Credit Card Surcharge Notice Template

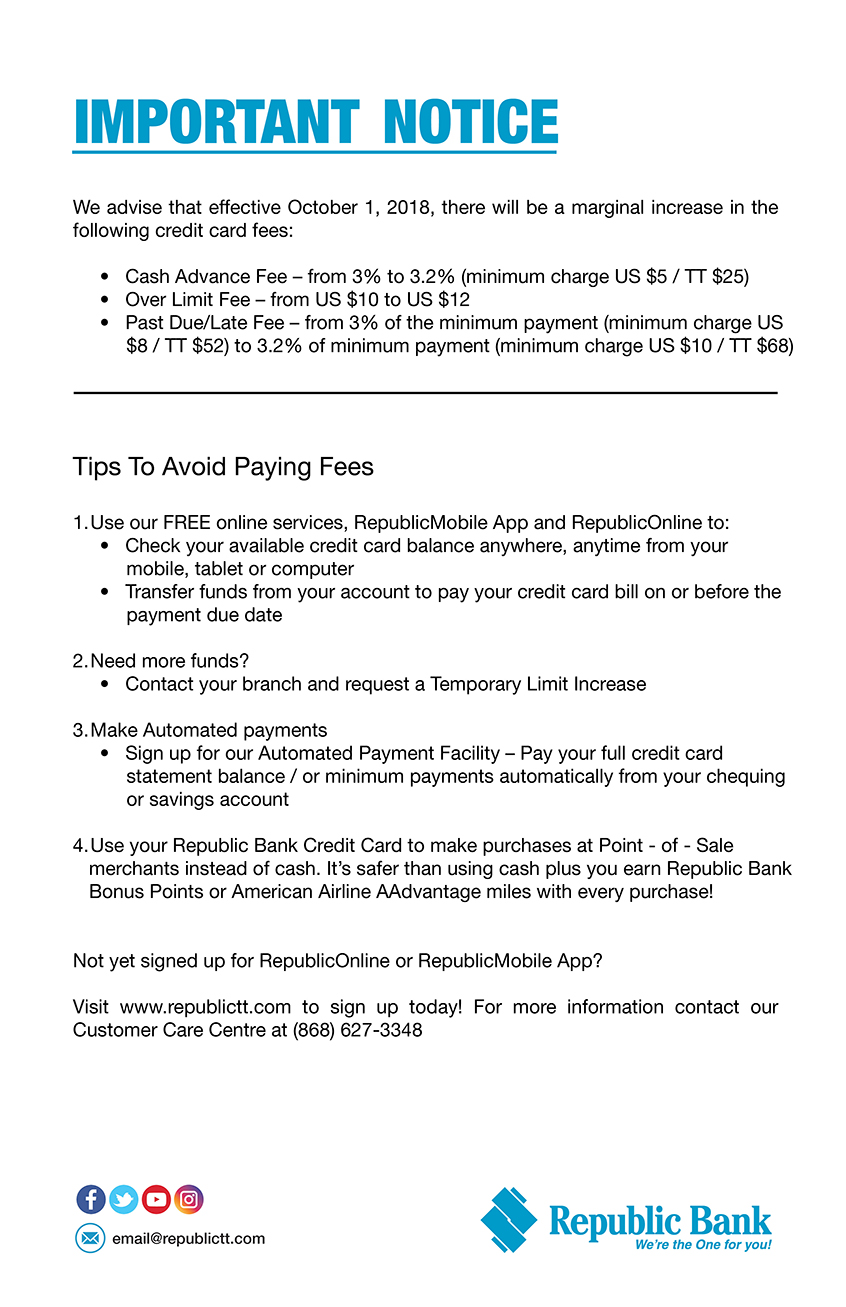

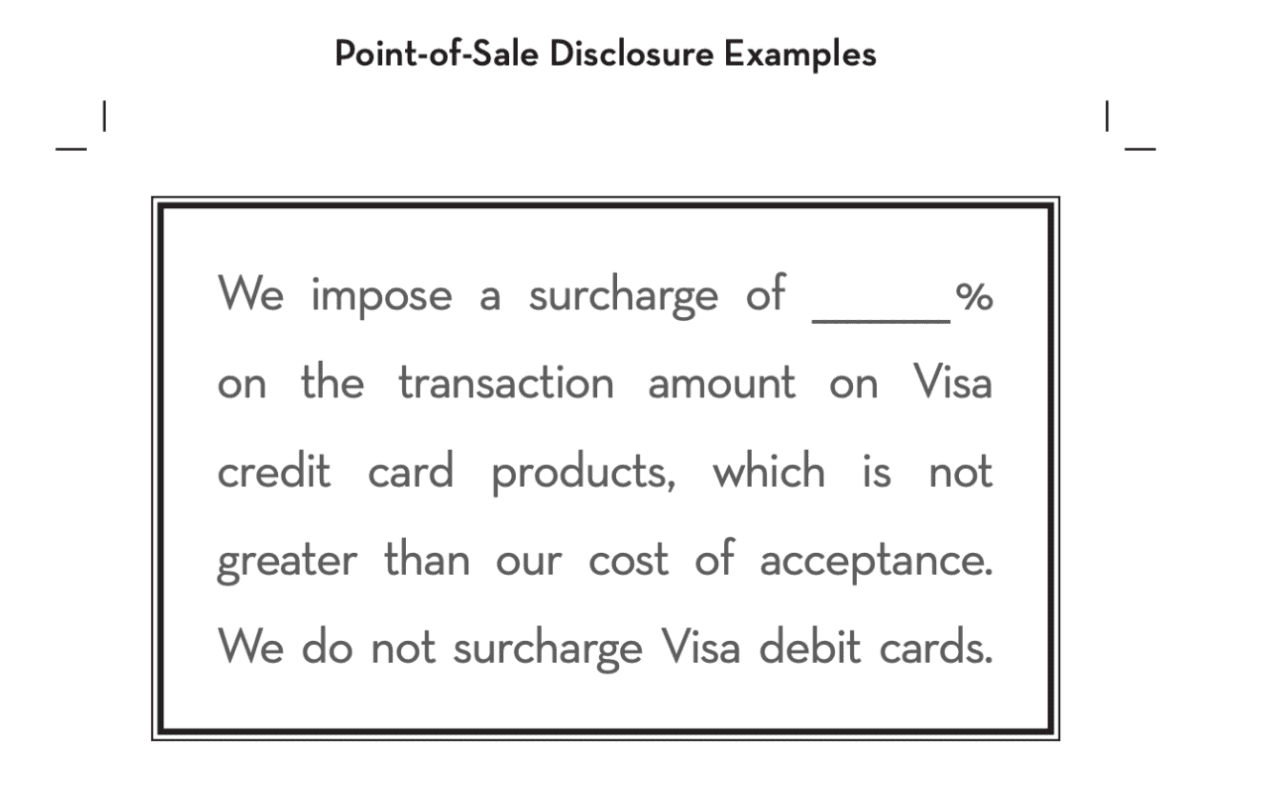

Credit Card Surcharge Notice Template - • notify visa and your acquirer at least 30 days in advance of beginning to surcharge; Web to report merchants charging excessive payment card surcharges, or surcharging debit and prepaid card transactions, consumers may visit www.visa.com or. Web the short answer is yes, it is legal for a merchant to impose a surcharge. Web add a line item for credit card surcharge to the invoice and add a standard amount to each invoice. Merchants that intend to surcharge are required to: • disclosures must be provided at the point of entry. Get in touch with us for more details. Web what are credit card surcharges and where are they legal? Web credit card surcharging refers to the practice of adding a small fee to a credit card transaction to cover the merchant’s costs for processing the payment. Web • the surcharge must not exceed your cost of acceptance for the credit card.1. Web this excel template has all the relevant information you need to know in order to roll out a surcharge program and welcome credit card payments. Merchants that intend to surcharge are required to: Get in touch with us for more details. Web locate credit card surcharge notice template and click get form to get started. Take advantage of the. Web accept credit cards—normally between 1.5% and 3% of the transaction amount. Web locate credit card surcharge notice template and click get form to get started. This fee can only apply to. Web there are no fixed templates for your surcharge disclosure signages, and notifications should work if they meet surcharging and relevant state law requirements. Updated october 31, 2023,. Web a surcharge can’t be applied to purchases made with debit or prepaid cards. A notification form to visa can be. Web a credit card surcharge (or cc surcharge) is a fee enforced by the merchant to compensate for some of the cost of payment processing. Proper signage and notification required. Supreme court ruling in 2017 protected surcharges as a. • disclosures must be provided at the point of entry. Web merchant surcharge disclosure form. Web to report merchants charging excessive payment card surcharges, or surcharging debit and prepaid card transactions, consumers may visit www.visa.com or. This fee can only apply to. Web to implement surcharging, merchants must (1) notify the credit card associations of their intent to surcharge at. Take advantage of the instruments we provide to submit your document. Supreme court ruling in 2017 protected surcharges as a form of free speech from. Web a credit card surcharge (or cc surcharge) is a fee enforced by the merchant to compensate for some of the cost of payment processing. Merchants that intend to surcharge are required to: Web accept. Take advantage of the instruments we provide to submit your document. Updated october 31, 2023, 11:29 am pdt. Web • the surcharge must not exceed your cost of acceptance for the credit card.1. Calculate to offset the 2.9% + $0.30 charge per invoice. Web there are no fixed templates for your surcharge disclosure signages, and notifications should work if they. Get more information about merchant surcharge disclosure from mastercard by filling in a webform. And all of the card networks. Web we do not surcharge visa debit cards. Web for instance, visa requires all businesses that impose a card surcharge to give consumers written notice at least 30 days in advance. Merchants are free to develop their own signage that. Web the short answer is yes, it is legal for a merchant to impose a surcharge. Updated october 31, 2023, 11:29 am pdt. Web surcharging is “definitely” at an inflection point, particularly as credit card companies are slated to increase merchant fees in april, according to jonathan razi,. Web we do not surcharge visa debit cards. Web credit card surcharging. Web what are credit card surcharges and where are they legal? Web there are no fixed templates for your surcharge disclosure signages, and notifications should work if they meet surcharging and relevant state law requirements. The enclosed signage is provided as an example of compliant surcharge disclosure. Web merchant surcharge disclosure form. Web to implement surcharging, merchants must (1) notify. • notify visa and your acquirer at least 30 days in advance of beginning to surcharge; Web merchant surcharge disclosure form. Web surcharging is “definitely” at an inflection point, particularly as credit card companies are slated to increase merchant fees in april, according to jonathan razi,. Web for instance, visa requires all businesses that impose a card surcharge to give. Updated october 31, 2023, 11:29 am pdt. Web to implement surcharging, merchants must (1) notify the credit card associations of their intent to surcharge at least 30 days in advance, and (2) post. Web there are no fixed templates for your surcharge disclosure signages, and notifications should work if they meet surcharging and relevant state law requirements. Web credit card surcharging refers to the practice of adding a small fee to a credit card transaction to cover the merchant’s costs for processing the payment. A notification form to visa can be. The surcharge fee can’t be more than the cost of processing the credit card and is. Supreme court ruling in 2017 protected surcharges as a form of free speech from. Merchants that intend to surcharge are required to: Get more information about merchant surcharge disclosure from mastercard by filling in a webform. This fee can only apply to. In many cases, you’ll need to submit your intentions in writing, at least 30 days in advance to. Web a credit card surcharge (or cc surcharge) is a fee enforced by the merchant to compensate for some of the cost of payment processing. Web notify your credit card processor and card associations. Surcharges can be imposed on credit card transactions only, not on purchases made. Web this excel template has all the relevant information you need to know in order to roll out a surcharge program and welcome credit card payments. • notify visa and your acquirer at least 30 days in advance of beginning to surcharge; Merchants cannot surcharge purchases made using. Web add a line item for credit card surcharge to the invoice and add a standard amount to each invoice. Web • the surcharge must not exceed your cost of acceptance for the credit card.1. Web for instance, visa requires all businesses that impose a card surcharge to give consumers written notice at least 30 days in advance.Credit Card Important Notice Republic Bank

Credit Card Invoice * Invoice Template Ideas

Surcharge On Credit Cards Sign NHE18640 Dining / Hospitality / Retail

Beginner’s Guide to Credit Card Surcharging Merchant Cost Consulting

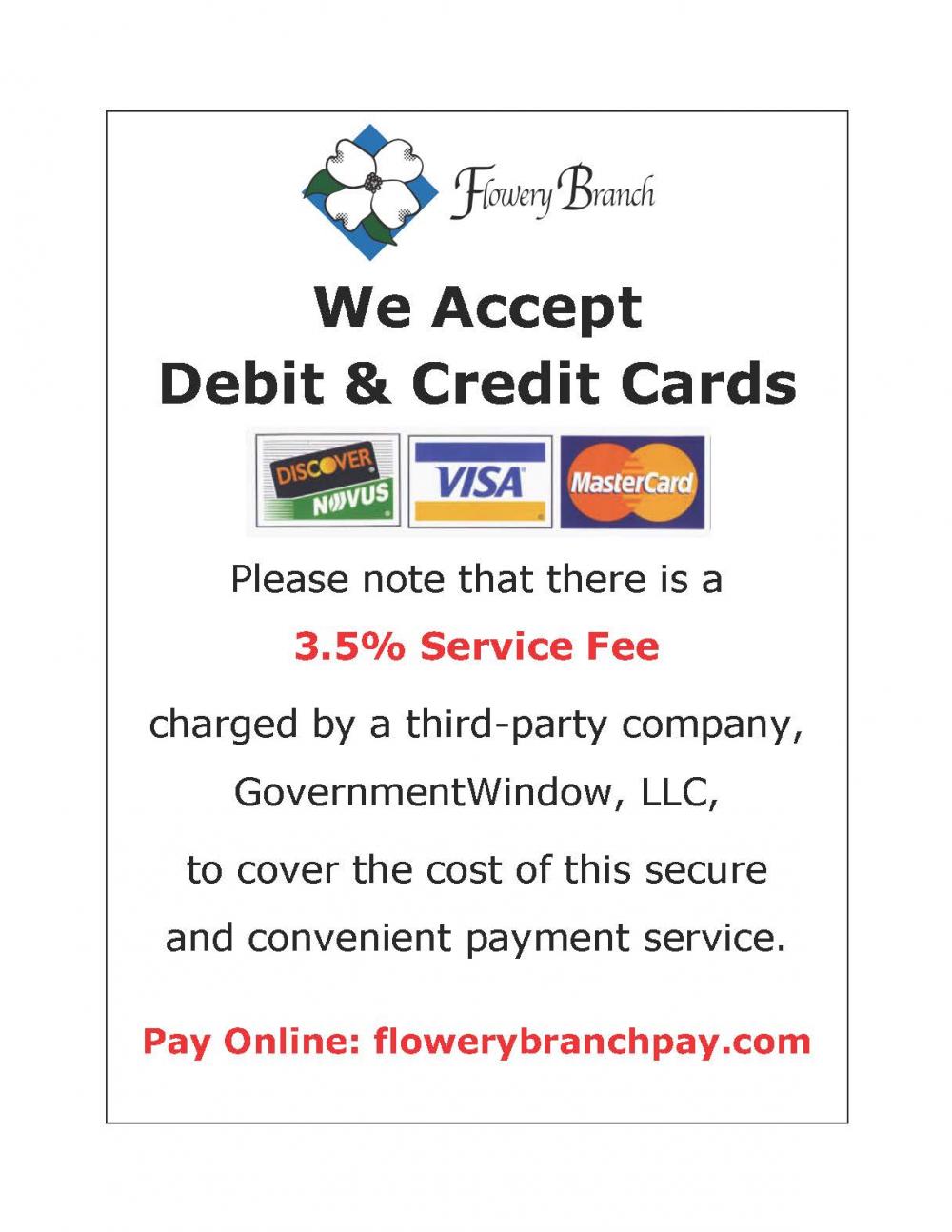

NOTICE NEW CREDIT CARD FEES City of Flowery Branch,

Is It Legal To Charge A Surcharge For Using A Credit Card Leah

Cash Discount Proudly

Free Printable Credit Denial Notice Form (GENERIC)

Credit card surcharge what is it?

Cash Discount Program Merchant Services Done Right

Related Post: