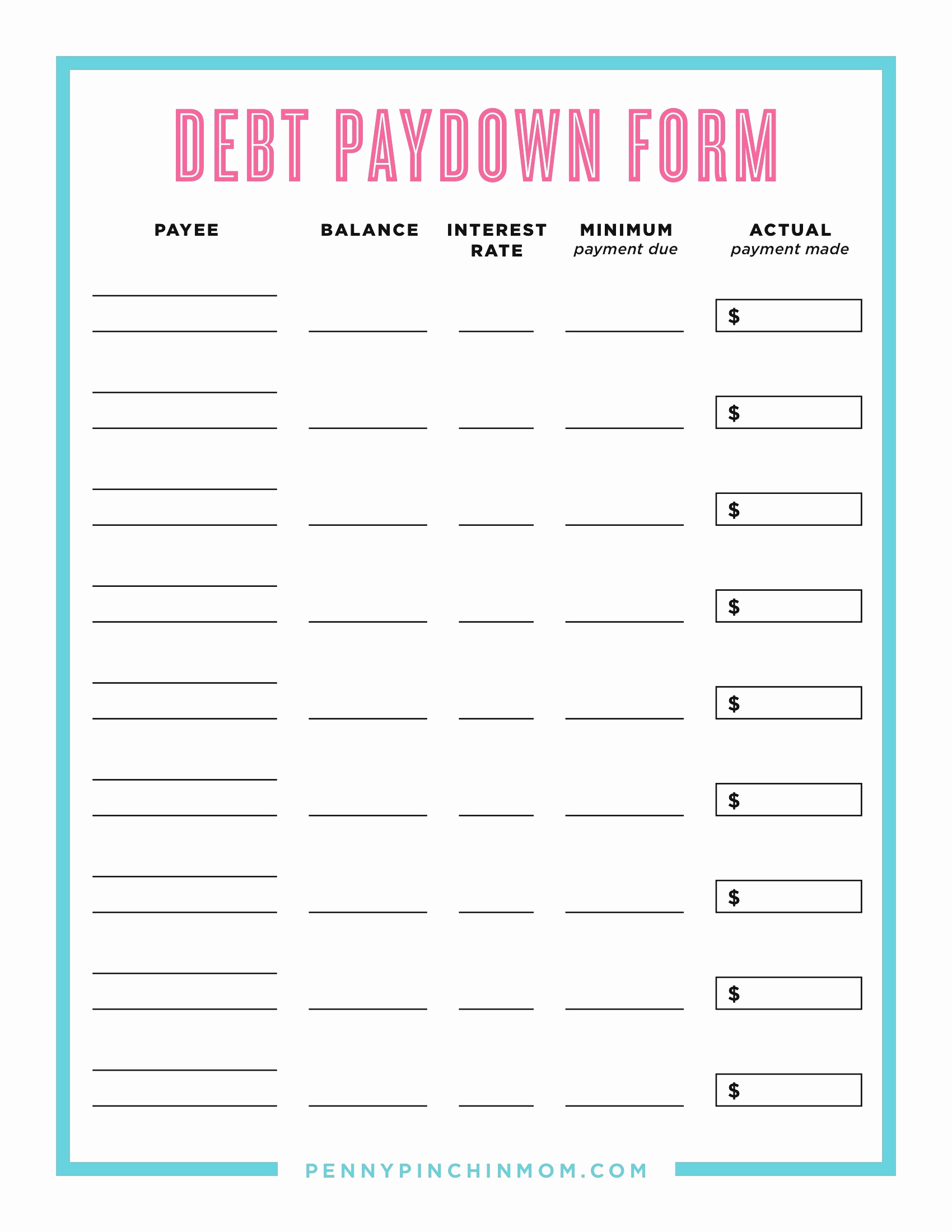

Free Printable Debt Payoff Worksheet —

Easy To Use Free Printable Debt Tracker To Help Get Out Of —

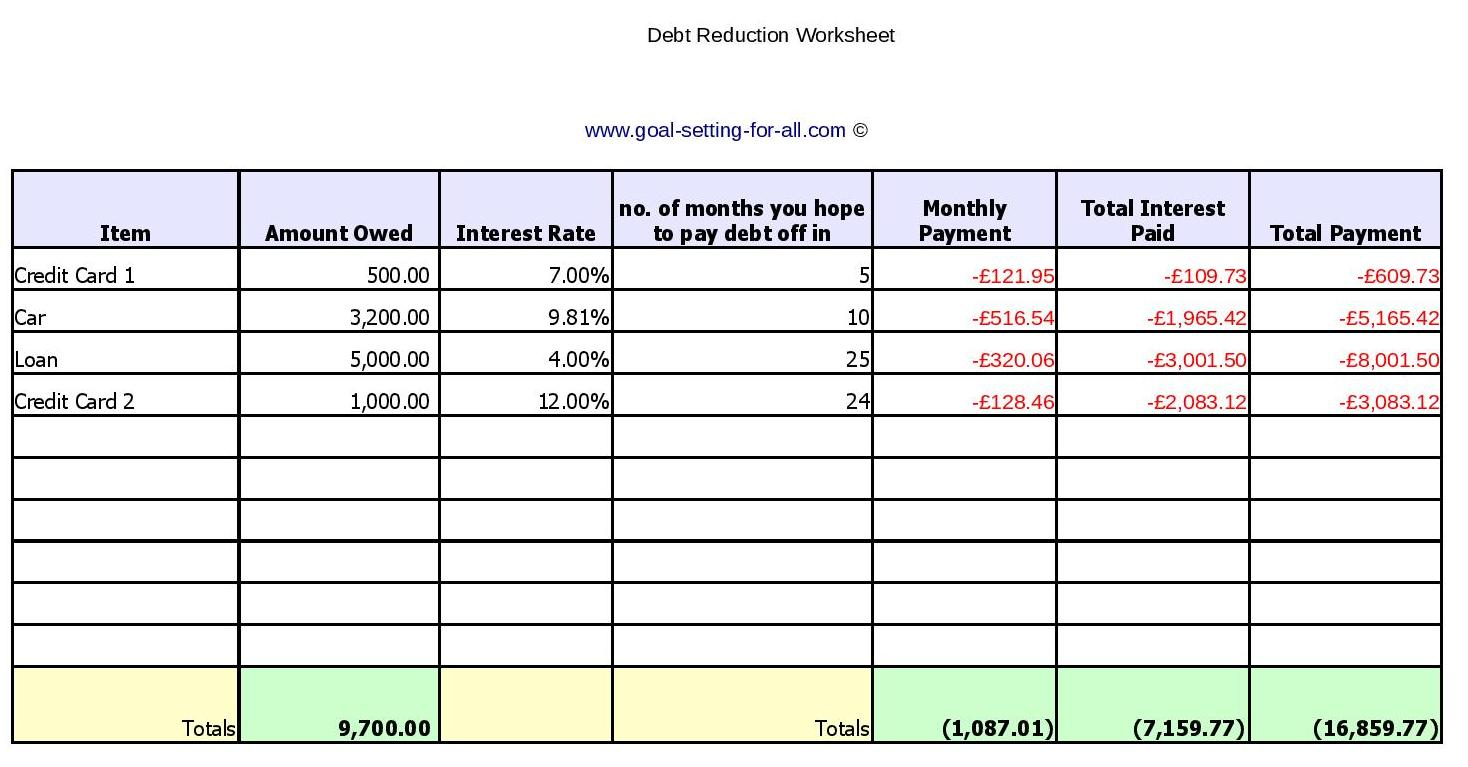

Debt Spreadsheet inside A Free Debt Reduction Worksheet That's Simple

Snowball Debt Payoff Spreadsheet ExcelTemplate

Free Printable Debt Payoff Worksheet Free Printable

Debt Payoff Tracker Debt tracker, Debt payoff, Debt

Debt Worksheet Decker Retirement Planning

Debt Payment Spreadsheet —

Credit Card Debt Payoff Spreadsheet Spreadsheet Softwar credit card

Related Post: