Asc 842 Lease Excel Template Free

Asc 842 Lease Excel Template Free - Deloitte’s lease accounting guide examines. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Ad track everything in one place. Define your lease data categories before you start building the template, it’s crucial to identify the data categories you need to track to comply with asc. Explore the #1 accounting software for small businesses. Ad get powerful, streamlined insights into your company’s finances. Full asc 842, gasb 87, gasb 96, and ifrs 16 accounting and. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web download now with this lease amortization schedule you will be able to : Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. The user merely answers the lease and. Click the link to download a template for asc 842. Explore the #1 accounting software for small businesses. Financing leases schedule and guide; Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Explore the #1 accounting software for small businesses. The user merely answers the lease and. Web on february 25, 2016, the fasb issued accounting standards update no. Define your lease data categories before you start building the template, it’s crucial to identify the data. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Define your lease data categories before you start building the template, it’s crucial to identify the data categories you need to track to comply with asc. Full asc 842, gasb 87, gasb 96, and ifrs 16 accounting. Deloitte’s lease accounting guide examines. Web a few of the specific disclosures required are: Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Financing leases schedule and guide; Web download now with this lease amortization schedule you will be. The user merely answers the lease and. Web on february 25, 2016, the fasb issued accounting standards update no. Web larson lease accounting template asc 842. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. Web download our free asc 842 lease accounting calculator and calculate the. Deloitte’s lease accounting guide examines. Explore the #1 accounting software for small businesses. Financing leases schedule and guide; Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Full asc 842, gasb 87, gasb 96, and ifrs 16 accounting and. Keep in mind that our software solution, netlease, automates all of these steps and delivers the required disclosures for asc 842, ifrs 16 and gasb 87 compliance. Define your lease data categories before you start building the template, it’s crucial to identify the data categories you need to track to comply with asc. Web this solution will suffice for entities. Keep in mind that our software solution, netlease, automates all of these steps and delivers the required disclosures for asc 842, ifrs 16 and gasb 87 compliance. Define your lease data categories before you start building the template, it’s crucial to identify the data categories you need to track to comply with asc. Web this solution will suffice for entities. Or, try it for free. Financing leases schedule and guide; Web on february 25, 2016, the fasb issued accounting standards update no. Define your lease data categories before you start building the template, it’s crucial to identify the data categories you need to track to comply with asc. Web what does our lease classification template cover? Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Click the link to download a template for asc 842. Asc 842 transition blueprint & workbook; Deloitte’s lease accounting guide examines. Web download now with this lease amortization schedule you will be able to : Or, try it for free. Give it a try on your own, or download our free asc 842 lease amortization schedule spreadsheet template. Ad track everything in one place. Web on february 25, 2016, the fasb issued accounting standards update no. Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Web what does our lease classification template cover? Click the link to download a template for asc 842. Web download now with this lease amortization schedule you will be able to : Explore the #1 accounting software for small businesses. Ad get powerful, streamlined insights into your company’s finances. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Financing leases schedule and guide; Manage all your business expenses in one place with quickbooks®. Asc 842 transition blueprint & workbook; Web a detailed calculation example of how to calculate a lease liability and right of use asset for a finance lease in compliance with asc 842. Web larson lease accounting template asc 842. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. Web a few of the specific disclosures required are: Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Web a lease liability is required to be calculated for both asc 842 & ifrs 16.ASC 842 Guide

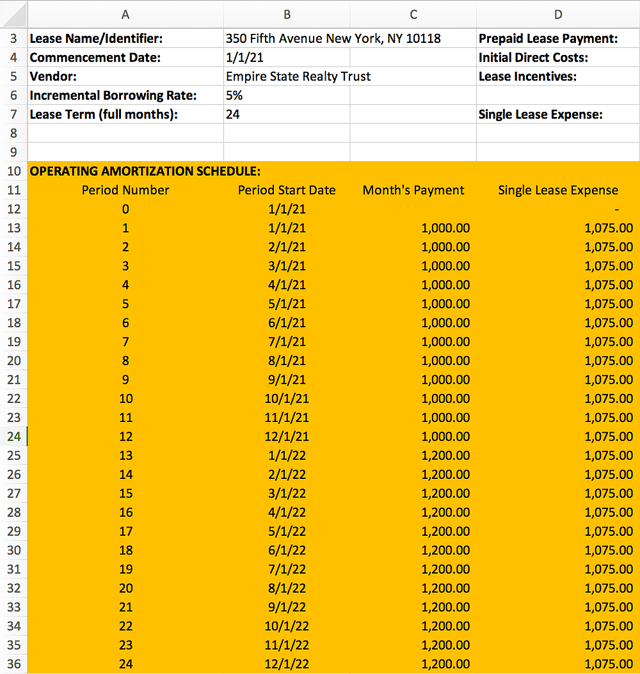

ASC 842 Excel Template Download

Sensational Asc 842 Excel Template Dashboard Download Free

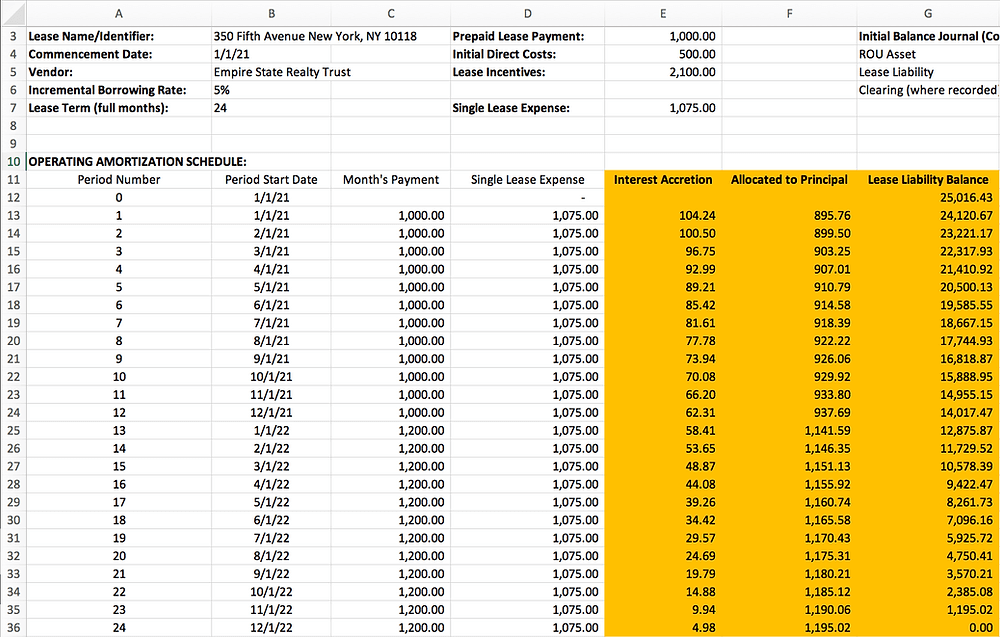

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

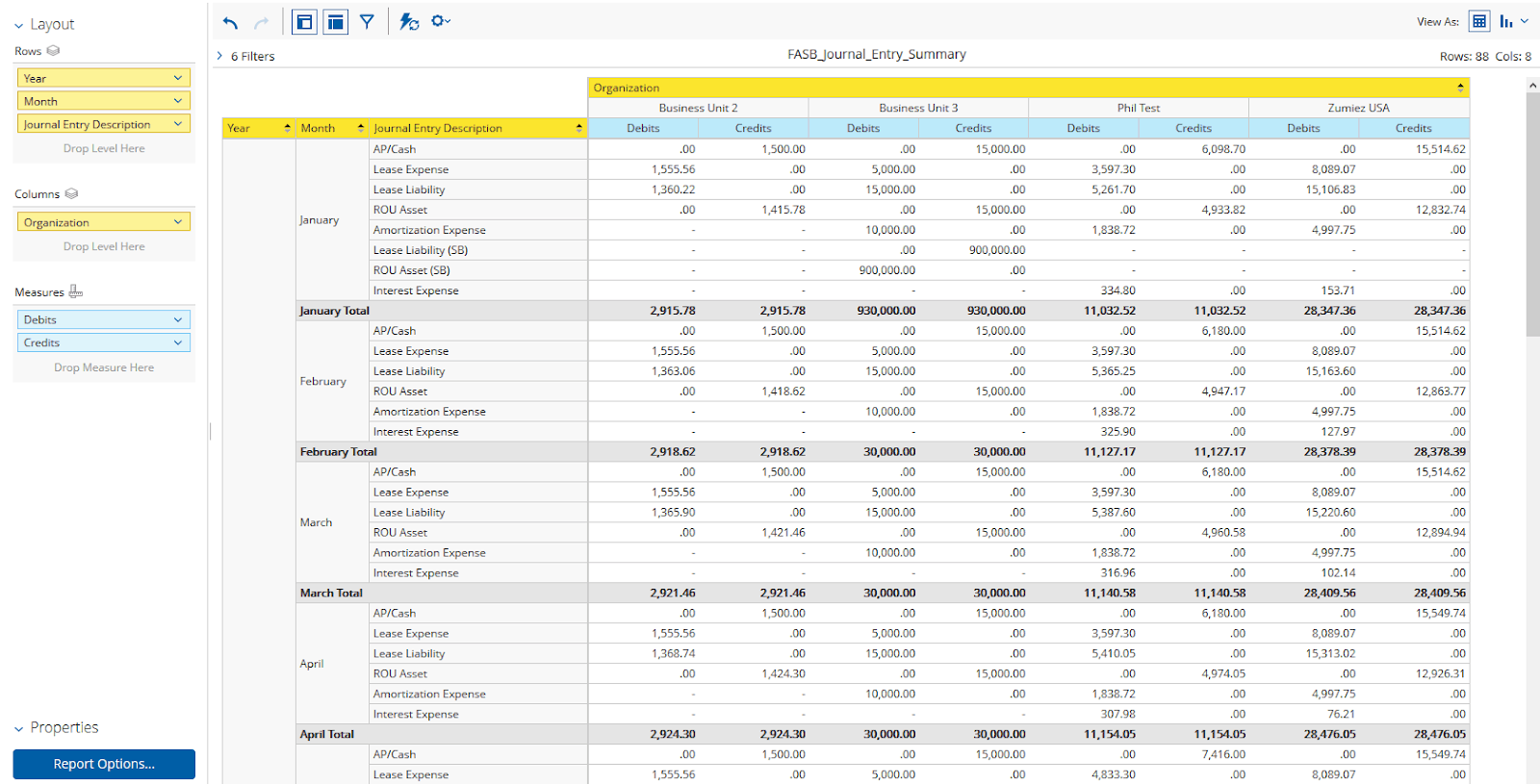

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

How to Calculate the Journal Entries for an Operating Lease under ASC 842

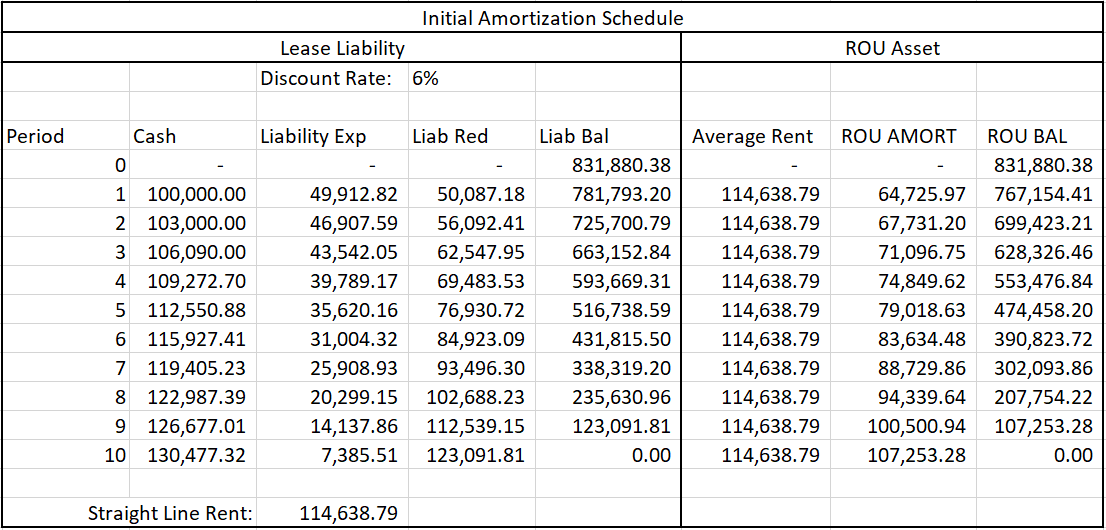

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Lease Modification Accounting under ASC 842 Operating Lease to

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Related Post: