501C3 Donation Receipt Template

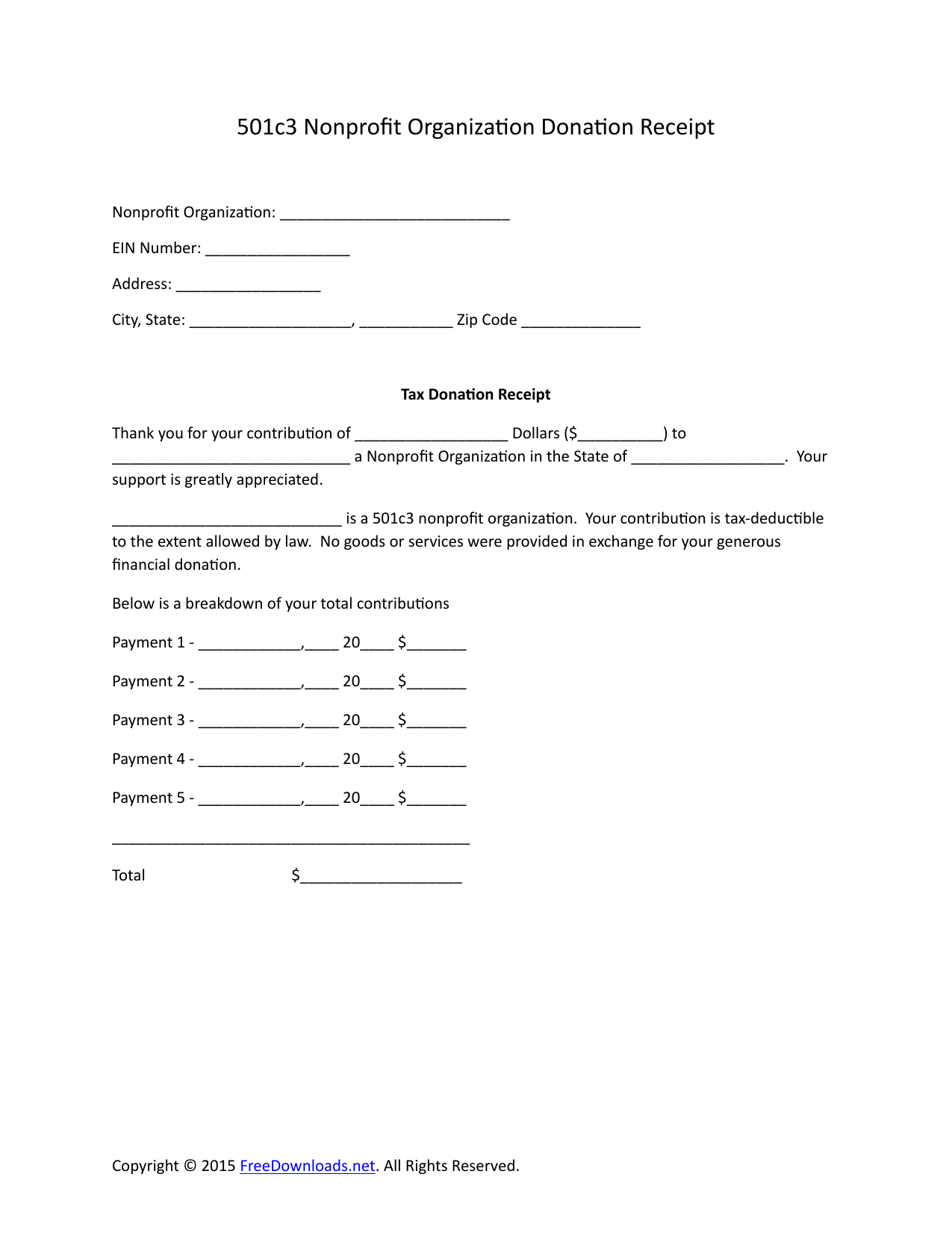

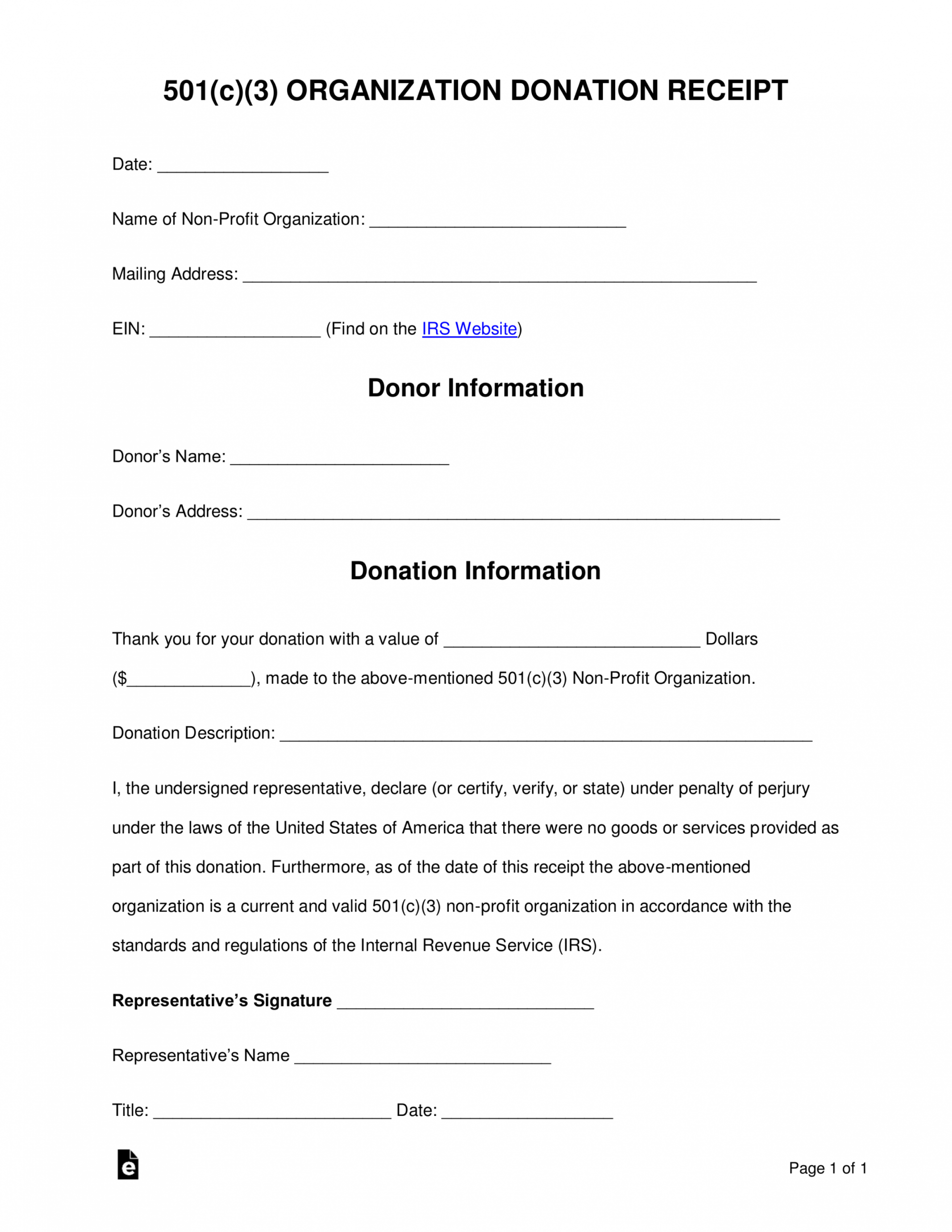

501C3 Donation Receipt Template - Web the donation receipt that captures personal property donations should consist of the name of the item being contributed, the value of the item, and a brief description of the. Do you know the organization's street address? These are examples of tax donation receipts that a 501c3. Who is this being donated to? Donation receipts are important for a few reasons. There are two main types of donation. First, craft the outline of your donation receipt with all the legal requirements included. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. 501 (c) (3) organization donation receipt. Customizable with your group's name and. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web use skynova for donation receipt templates and more. These are examples of tax donation receipts that a 501c3. Web donation receipts can serve as a convenient form of proof that the donation happened, and can be used in the event. Web 501 (c) (3) donation receipt template. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The irs requires nonprofits to send receipts. There are two main types of donation. Web donation receipts can serve as a convenient form of proof that the donation happened,. Customizable with your group's name and. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web use skynova for donation receipt templates and more. Donation receipts are important for a few reasons. Access legal documents to help you invoice clients, hire employees, gain funding & more. Web 501 (c) (3) donation receipt template. First, craft the outline of your donation receipt with all the legal requirements included. It offers premium templates of cash receipt. Do you know the organization's street address? Web 501 (c) (3) charity donation. These are examples of tax donation receipts that a 501c3. Ad 1) customize receipt templates online 2) 100% free. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. Web 501c3 donation receipt template pdf, word, excel. Content marketing manager, neon one. Do you know the organization's street address? It offers premium templates of cash receipt. Donation receipts are important for a few reasons. The irs requires nonprofits to send receipts. Access legal documents to help you invoice clients, hire employees, gain funding & more. The organization receiving the donation (s). A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. The irs requires nonprofits to send receipts. Web use skynova for donation receipt templates and more. 501 (c) (3) organization donation receipt. Ad 1) customize receipt templates online 2) 100% free. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. Content marketing manager, neon one. Ad create professional, legal documents for starting & running your business. Web donation receipts can serve as a convenient form of proof that the donation happened, and can be used in the. It offers premium templates of cash receipt. These are examples of tax donation receipts that a 501c3. Donation receipts are important for a few reasons. Who is this being donated to? Web 501 (c) (3) donation receipt template. First, craft the outline of your donation receipt with all the legal requirements included. 501 (c) (3) organization donation receipt. Web the donation receipt that captures personal property donations should consist of the name of the item being contributed, the value of the item, and a brief description of the. Web use skynova for donation receipt templates and more. Who. 501 (c) (3) organization donation receipt. First, craft the outline of your donation receipt with all the legal requirements included. Content marketing manager, neon one. Web 501 (c) (3) donation receipt template. Web 501c3 donation receipt template pdf, word, excel. The organization receiving the donation (s). A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Access legal documents to help you invoice clients, hire employees, gain funding & more. Then, you can customize this basic template based on donation. Ad create professional, legal documents for starting & running your business. Who is this being donated to? Donation receipts are important for a few reasons. Ad 1) customize receipt templates online 2) 100% free. Web donation receipts can serve as a convenient form of proof that the donation happened, and can be used in the event of an irs audit. Web use skynova for donation receipt templates and more. The irs requires nonprofits to send receipts. Skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. These are examples of tax donation receipts that a 501c3. Year end donation receipt template. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information:Download 501c3 Donation Receipt Letter for Tax Purposes PDF RTF Word

501c3 donation receipt template addictionary download 501c3 donation receipt letter for tax

501c3 donation receipt template addictionary download 501c3 donation receipt letter for tax

501c3 donation receipt template addictionary 501c3 donation receipt template addictionary

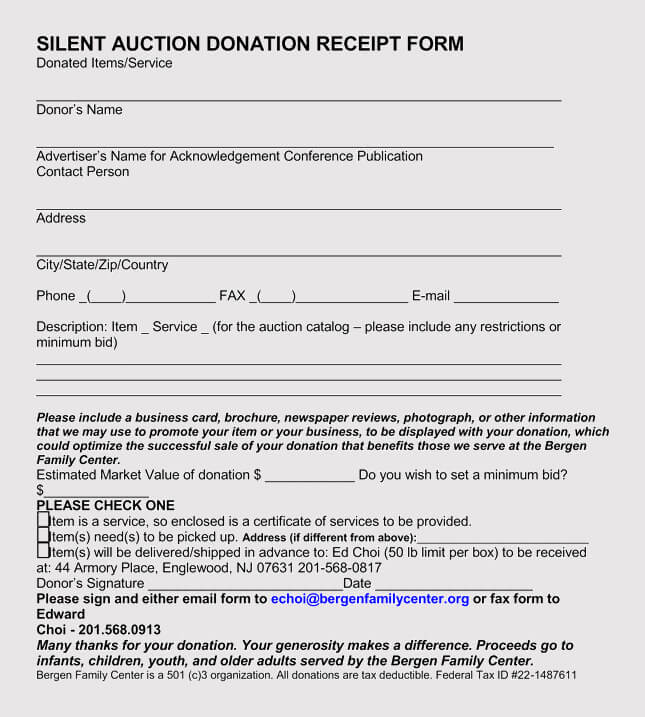

19+ Sample 501c3 Letter Lodi Letter

501c3 donation receipt template addictionary 501c3 donation receipt template addictionary

Pin on Receipt Templates

Free 501C3 Donation Receipt Template Sample Pdf Charity Donation Form Template PDF

501C3 Donation Receipt Template For Your Needs

501c3 donation receipt template addictionary download 501c3 donation receipt letter for tax

Related Post: