Dcf Template Excel

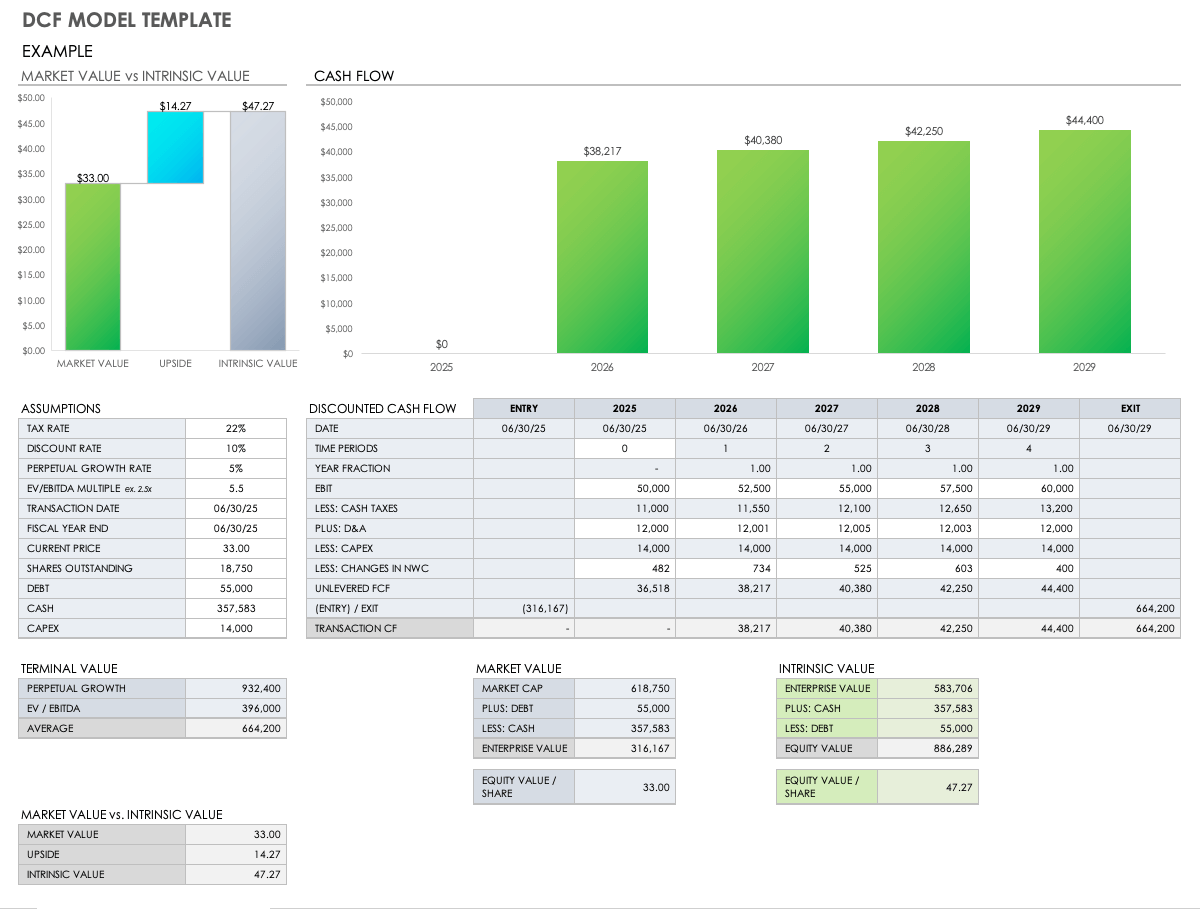

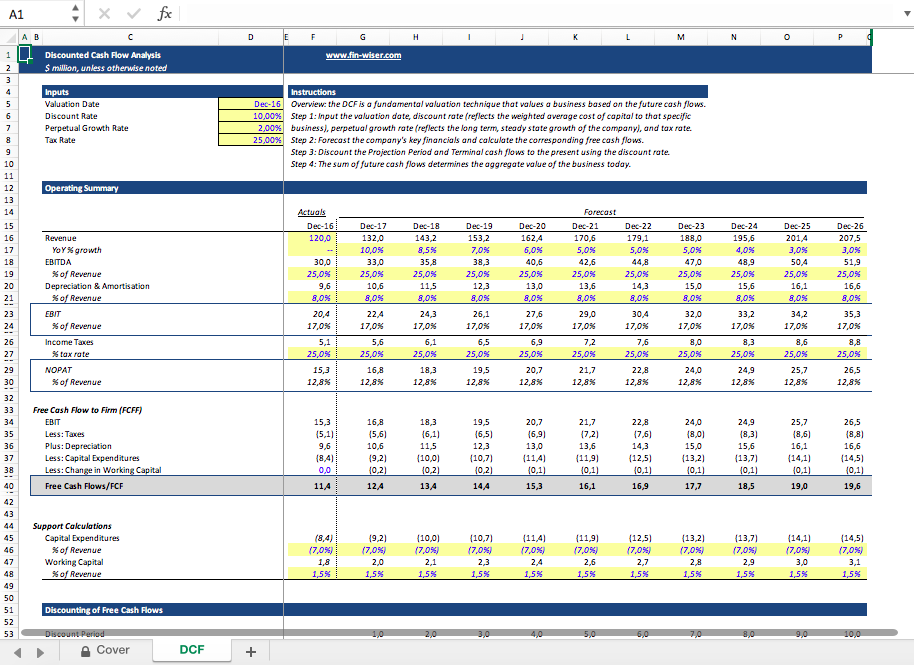

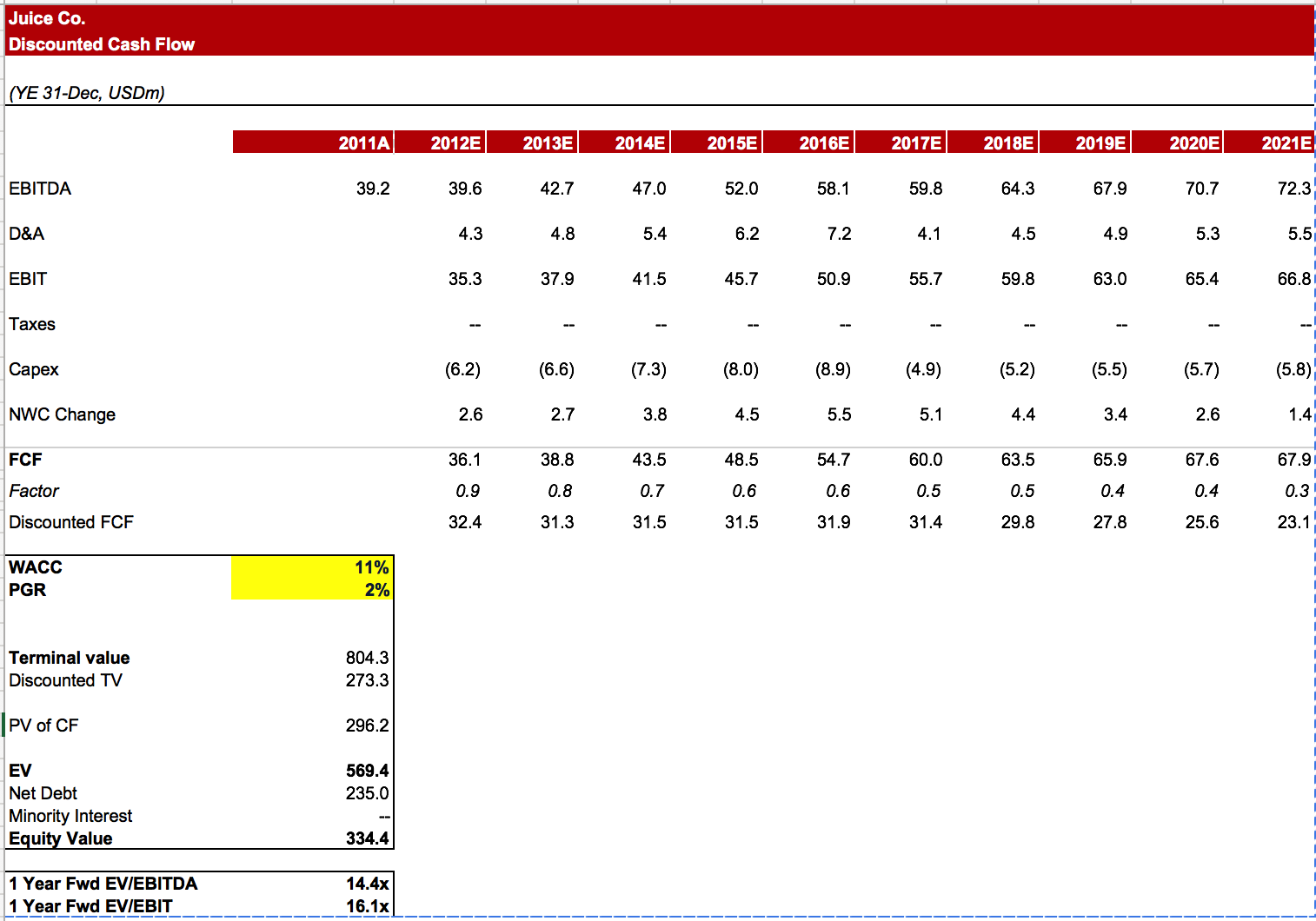

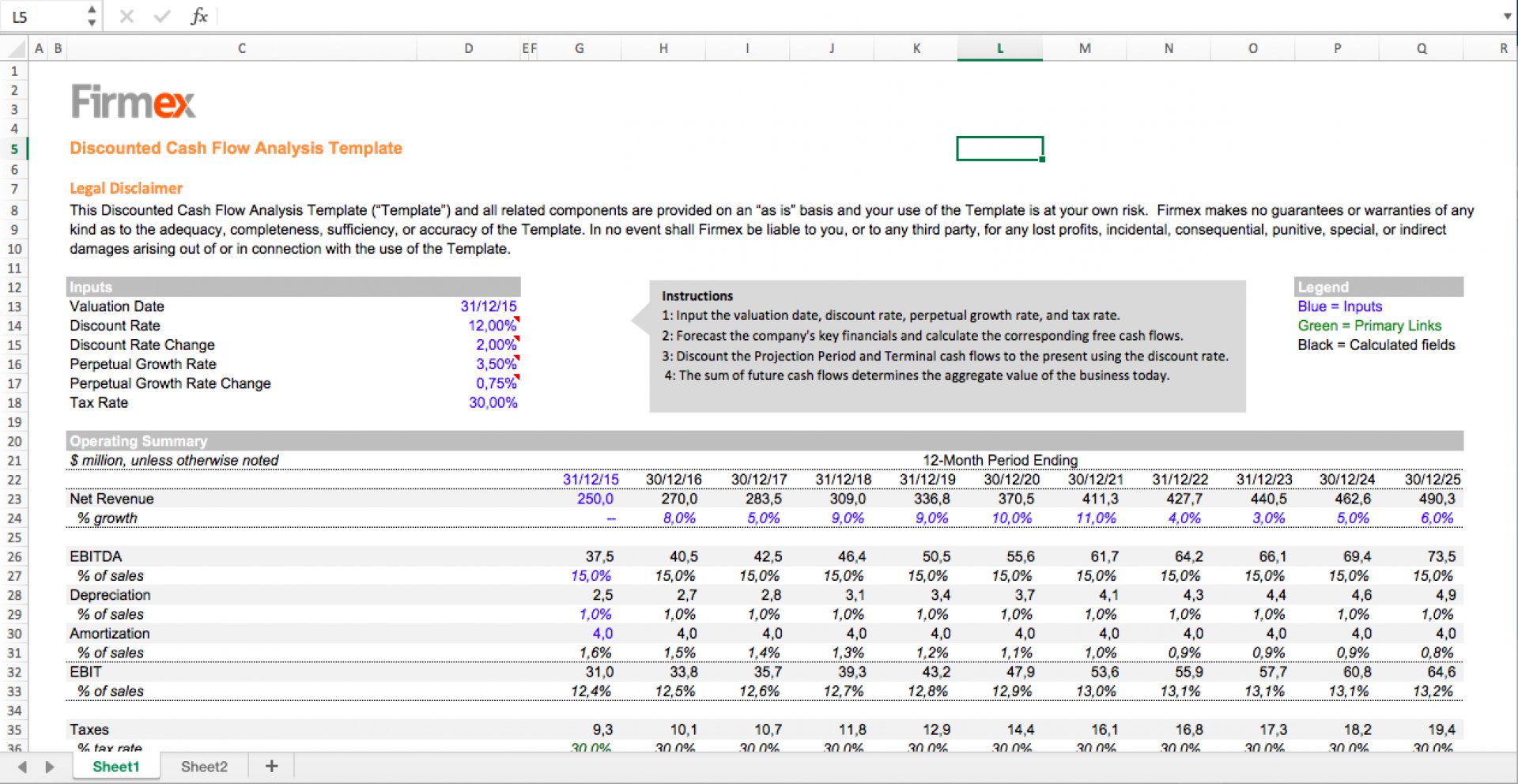

Dcf Template Excel - I have saved up some money to invest and would like to learn how to make dcf analysis for companies to find undervalued stocks. Web excel template for dcf. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Web discounted cash flow excel template. 4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Discounted cash flow, net present value, valuation, uncertainty analysis, pharmaceuticals, drug value, trend chart, negotiation. Web here you can download 11 financial modeling templates for free, including the alibaba ipo model, box ipo model, colgate financial model, beta calculation, free cash flow to firm model, sensitivity analysis model, comparable company analysis model, pe and pe band chart, scenario model and football field chart. Forecast the company's key financials and calculate the corresponding free cash flows. Web this spreadsheet allows you to make a quick (and dirty) estimate of the effect of restructuring a firm in a discounted cashflow framework. Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Thus, the first challenge in building a dcf model is to define and calculate the cash flows that a business generates. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Web. Capm and actual dividend methods. Click here to download the dcf template Web discounted cash flow template. Web use the form below to download our sample dcf model template: Thus, the first challenge in building a dcf model is to define and calculate the cash flows that a business generates. Forecast the company's key financials and calculate the corresponding free cash flows. The premise of the dcf model is that the value of a business is purely a function of its future cash flows. Web start free trial to access template. Below is a preview of the dcf model template: The template uses the discounted cash flow (dcf) method, which. Web use the form below to download our sample dcf model template: Estimate value of future cash flows. Discount the projection period and terminal cash flows to the present using the discount rate. Download wso's free discounted cash flow (dcf) model template below! The premise of the dcf model is that the value of a business is purely a function. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Scribd is the world's largest social reading and publishing site. 4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. Web this spreadsheet allows you to make a quick (and dirty) estimate of the effect of restructuring a firm in. Below is a preview of the dcf model template: Web discounted cash flow excel template. Web discounted cash flow template. Web to help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Web excel template for dcf. Web automated dcf using bloomberg terminal xltp function. This spreadsheet allows you to estimate the current cfroi for a firm. Instruction on using the automated dcf template from the excel template library (xltp function) in bloomberg in your idea generation process. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Web here you can download 11 financial. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Rated 4.70 out of 5 based on 10 customer ratings. Thus, the first challenge in building a dcf model is to define and calculate the cash flows that a business generates. Forecast the company's. 4.7 ( 10 reviews ) dcf valuation spreadsheet in excel. This template is designed to include. Discounted cash flow, net present value, valuation, uncertainty analysis, pharmaceuticals, drug value, trend chart, negotiation. Reverse dcf model operating assumptions. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Estimate value of future cash flows. Rated 4.70 out of 5 based on 10 customer ratings. This dcf model template provides you. Web use the form below to download our sample dcf model template: The premise of the dcf model is that the value of a business is purely a function of its future cash flows. Click here to download the dcf template Thus, the first challenge in building a dcf model is to define and calculate the cash flows that a business generates. Input the valuation date, discount rate, perpetual growth rate, and tax rate. Join 307,012+ monthly readers mergers & inquisitions Forecast the company's key financials and calculate the corresponding free cash flows. Reverse dcf model operating assumptions. I have saved up some money to invest and would like to learn how to make dcf analysis for companies to find undervalued stocks. Web discounted cash flow template. Below is a preview of the dcf model template: Rated 4.70 out of 5 based on 10 customer ratings. Web the dcf template is an excel spreadsheet that allows you to input data and perform calculations to determine the intrinsic value of a stock. Web excel template for dcf. We’ll now move to a modeling exercise, which you can access by filling out the form below. It helps in making more informed business decisions by calculating the value of an investment based on its expected future cash flows. This spreadsheet shows the equivalence of the dcf and eva approaches to valuation. This template allows you to build your own discounted cash flow model with different assumptions. Capm and actual dividend methods. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date.Dcf model excel template Блог о рисовании и уроках фотошопа

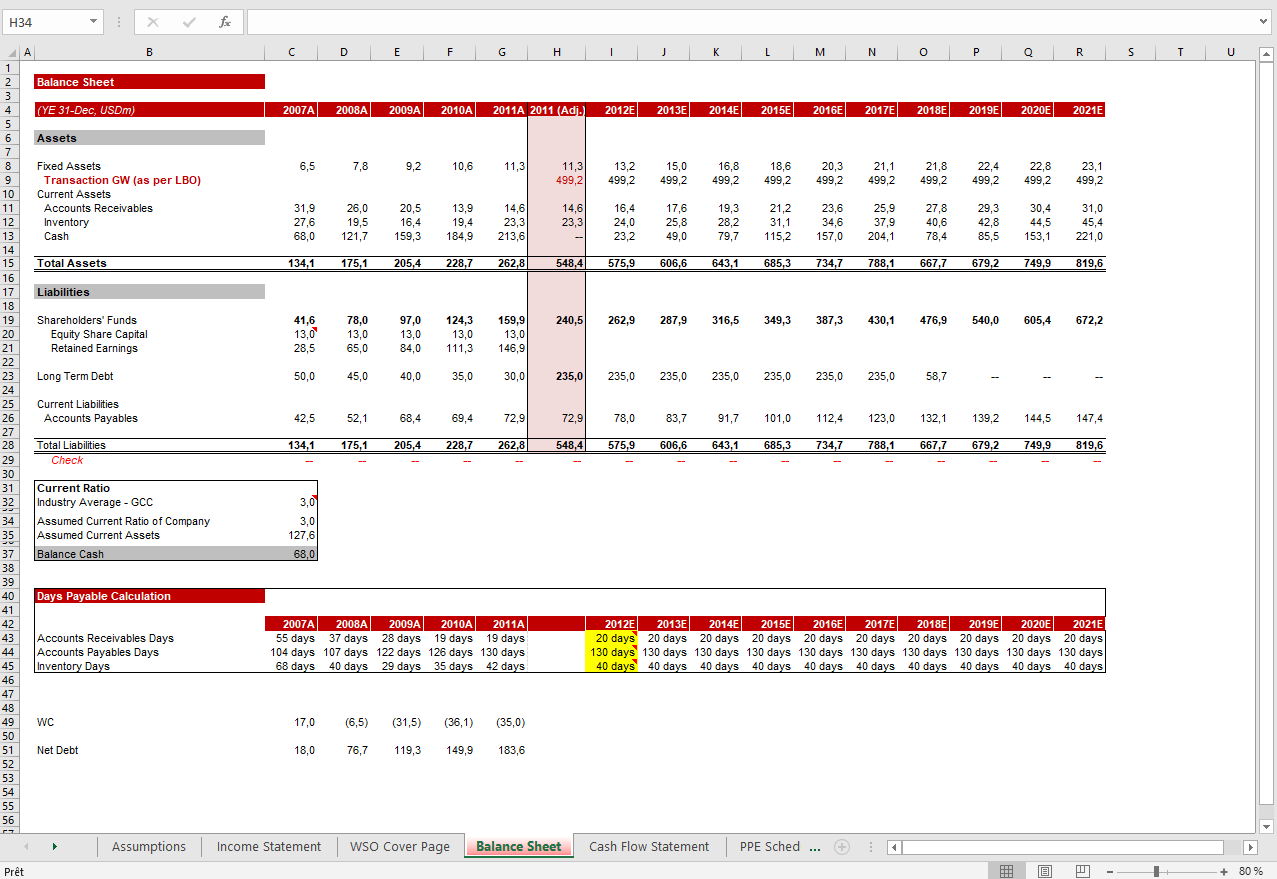

Discounted Cash Flow (DCF) Model Macabacus

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

DCF model tutorial with free Excel

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

DCF Discounted Cash Flow Model Excel Template Eloquens

Free DCF Template Excel [Download & Guide] Wisesheets Blog

DCF Model Full Guide, Excel Templates, and Video Tutorial (2022)

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Related Post:

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)