Budget Template 50 30 20

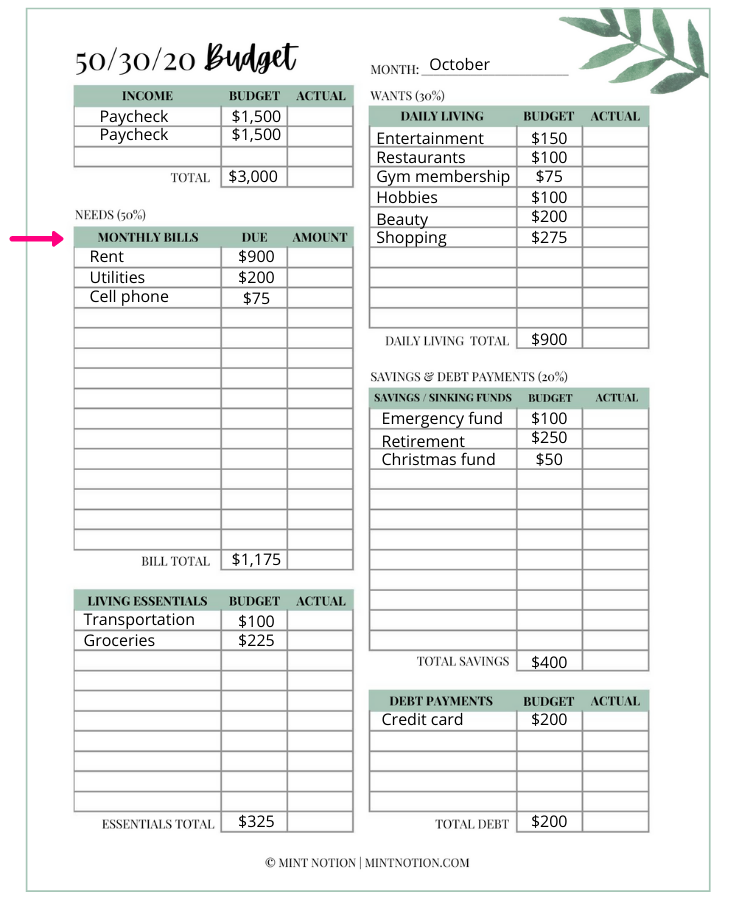

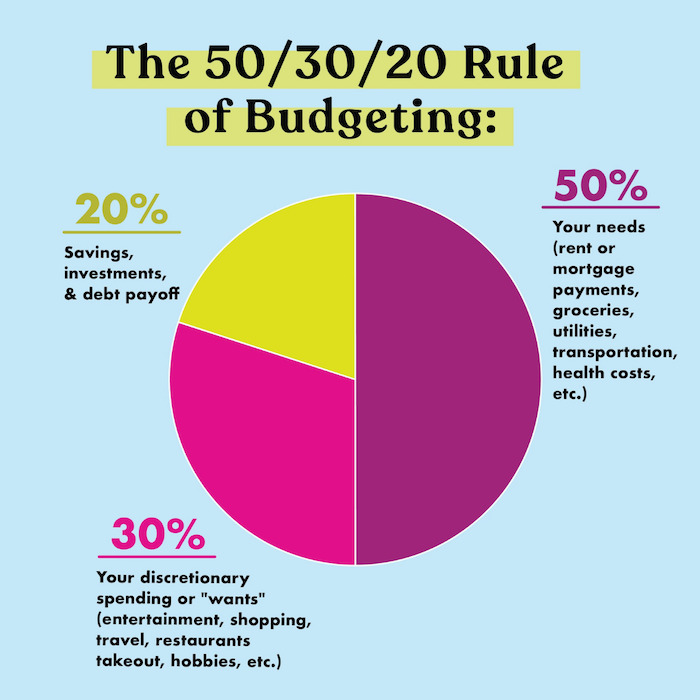

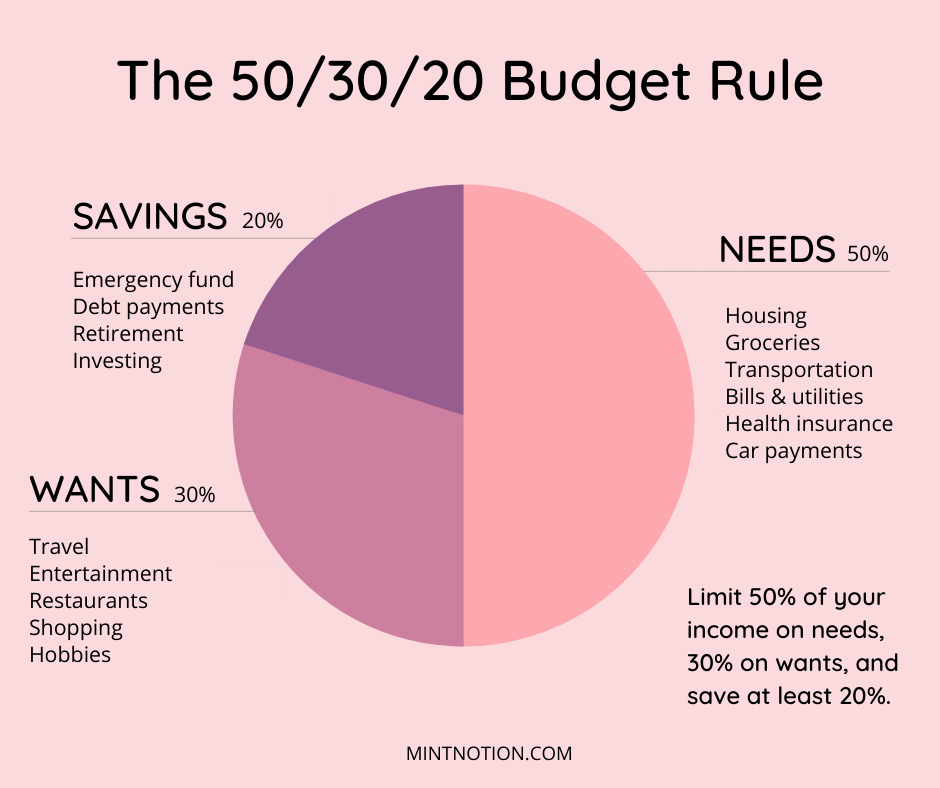

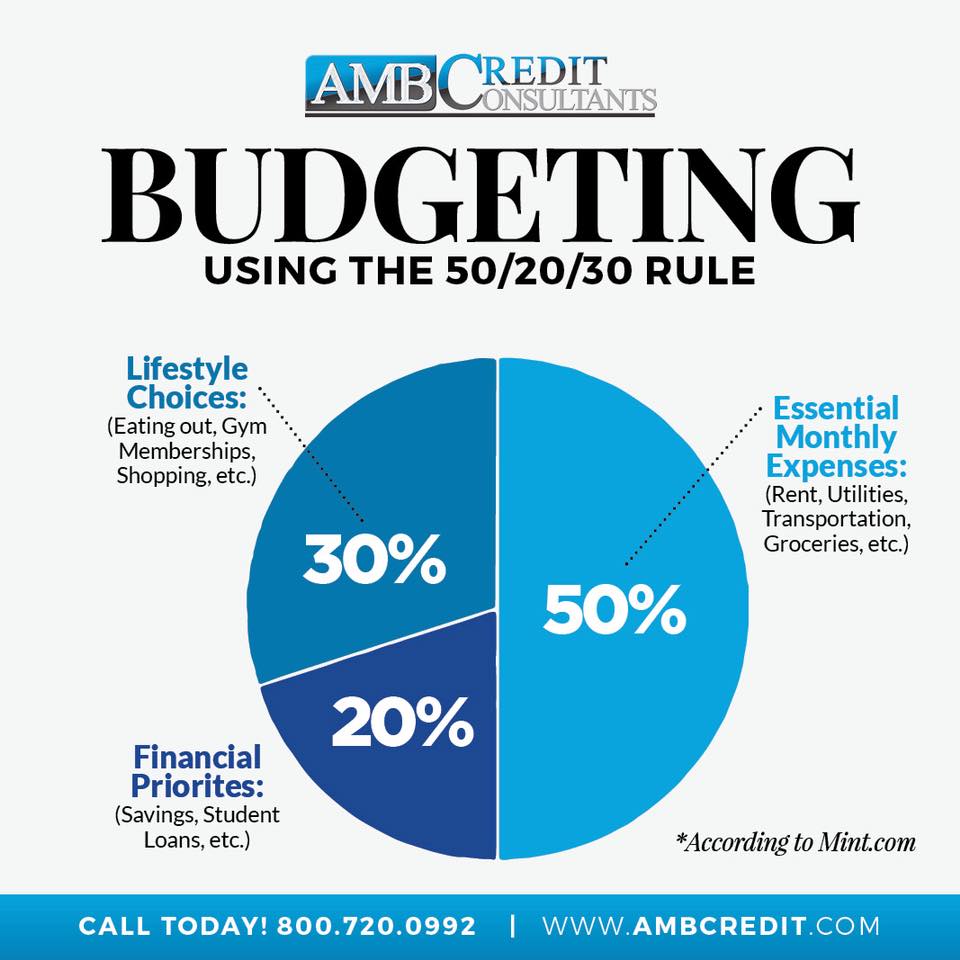

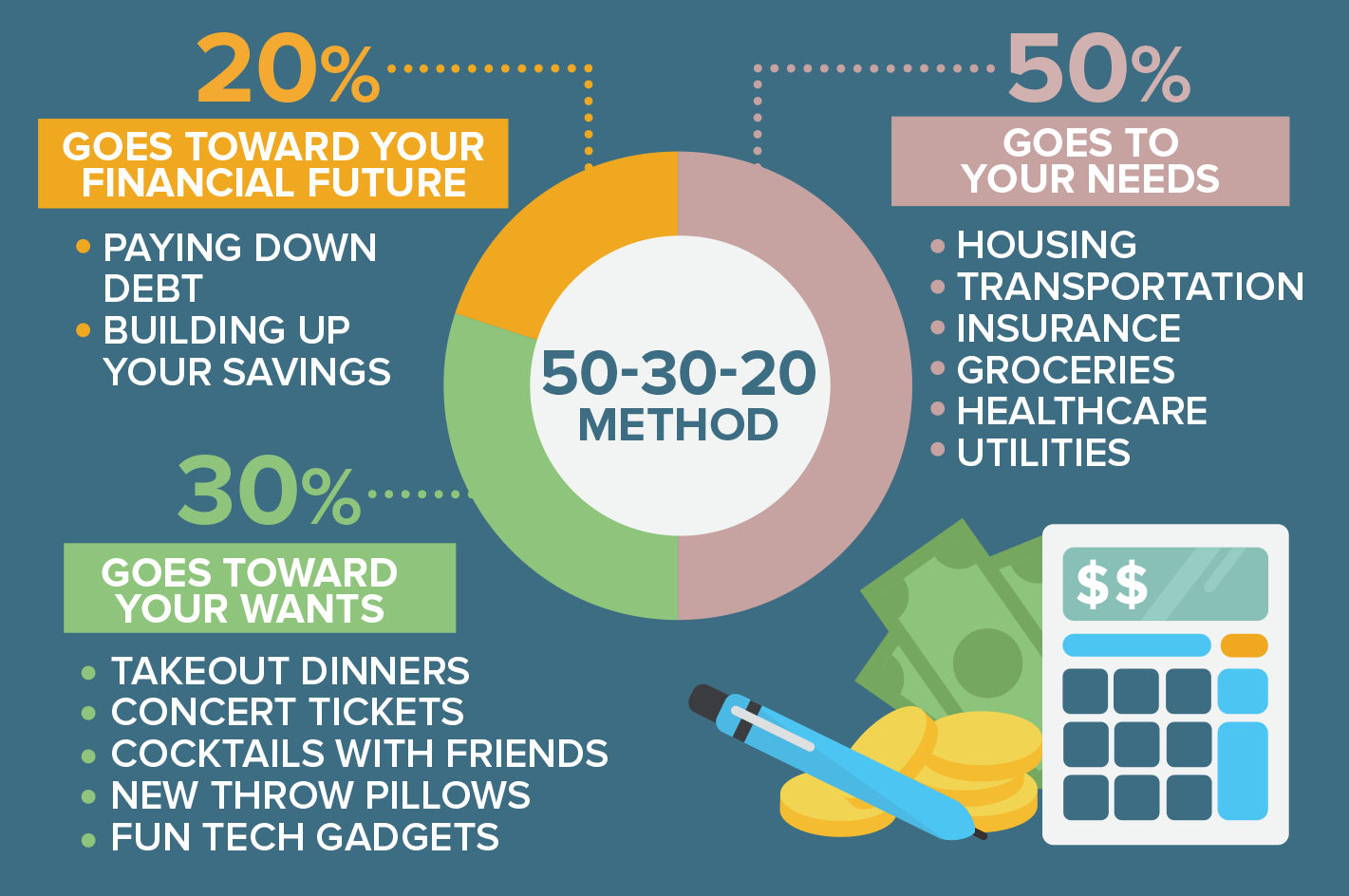

Budget Template 50 30 20 - 50% for your needs, 30% for your wants and 20% for your savings. Adjust your actual spending to fit; Browse around for the right template. Browse our free templates for budget designs you can easily customize and share. Who is this budget method for? This intuitive and straightforward rule can help you draw up a. Elegant and clean monthly budget planner sheet. 50% for needs, 30% for wants, 20% for savings and debt. The 50% needs category is for all your monthly essentials. Web learn how to make a 50/30/20 budget template to separate your earnings into needs, wants, and savings. Unlimited data plans restaurants new clothes (not because your kid outgrew his jacket but because you fell in love with a cute new jacket) sporting events concert tickets streaming services Web here are five steps to help you create a startup budget so you can start your business off on the right foot. Adjust your actual spending to fit; Web. Your budget goal is the total amount you are willing to spend on your business. Many experts agree that one simple way to budget is to divide your income into three parts: Web learn how to make a 50/30/20 budget template to separate your earnings into needs, wants, and savings. $720 (401k and hsa) total income: 50% for your needs,. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts. How do you pay off debt with a 50 / 20 / 30 budget? The 50% needs category is for all your monthly essentials. Adjust your actual spending to fit; Web the. Create a monthly financial plan for your small business with template.net with its free printable sample business budget templates. This budget template can help different departments keep track of their income and spending. Web the 50/30/20 budget template is a simple budgeting rule for anyone to start a budget. This free template from template.net works in either document or spreadsheet. Many experts agree that one simple way to budget is to divide your income into three parts: How do you pay off debt with a 50 / 20 / 30 budget? Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web percentages for your budget. What budget apps work with the 50 / 30 /. Adjust your actual spending to fit; How do you pay off debt with a 50 / 20 / 30 budget? The 50% needs category is for all your monthly essentials. How to set up a 50 / 30 / 20 budget. Web it sounds harder than it is. Your budget goal is the total amount you are willing to spend on your business. Keep your monthly budget and savings on track and on target with the 50/30/20 approach. This intuitive and straightforward rule can help you draw up a. 50% towards needs, such as rent, mortgage, food, for example 30% for wants and discretionary items like entertainment, traveling,. 50% of income going to needs, 30% going to wants, and the remaining 20% going to savings and financial goals. Your needs, your wants, and your savings. Web the 50/30/20 budget template is a simple budgeting rule for anyone to start a budget. Web monthly 50/30/20 budget worksheet. 50% for your needs, 30% for your wants and 20% for your. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and. 50% of income going to needs, 30% going to wants, and the remaining 20% going to savings and financial goals. Browse our free templates for budget designs you can easily. Web nerdwallet recommends the 50/30/20 budget, which suggests that 50% of your income goes toward needs, 30% toward wants and 20% toward savings and debt repayment. Web here are five steps to help you create a startup budget so you can start your business off on the right foot. 50% for needs, 30% for wants, and also 20% for savings.. Who is this budget method for? Web having a specific template for each department can help teams keep track of spending and plan for growth. Browse our free templates for budget designs you can easily customize and share. 50% for needs, 30% for wants, and also 20% for savings. This method is super easy to follow! How do you pay off debt with a 50 / 20 / 30 budget? The 50% needs category is for all your monthly essentials. Web what is the 50 30 20 rule? Skip to end of list. Web percentages for your budget. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts. Browse around for the right template. 50% of income going to needs, 30% going to wants, and the remaining 20% going to savings and financial goals. Unlimited data plans restaurants new clothes (not because your kid outgrew his jacket but because you fell in love with a cute new jacket) sporting events concert tickets streaming services This budget template can help different departments keep track of their income and spending. Keep your monthly budget and savings on track and on target with the 50/30/20 approach. Get your 50/30/20 budget template today. 50% on needs, 30% on wants, and 20% on savings. 50% for your needs, 30% for your wants and 20% for your savings.The 50/30/20 rule to budgeting and saving Locke Digital

What is the 50/30/20 Budget Rule and How it Works Mint Notion

The 50/30/20 Budget What It Is & Why You Need To Start Using It ASAP

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

503020 Budget Rule How to Make a Realistic Budget Mint Notion

AMB Credit Consultants A New Way To Budget! Budgeting Using The 50/30

Enjoy Budgeting With the 503020 Rule Investdale

The 50/30/20 Budget Rule Explained (with Examples)

Monthly 50/30/20 Budget Worksheet in 2021 Budgeting, Budgeting

50/30/20 Budget Worksheet Fillable PDF Etsy Personal Budget Planner

Related Post: