Collection Agency Dispute Letter Template

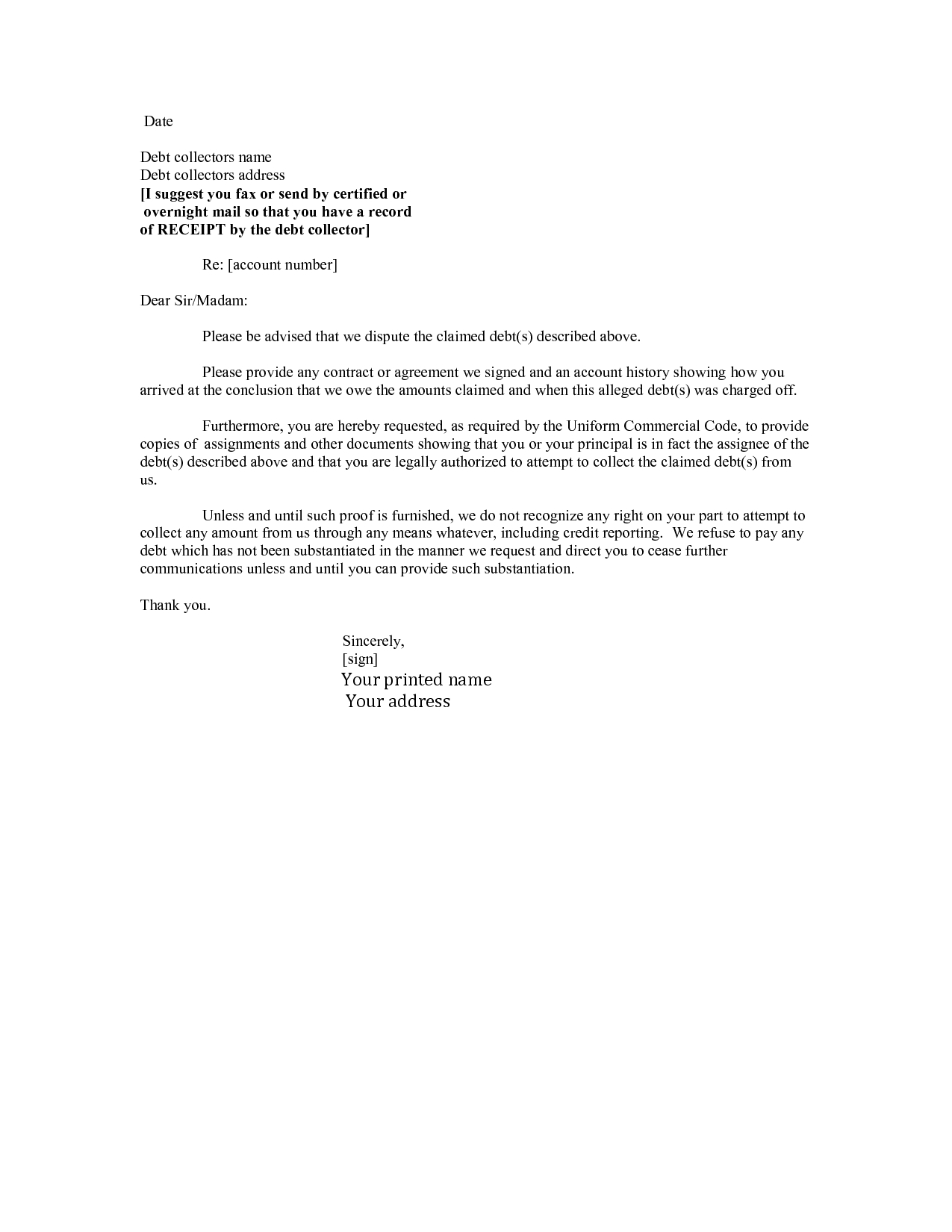

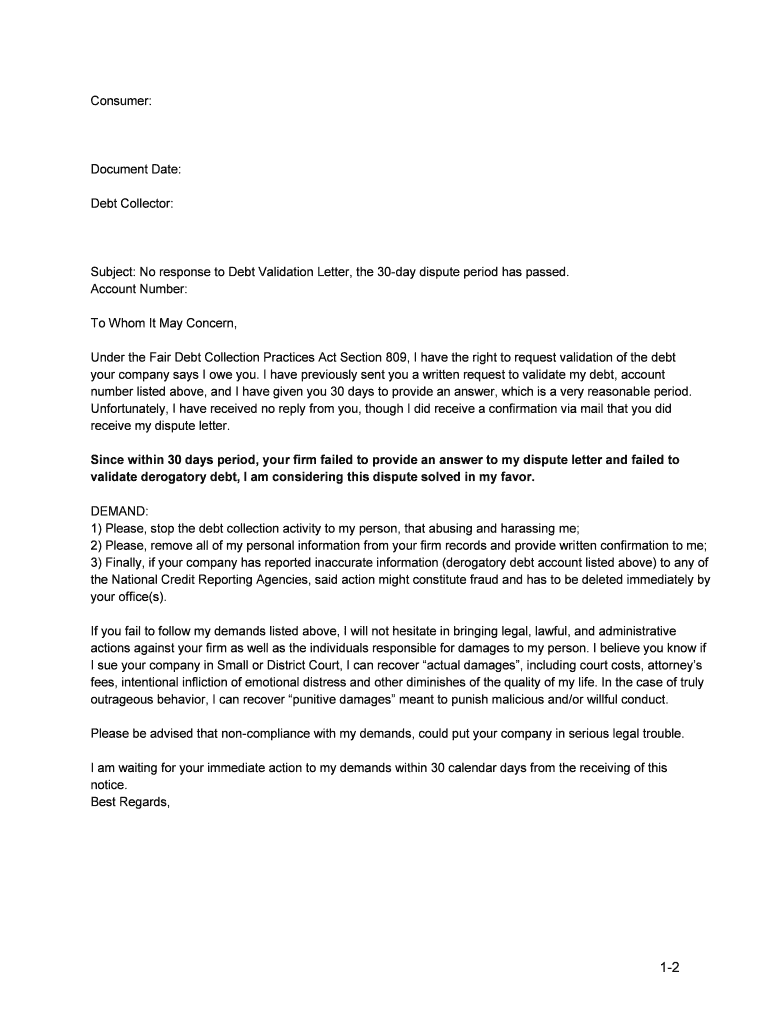

Collection Agency Dispute Letter Template - Do not discuss the debt with anyone who calls, texts, emails or otherwise contacts you. Disputing a debt with a collection agency. It is a strategic tool that. Web tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. That you can dispute the debt and that if you don’t dispute the debt within 30 days the debt collector will assume the. Verification or copy of any judgment (if. The full name and mailing address of the original creditor for this alleged debt; Dear {insert name of collector or company},. [date] [collection agency name] [collection agency address] [re: Web some instructions and tips to write the dispute letter to a collection agency : A business format should used and in the top corner write your address and the date. Web respectfully request that you provide me with the following: Web tell us about your issue—we'll forward it to the company and work to get you a response, generally. Curate a dispute letter to the collections agency or your creditor. Web writing a letter to the credit bureaus or a debt collection agency can be daunting. Documentation showing you have verified. Remember, a dispute letter is not just a means of expressing your frustration or dissatisfaction with the collection agency. Answer a few questions and your document is created. Documentation showing you have verified. [date] [collection agency name] [collection agency address] [re: If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Dear {insert name of collector or company},. Web tell us about your issue—we'll forward it to the company and work to get you a. Start by clicking on fill out the template 2. Web tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days. That you can dispute the debt and that if you don’t dispute the debt within 30 days the debt collector will assume the. Web when a debt collector first. The full name and mailing address of the original creditor for this alleged debt; Documentation showing you have verified. Web sample dispute letter to debt collector. Web sample letters to dispute information on a credit report. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. It is a strategic tool that. Web respectfully request that you provide me with the following: Web draft a debt collection dispute letter: This form is to be used when a collection company is. Start by clicking on fill out the template 2. Web some instructions and tips to write the dispute letter to a collection agency : Remember, a dispute letter is not just a means of expressing your frustration or dissatisfaction with the collection agency. Your account number, if known]. Web respectfully request that you provide me with the following: A business format should used and in the top corner write. Curate a dispute letter to the collections agency or your creditor. Documentation showing you have verified. These blog posts represent the opinion of donotpay’s writers, but each person’s situation and circumstances vary. Disputing a debt with a collection agency. Web here’s what you do: Web tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days. Do not discuss the debt with anyone who calls, texts, emails or otherwise contacts you. Web initial debt collection dispute letter. Web some instructions and tips to write the dispute letter to a collection agency : Web the. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. The amount of the alleged debt; Web the name of the creditor. Your account number, if known]. A business format should used and in the top corner write your address and the date. These blog posts represent the opinion of donotpay’s writers, but each person’s situation and circumstances vary. Documentation showing you have verified. Web tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days. We’ve gathered all of our sample letter templates, as well as writing tips to help you. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that. Do not discuss the debt with anyone who calls, texts, emails or otherwise contacts you. Answer a few questions and your document is created. Web some instructions and tips to write the dispute letter to a collection agency : Web draft a debt collection dispute letter: Disputing a debt with a collection agency. Web if errors are found, gather evidence to support your claim. The amount of the alleged debt; Understand how debt collection works, what. The name of the creditor to whom the debt is owed; Curate a dispute letter to the collections agency or your creditor. Verification or copy of any judgment (if. It is a strategic tool that. Web respectfully request that you provide me with the following: Web here’s what you do: Mention the inaccuracies and errors with evidence.FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

How To Write A Letter Of Dispute To Collection Agency Amadio Hand

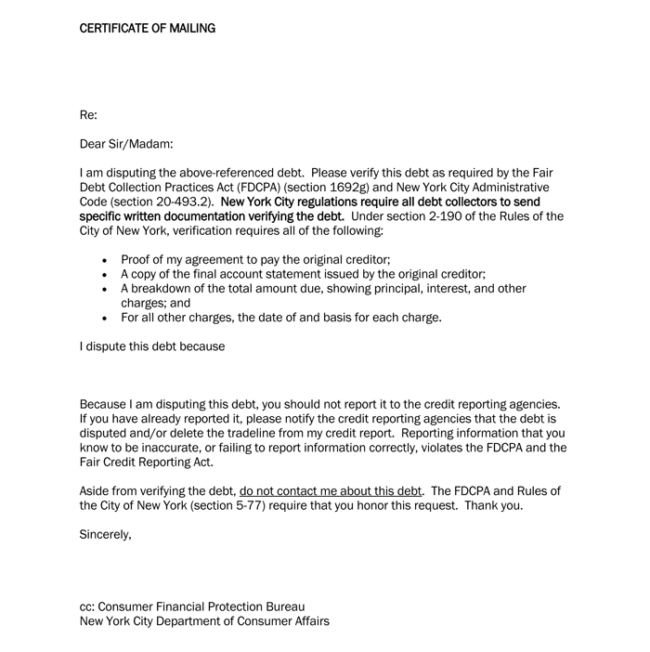

Sample Debt Dispute Letter Collection Letter Template Collection

Charge Off Dispute Letter Template Collection Letter Template Collection

Collection Dispute Letter The form letter below will help you dispute

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Debt Dispute Letter Template Fill Online, Printable, Fillable, Blank

Dispute Letter To Collection Agency Luxury Cease And Desist Intended

35+ Sample Letter Disputing Debt To Collection Agency Cecilprax

40+ Sample Letter Dispute Debt Collection Agency Cecilprax

Related Post: