Asc 842 Lease Amortization Schedule Template

Asc 842 Lease Amortization Schedule Template - A roadmap to adoption and implementation lease accounting is like a tale of two cities, with companies that have. For asc 842 compliance, you’ll need to calculate the present value of. Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease. Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb asc 840, with the same title, with respect to leasehold. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Web since the issuance of accounting standards update no. Lease transfers ownership of underlying asset. Contavio | asc 842 leases calculation template. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Web the lease liability of $14,048,925 is the present value of lease payments discounted at 5%; Incorporate excel formulas to calculate values automatically. Web asc 842 leases calculation template. Contavio | asc 842 leases calculation template. Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb asc 840, with the same title, with respect to leasehold. Certified software for covering ifrs 16 leases, asc 842 leases, ifrs. Lease transfers ownership of underlying asset. The entry to record the lease upon its commencement is a debit to rou asset and a credit to lease liability:. Web download now with this lease amortization schedule you will be able to : Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb. Web the lease liability of $14,048,925 is the present value of lease payments discounted at 5%; Under asc 842, operating leases and financial leases have different amortization calculations. Lease transfers ownership of underlying asset. Web the amortization schedule for this lease is below. For asc 842 compliance, you’ll need to calculate the present value of. Certified software for covering ifrs 16 leases, asc 842 leases, ifrs 15,. Incorporate excel formulas to calculate values automatically. Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web perspectives the asc 842 leasing standard on the radar: Contavio | asc 842 leases calculation template. Web perspectives the asc 842 leasing standard on the radar: The $150,000 of initial direct cost is added to $14,048,925 (see column. Web the amortization schedule for this lease is below. Click the link to download a template for asc 842. A roadmap to adoption and implementation lease accounting is like a tale of two cities, with companies that have. Determine the lease term under asc 840 step 2: For asc 842 compliance, you’ll need to calculate the present value of. Contavio | asc 842 leases calculation template. Web your organization adheres to accounting policies to address lease accounting standards, be they asc 842, ifrs 16, or gasb 87. Web the amortization schedule for this lease is below. Web the lease liability of $14,048,925 is the present value of lease payments discounted at 5%; Web the following is the lease amortization schedule, prepared with the effective interest method, used to record the journal entries under finance lease. Certified software for covering ifrs 16 leases, asc 842 leases, ifrs 15,. Web your organization adheres to accounting policies to address. For asc 842 compliance, you’ll need to calculate the present value of. Determine the total lease payments under gaap step 3: Web for each lease that is covered under 842 you’ll need to create an amortization schedule based on the classification of the lease (finance or operating). Whether financing or operating, you can easily make an operating lease schedule that. Web your organization adheres to accounting policies to address lease accounting standards, be they asc 842, ifrs 16, or gasb 87. Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb asc 840, with the same title, with respect to leasehold. Under asc 842, operating leases and financial leases have different. Web since the issuance of accounting standards update no. Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb asc 840, with the same title, with respect to leasehold. For asc 842 compliance, you’ll need to calculate the present value of. Click the link to download a template for asc 842.. Web download now with this lease amortization schedule you will be able to : Certified software for covering ifrs 16 leases, asc 842 leases, ifrs 15,. The $150,000 of initial direct cost is added to $14,048,925 (see column. For asc 842 compliance, you’ll need to calculate the present value of. Web since the issuance of accounting standards update no. A roadmap to adoption and implementation lease accounting is like a tale of two cities, with companies that have. Determine the total lease payments under gaap step 3: Web the new lease standard in fasb asc 842 generally is consistent with the old lease standard in fasb asc 840, with the same title, with respect to leasehold. Web your organization adheres to accounting policies to address lease accounting standards, be they asc 842, ifrs 16, or gasb 87. Under asc 842, operating leases and financial leases have different amortization calculations. Web how to calculate your lease amortization. Incorporate excel formulas to calculate values automatically. Click the link to download a template for asc 842. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Web the amortization schedule for this lease is below. Web asc 842 leases calculation template. Determine the lease term under asc 840 step 2: Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Web perspectives the asc 842 leasing standard on the radar: Web the lease liability of $14,048,925 is the present value of lease payments discounted at 5%;ASC 842 Guide

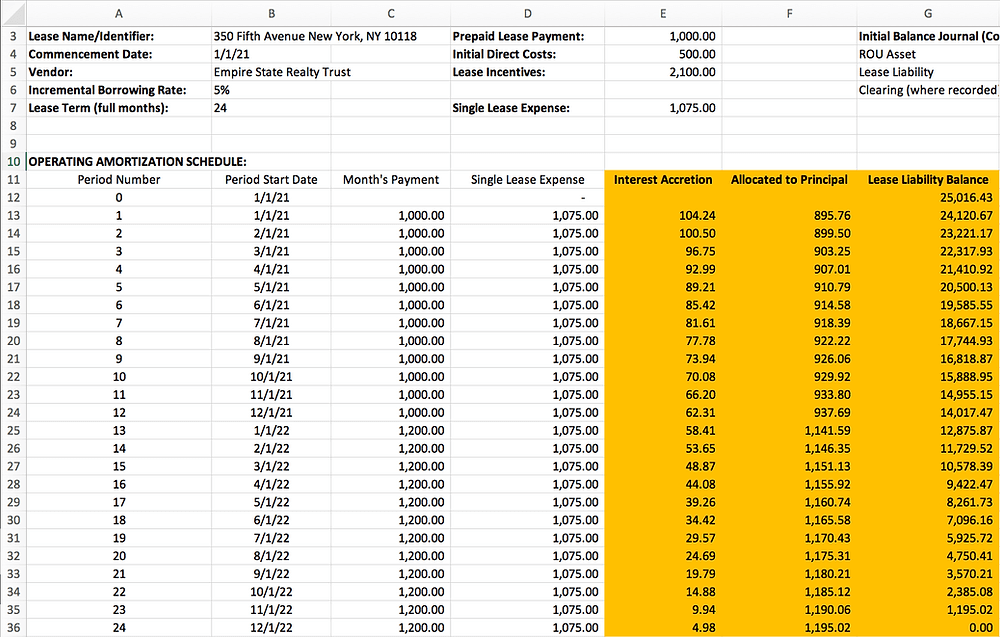

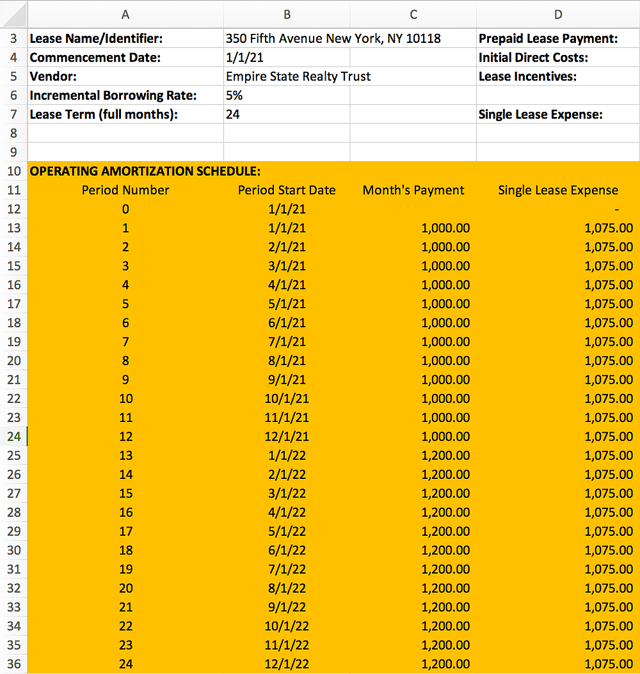

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Lease Modification Accounting under ASC 842 Operating Lease to

Sensational Asc 842 Excel Template Dashboard Download Free

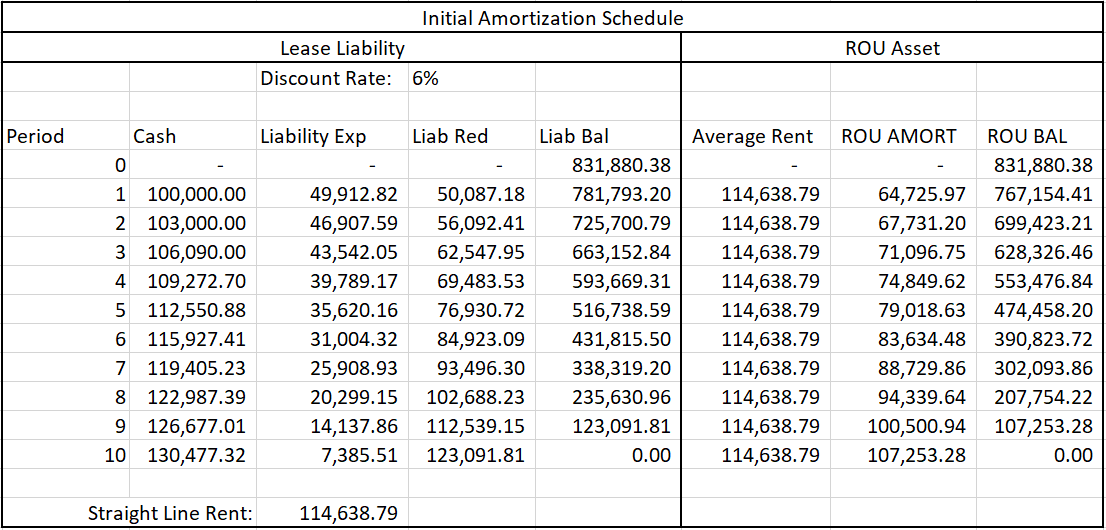

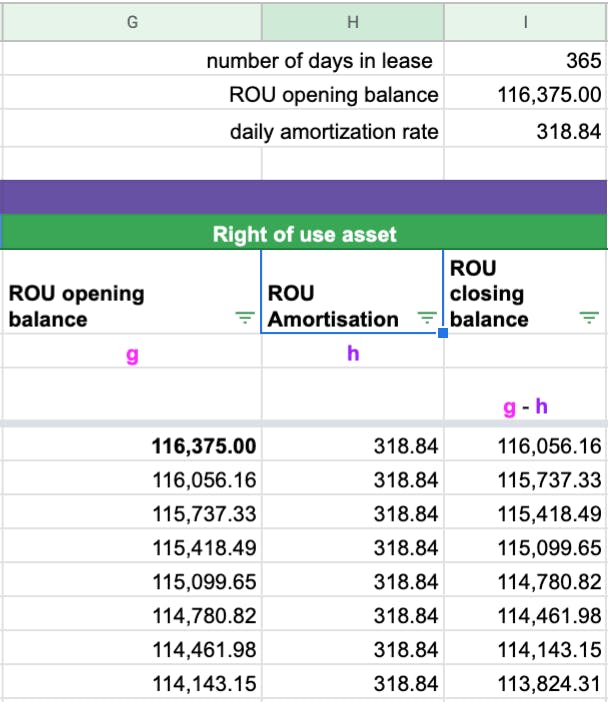

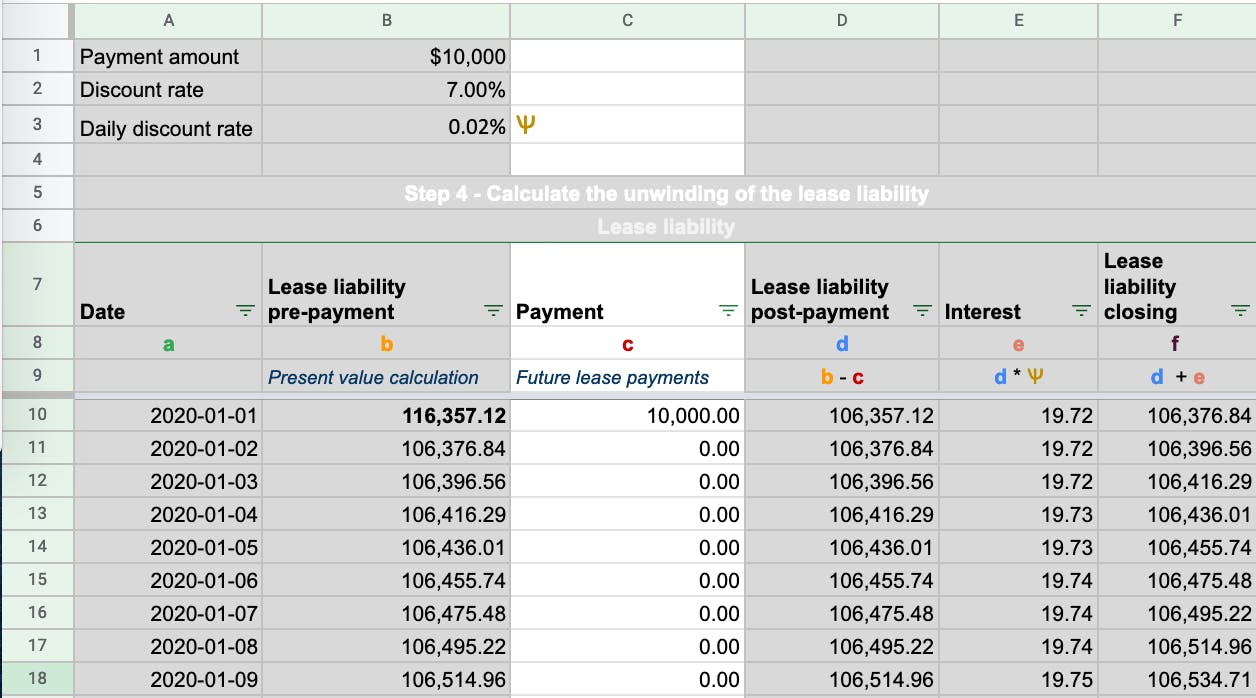

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate a Finance Lease under ASC 842

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Related Post: