Business Debt Schedule Template Excel

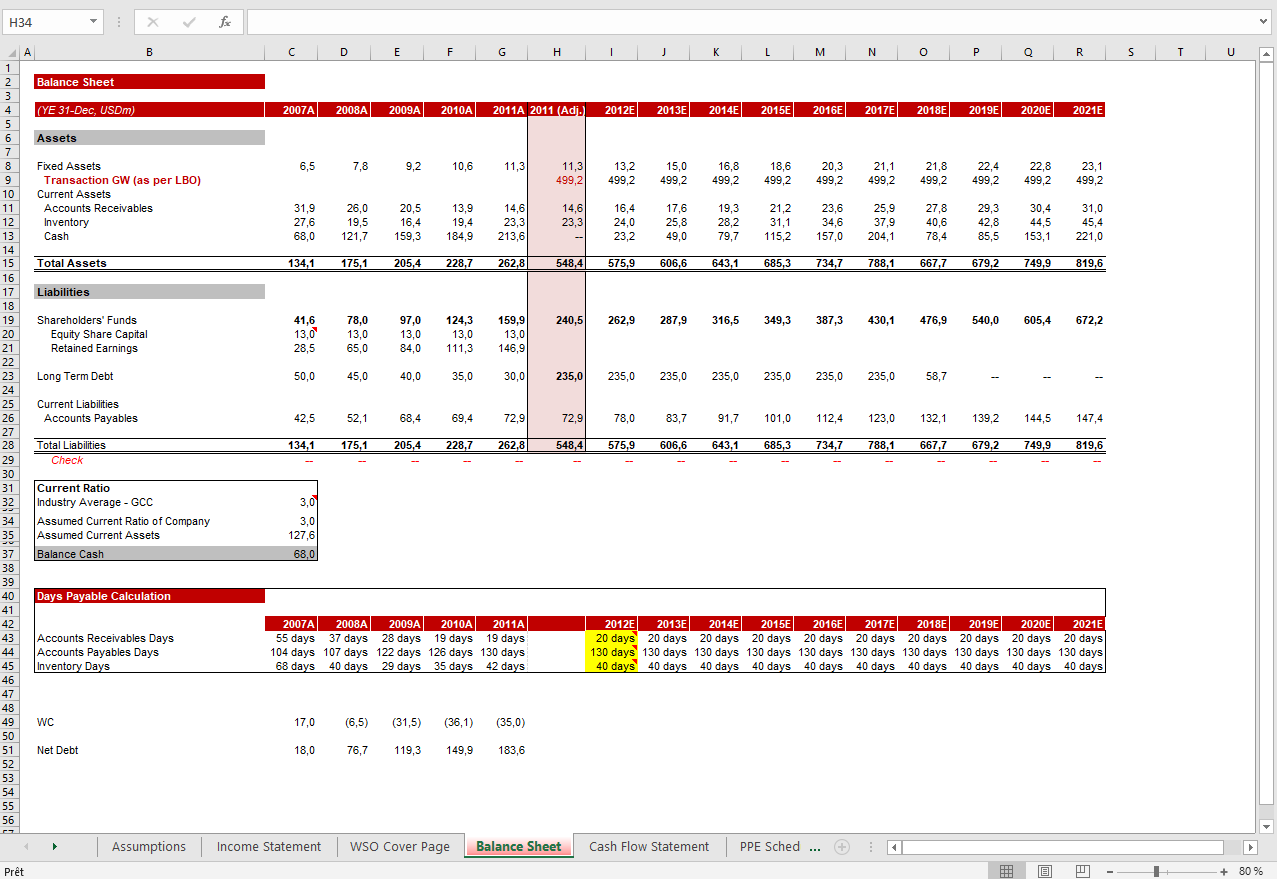

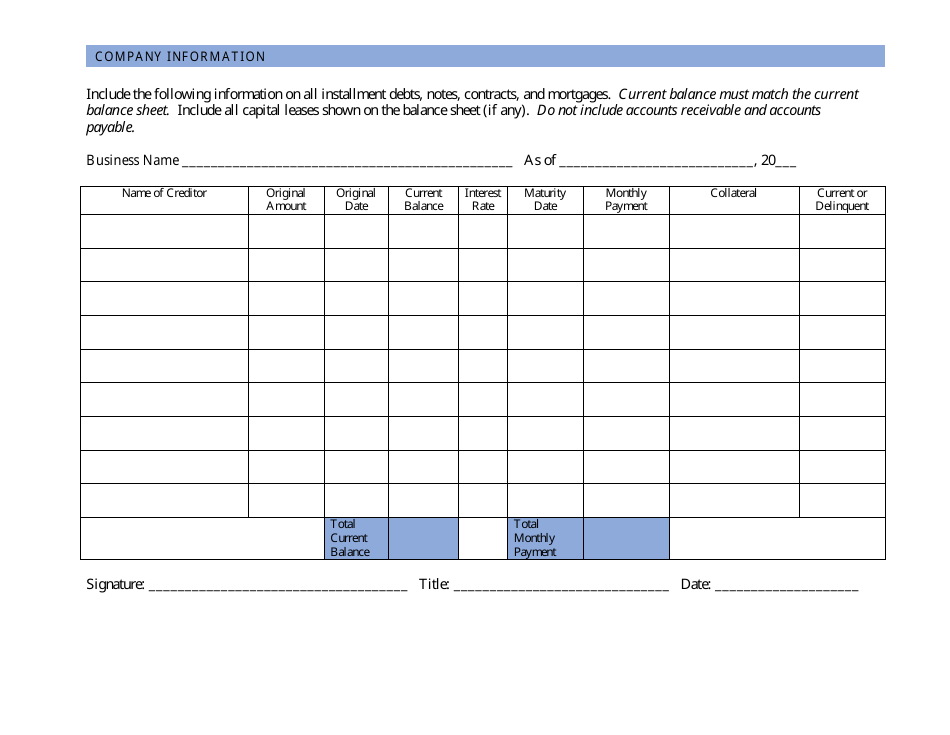

Business Debt Schedule Template Excel - At the end of the day, a business debt schedule connects 3 essential financial documents:. This template can be used for the calculation and the reducing ratio of the debt after payments. How to do it in 7 steps. Ad easily manage employee expenses. That alone can feel like a lot to handle, but you can’t. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. It can be used in. Fully integrated w/ employees, invoicing, project & more. You cannot directions your customize calculations to confirm your. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Debt schedules in excel are an important tool for managing your finances and keeping track of your debts. Web business debt schedule template. Web up to 50% cash back 1. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. This form is provided for your convenience in responding to filing requirements on sba form 5,. Web sba form 2202. Web up to 50% cash back 1. Web business debt schedule template. You cannot directions your customize calculations to confirm your. Web download this debt schedule template design in excel, google sheets format. Web sba form 2202. This template can be used for the calculation and the reducing ratio of the debt after payments. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Web we can use excel’s pmt, ipmt, and if formulas to create a debt schedule. That. The schedule should include loans for contracts/notes payable and lines of credit, not accounts payable or accrued liabilities. Web sba form 2202. Web business debt schedule worksheet.xls. Web business debt schedule template. A business debt schedule is a table that lists your monthly debt payments in order of maturity. Optimize your financial strategy with our debt. Debt schedules in excel are an important tool for managing your finances and keeping track of your debts. Fully integrated w/ employees, invoicing, project & more. Web we can use excel’s pmt, ipmt, and if formulas to create a debt schedule. Web with an amortization schedule template for microsoft excel, you can enter. Best overall payroll software for small businesses by business.com Stop losing receipts and have employees upload them directly into your expenses app. Download wso's free debt schedule model template below! It can be used in. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Best overall payroll software for small businesses by business.com Optimize your financial strategy with our debt. Web we can use excel’s pmt, ipmt, and if formulas to create a debt schedule. Web download this debt schedule template design in excel, google sheets format. Web download this business debt schedule template design in excel, google sheets format. 7shifts is the #1 team management platform built for restaurants. This template allows you to record debt and interest payments over time. Start with a free account to explore. Web download this business debt schedule template design in excel, google sheets format. First, we need to set up the model by inputting some debt assumptions. Start with a free account to explore. Web business debt schedule template. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. A business debt schedule, or schedule of debt, tracks the. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Ad easily manage employee expenses. It can be used in. You cannot directions your customize calculations to confirm your. Web download this debt schedule template design in excel, google sheets format. Web a repayment schedule of debt in excel. It can be used in. A business debt schedule is a table that lists your monthly debt payments in order of maturity. Web download our free business debt schedule template. Web download this debt schedule template design in excel, google sheets format. This template allows you to record debt and interest payments over time. Debt schedules in excel are an important tool for managing your finances and keeping track of your debts. A comprehensive guide to business debt schedule templates in excel introduction (100 words): Ad integration & automation turns complex restaurant accounting work into simple tasks. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. The schedule should include loans for contracts/notes payable and lines of credit, not accounts payable or accrued liabilities. Why do i need a business debt schedule template? Ad the #1 employee scheduling creator for restaurants. Here are the types of debt to include in a business debt schedule: Web up to 50% cash back 1. Start with a free account to explore. Web a business debt schedule, schedule of debt or schedule of liabilities is a list of all the debts your business currently owes, their current balance, original amount,. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. In this example, we assume. Connect restaurant pos & payroll to accounting & scheduling to save time and money. Ad easily manage employee expenses.Free Debt Schedule Template

Business Debt Schedule Template Excel Darrin Kenney's Templates

Debt Schedule Excel Model Template Eloquens

Business Debt Schedule Template Excel Darrin Kenney's Templates

Business Debt Schedule Template Excel Darrin Kenney's Templates

Accelerated Debt Payoff Spreadsheet ExcelTemplate

Business Debt Schedule Form Ethel Hernandez's Templates

Business Debt Schedule Template Excel Darrin Kenney's Templates

Debt Schedule Template

Company Debt Schedule Template Download Printable PDF Templateroller

Related Post: