50/20/30 Budget Template

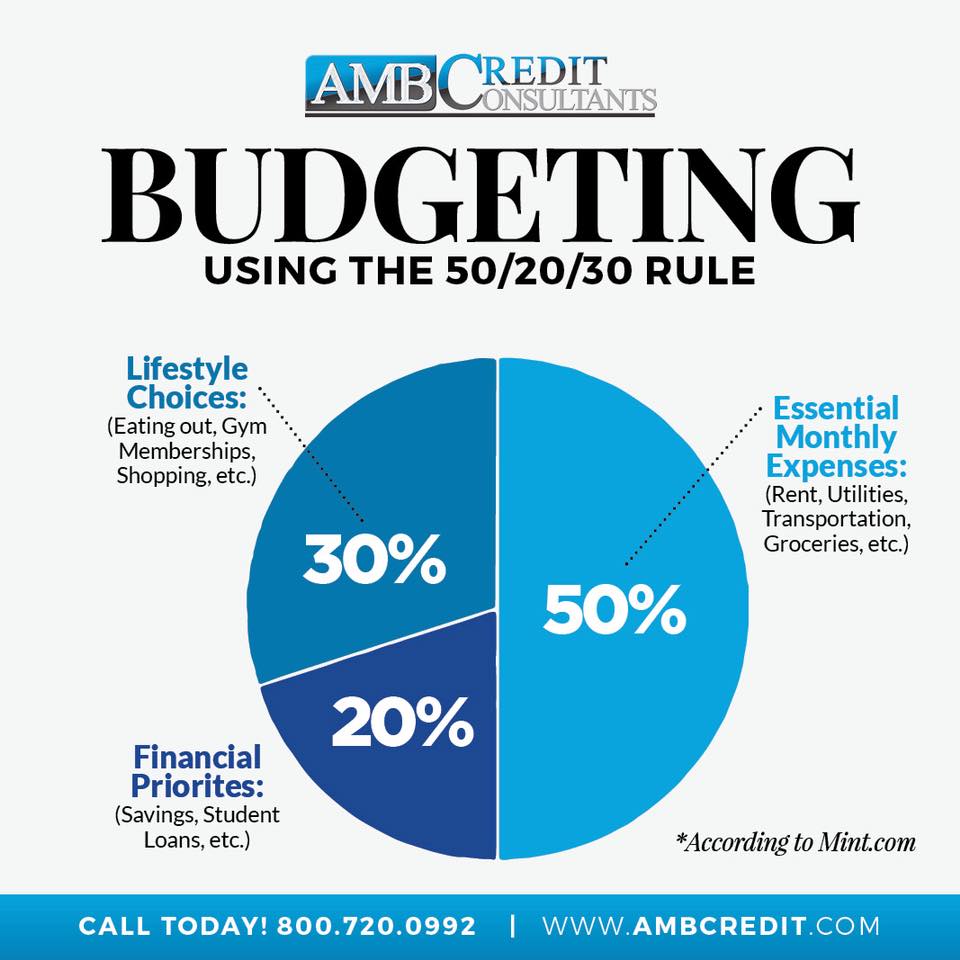

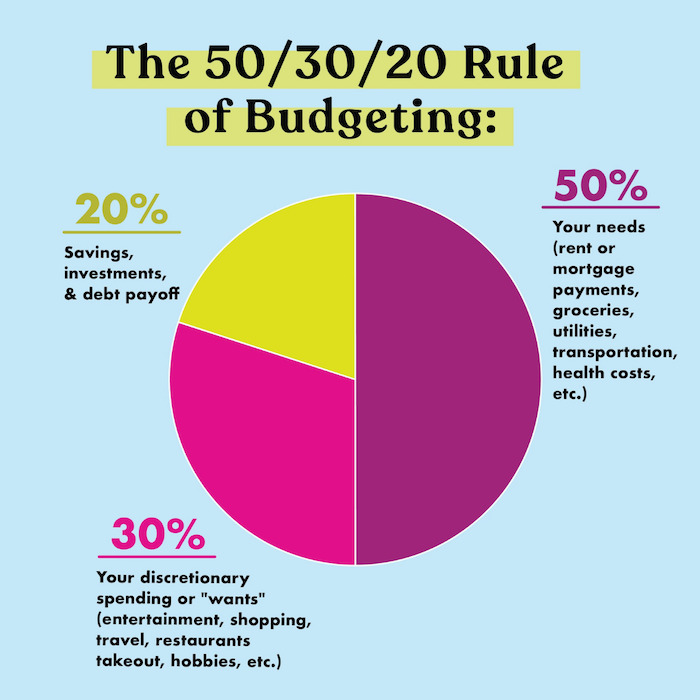

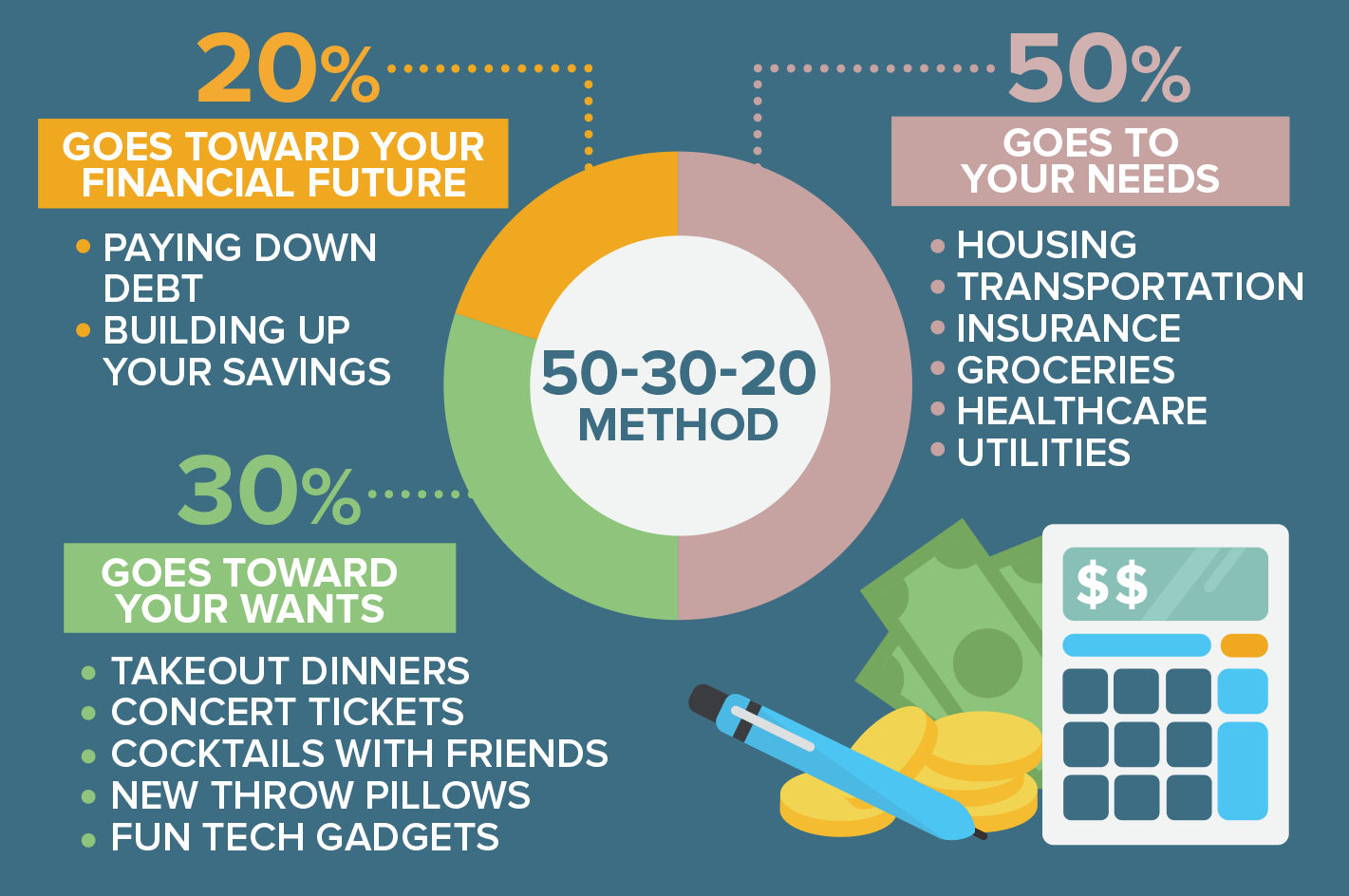

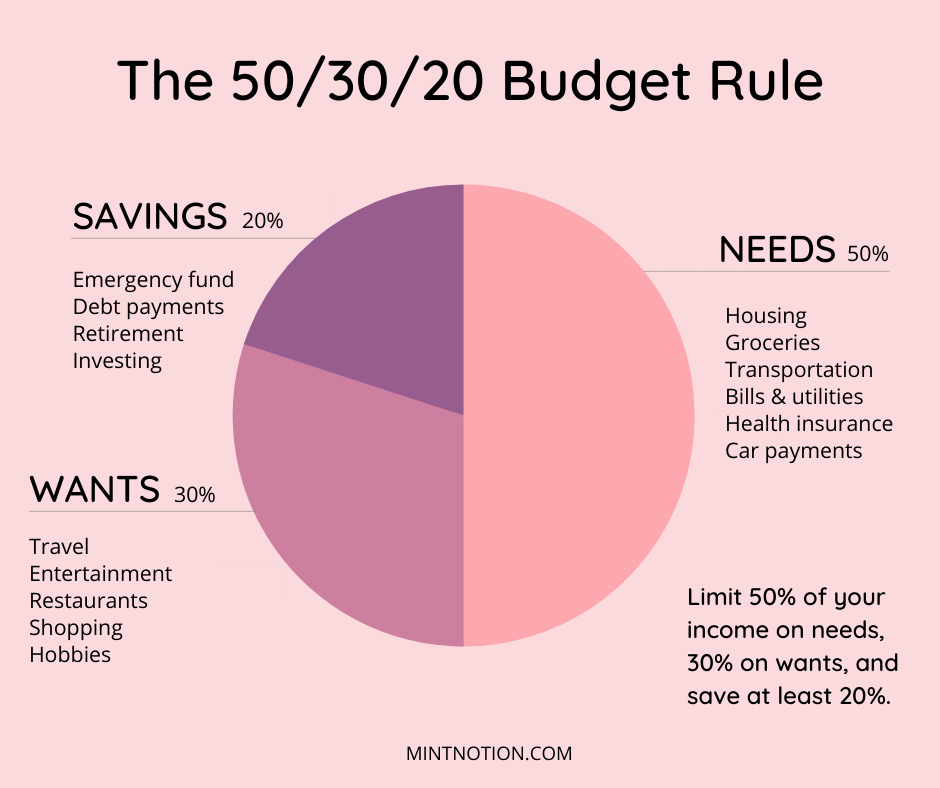

50/20/30 Budget Template - This figure is your income after taxes have been deducted. Purchase · try it free · expenses · invoicing · appointments · employees Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: Web crunching the numbers. We often get a paycheck. There are three sections in a 50 30 20 budget template. Web sections of the 50 30 20 budget template. Web in step 1: One of the primary attractions of the 50/30/20 budget rule is its simplicity. For instance, instead of ‘needs: There are three sections in a 50 30 20 budget template. Consider an individual who takes home $5,000 a month. Web so, what are the rules for setting up a 50/30/20 budget template? Web sections of the 50 30 20 budget template. Elizabeth warren popularized the 50/20/30. For instance, instead of ‘needs: There are three sections in a 50 30 20 budget template. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to. We often get a paycheck. Web 50/30/20 budget calculator to plan your income and expenses. Web crunching the numbers. The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. Web in step 1: Purchase · try it free · expenses · invoicing · appointments · employees Web so, what are the rules for setting up a 50/30/20 budget template? One of the primary attractions of the 50/30/20 budget rule is its simplicity. 50% of income going to needs, 30% going to wants, and the. 5 free budgeting templates & excel spreadsheets. All 15 are 100% free! We often get a paycheck. Web sections of the 50 30 20 budget template. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: There are three sections in a 50 30 20 budget template. 50% for your needs, 30% for your wants and 20% for your savings. Web keep your monthly budget and savings on track and on target with. 50% of your income’, you. Here's how it breaks down: 50% of income going to needs, 30% going to wants, and the. Purchase · try it free · expenses · invoicing · appointments · employees 5 free budgeting templates & excel spreadsheets. One of the primary attractions of the 50/30/20 budget rule is its simplicity. This figure is your income after taxes have been deducted. Web keep your monthly budget and savings on track and on target with the 50/30/20 approach. They all correlate with the three major categories where you should put the. Web 50/30/20 budget calculator to plan your income. Web 50/30/20 budget calculator to plan your income and expenses. There are three sections in a 50 30 20 budget template. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: 50% for your needs, 30% for your wants and 20% for your savings. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30%. Track your spending and manage it better with this template. 50% for your needs, 30% for your wants and 20% for your savings. Web master your monthly budget using the 50/30/20 budgeting method with these free printable budget templates. They all correlate with the three major categories where you should put the. It's likely you'll have additional payroll deductions for. Web a 50/30/20 budget calculator, specifically, will split your income into three different categories: 50% for your needs, 30% for your wants and 20% for your savings. The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. Consider an individual who takes home $5,000 a month. There are three sections in a 50. 50% for your needs, 30% for your wants and 20% for your savings. We often get a paycheck. Elizabeth warren popularized the 50/20/30. Web master your monthly budget using the 50/30/20 budgeting method with these free printable budget templates. It's likely you'll have additional payroll deductions for things like health insurance,. Consider an individual who takes home $5,000 a month. 50% of income going to needs, 30% going to wants, and the. One of the primary attractions of the 50/30/20 budget rule is its simplicity. It’s all about dividing your monthly. Web sections of the 50 30 20 budget template. Web so, what are the rules for setting up a 50/30/20 budget template? You break your take home pay down into percentages for your different types of expenses. Web 50/30/20 budget calculator to plan your income and expenses. Printable 50/30/20 budget overview template, monthly budget planner worksheet for managing income. The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. 50% of your income’, you. Designate 50% of your income to needs (mortgage/rent, utilities, car payments), 30% to. This figure is your income after taxes have been deducted. These online tools let you skip the setup and math, and start tracking and saving your. Web keep your monthly budget and savings on track and on target with the 50/30/20 approach.AMB Credit Consultants A New Way To Budget! Budgeting Using The 50/30

The 50/30/20 rule to budgeting and saving Locke Digital

50/30/20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny

The 50/30/20 Budget What It Is & Why You Need To Start Using It ASAP

Enjoy Budgeting With the 503020 Rule Investdale

What is the 50/30/20 Budget Rule and How it Works Budgeting, Life on

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

The 50/30/20 Budget Rule Explained (with Examples)

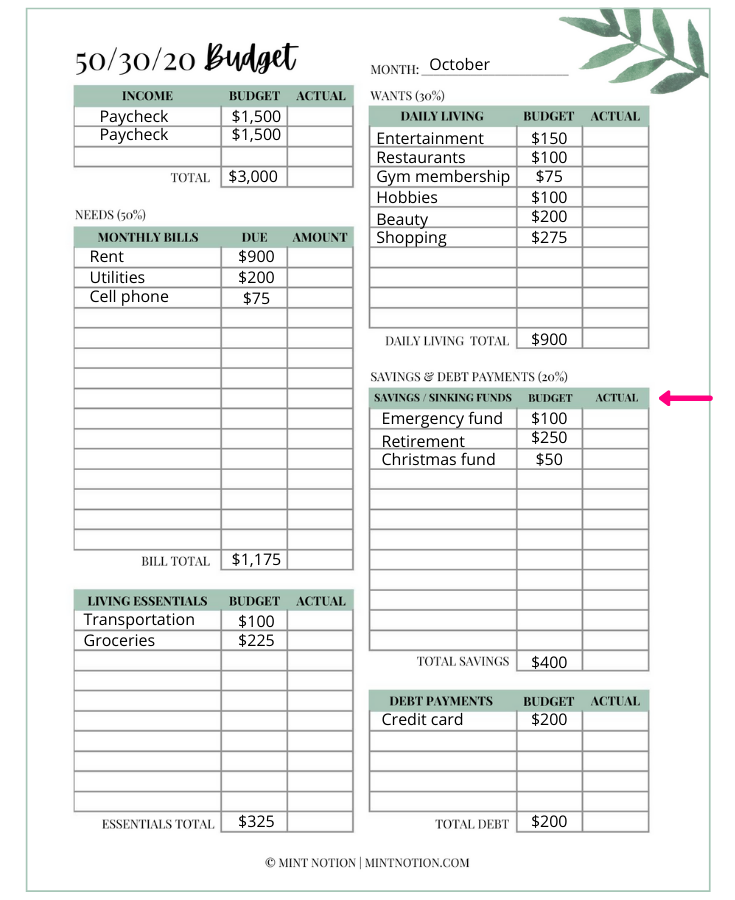

503020 Budget Rule How to Make a Realistic Budget Mint Notion

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Related Post: