Business Mileage Log Template

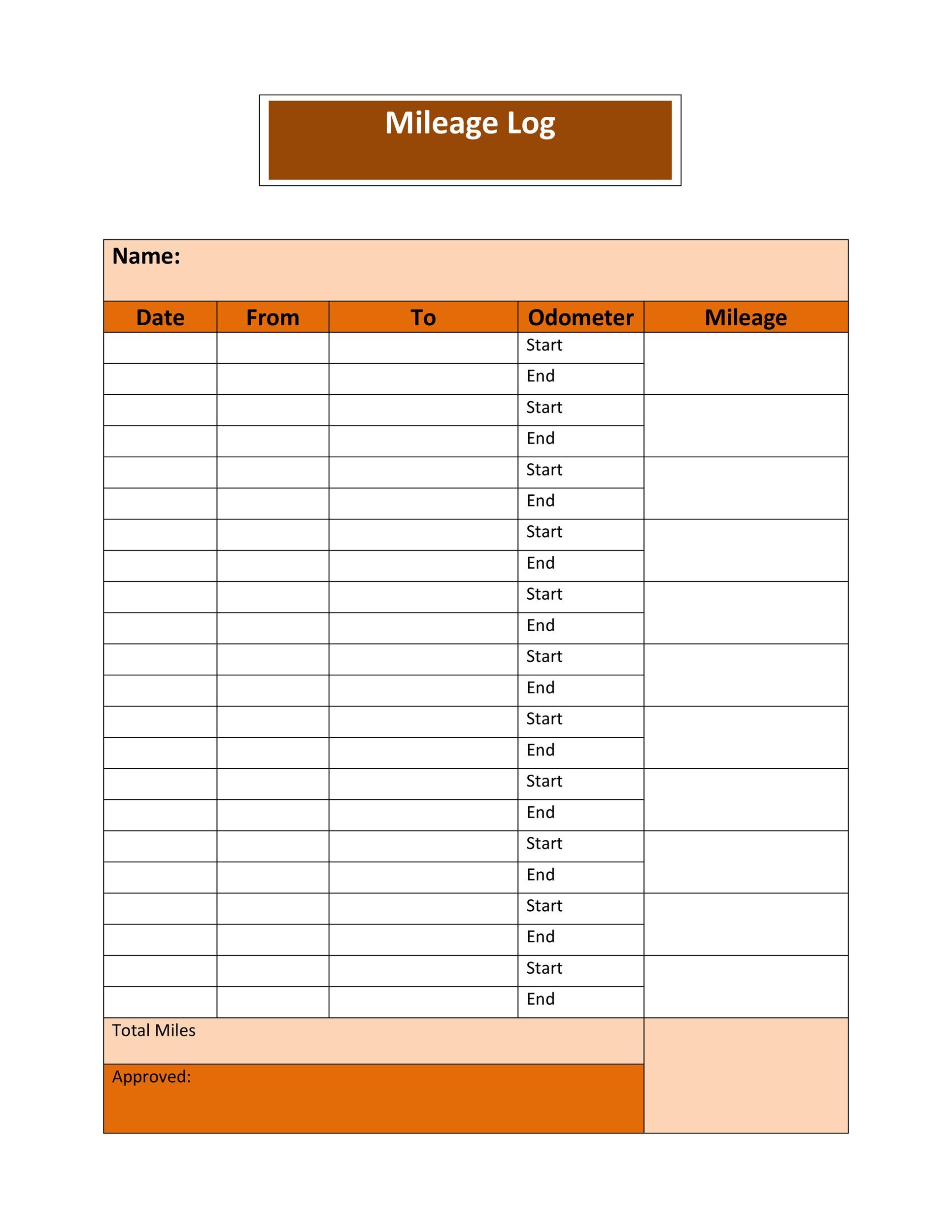

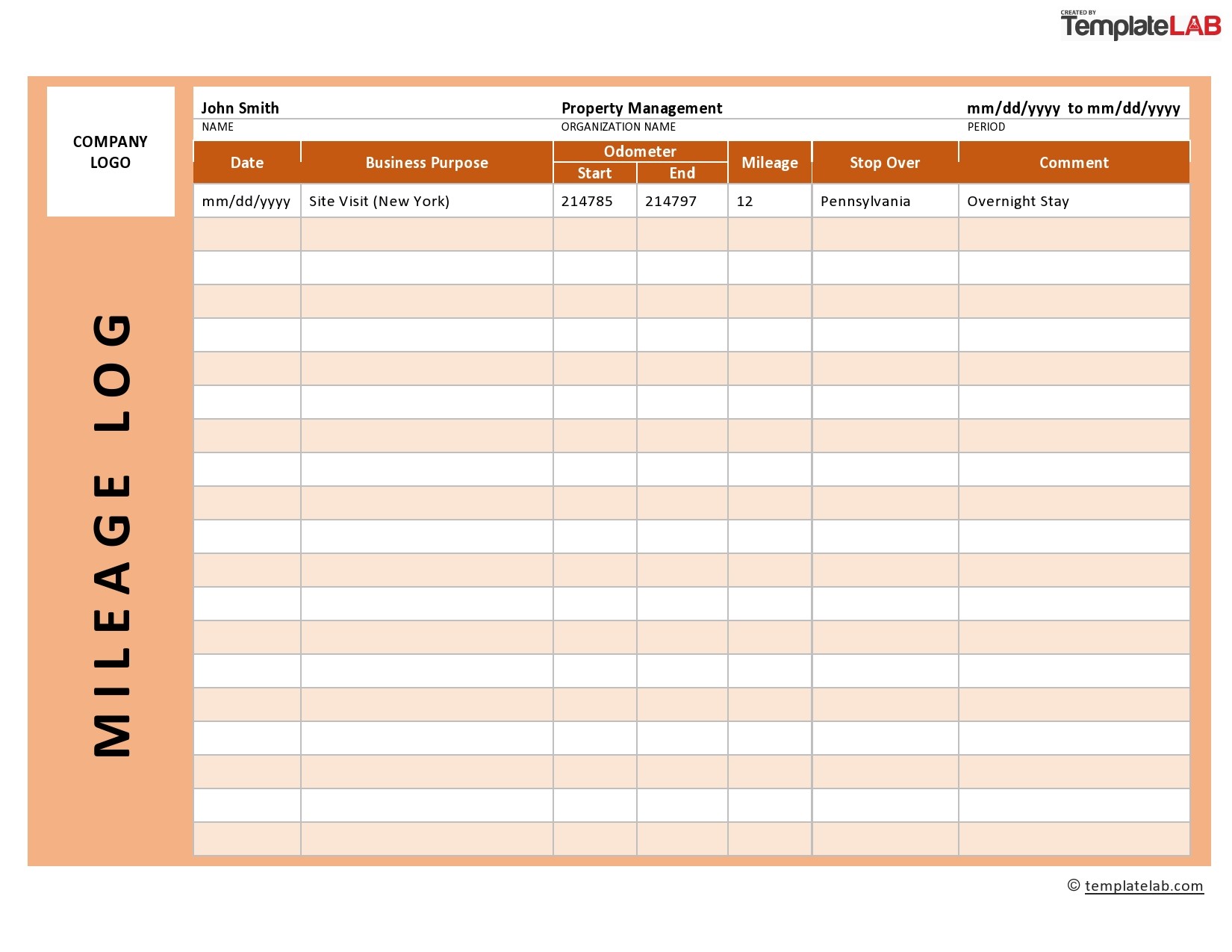

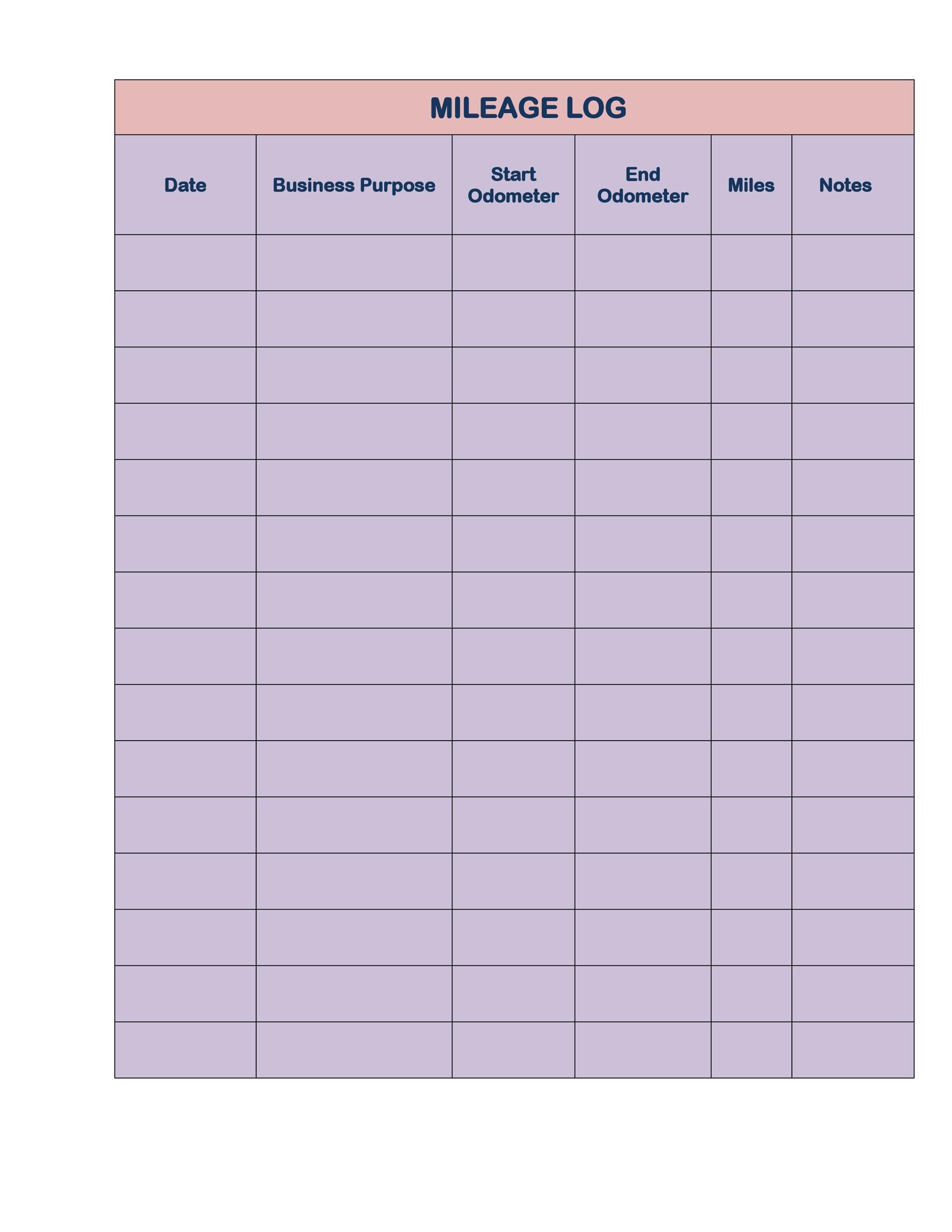

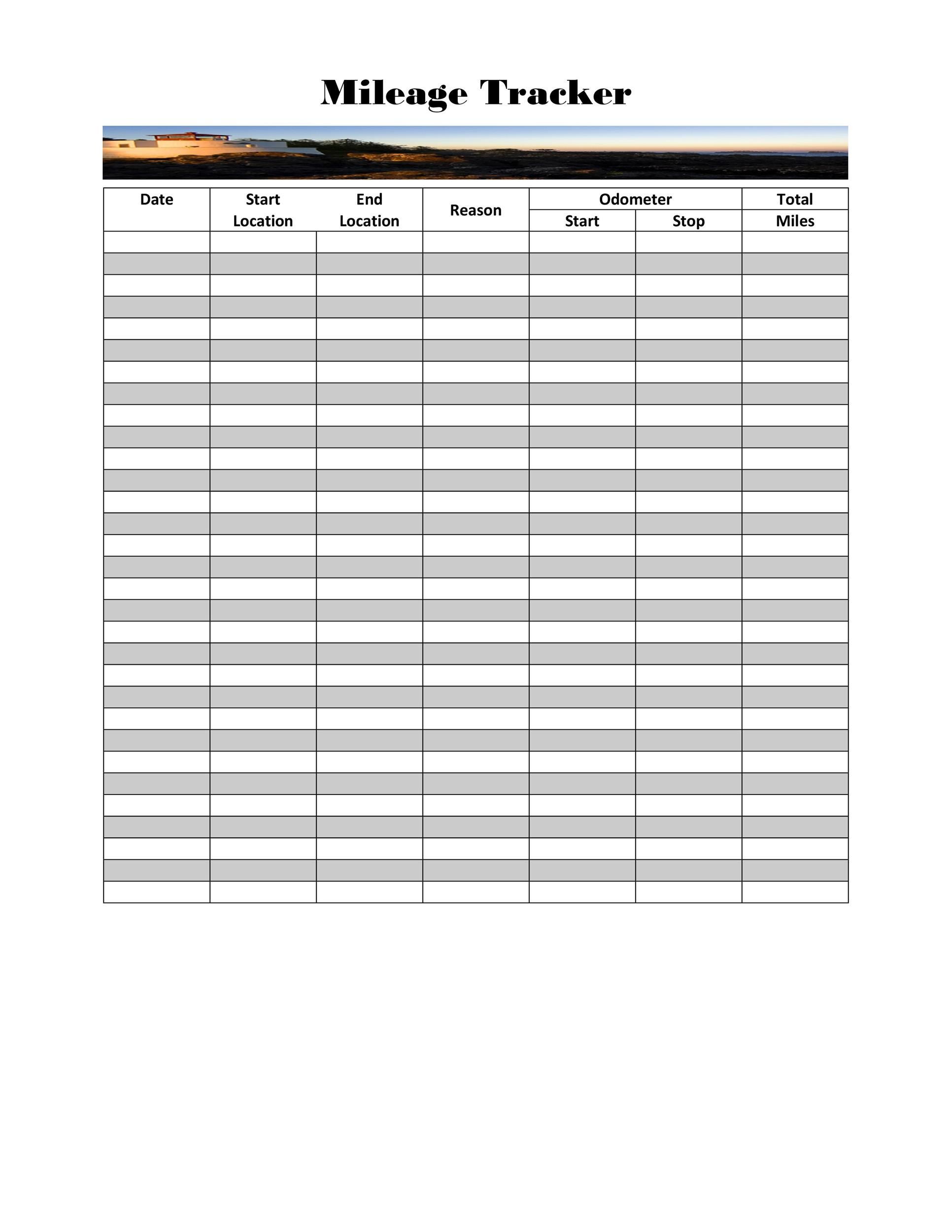

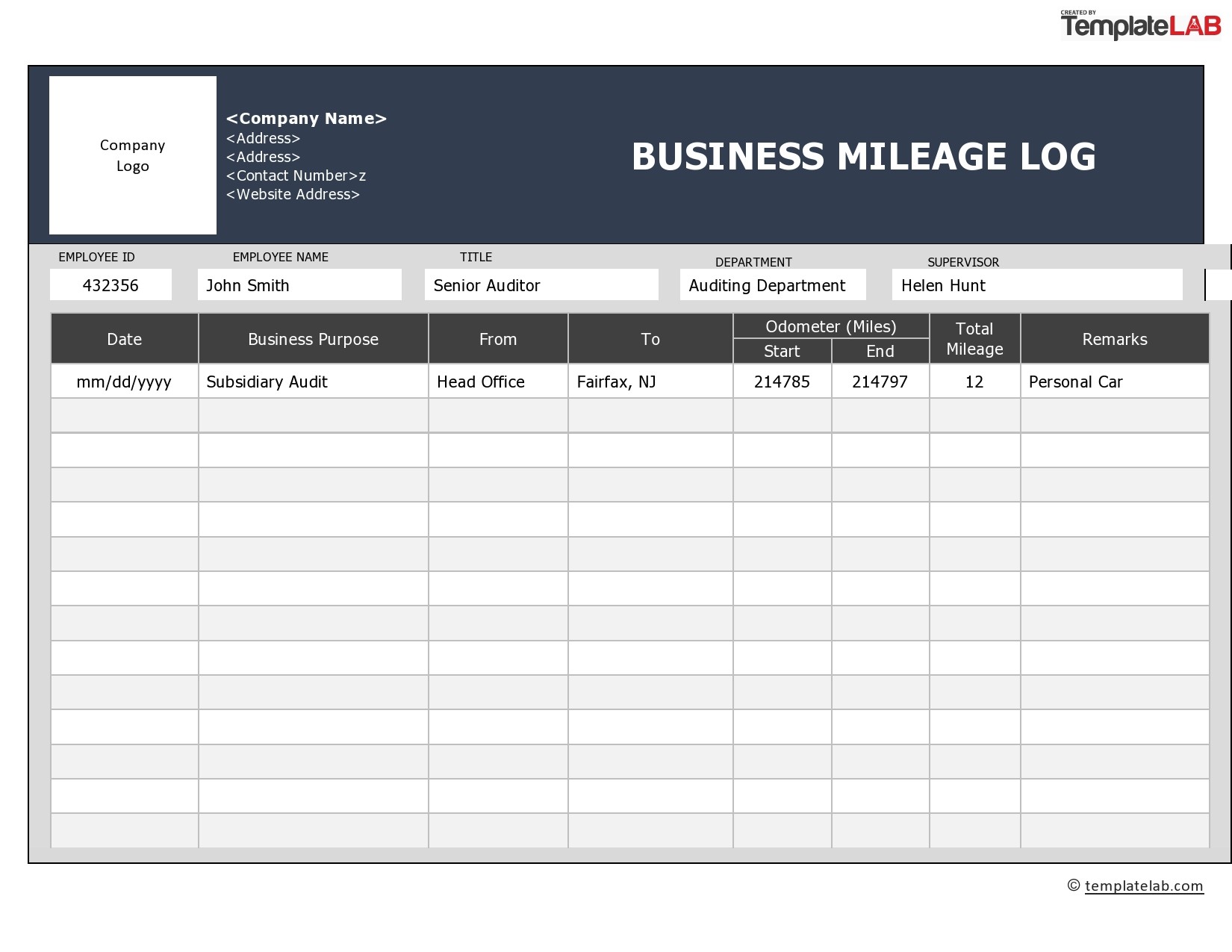

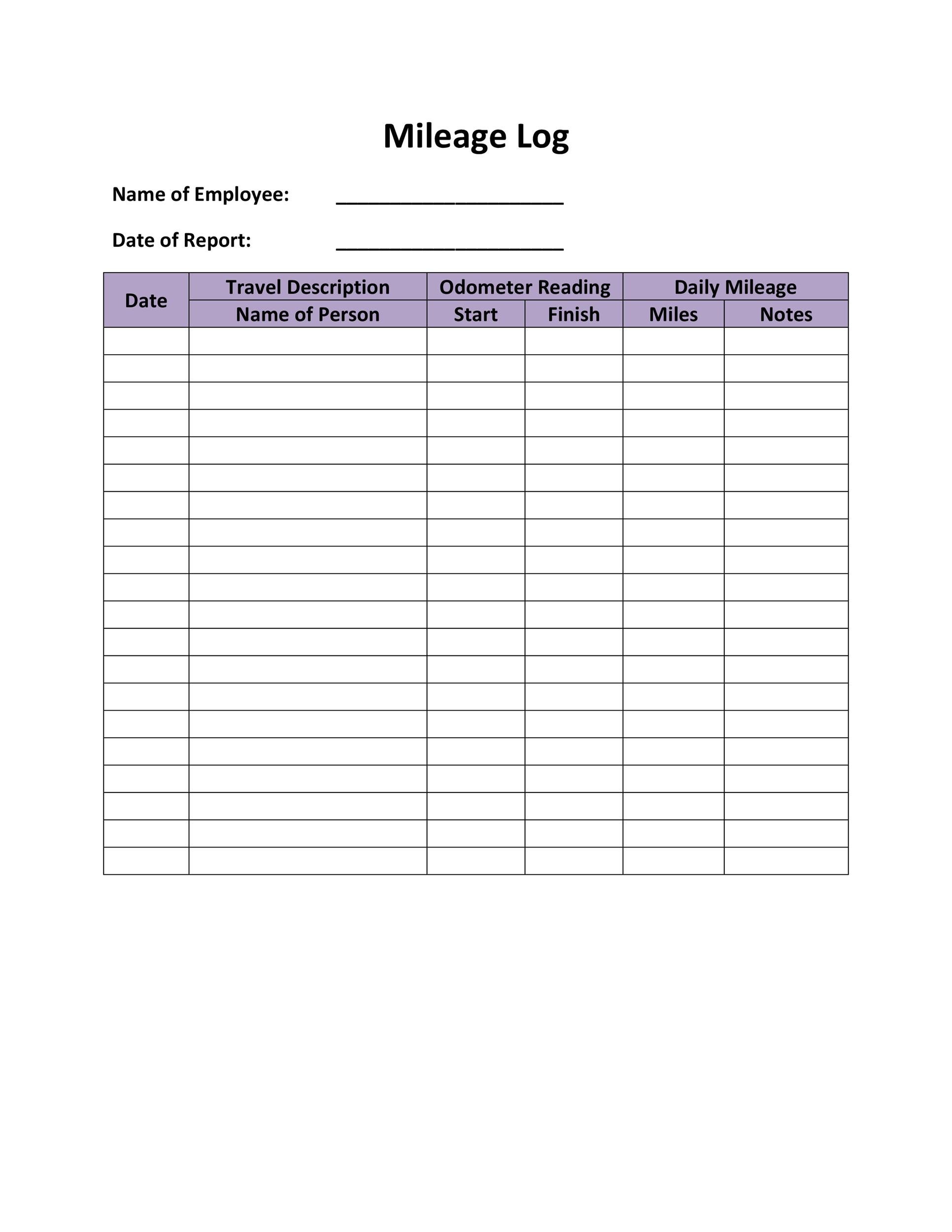

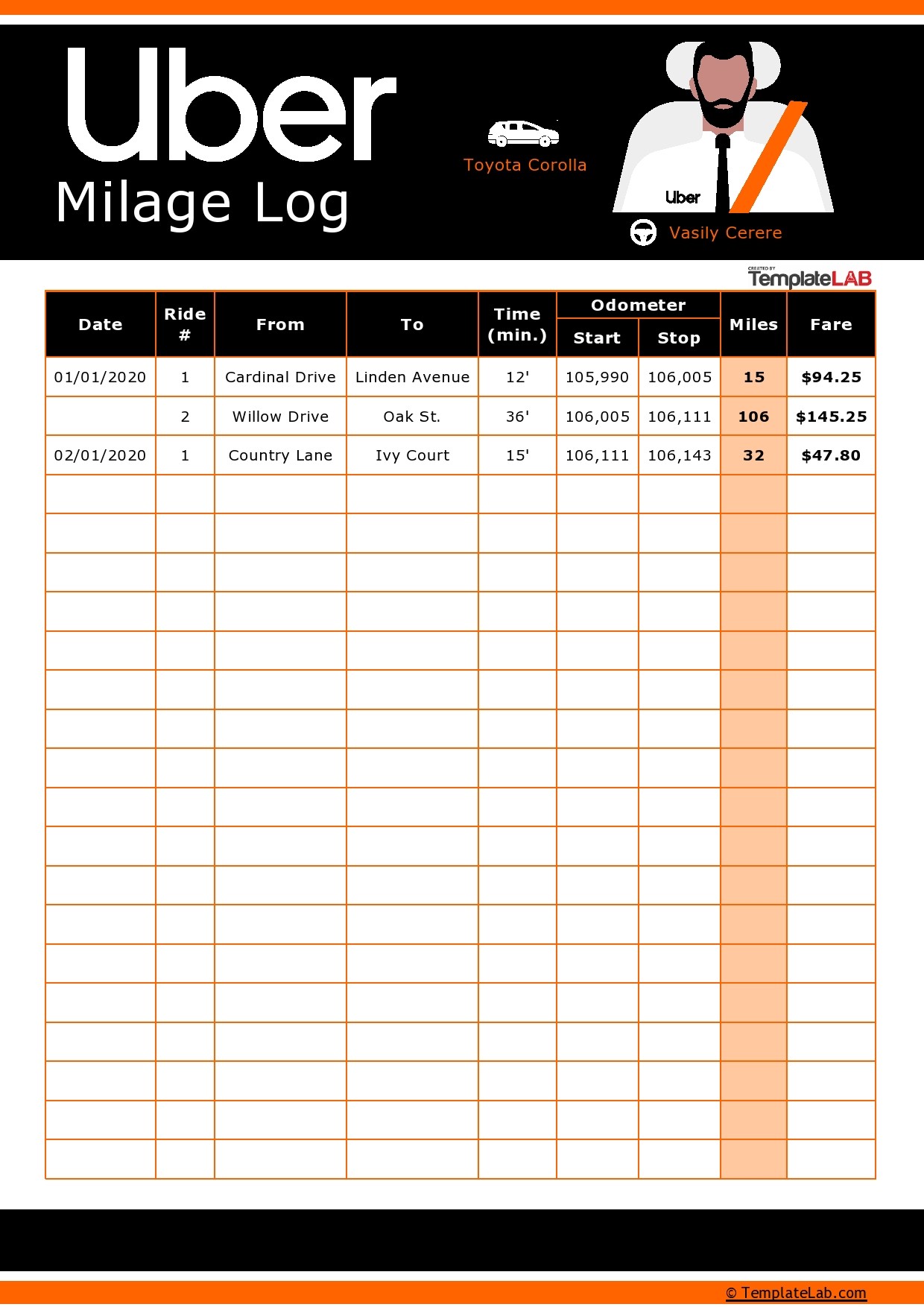

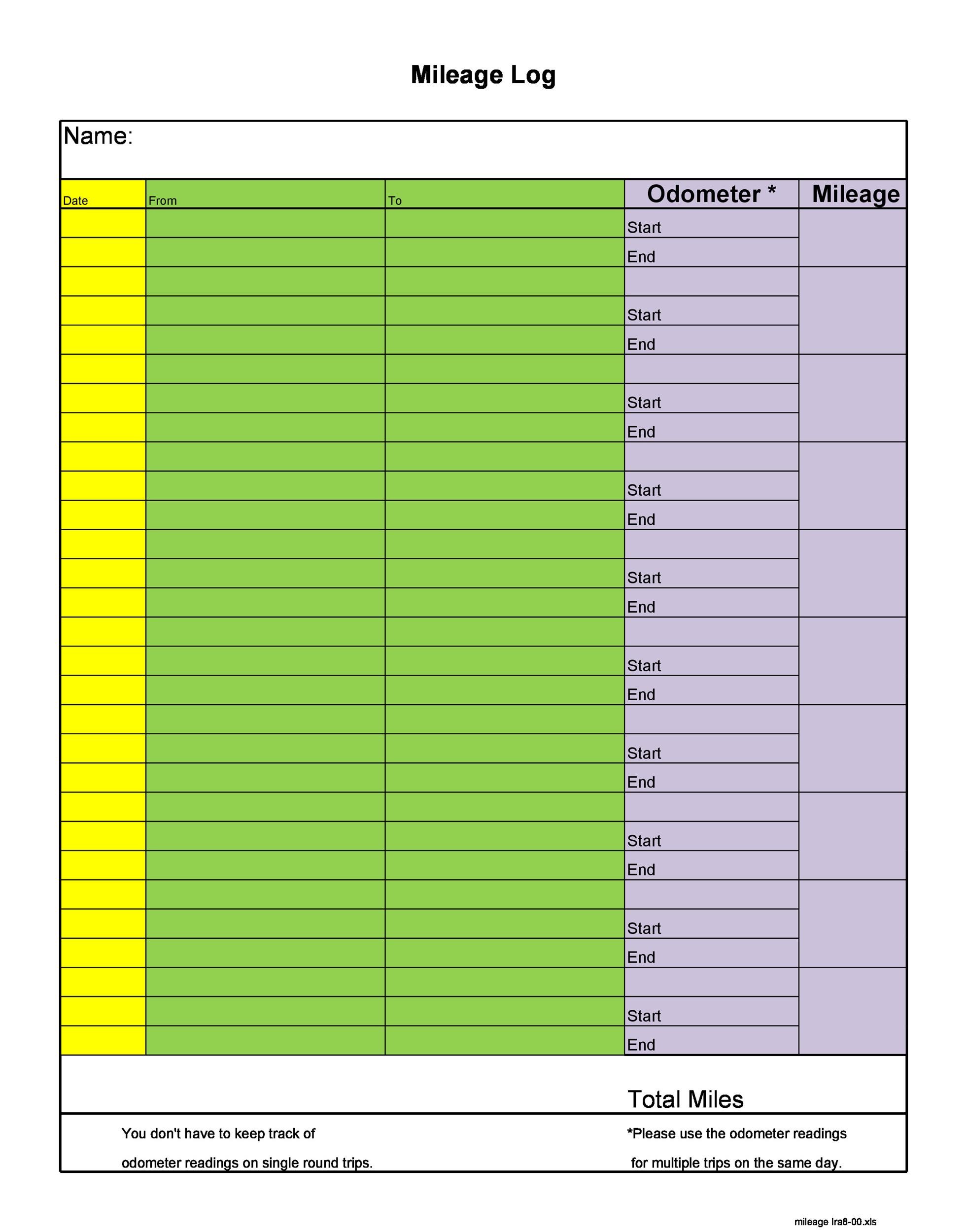

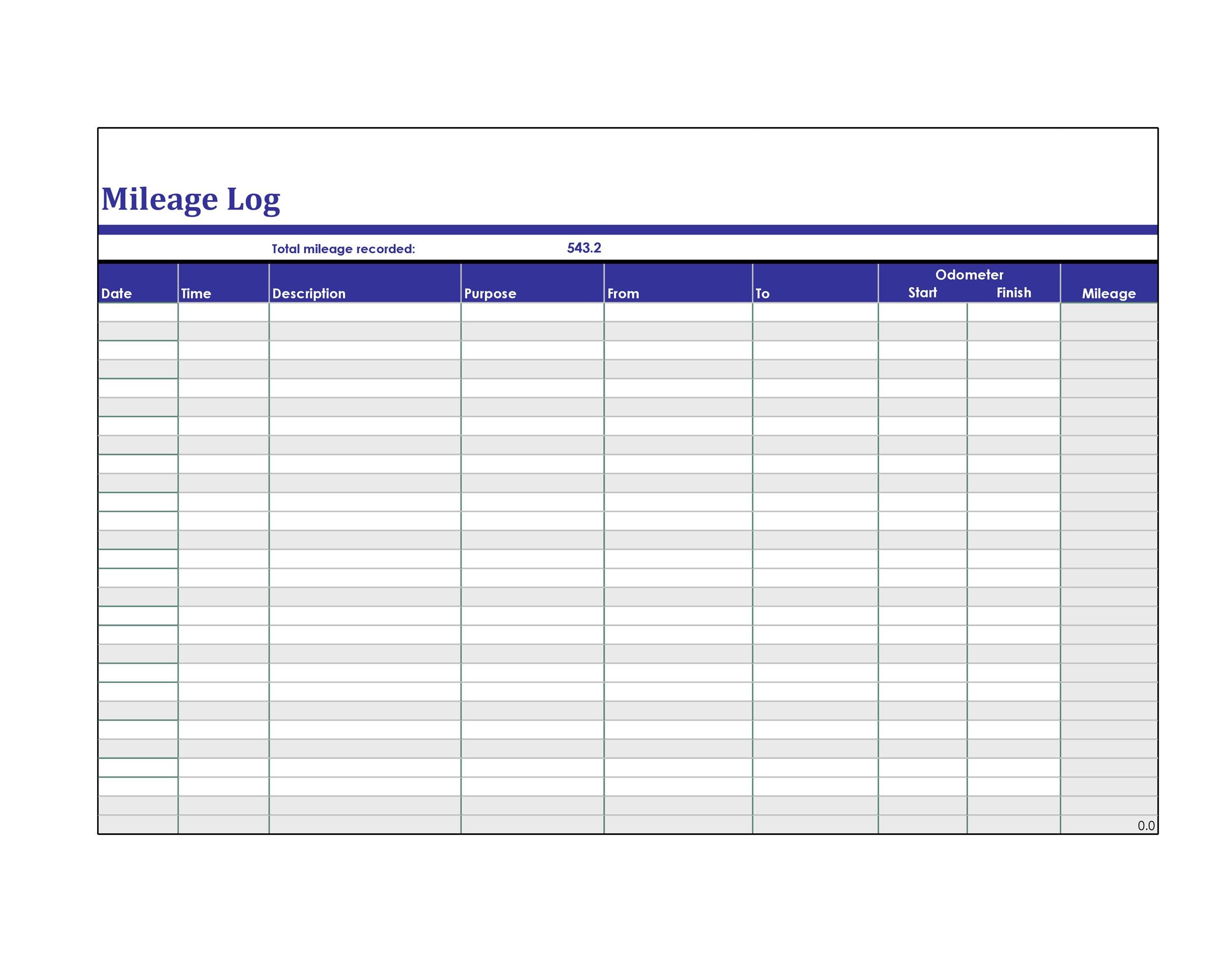

Business Mileage Log Template - Web uses of excel mileage log template. Each mobile worker is responsible for the quality of their mileage records. Print it out and keep a copy in your vehicle’s glove compartment so that you always remember to record your trip miles, expenses and other data required by your employer or tax. Choose from 15 different styles and print for free. Web mileage log template edit & download free printable vehicle mileage log edit & download vehicle maintenance inspection report and mileage log edit & download mileage log form edit & download business vehicle mileage log edit & download mileage log sheet edit & download mileage log sample edit & download vehicle. The irs has been known to disqualify some deductions. Web download our free company mileage log template to make your mileage reimbursement process simpler! If you don’t, drop your pen and do something else because mileage tracking can prove to be a lot of work. Web try smartsheet for free, today. 4 types of business driving that qualifies; Print it out and keep a copy in your vehicle’s glove compartment so that you always remember to record your trip miles, expenses and other data required by your employer or tax. Web try smartsheet for free, today. This assigned period may be of an hour, a day or a week, month or year. This is because there wasn’t a. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. It may save you from forgetting any business mileage. Many business owners underestimate how beneficial it is to track their business mileage. Web download our free company mileage log template to make your mileage reimbursement process simpler!. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Print it out and keep a copy in your vehicle’s glove compartment so that you always remember to record your trip miles, expenses and other data required by your employer or tax. Web our free mileage log. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. Web use these mileage log templates to help you track your mileage expenses and related expenses. This template is practical for employees who make several trips throughout their workday, with ample space to record the details of their vehicle. Print it out and keep a copy in your vehicle’s glove compartment so that you always remember to record your trip miles, expenses and other data required by your employer or tax. At a minimum, they track the dates, start and end locations and purpose of each trip. Use it to record the start and end odometer reading, as well. Web mileage log template our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. At a minimum, they track the dates, start and end locations and purpose of each trip. Web 1 mileage log templates; Choose from 15 different styles and print for free. Your name date trip purpose starting. The business mileage tracker includes a mileage log worksheet that you can print, fold in half, and store in your vehicle. 4 types of business driving that qualifies; Web uses of excel mileage log template. Web 1 mileage log templates; Web mileage log template edit & download free printable vehicle mileage log edit & download vehicle maintenance inspection report and. It may save you from forgetting any business mileage. Requirements of a proper mileage log. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web mileage logs are effective tools for both 1099 and w2 workers alike. If it is kept in your vehicle, you can. Web uses of excel mileage log template. However, the qualification to get the federal income tax reductions is largely pegged on a crucial document called the mileage log. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web mileage logs are effective tools for both 1099 and w2 workers alike. Web. Remember to use the 2022 irs mileage rate if you log trips for last year. If it is kept in your vehicle, you can record each journey at the time. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. This assigned period may. Web uses of excel mileage log template. Mileage log is used to trace or schedule how many miles a vehicle has traveled in a specific or assigned period of time. At a minimum, they track the dates, start and end locations and purpose of each trip. Web mileage logs are effective tools for both 1099 and w2 workers alike. Web try smartsheet for free, today. Requirements of a proper mileage log. 6 mileage that doesn’t qualify Your name date trip purpose starting mileage ending mileage miles notes company date trip purpose starting mileage ending mileage miles notes w w. If you don’t, drop your pen and do something else because mileage tracking can prove to be a lot of work. 4 types of business driving that qualifies; Choose from 15 different styles and print for free. Remember to use the 2022 irs mileage rate if you log trips for last year. Print it out and keep a copy in your vehicle’s glove compartment so that you always remember to record your trip miles, expenses and other data required by your employer or tax. Use it to record the start and end odometer reading, as well as the business purpose, whenever you use your vehicle for business travel. Many business owners underestimate how beneficial it is to track their business mileage. Web to help you establish your own business mileage log, follow the steps below: However, the qualification to get the federal income tax reductions is largely pegged on a crucial document called the mileage log. Web print this mileage log template and keep a copy in your vehicle. Web 1 mileage log templates; The irs has been known to disqualify some deductions.30 Printable Mileage Log Templates (Free) Template Lab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) ᐅ Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Related Post: