Asc 842 Calculation Template

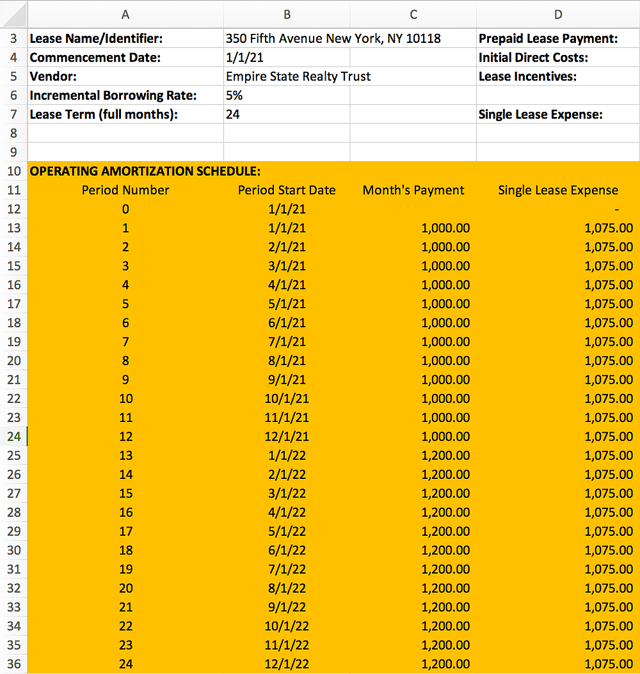

Asc 842 Calculation Template - Web we'll now go through the following calculation steps of a modification that increases the fixed payments for a finance lease under asc 842. Easily sync odoo accounting with your inventory stock and keep your valuation up to date. Web here's that excel template again: For asc 842 compliance, you’ll need to calculate the present value of. Web capital lease accounting and finance lease accounting: Web where to start asc 842 is the new leasing standard, superseding asc 840. Web brandon campbell jr. Web step 1 recognize the lease liability and right of use asset. A full example ultimate lease accounting guide for asc 842 on the lessor’s books. For a comprehensive discussion of the. In my opinion, asc 840 was a little misleading when looking at assets and. Web here's that excel template again: Incorporate excel formulas to calculate values automatically. Web we'll now go through the following calculation steps of a modification that increases the fixed payments for a finance lease under asc 842. Ad integrate book keeping with all your operations to. Web • current process (if any) to apply fasb asc 842 (remeasurements, modifications, new leases, terminated leases, etc.) after the transition adjustment (january 1, 2022 for most. Web learn more about lease accounting. Ad get powerful, streamlined insights into your company’s finances. Determine the total lease payments under gaap step 3:. A full example ultimate lease accounting guide for asc. Determine the total lease payments under gaap step 3:. Ad integrate book keeping with all your operations to avoid double entry. Using the details of example 1: The new standard is effective from 1 january 2019 for public companies and 15 december 2021. Web learn more about lease accounting. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. Determine the lease term under asc 840 step 2: Web here's that excel template again: The process below reflects how. Web where to start asc 842 is the new leasing standard, superseding asc 840. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. A full example ultimate lease accounting guide for asc 842 on the lessor’s books. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Web where to start asc 842 is the new leasing standard, superseding asc 840.. Web step 1 recognize the lease liability and right of use asset. The process below reflects how. My take on the “why” we are switching to asc 842: Apply asc 842 for fiscal years beginning after dec. For asc 842 compliance, you’ll need to calculate the present value of. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Web step 1 recognize the lease liability and right of use asset. A full example ultimate lease accounting guide for asc 842 on the lessor’s books. Web the lease liability is equal to the present. Determine the lease term under asc 840 step 2: Determine the total lease payments under gaap step 3:. My take on the “why” we are switching to asc 842: Web we'll now go through the following calculation steps of a modification that increases the fixed payments for a finance lease under asc 842. Asc 842 offers practical expedients that can. Web where to start asc 842 is the new leasing standard, superseding asc 840. In my opinion, asc 840 was a little misleading when looking at assets and. My take on the “why” we are switching to asc 842: Web the lease liability is equal to the present value of the remaining lease payments. Apply asc 842 for fiscal years. Web where to start asc 842 is the new leasing standard, superseding asc 840. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Web • current process (if any) to apply fasb asc 842 (remeasurements, modifications, new leases, terminated leases, etc.) after the transition. First, determine the lease term. Web where to start asc 842 is the new leasing standard, superseding asc 840. Ad get powerful, streamlined insights into your company’s finances. Determine the lease term under asc 840 step 2: Web learn more about lease accounting. Determine the total lease payments under gaap step 3:. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Incorporate excel formulas to calculate values automatically. 15, 2021 and interim periods for years beginning after dec. For asc 842 compliance, you’ll need to calculate the present value of. Web we'll now go through the following calculation steps of a modification that increases the fixed payments for a finance lease under asc 842. Deals partner, leasing accounting solutions leader, pwc us most nonpublic companies will be required to adopt asc 842 (or the “new. In my opinion, asc 840 was a little misleading when looking at assets and. Web capital lease accounting and finance lease accounting: Web here's that excel template again: My take on the “why” we are switching to asc 842: Easily sync odoo accounting with your inventory stock and keep your valuation up to date. Web brandon campbell jr. Using the details of example 1: The new standard is effective from 1 january 2019 for public companies and 15 december 2021.ASC 842 Lease Amortization Schedule Templates in Excel Free Download

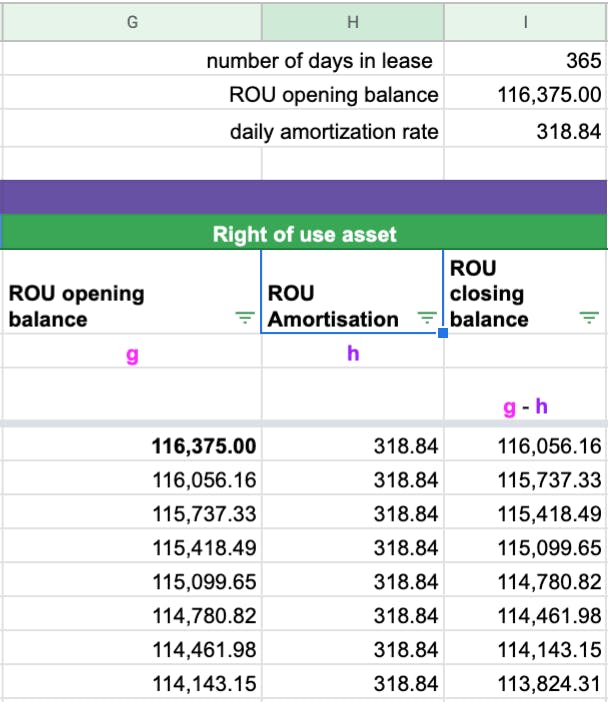

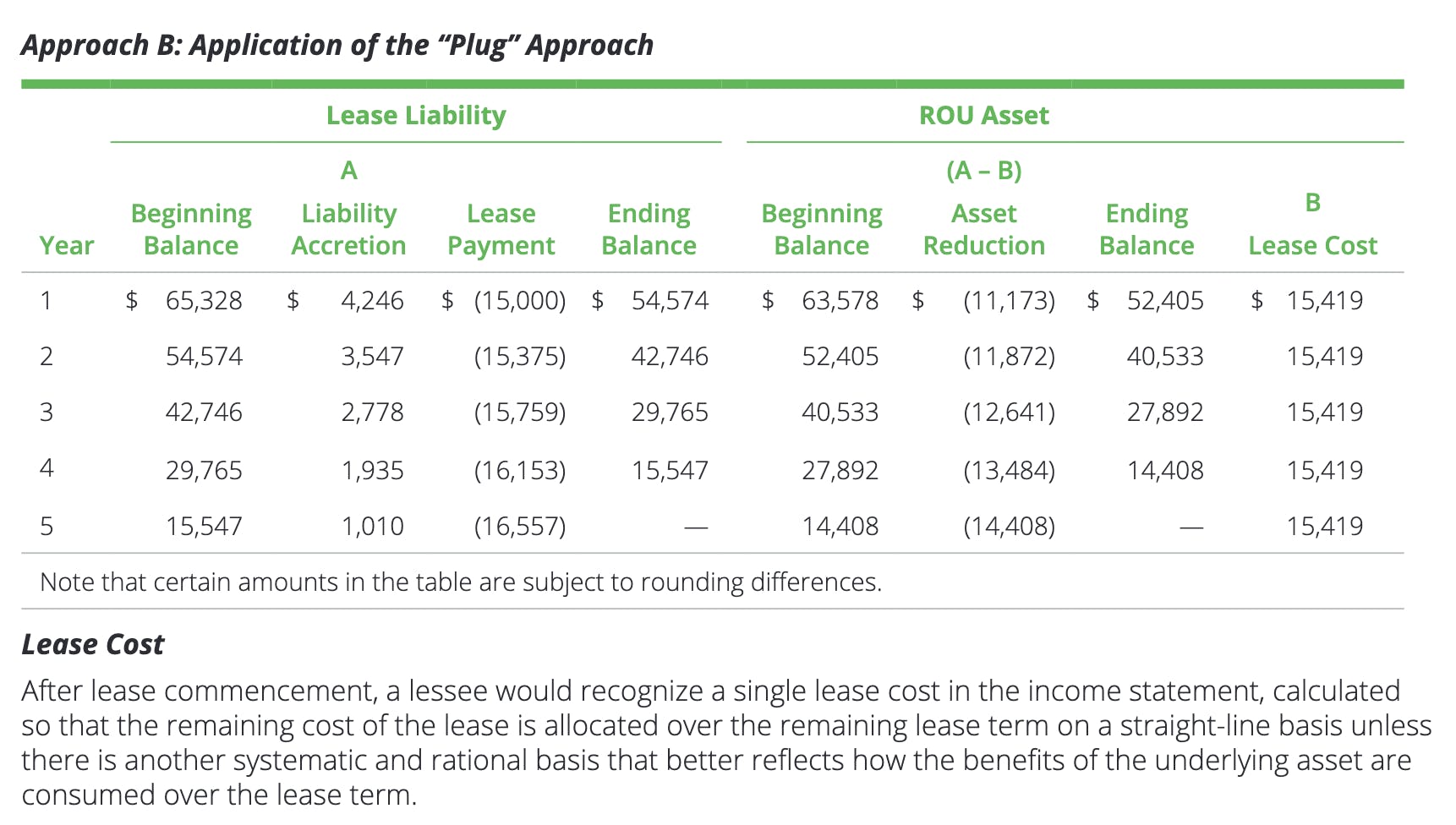

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

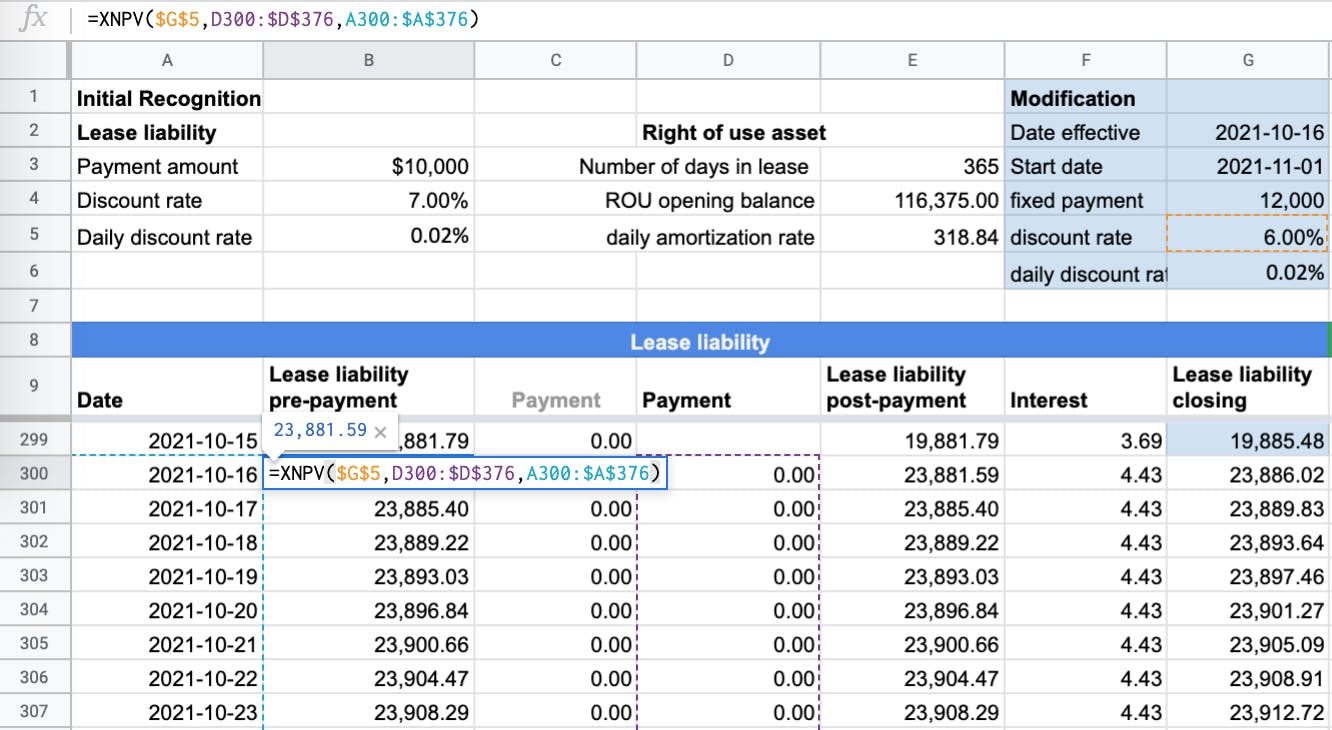

How to Calculate a Finance Lease under ASC 842

ASC 842 Excel Template Download

How to Calculate a Finance Lease under ASC 842

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Guide

How to Reconcile Non GAAP Lease Accounting with ASC 842 for an

Sensational Asc 842 Excel Template Dashboard Download Free

Related Post: