Debt Collection Lawsuit Response Template

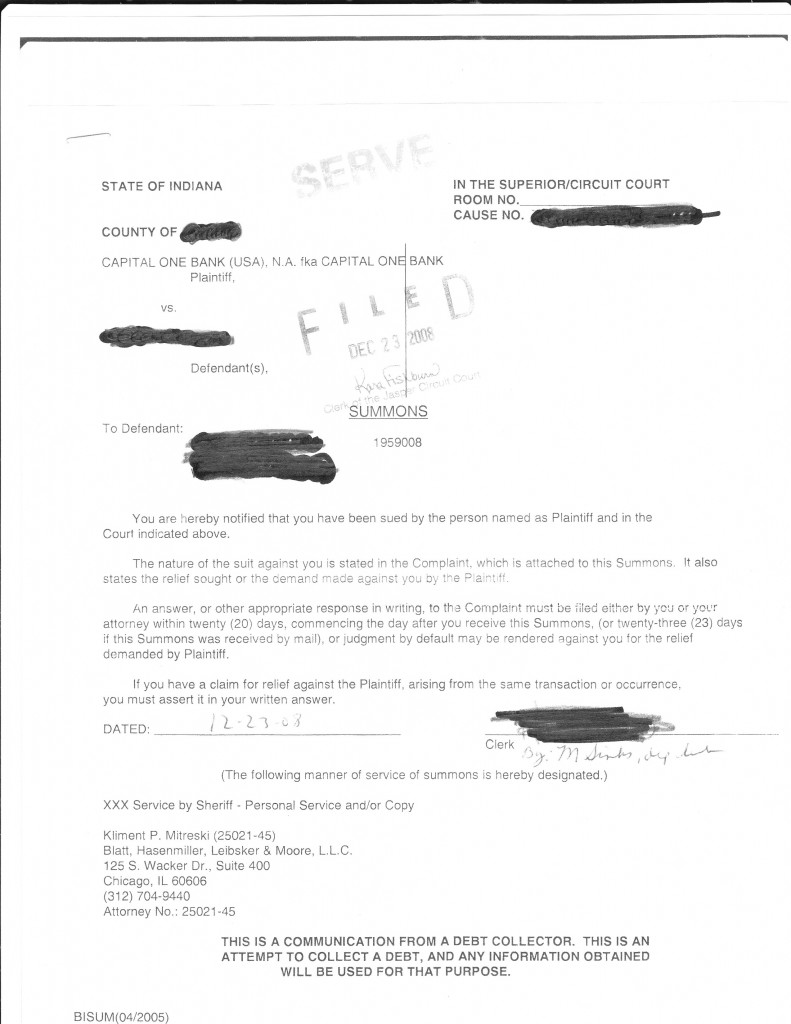

Debt Collection Lawsuit Response Template - Two answer forms are included below: Two answer forms are included below: A guide for washington residents who are sued by creditors or debt collectors. It includes instructions and forms. This pdf document explains your rights and. You should receive a validation letter that documents the amount owed, the original creditor,. In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate debt. Or if you want help filling. Web george simons | october 19, 2022 summary: Web debt collection model forms and samples. When contacted regarding a debt, you need to verify the debt. New hampshire statute of limitations. Not sure how to respond? Identifies the court in which it’s filed, names of the. Web form to respond to debt claim lawsuit. Here's a sample answer to a. How to respond to a debt collection lawsuit when most people who are served with a debt collection lawsuit first receive notice thereof, they are shocked,. In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate debt. Web this guide contains information to. Web how to answer a lawsuit for debt collection: Web what to do if you owe the debt answer the lawsuit. Web parts of an answer. Or if you want help filling. Two answer forms are included below: Answer form (pdf version, fillable if opened with adobe. Effective strategies for how to get back on track after a debt lawsuit. How to respond to a debt collection lawsuit when most people who are served with a debt collection lawsuit first receive notice thereof, they are shocked,. Send the stamped copy certified mail to the plaintiff. An answer is. Are you being sued by a bill collector for an old debt? Advice on how to answer a summons for debt collection. Answer the complaint step 2: Use this when you want to fight a lawsuit for debt collection. In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate. Web last review and update: Editable versions of the forms are provided on the. Web if you are being sued over a consumer debt or a loan (a credit card or medical debt, for example) and you have decided to file an answer, use this form: Web form to respond to debt claim lawsuit. An answer is designed to help. When contacted regarding a debt, you need to verify the debt. Respond to the lawsuit by the date outlined in the summons, even if you don't think you can afford to. Web what to do if you owe the debt answer the lawsuit. A guide for washington residents who are sued by creditors or debt collectors. This pdf document explains. In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate debt. It discusses several options and provides. Editable versions of the forms are provided on the. Not sure how to respond? Use this when you want to fight a lawsuit for debt collection. The program works by asking you. Web how to answer a lawsuit for debt collection: It includes instructions and forms. An answer is designed to help you in responding to a debt collection claim. In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate debt. This pdf document explains your rights and. Web parts of an answer. Identifies the court in which it’s filed, names of the. Ask for a stamped copy of the answer from the clerk of court. Advice on how to answer a summons for debt collection. Web how to answer a lawsuit for debt collection: Answer form (pdf version, fillable if opened with adobe. Use this when you want to fight a lawsuit for debt collection. Web parts of an answer. Or if you want help filling. Effective strategies for how to. Web advice on how to answer a summons for debt collection. Are you being sued by a bill collector for an old debt? Web this guide contains information to help you respond to a breach of contract lawsuit, such as a lawsuit over a credit card or auto loan debt. New hampshire statute of limitations. Effective strategies for how to get back on track after a debt lawsuit. Our answer documents follow the typical legal format, which includes the following: Two answer forms are included below: It discusses several options and provides. Respond to the lawsuit by the date outlined in the summons, even if you don't think you can afford to. An answer is designed to help you in responding to a debt collection claim. Raise your defenses step 3: In order for a debt to appear on your credit report, it needs to have correct information and be a legitimate debt. Web tips on you can to file an fdcpa lawsuit against a debt collection agency. Two answer forms are included below:Free Debt Collections Letter Template Sample PDF Word eForms

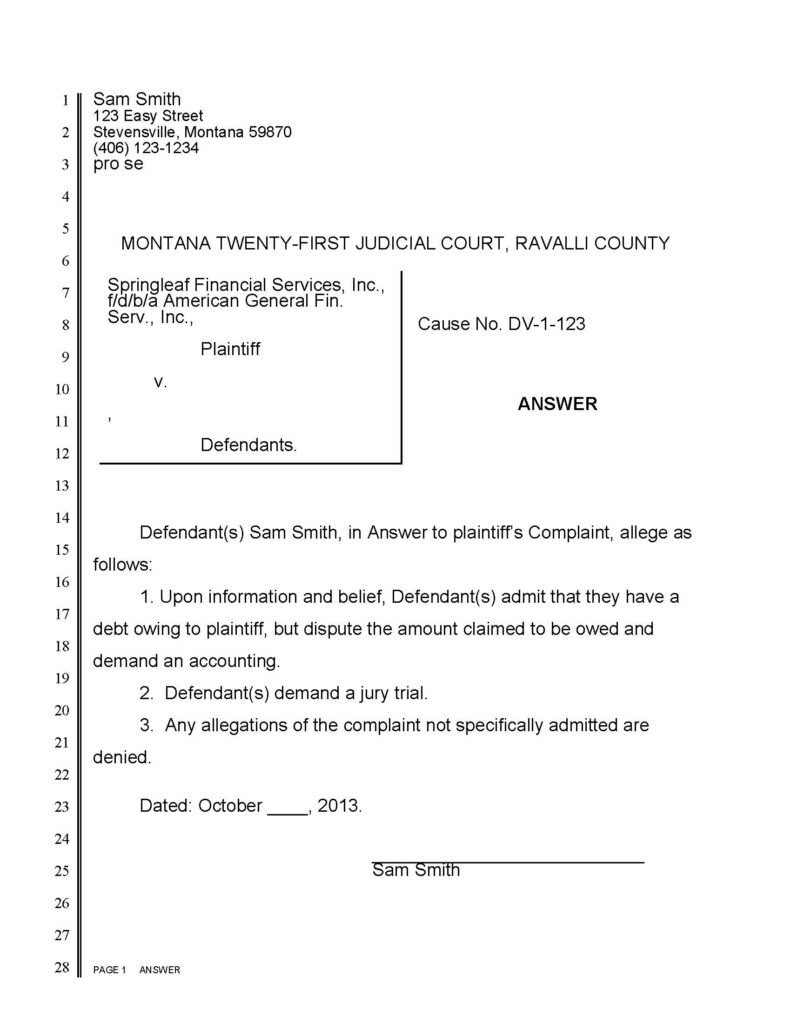

How To Draft An Answer To A Collection Lawsuit

Credit Card Lawsuit Answer Template Luxury How to Answer A Debt

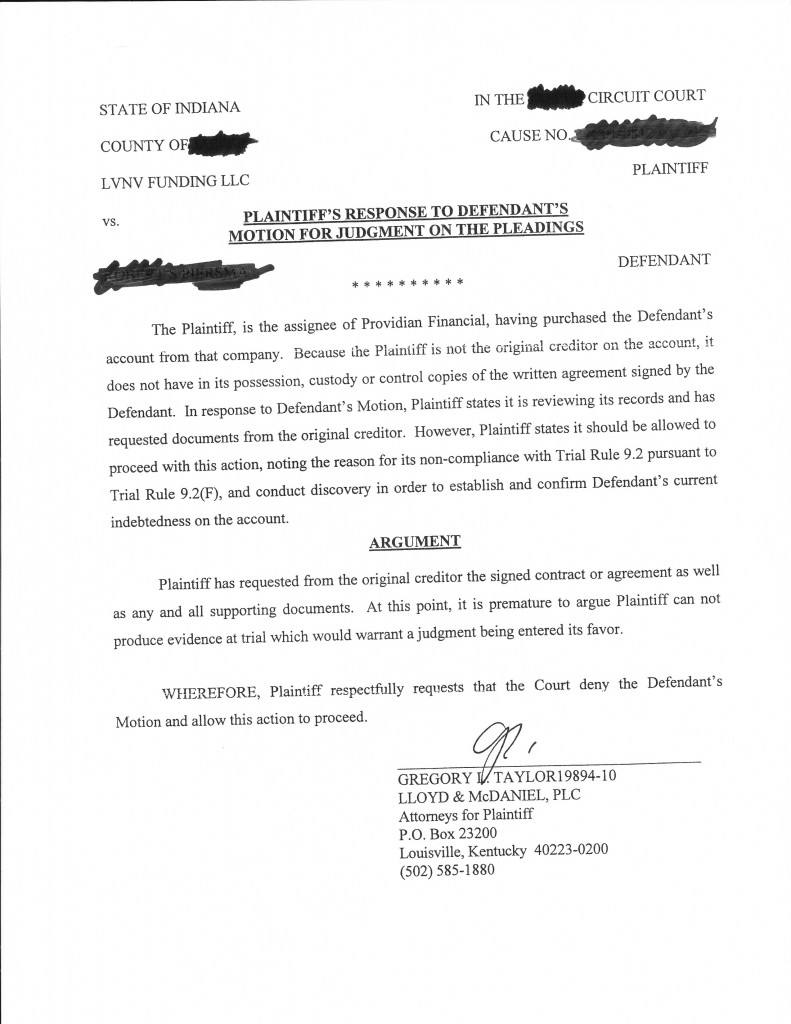

LVNV Defendant Response to Request to Admissions How To Win A Credit

Answer to Debt Collection Lawsuit Example Texas PDF Form Fill Out and

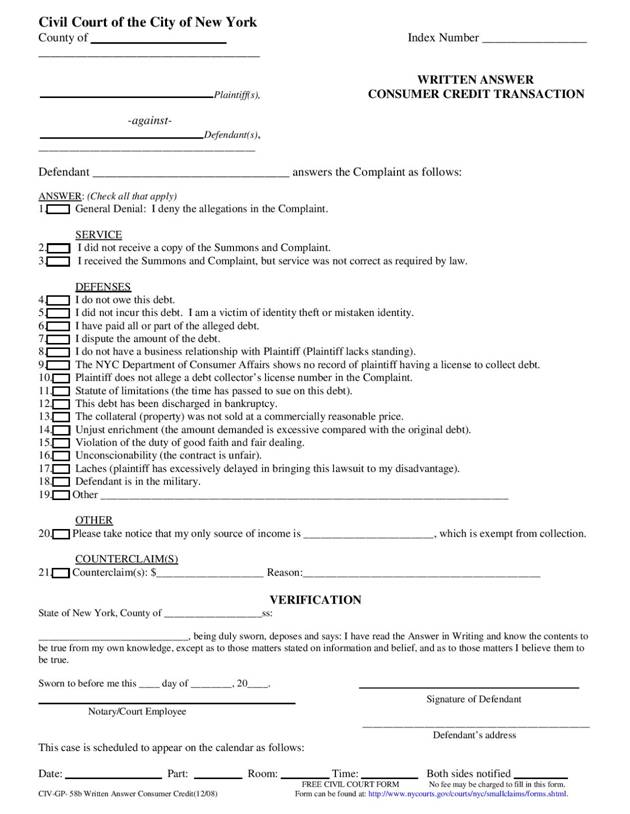

How To Answer a Summons and Complaint in a Bronx Debt Collection

Answer to Complaint Sample Awesome Lawsuit Answer Template Beepmunk in

Debt Summons Response Letter Sample Form Fill Out and Sign Printable

Answer To Debt Collection Lawsuit Template Card Template

Here’s a Sample Letter to Collection Agencies to Settle Debt SoloSuit

Related Post: