Budget Template For Paying Off Debt

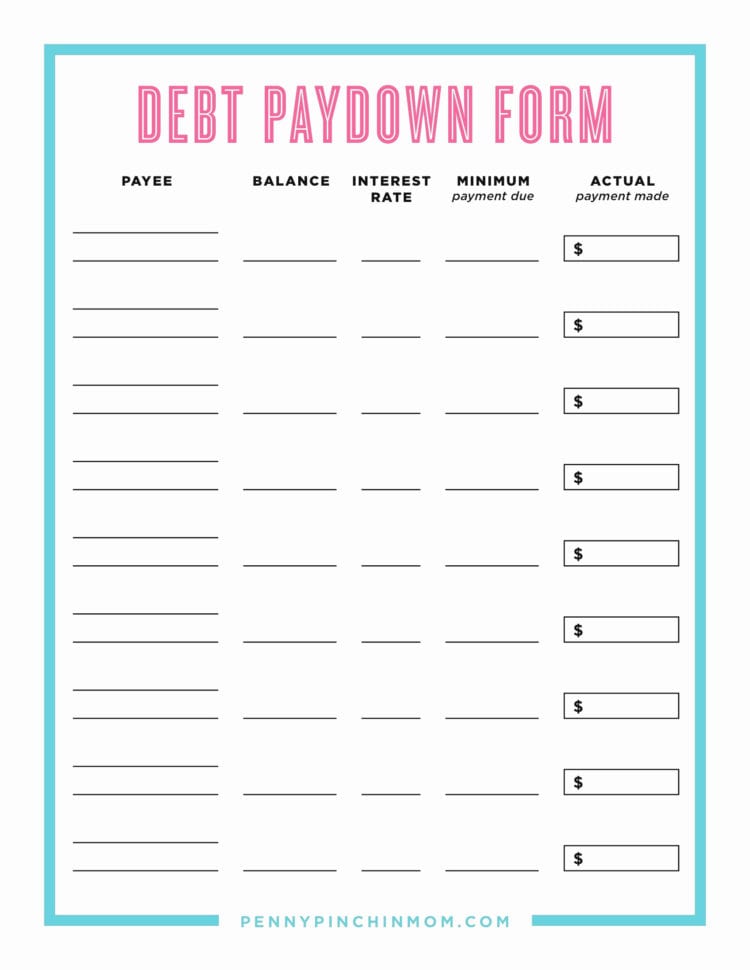

Budget Template For Paying Off Debt - Prioritize which debts to pay off first 2. Evaluate your balance and budget. Web download this fiscal and debt budget summary offers you a clear strategy of reducing your debt. Web (5) impose upon a debtor a penalty for failure to pay a debt when due under subpart e of this part; To find this number, enter your expected monthly income and. Web setting specific goals can help you pay off any outstanding debt that you may have, which can eventually free up your finances at some point down the line. Our guide shares our favorite tools and explains how they work. For example, if your income and. Web but upping that monthly repayment by $50 will get you out of debt 11 months sooner and save you $1,156 in interest (assuming you stop using the card). Jared polis on wednesday sent his proposal for next year's state spending to the joint budget committee, seeking funds that, after 14 years,. Web exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! Web budget templates and spreadsheets help you track expenses and spot ways to save. Jared polis on wednesday sent his proposal for next year's state spending to the joint budget committee, seeking funds that, after 14 years,. Web setting specific goals can help you pay. Free monthly budget + money bundle templates want to know where your money goes. See where your money is going. Web download this fiscal and debt budget summary offers you a clear strategy of reducing your debt. Web browse budget templates made for a range of uses, from regular monthly budgets to budgets focused on weddings, college, or saving for. Our guide shares our favorite tools and explains how they work. Web download this fiscal and debt budget summary offers you a clear strategy of reducing your debt. When getting ready to pay off your debt, it’s important to evaluate your debt balances. Record your income and expenses. Web browse budget templates made for a range of uses, from regular. Web setting specific goals can help you pay off any outstanding debt that you may have, which can eventually free up your finances at some point down the line. Free monthly budget + money bundle templates want to know where your money goes. Evaluate your balance and budget. Budgets should use monthly figures because most important bills are. Web consider. Web consider these steps to pay off debt. Web budget templates and spreadsheets help you track expenses and spot ways to save. Check it out here for a free download. Our guide shares our favorite tools and explains how they work. Evaluate your balance and budget. Web a budget can help you: Prioritize which debts to pay off first 2. (6) compromise a debt, or suspend or terminate collection of a debt, under. You won't need to worry. Web consider these steps to pay off debt. Free monthly budget + money bundle templates want to know where your money goes. Our guide shares our favorite tools and explains how they work. Prioritize which debts to pay off first 2. For example, if your income and. Budgets should use monthly figures because most important bills are. Look for a budget planner that fits well with your lifestyle. Invest 15% of your household income in retirement. See where your money is going. Web consider these steps to pay off debt. When getting ready to pay off your debt, it’s important to evaluate your debt balances. When getting ready to pay off your debt, it’s important to evaluate your debt balances. Evaluate your balance and budget. See where your money is going. Web you can find tons of budget template options online to download. It lets you enter your current creditors, the balance for each debt and interest. For example, if your income and. Look for a budget planner that fits well with your lifestyle. Web browse budget templates made for a range of uses, from regular monthly budgets to budgets focused on weddings, college, or saving for a home. (6) compromise a debt, or suspend or terminate collection of a debt, under. Record your income and expenses. For example, if your income and. Check it out here for a free download. Budgets should use monthly figures because most important bills are. Web setting specific goals can help you pay off any outstanding debt that you may have, which can eventually free up your finances at some point down the line. Prioritize which debts to pay off first 2. Find a side hustle 6. follow @easy_budget so you don’t miss out on daily tips to help you grow & master your. Web budget templates and spreadsheets help you track expenses and spot ways to save. Record your income and expenses. The first tab in our budgeting workbook is a. When getting ready to pay off your debt, it’s important to evaluate your debt balances. Web you can find tons of budget template options online to download. Web 5 free budgeting templates & excel spreadsheets. Web 15 free budget templates to help you pay off debt in 2022 1. Web but upping that monthly repayment by $50 will get you out of debt 11 months sooner and save you $1,156 in interest (assuming you stop using the card). Web download this fiscal and debt budget summary offers you a clear strategy of reducing your debt. Web exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! Invest 15% of your household income in retirement. To find this number, enter your expected monthly income and. See where your money is going.Free Printable Debt Payoff Worksheet —

Printable The Ultimate Debt Payoff Planner That Will Help You Crush

17 Brilliant and FREE Monthly Budget Template Printable you need to Grab

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

(Free Template!) How to Use a Debt Tracker to Visualize Debt Payoff

Printable Debt Payoff Tracker Budget Binder Page A Cultivated Nest

Debt Payoff Planner Free Printable Debt payoff, Budget planner

Editable Paying Off Debt Worksheets Debt Repayment Budget Template

Accelerated Debt Payoff Spreadsheet ExcelTemplate

Debt Payments • 1 Page • Instant Download PDF Printable Debt payoff

Related Post: