Dave Ramsey Template

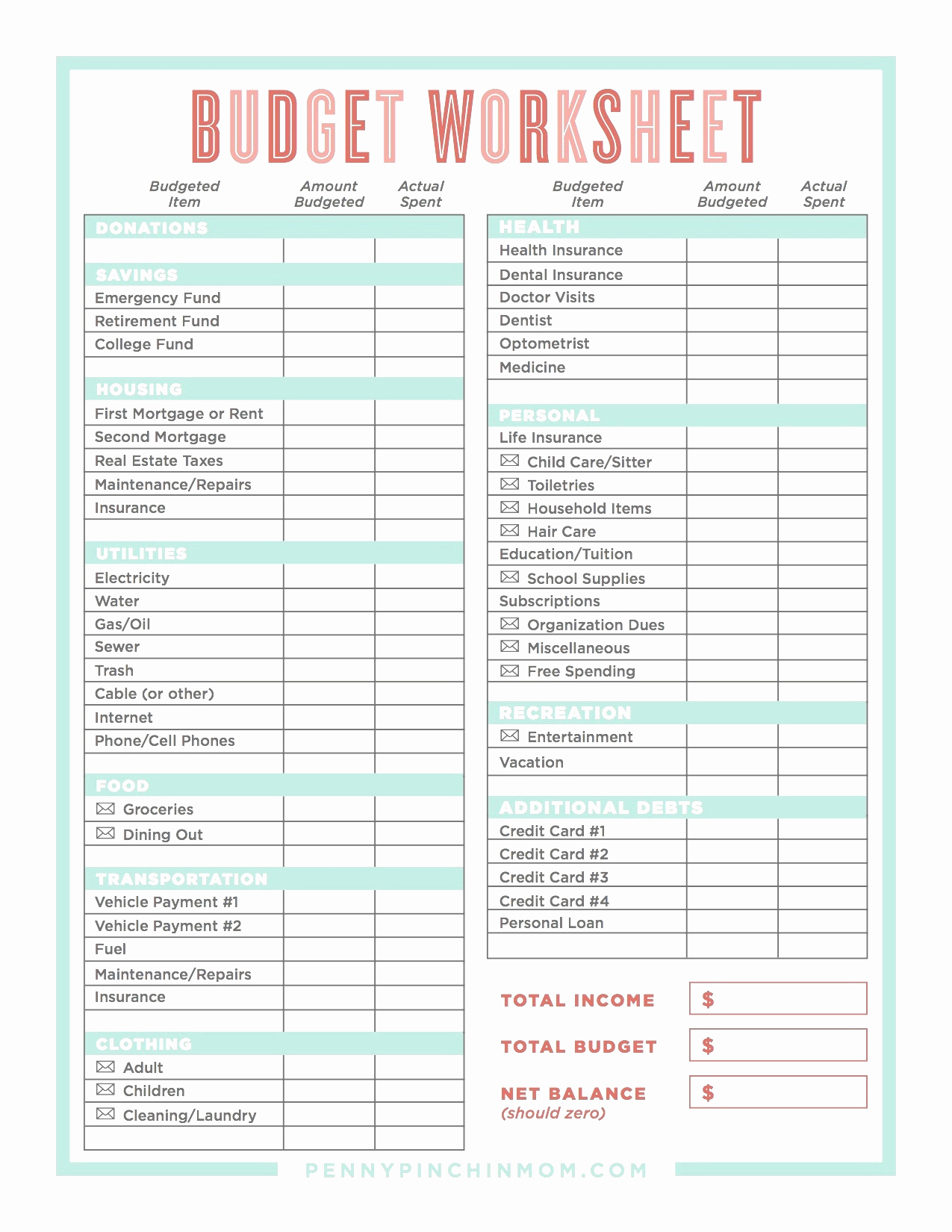

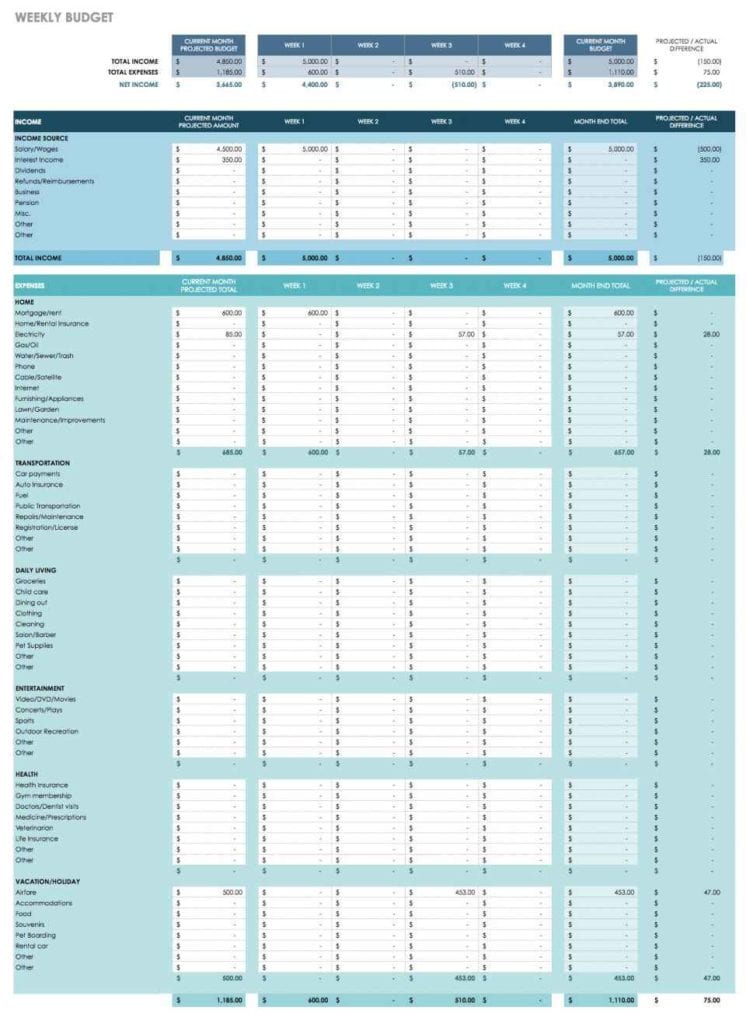

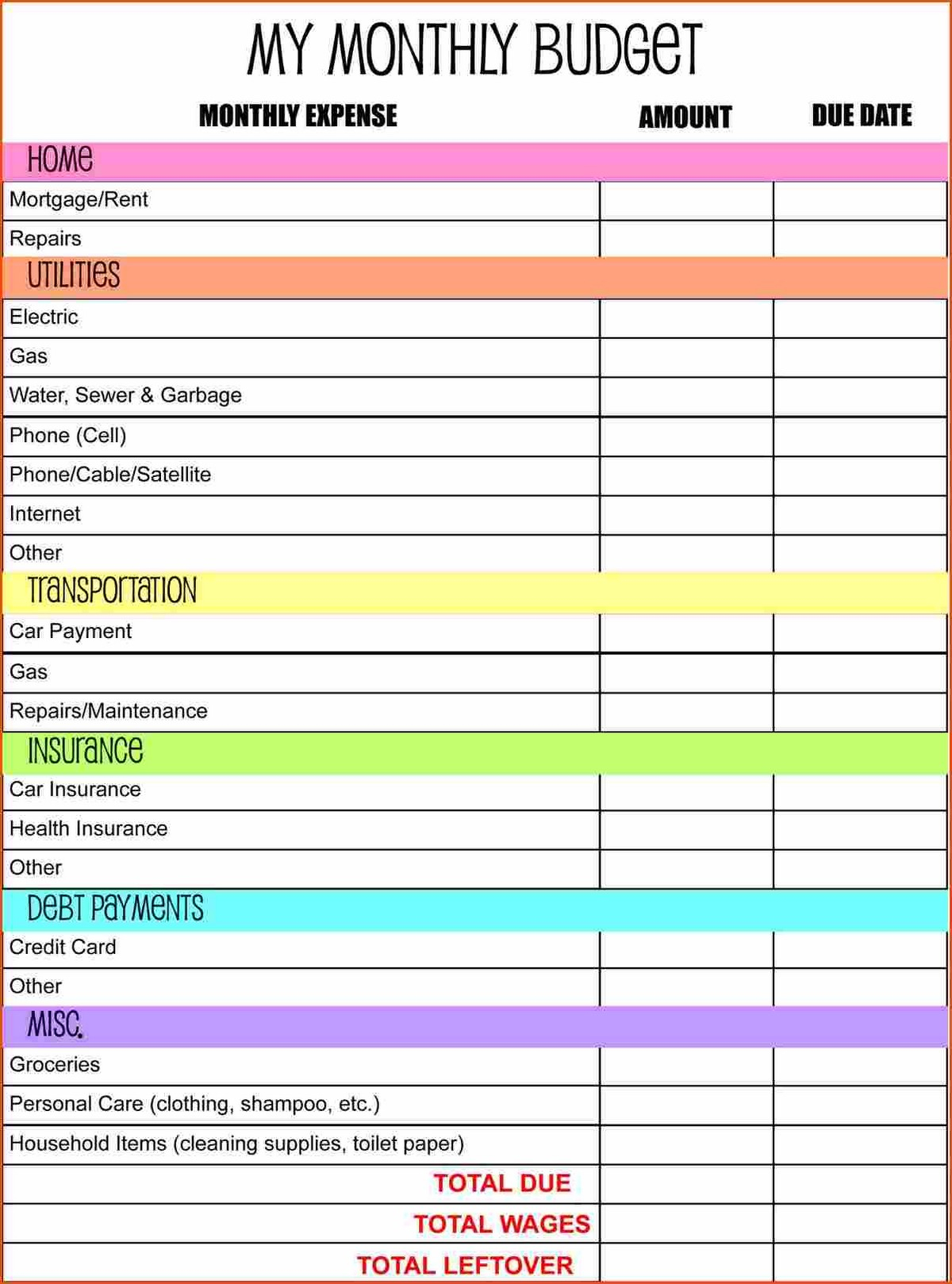

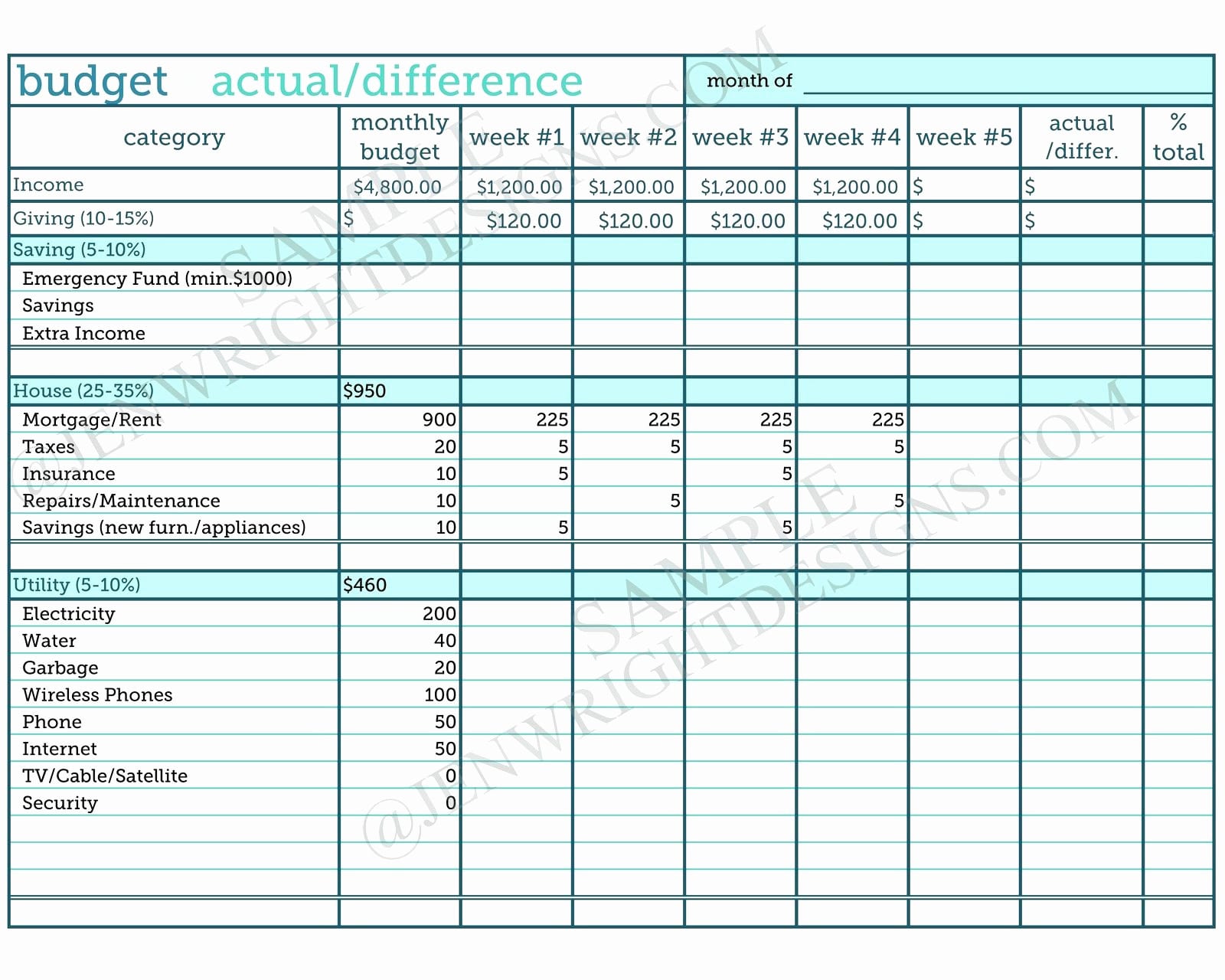

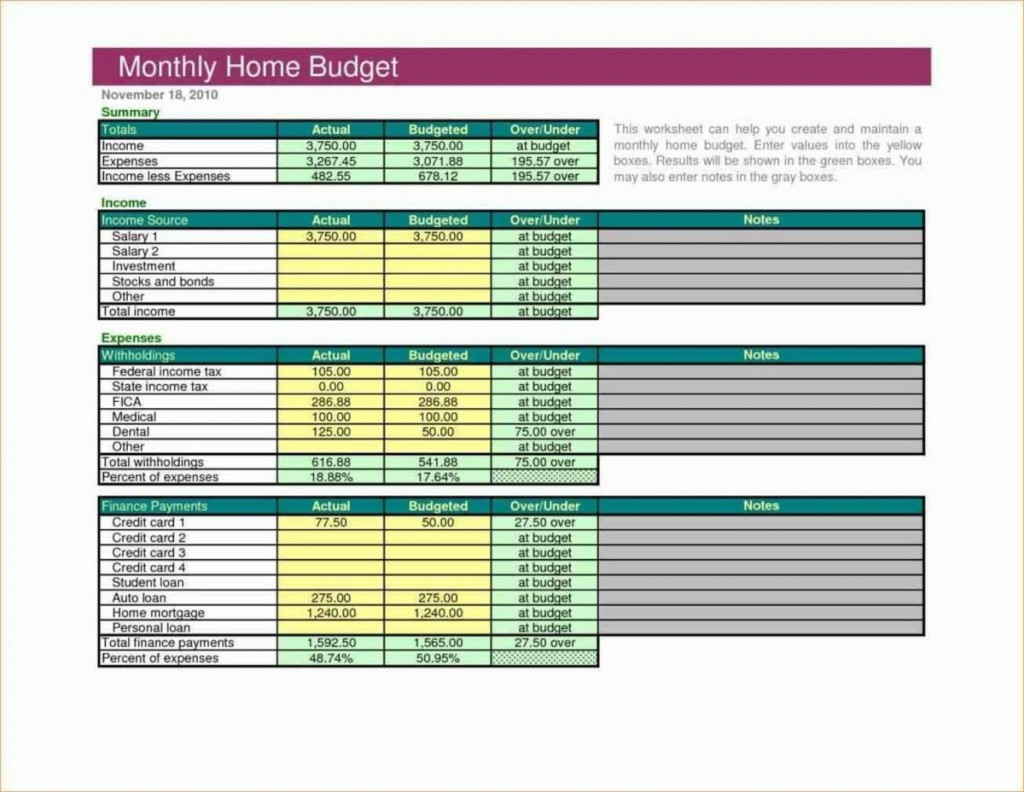

Dave Ramsey Template - Web 2 dave ramsey budget form free download. Web check out our dave ramsey budget template selection for the very best in unique or custom, handmade pieces from our paper shops. Web ramsey went into some detail on his recommendations for people beginning to save and invest for retirement. Web this free zero based budget spreadsheet is designed to help you quickly create and maintain a zero based budget. Download lump sum payment form We’ve got three steps to set up that budget and two more to keep it going—each and every month. The monthly cash flow plan form consist of different component made up of charity, food, savings, clothes, housing, transportation, utilities, medical health, insurance. Web six resumé templates (word documents) instructions for using the resumé templates (pdf) the do’s and don’ts of job applications (pdf) how it works: You can grab all of these adorable dave ramsey printables inside my free printable budget planner here. Decide what to include in your will. Decide what to include in your will. Download lump sum payment form Over 10 million people have learned to love budgeting with everydollar’s intuitive features that. Overspending, stick to a plan, and kick money stress out of your life for good. Taking control of your family’s finances is easier than you think! Pay as much as possible on your smallest debt. Web these 5 free diy cash envelope templates make it easy for you to budget your money the dave ramsey way. Envelopes are categorized by budget categories. Download lump sum payment form 77 document(s) celsius to fahrenheit chart. Say goodbye to money stress. You can grab all of these adorable dave ramsey printables inside my free printable budget planner here. Create your free account everydollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits. You don't need to understand macros to use this spreadsheet. We’ve got three steps. You don't need to understand macros to use this spreadsheet. Web the dave ramsey budget forms consist of the monthly cash flow plan form and the irregular planning budget form working together to provide a solid budget template for users. Web a budget template (or budget worksheet) is a great way to get everything on paper, right there in front. This form allows you to plan out in advance where every dollar will go for the month. Download lump sum payment form Download free printable dave ramsey budget form samples in pdf, word and excel formats. Save for your children’s college fund. Pay as much as possible on your smallest debt. Web dave ramsey’s envelope system is a budgeting method that thousands of people have successfully used to save money and achieve financial goals. Use this form to break down each paycheck and tell your money where to go. Decide what to include in your will. 6 document(s) dot to dot. Web our favorite printable budgeting template came from dave ramsey. Web dave ramsey’s envelope system is a budgeting method that thousands of people have successfully used to save money and achieve financial goals. Web see ramsey’s latest apps, calculators, guides, books and more to help you get out of debt, save money, and build wealth. You don't need to understand macros to use this spreadsheet. Decide what to include in. Web our favorite printable budgeting template came from dave ramsey. Over 10 million people have learned to love budgeting with everydollar’s intuitive features that. Decide what to include in your will. As dave explains in his book total money makeover, using cash helps you track your budgeting better than using a credit or debit card. Here’s how you enter your. Web check out our dave ramsey budget template selection for the very best in unique or custom, handmade pieces from our paper shops. You can grab all of these adorable dave ramsey printables inside my free printable budget planner here. If you’re looking for ways to get a handle on your budget, the cash envelope system is tried and true.. As dave explains in his book total money makeover, using cash helps you track your budgeting better than using a credit or debit card. Use this form to break down each paycheck and tell your money where to go. Printable cash envelopes so you can take control of your miscellaneous spending. Web our favorite printable budgeting template came from dave. Printable cash envelopes so you can take control of your miscellaneous spending. This form allows you to plan out in advance where every dollar will go for the month. Web download consumer equity sheet what's your net worth? We’ve got three steps to set up that budget and two more to keep it going—each and every month. Download allocated spending plan give every dollar a name. Web a budget template (or budget worksheet) is a great way to get everything on paper, right there in front of your eyes. Web a spending log to keep track of your payments and prevent overdraft. Taking control of your family’s finances is easier than you think! Create your free account everydollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits. Baby step 4 of my plan says to put 15 percent of your income into retirement accounts. List your debts from smallest to largest regardless of interest rate. Web without complicated math or fancy spreadsheets. Web here’s how the debt snowball works: 77 document(s) celsius to fahrenheit chart. Make minimum payments on all your debts except the smallest. Here’s how you enter your income in everydollar: It includes putting cash into envelopes and using this cash for spending money, instead of using a debit or credit card. How to make a budget binder. Say goodbye to money stress. Save for your children’s college fund.Dave Ramsey Budget Spreadsheet Template —

budget spreadsheet dave ramsey —

Budgeting Printables for Dave Ramsey Baby Steps Dave ramsey budgeting

Dave Ramsey Budget Spreadsheet Template —

Dave Ramsey Budget Spreadsheet Excel —

25 Awesome & Free Dave Ramsey Budgeting Printables That'll Help You Win

The Easiest Way To Make A Monthly Budget Dave ramsey budgeting, Dave

Dave Ramsey Budget Spreadsheet Template —

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

Dave Ramsey Printable Budget Forms

Related Post: