Cecl Policy Template

Cecl Policy Template - Web current expected credit losses policy. Cecl becomes effective for federally insured credit unions for financial reporting years. Web interagency policy statement on allowances for credit losses (revised april 2023) describes the measurement of expected credit losses under the cecl. The financial accounting standards board (fasb) announced in 2016 a new accounting standard introducing the current expected credit loss, or cecl, methodology for estimating allowances for credit losses. Web the policy statement. Enabling technology understanding the existing. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. This current expected credit losses policy template (cecl policy template) is for a bank, credit union, fintech. The current expected credit loss (cecl) model under accounting. First, it is effective when each institution adopts cecl. The measurement of expected credit losses under the cecl methodology is applicable to financial assets. Web the scale tool, also developed by the federal reserve, is a template that smaller community banks with total assets of less than $1 billion can use if they wish to use the. Insights on implementing the cecl model. Web the booklet provides bankers and. The current expected credit loss (cecl) model under accounting. Web the scale tool, also developed by the federal reserve, is a template that smaller community banks with total assets of less than $1 billion can use if they wish to use the. Web the policy statement. Web referred to as the current expected credit loss (cecl) methodology. Web francisco covas. First, it is effective when each institution adopts cecl. Web 27 rows bank protection act policy. Web policies and procedures in place to articulate the expectations of the cecl model and ongoing execution of the model. The financial accounting standards board (fasb) announced in 2016 a new accounting standard introducing the current expected credit loss, or cecl, methodology for estimating. Web current expected credit loss policy. The measurement of expected credit losses under the cecl methodology is applicable to financial assets. Web interagency policy statement on allowances for credit losses (revised april 2023) describes the measurement of expected credit losses under the cecl. This current expected credit losses policy template (cecl policy template) is for a bank, credit union, fintech.. First, it is effective when each institution adopts cecl. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. Enabling technology understanding the existing. Cecl becomes effective for federally insured credit unions for financial reporting years. Designed to maintain an adequate methodology for complying with cecl. The financial accounting standards board (fasb) announced in 2016 a new accounting standard introducing the current expected credit loss, or cecl, methodology for estimating allowances for credit losses. Web current expected credit loss policy. Web francisco covas and gonzalo fernandez dionis. Designed to maintain an adequate methodology for complying with cecl. The policy statement does a couple of things. Web francisco covas and gonzalo fernandez dionis. Web current expected credit losses policy. Web the scale tool, also developed by the federal reserve, is a template that smaller community banks with total assets of less than $1 billion can use if they wish to use the. Web if your credit union adopts cecl on january 1, 2023, then the march. The policy statement does a couple of things. Web current expected credit losses policy. Web if your credit union adopts cecl on january 1, 2023, then the march 2023 call report cycle will be the first cycle to report the implementation of cecl. Web 27 rows bank protection act policy. Provides the requirements of the regulatory agencies and covers all. First, it is effective when each institution adopts cecl. Web referred to as the current expected credit loss (cecl) methodology. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. The measurement of expected credit losses under the cecl methodology is applicable to financial assets. Insights on implementing the cecl model. Web the scale tool, also developed by the federal reserve, is a template that smaller community banks with total assets of less than $1 billion can use if they wish to use the. Web 27 rows bank protection act policy. This current expected credit losses policy template (cecl policy template) is for a bank, credit union, fintech. Web current expected. In this note, we examine the impact of the current expected credit loss (cecl) standard on loan. The current expected credit loss (cecl) model under accounting. Web policies and procedures in place to articulate the expectations of the cecl model and ongoing execution of the model. Web current expected credit losses policy. Insights on implementing the cecl model. Web 27 rows bank protection act policy. Web current expected credit loss (cecl) is finally here. Web referred to as the current expected credit loss (cecl) methodology. Web the scale tool, also developed by the federal reserve, is a template that smaller community banks with total assets of less than $1 billion can use if they wish to use the. The measurement of expected credit losses under the cecl methodology is applicable to financial assets. Enabling technology understanding the existing. Web cecl and regulatory capital • regulatory capital. Provides the requirements of the regulatory agencies and covers all aspects of bank security, including designation of a security officer,. Web the new accounting standard introduces the current expected credit losses methodology (cecl) for estimating allowances for credit losses. The policy statement does a couple of things. Web the booklet provides bankers and examiners with information about the scope of the current expected credit losses (cecl) accounting methodology, risks. The federal reserve board (frb) has updated reporting requirements to address cecl and broader credit. Web if your credit union adopts cecl on january 1, 2023, then the march 2023 call report cycle will be the first cycle to report the implementation of cecl. The financial accounting standards board (fasb) announced in 2016 a new accounting standard introducing the current expected credit loss, or cecl, methodology for estimating allowances for credit losses. This current expected credit losses policy template (cecl policy template) is for a bank, credit union, fintech.50 Free Policy And Procedure Templates (& Manuals) ᐅ TemplateLab

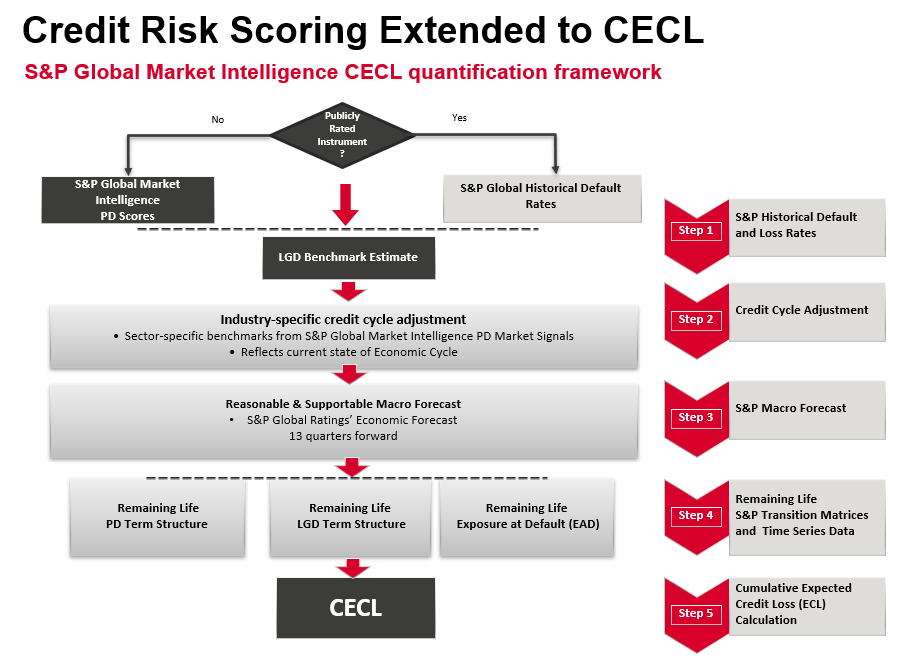

CECL Scorecard S&P Global Market Intelligence

Security Policy Template by BusinessinaBox™

Booking Cancellation Policy Template

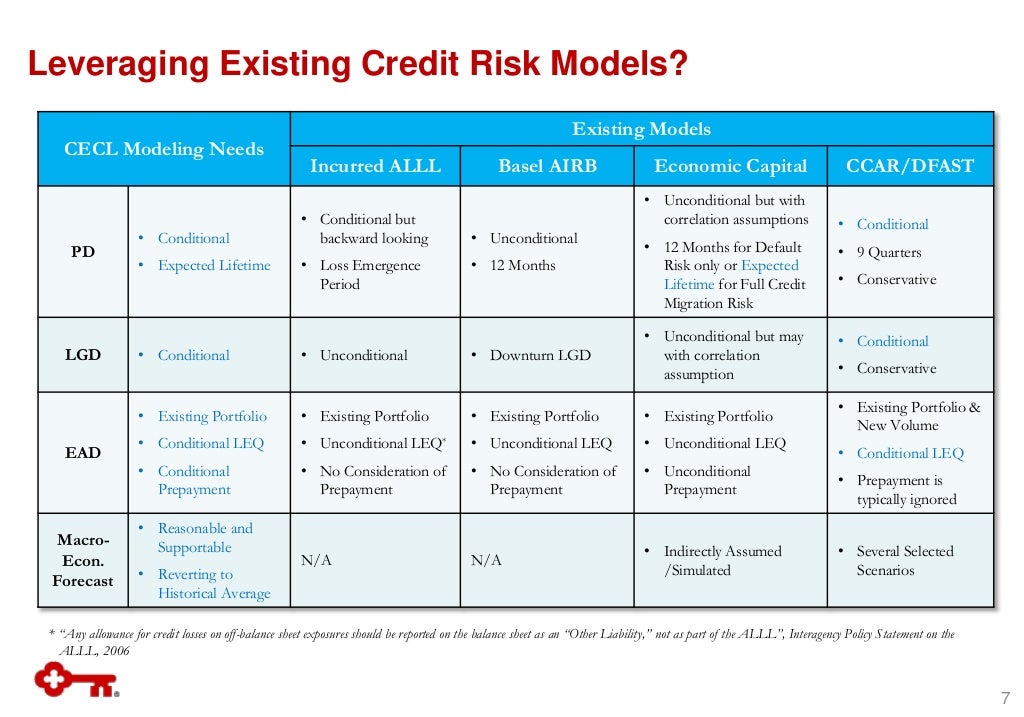

The Impacts of CECL on Modeling and Risk Management

Best Practice CECL Policy Guide Download Now

Addictionary

CECL Interagency Policy Statement on Allowance for Credit Losses

NCUA takes steps to blunt CECL's immediate impact on credit unions

CECL Plansmith Software and Expertise for Banks and Credit Unions

Related Post: