Cost Segregation Template

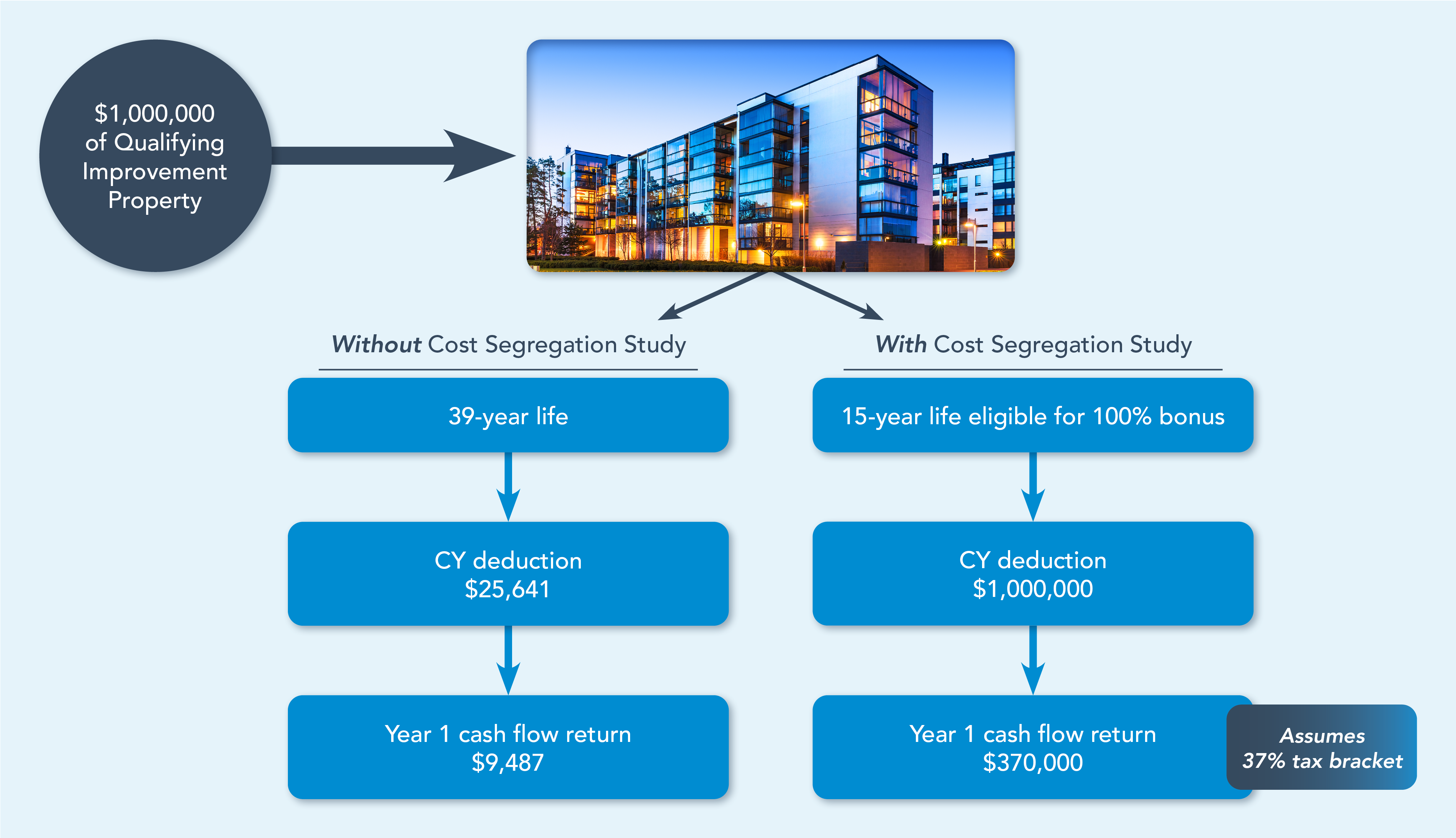

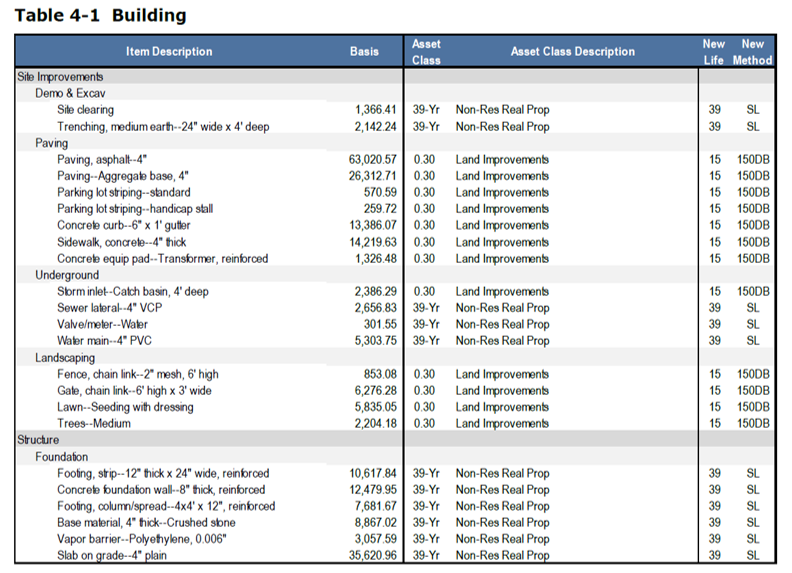

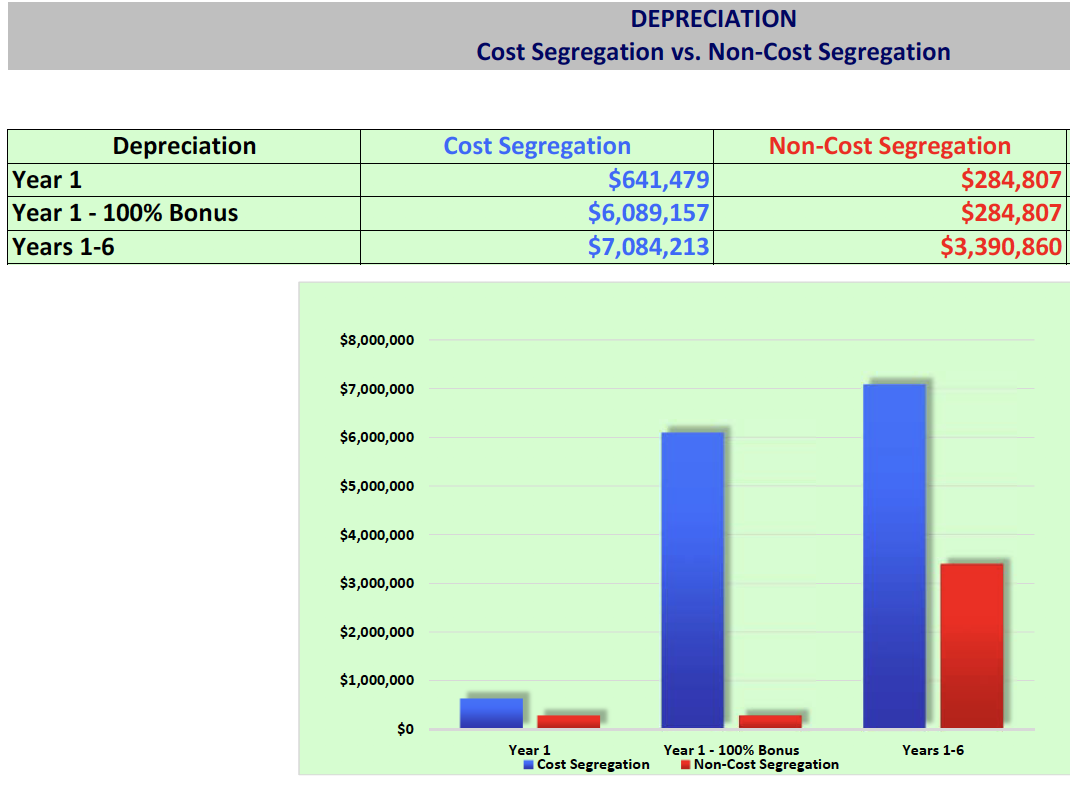

Cost Segregation Template - Web the residential cost segregator® is an online software program that allows cpa’s to generate custom reports in just minutes, providing tax benefits to clients without hiring a. Web how does cost segregation work? Web a cost segregation excel template enables a provider to more efficiently and effectively assign correct asset classes to various components of the building. We will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year. 100% bonus depreciation now available! Ad lower your tax liability and increase cash flow. What is a cost segregation study? $ (must be over $100,000) land allocation *: What is a cost segregation study? This process accelerated $392,321 of depreciation deductions for the client which. 100% bonus depreciation now available! $ (must be over $100,000) land allocation *: If a study costs $10,000 and yields a net present value benefit of $250,000, that’s a 25x return on investment. A building, termed § 1250 property, is. What is a cost segregation study? Web the below discussion and cost segregation study example outlines the benefits and importance of a cost segregation study. Web cost segregation form in excel. What is a cost segregation study? $ (must be over $100,000) land allocation *: A cost segregation study is. What is a cost segregation study? Web how does cost segregation work? A cost segregation study is. $ (must be over $100,000) land allocation *: If a study costs $10,000 and yields a net present value benefit of $250,000, that’s a 25x return on investment. Web a cost segregation excel template enables a provider to more efficiently and effectively assign correct asset classes to various components of the building. Web cost segregation studies are most commonly prepared for the allocation or reallocation of building costs to tangible personal property. Web the below discussion and cost segregation study example outlines the benefits and importance of a. Web the capstan standard cost segregation study (scss) is designed to aid commercial real estate owners in the united states. What is a cost segregation study? Web cost segregation is a tax deferral strategy that frontloads depreciation deductions for real estate assets into the early years of ownership. Ad lower your tax liability and increase cash flow. This process accelerated. Web the below discussion and cost segregation study example outlines the benefits and importance of a cost segregation study. Get powerful, streamlined insights into your company’s finances. Web a cost segregation study is an analysis of the costs associated with a property. As your building ages, depreciation occurs and decreases the value of your. (select one) basis of building/improvements: Get powerful, streamlined insights into your company’s finances. 43 views 10 days ago accounting trackers and templates. Web how does cost segregation work? Web a cost segregation study is an analysis of the costs associated with a property. A building, termed § 1250 property, is. Web the capstan standard cost segregation study (scss) is designed to aid commercial real estate owners in the united states. What is a cost segregation study? Web cost segregation form in excel. Web diy cost segregation study tips/tools/templates? As part of a 1031 exchange, i have purchased a handful of short term rental properties in the last few mos. Web how does cost segregation work? Web the capstan standard cost segregation study (scss) is designed to aid commercial real estate owners in the united states. Web cost segregation form in excel. Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation of their investment properties. (select one) basis of building/improvements: We will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year. Web cost segregation studies range from around $5 to $15,000. What is a cost segregation study? What is a cost segregation study? Web the below discussion and cost segregation study example outlines the benefits and importance. Web a cost segregation excel template enables a provider to more efficiently and effectively assign correct asset classes to various components of the building. Web cost segregation is a tax planning tool that gives real estate investors the chance to accelerate the depreciation of their investment properties. Web the capstan standard cost segregation study (scss) is designed to aid commercial real estate owners in the united states. Web cost segregation studies are most commonly prepared for the allocation or reallocation of building costs to tangible personal property. This process accelerated $392,321 of depreciation deductions for the client which. Web in this article, we offer a complete guide to cost segregation studies for multifamily real estate. Web how does cost segregation work? Web cost segregation studies range from around $5 to $15,000. Ad lower your tax liability and increase cash flow. If a study costs $10,000 and yields a net present value benefit of $250,000, that’s a 25x return on investment. Get powerful, streamlined insights into your company’s finances. (select one) basis of building/improvements: Web the residential cost segregator® is an online software program that allows cpa’s to generate custom reports in just minutes, providing tax benefits to clients without hiring a. What is a cost segregation study? Web the below discussion and cost segregation study example outlines the benefits and importance of a cost segregation study. A building, termed § 1250 property, is. 100% bonus depreciation now available! Under united states tax laws and accounting rules, cost segregation is the process of identifying personal property assets that are grouped with. We will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year. Web cost segregation is a tax deferral strategy that frontloads depreciation deductions for real estate assets into the early years of ownership.Cost segregation QIP flow chart Dean Dorton CPAs and Advisors

A visual guide to cost segregation CSH

Cost Segregation Study Tax Savings Paragon International

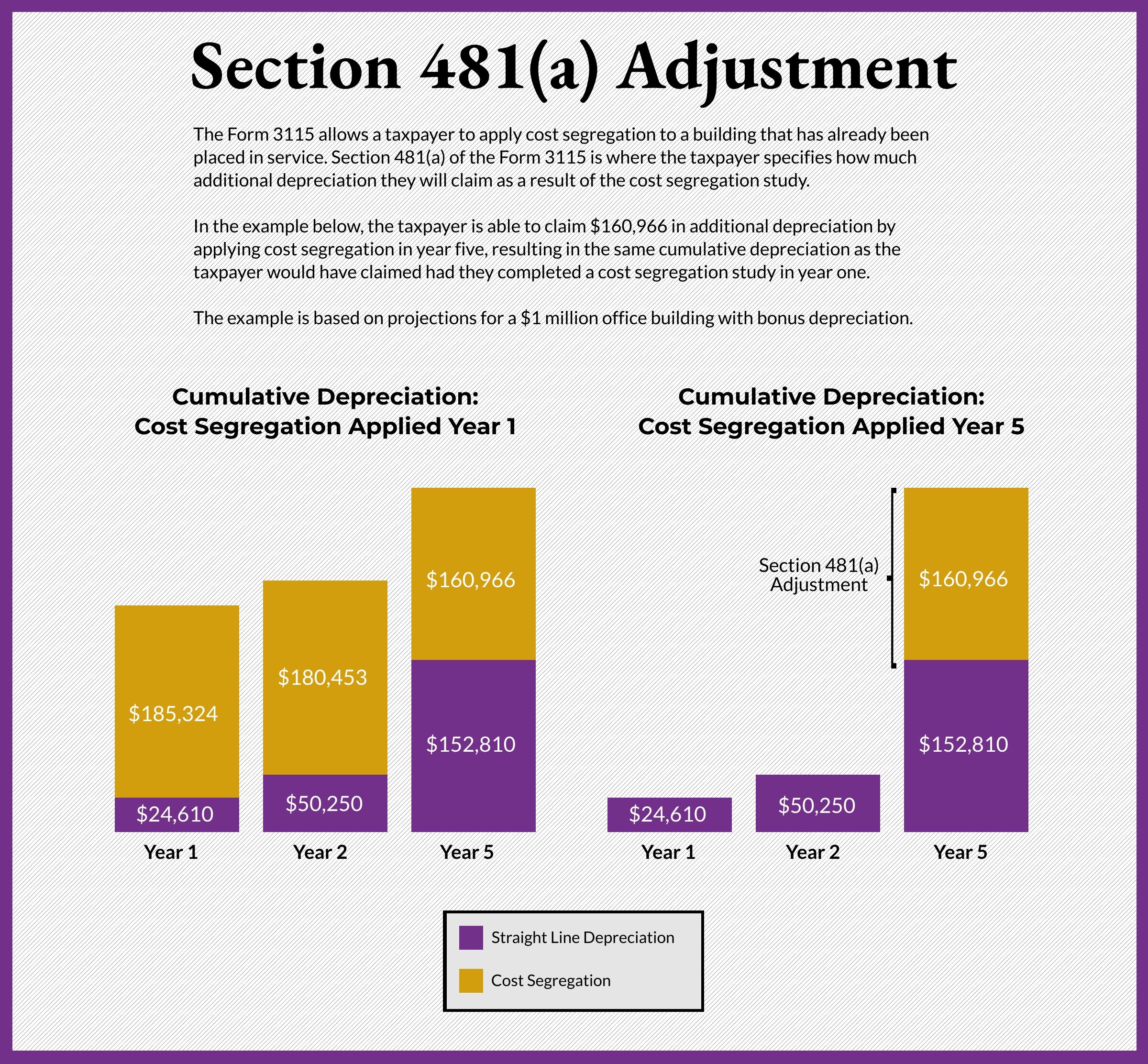

IRS Form 3115 How to Apply Cost Segregation to Existing Property

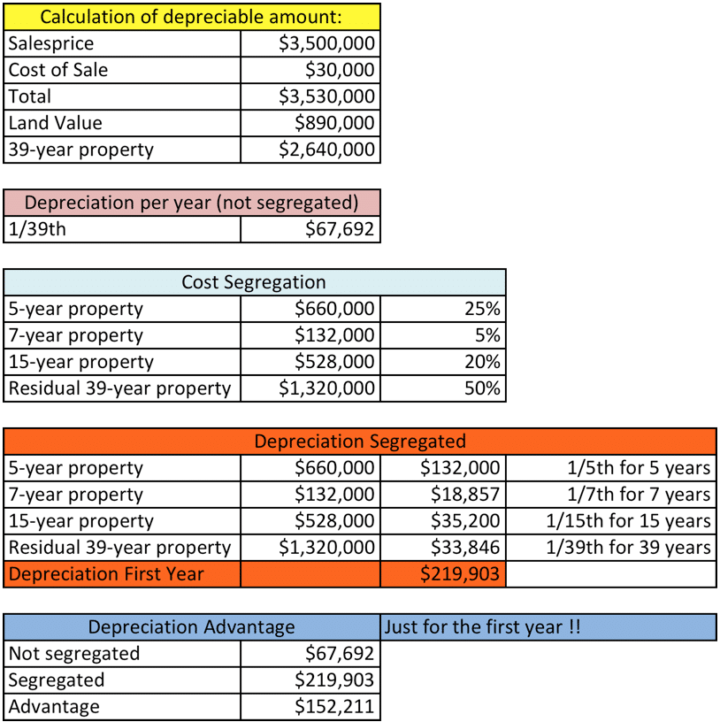

Simple Example of Cost Segregation Specializing in cost segregation

Cost Segregation Analysis Seals the Deal Staebler Real Estate

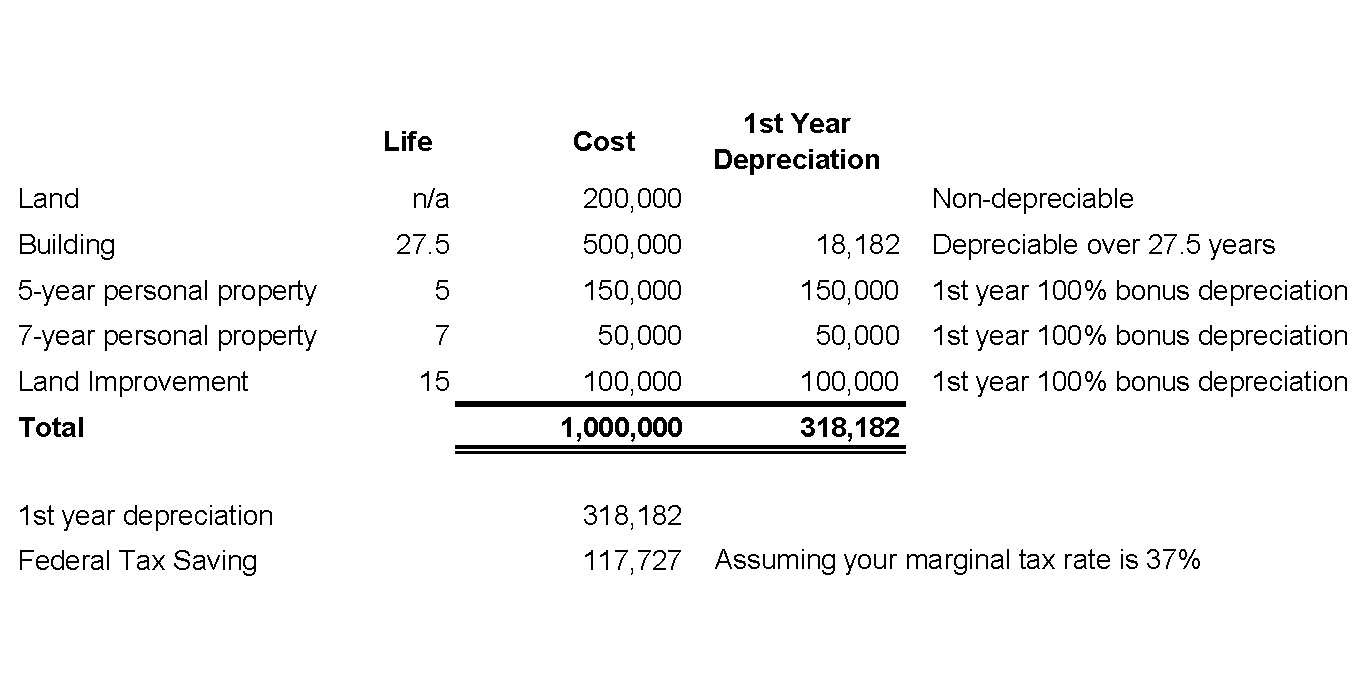

Cost Segregation Benefits for Real Estate Investors

Depreciation Strategy Using Cost Segregation Real Estate CPA

Cost Segregation Studies 5Fold Technical Consultants

Cost Segregation Excel Template

Related Post: