Cp2000 Response Template

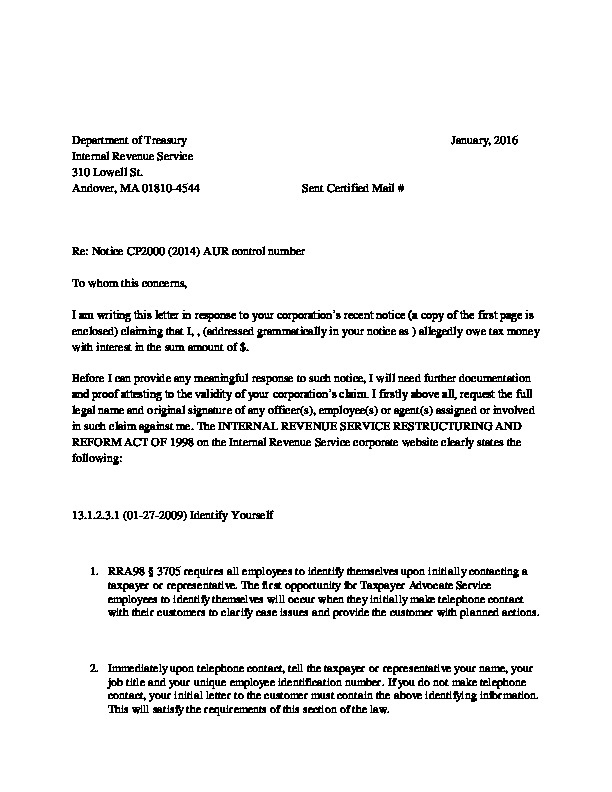

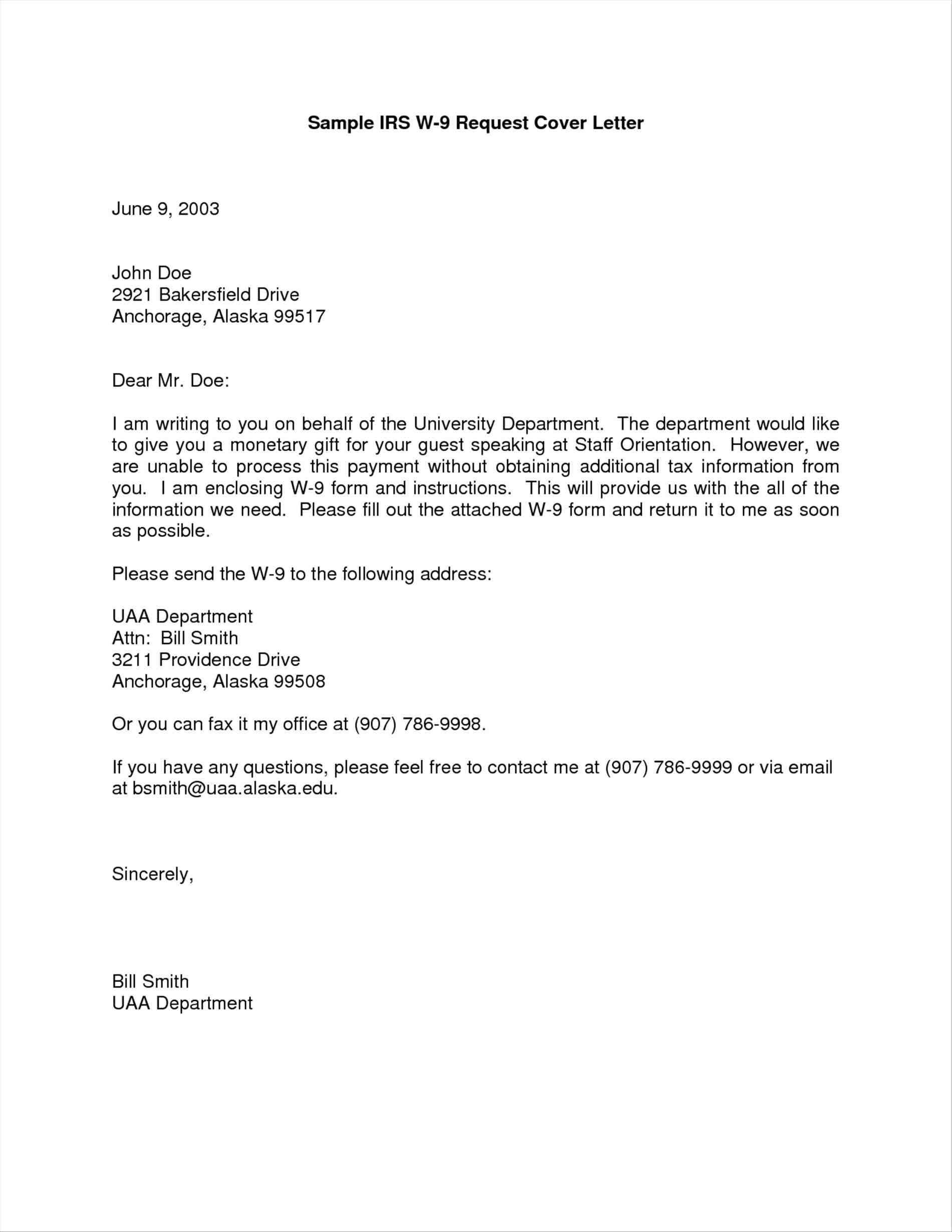

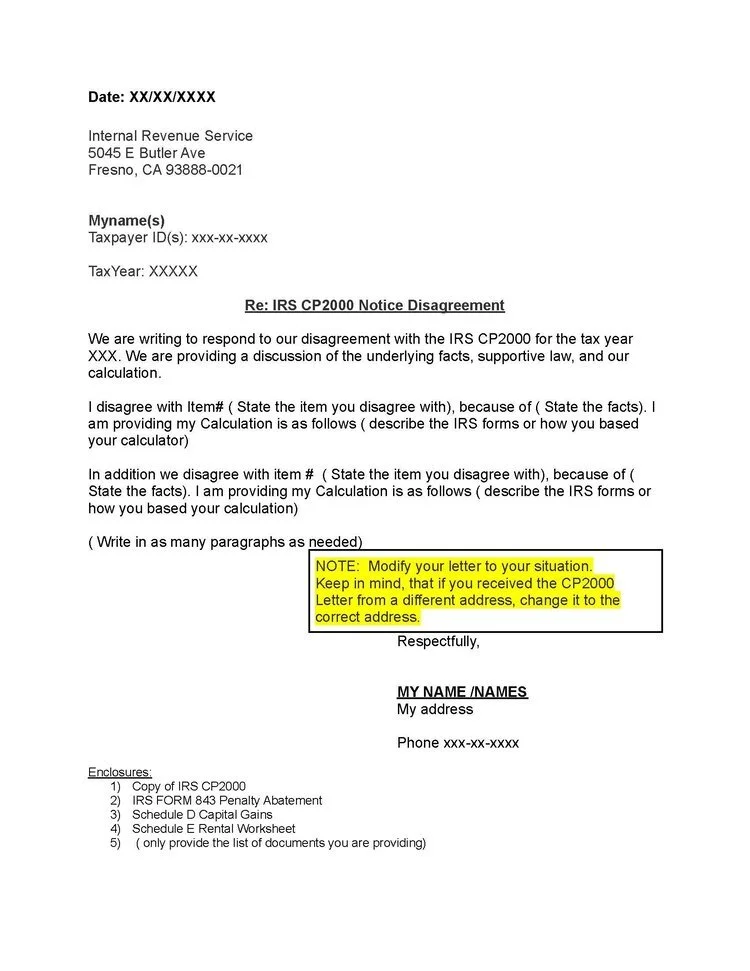

Cp2000 Response Template - Try it for free now! Complete, edit or print tax forms instantly. Review the proposed changes and compare them. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. If you agree with the proposed tax changes, sign and. Determine if you agree or disagree. The irs notice will include a response form, a payment voucher, and a mailing envelope for your reply. Web learn more about cp2000 notices here. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Web if you fought the irs through the whole procedure you would likely end up in tax court. Upload, modify or create forms. To whom it may concern, i received your notice. Web the most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. But, the usual method of handling a notice cp2000 is to either: Web the cp2000 notice means that the income and. If it is correct and you excluded a source of income, sign the response letter provided by the. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. As the world continues to recover from. Web you have two options on how you. As the world continues to recover from. Web a partial response is preferable to no response and the reporting platform also provides an opportunity to explain any incomplete information. Response to cp2000 notice dated month, xx, year. Upload, modify or create forms. 1) respond in writing to the. Review the information on the cp2000 carefully for accuracy. Complete, edit or print tax forms instantly. If it is correct and you excluded a source of income, sign the response letter provided by the. Web if you received a notice cp2000 (or letter 2030) the irs sends notice cp2000 (or letter 2030) to propose a change in tax. Web the. 1) respond in writing to the. To whom it may concern, i received your notice. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Review the proposed changes and compare them. If it is correct and you excluded a source of income, sign the response. To whom it may concern, i received your notice. The irs notice will include a response form, a payment voucher, and a mailing envelope for your reply. Web if you fought the irs through the whole procedure you would likely end up in tax court. Review the information on the cp2000 carefully for accuracy. 1) respond in writing to the. What triggers irs to send a cp 2000 letter? Web a response form, payment voucher, and an envelope. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. What do i do if i receive a cp 2000? Complete, edit or print tax. Web you have two options on how you can respond to a cp2000 notice. Web a partial response is preferable to no response and the reporting platform also provides an opportunity to explain any incomplete information. Response to cp2000 notice dated month, xx, year. Web letter cp 2000 is sent to notify you that one or more items on your. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Review the proposed changes and compare them. Determine if you agree or disagree. Web a partial response is preferable to no response and the reporting platform also provides an opportunity to explain any incomplete information. But,. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Web a response form, payment voucher, and an envelope. Web if you fought the irs through the whole procedure you would likely end up in tax court. Web the most common reasons for a cp2000 notices. As the world continues to recover from. Review the proposed changes and compare them. Web a sample response letter for irs cp2000 is a template letter that you can use as a reference when responding to a cp2000 notice received from the irs. Web a partial response is preferable to no response and the reporting platform also provides an opportunity to explain any incomplete information. What do i do if i receive a cp 2000? To whom it may concern, i received your notice. Web learn more about cp2000 notices here. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Determine if you agree or disagree. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Complete, edit or print tax forms instantly. Upload, modify or create forms. Web if you received a notice cp2000 (or letter 2030) the irs sends notice cp2000 (or letter 2030) to propose a change in tax. But, the usual method of handling a notice cp2000 is to either: Web a response form, payment voucher, and an envelope. 1) respond in writing to the. Response to cp2000 notice dated month, xx, year. If the irs ultimately does not review your response. Web the most common reasons for a cp2000 notices are taxpayers incorrectly reporting income or failing to report all income received through out the year. Try it for free now!Irs Cp2000 Example Response Letter amulette

Cp2000 Response Letter Template Samples Letter Template Collection

Cp2000 Response Letter Template Samples Letter Template Collection

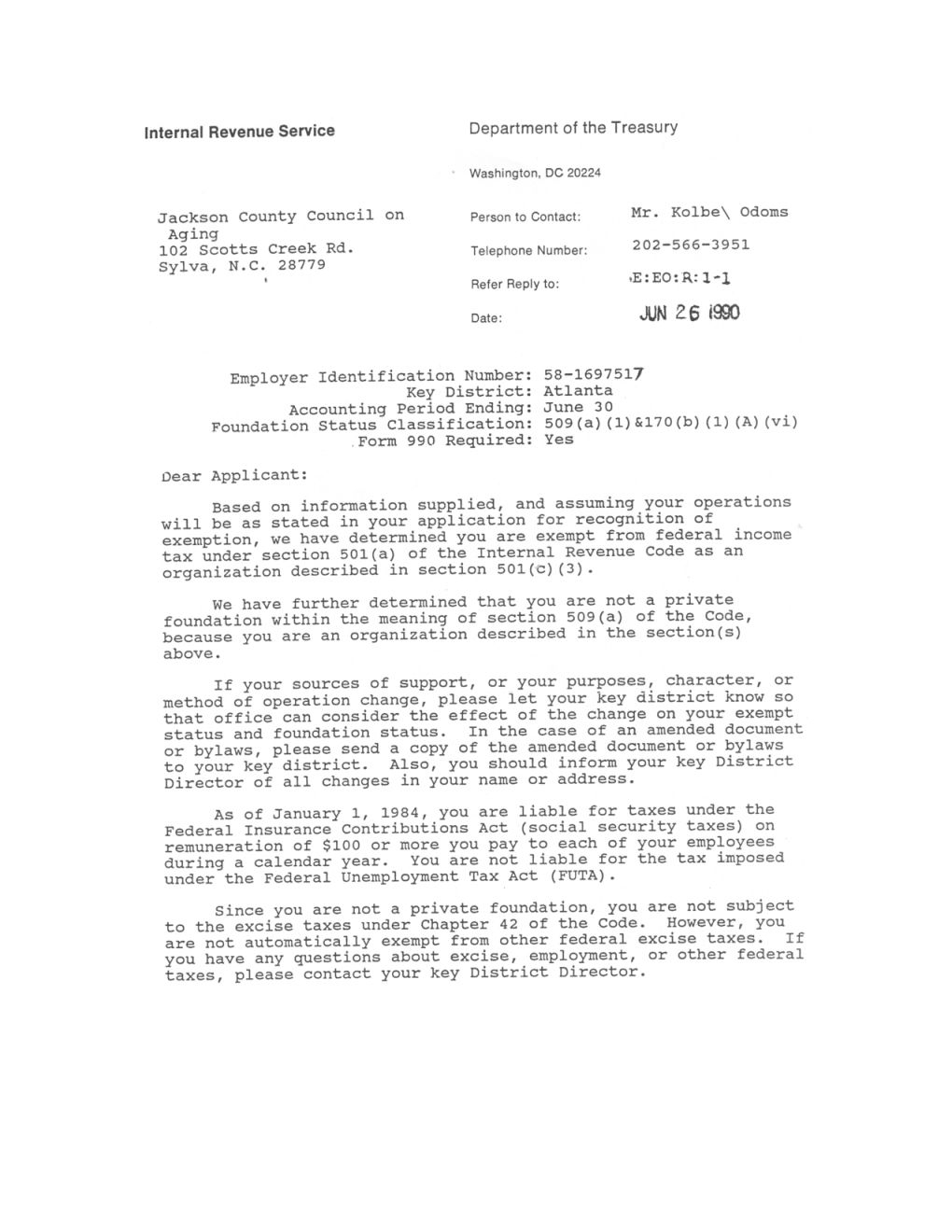

IRS Audit Letter CP2000 Sample 1

IRS Audit Letter CP2000 Sample 4

IRS CP2000 Notice, IRS proposed changes can be reversed, and eliminate

Understanding Your CP2000 Notice

IRS Audit Letter CP2000 Sample 1

What Is A Cp2000 Letter

Cp2000 Response Letter Template Resume Letter

Related Post:

.jpeg)