Compound Interest Excel Template

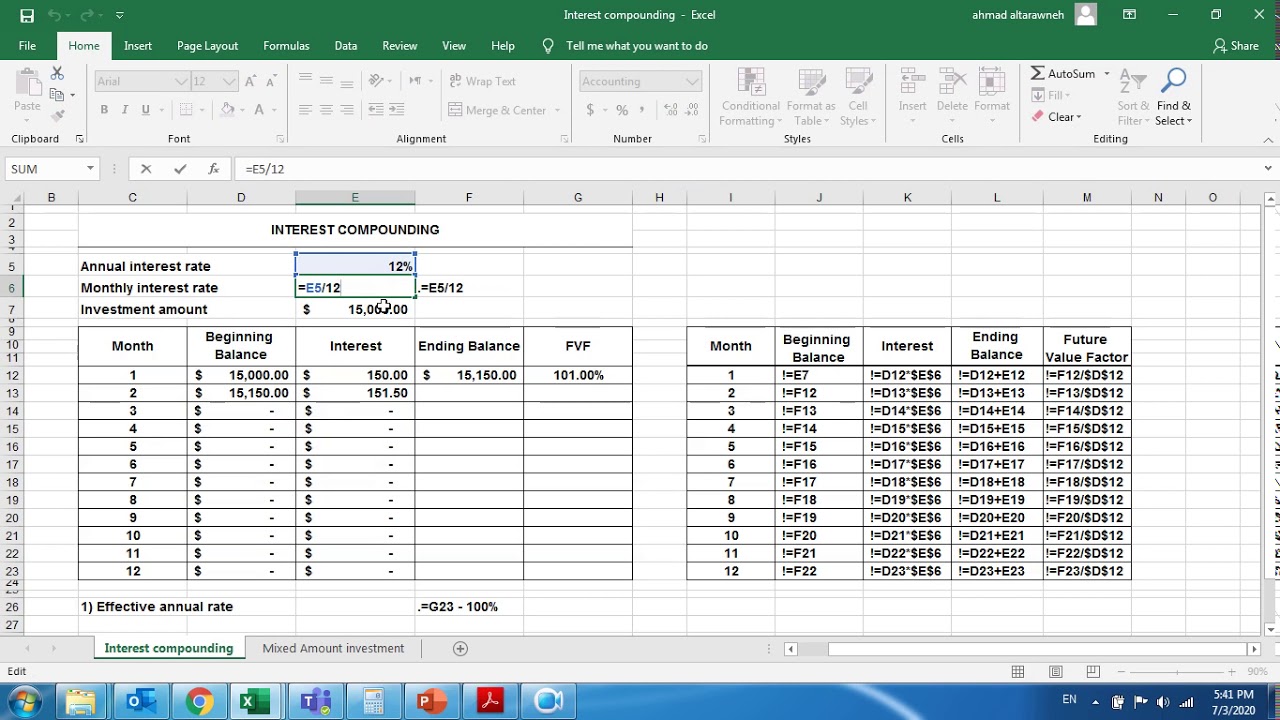

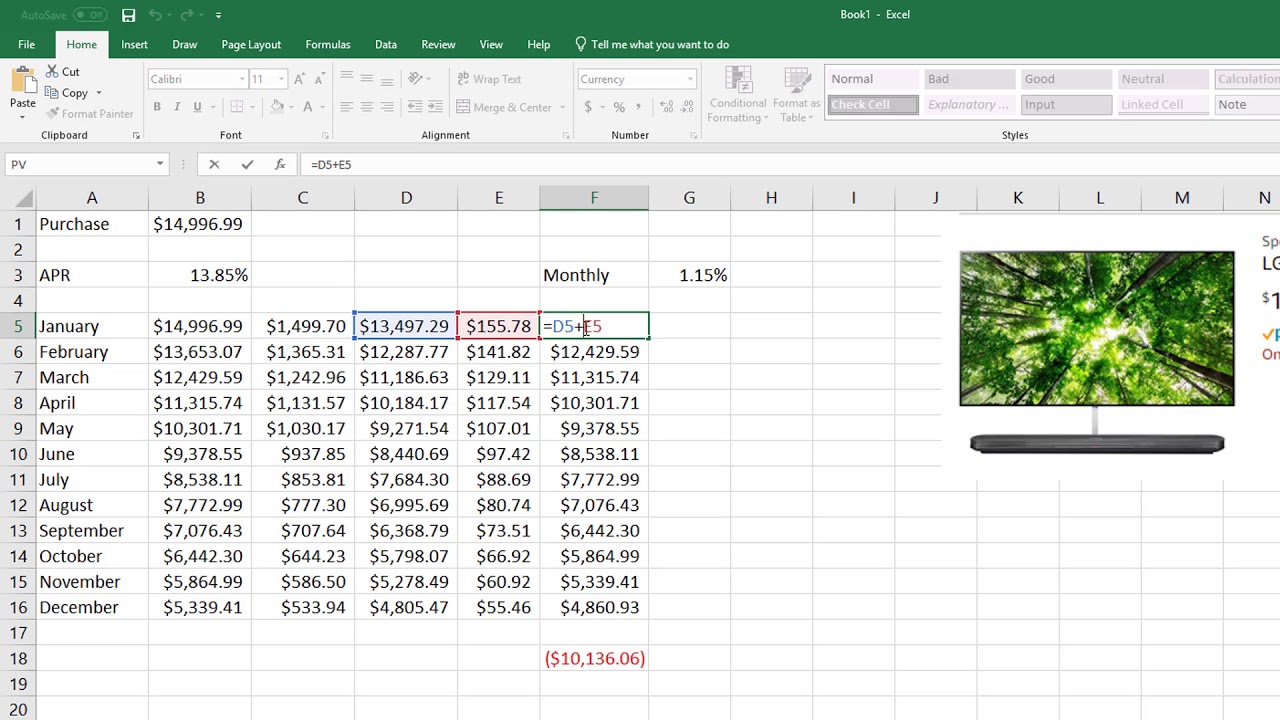

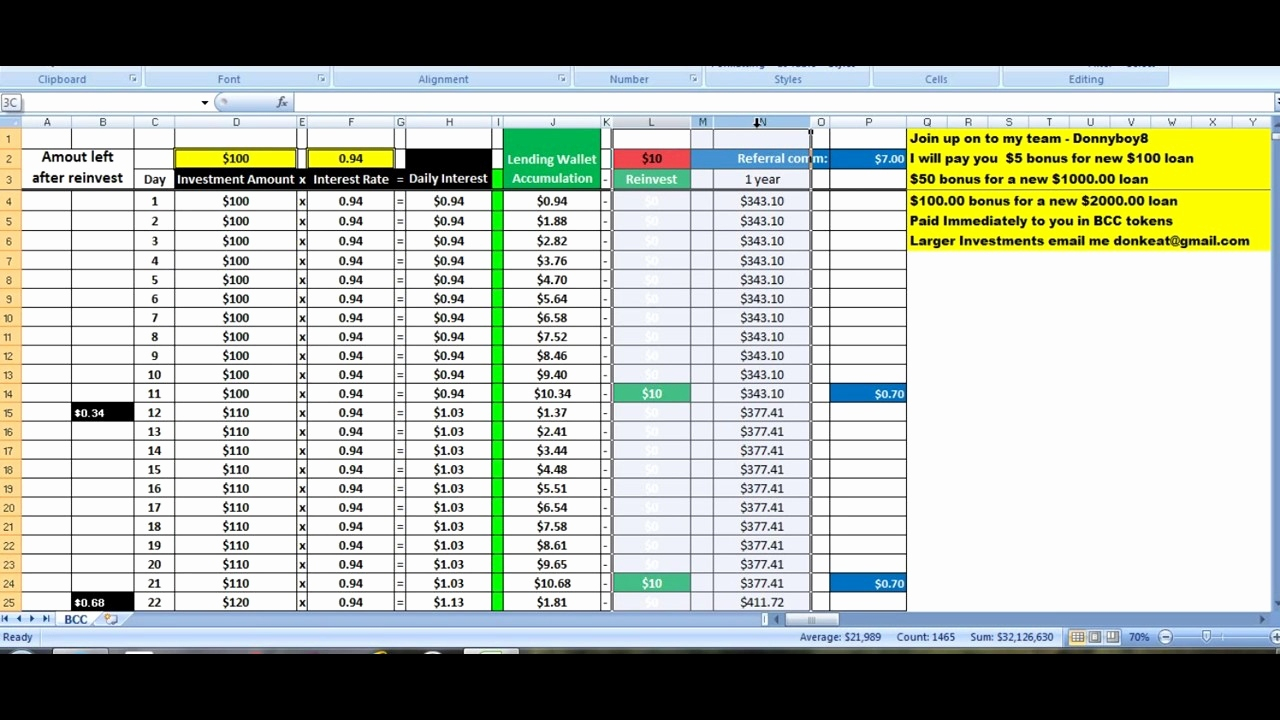

Compound Interest Excel Template - P (1+r/t) (n*t) here, t is the number of compounding periods in a year. Future value of investment with multiple compounding periods and inflation adjustments. Web the rate argument is the interest rate per period for the loan. A = p (1 + r/n)nt where: Web select the template and click create to use it. Web the formula for computing compound interests is: Web find out about compound interest and how to use the compounding interest formula in microsoft excel to calculate the compound interest on a loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. Interest=principal*rate*term so, using cell references, we have: In addition to that, the template also provides a complete schedule of payments. =b1 * 1.1 * 1.1 * 1.1 * 1.1 * 1.1 or =b1* (1.1)^5 so here is the formula for calculating the value of your investment when compound interest in used: Future value of investment with multiple compounding periods and inflation adjustments. All we have to do is to select the correct cell references. Web by svetlana cheusheva, updated on. =b1 * 1.1 * 1.1 * 1.1 * 1.1 * 1.1 or =b1* (1.1)^5 so here is the formula for calculating the value of your investment when compound interest in used: Web how to calculate monthly compound interest in excel we can use the following formula to find the ending value of some investment after a certain amount of time:. Assume you put $100 into a bank. You'll see a tool tip in the top left corner of the sheet as well as when you select the cells containing the loan details at the top. Number of compounding periods per year t: Web select the template and click create to use it. Daily compound interest formula in excel suppose we. Daily compound interest formula in excel suppose we invest $5,000 into an investment that compounds at a rate of 6% annually. This example assumes that $1000 is invested for 10 years at an annual interest rate of 5%, compounded monthly. Future value of investment with multiple compounding periods and inflation adjustments. This means we can further generalize the compound interest. How much will your investment be worth after 1 year at an annual interest rate of 8%? P = initial principal k = annual interest rate paid m = number of times per period (typically months) the interest is compounded n = number of periods (typically years) or term of the loan examples Web find out about compound interest and. This means we can further generalize the compound interest formula to: Let's try the compound interest formula first: In addition to that, the template also provides a complete schedule of payments. Web a = p (1 + r/365)365t the following example shows how to use this formula in excel to calculate the ending value of some investment that has been. P = initial principal k = annual interest rate paid m = number of times per period (typically months) the interest is compounded n = number of periods (typically years) or term of the loan examples Number of compounding periods per year t: How much will your investment be worth after 1 year at an annual interest rate of 8%?. Web find out about compound interest and how to use the compounding interest formula in microsoft excel to calculate the compound interest on a loan. If interest is compounded quarterly, then t =4. Now this interest ($8) will also earn interest (compound interest) next year. This means we can further generalize the compound interest formula to: Value of multiple payment. The schedule has sample data that you can simply replace. Future value of investment with multiple compounding periods and inflation adjustments. Let's try the compound interest formula first: Web find out about compound interest and how to use the compounding interest formula in microsoft excel to calculate the compound interest on a loan. How much will your investment be worth. A = p (1 + r/n)nt where: Web by svetlana cheusheva, updated on march 22, 2023 the tutorial explains the compound interest formula for excel and provides examples of how to calculate the future value of the investment at annual, monthly or daily compounding interest rate. Value of multiple payment investment with single/multiple compounding periods. We can calculate monthly, weekly,. In addition to that, the template also provides a complete schedule of payments. All we have to do is to select the correct cell references. Web to calculate compound interest in excel, you can use the fv function. Web the effect function returns the compounded interest rate based on the annual interest rate and the number of compounding periods per year. The pv or present value argument is 5400. Interest=principal*rate*term so, using cell references, we have: Web kasper langmann, microsoft office specialist let’s calculate the interest compounded annually for the below data using the formula. Value of multiple payment investment with single/multiple compounding periods. P (1+r/t) (n*t) here, t is the number of compounding periods in a year. Value of single payment investment with single/multiple compounding periods. How much will your investment be worth after 2 years at an annual interest rate of 8%? In excel, enter the general compound interest formula. Number of compounding periods per year t: The table is based on the payment frequency and shows the amount of interest added each period. Web the rate argument is the interest rate per period for the loan. Web a = p (1 + r/365)365t the following example shows how to use this formula in excel to calculate the ending value of some investment that has been compounded daily. You will also find the detailed steps to create your own excel compound interest calculator. =b1 * 1.1 * 1.1 * 1.1 * 1.1 * 1.1 or =b1* (1.1)^5 so here is the formula for calculating the value of your investment when compound interest in used: Web =p* (1+ (k/m))^ (m*n) where the following is true: The schedule has sample data that you can simply replace.Interest compounding By using Microsoft Excel YouTube

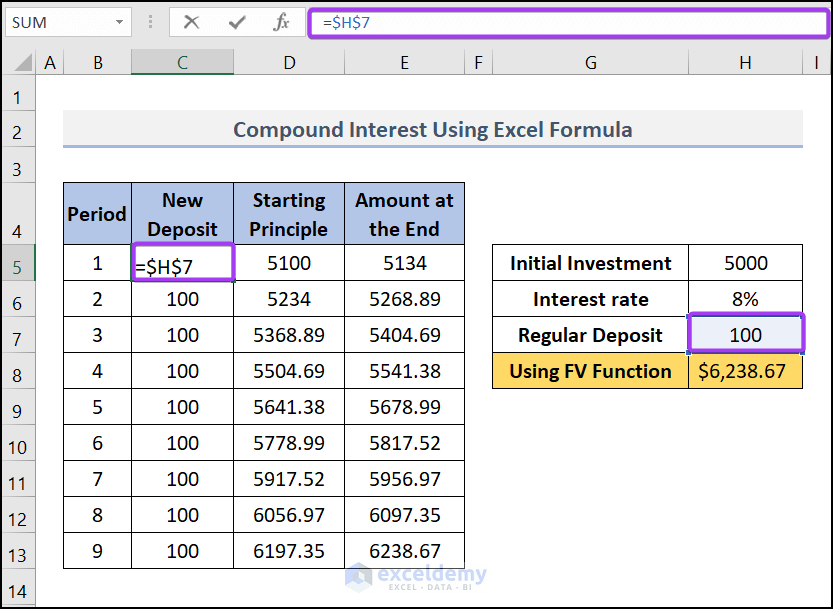

Excel Formula to Calculate Compound Interest with Regular Deposits

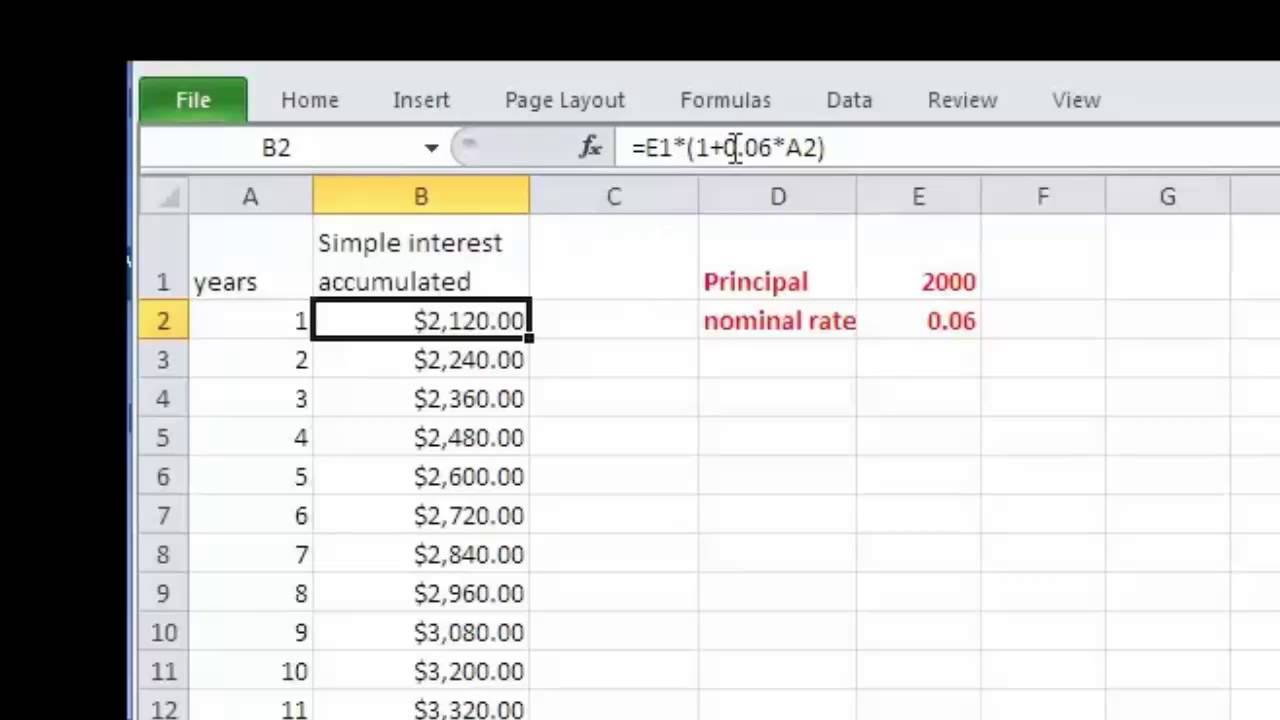

Finance Basics 2 Compound Interest in Excel YouTube

Simple and Compound Interest Schedules in Excel Part I YouTube

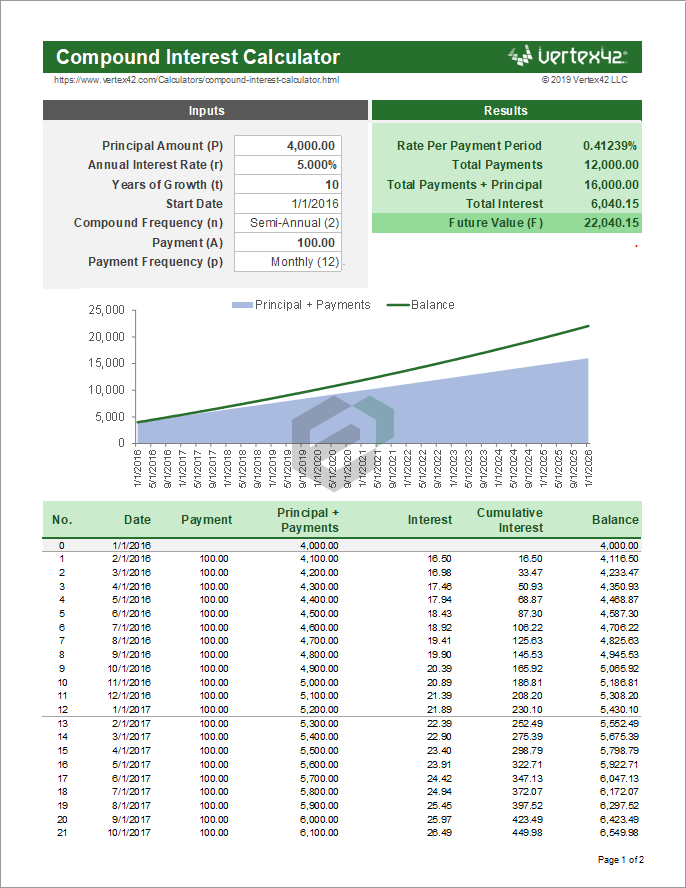

Compound Interest Calculator Template in Excel & Spreadsheet

Compound Interest Using Excel YouTube

Excel Compound Interest Calculator Etsy

How to Make a Compound Interest Calculator in Microsoft Excel by

Compound Interest Spreadsheet within Compound Interest Calculator Excel

Calculate compound interest Excel formula Exceljet

Related Post: