1031 Exchange Template

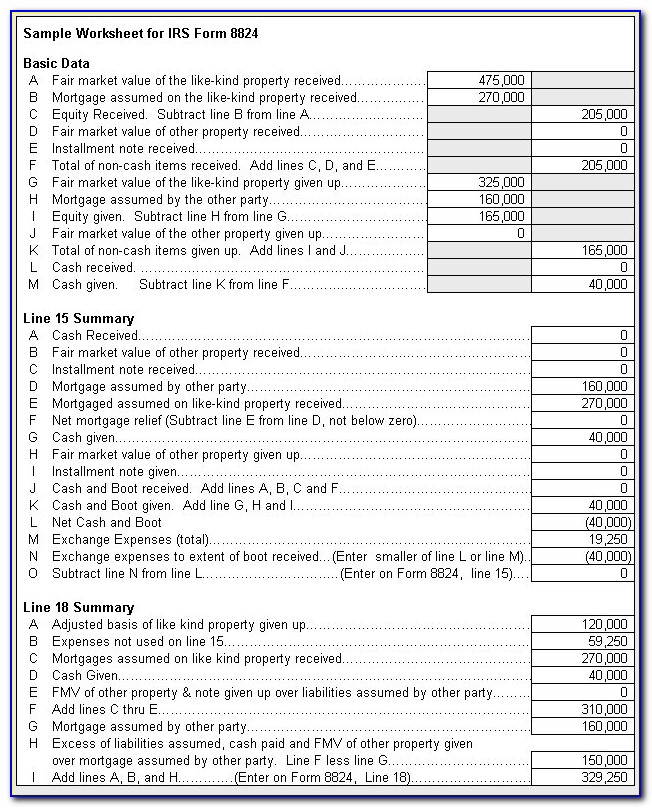

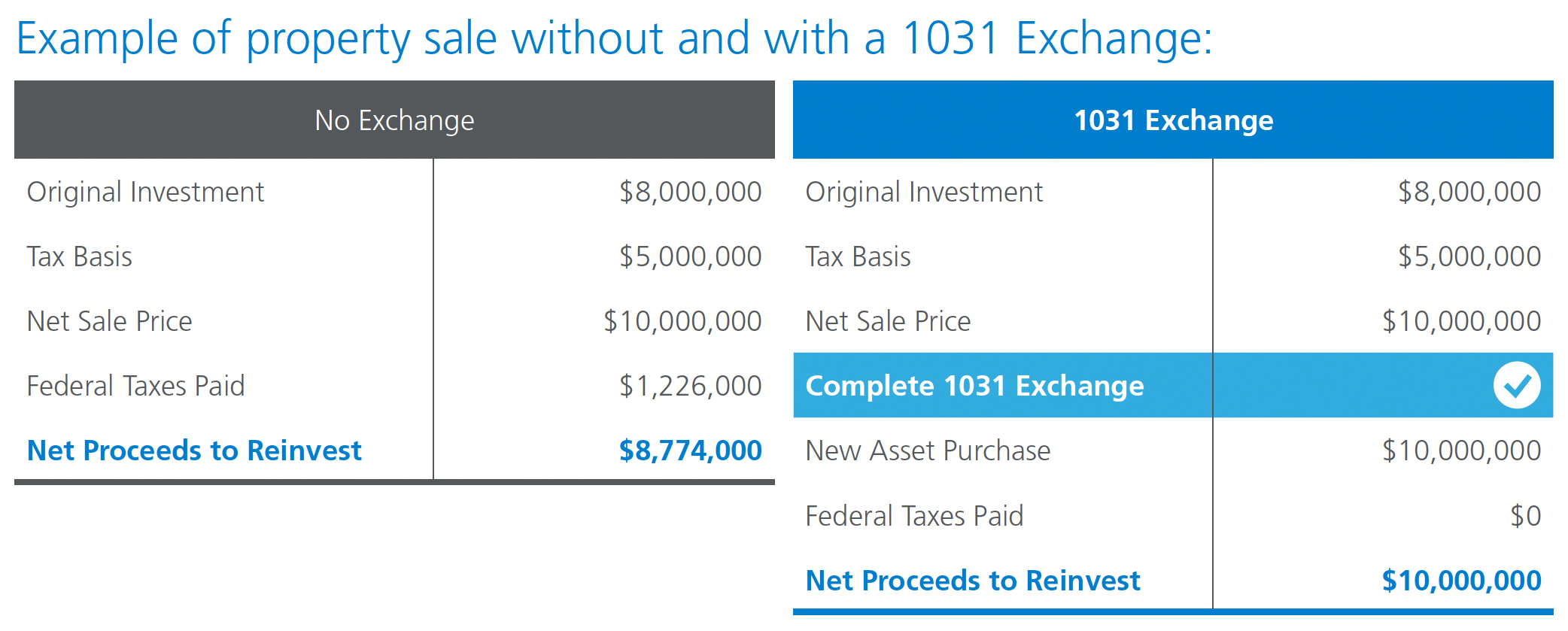

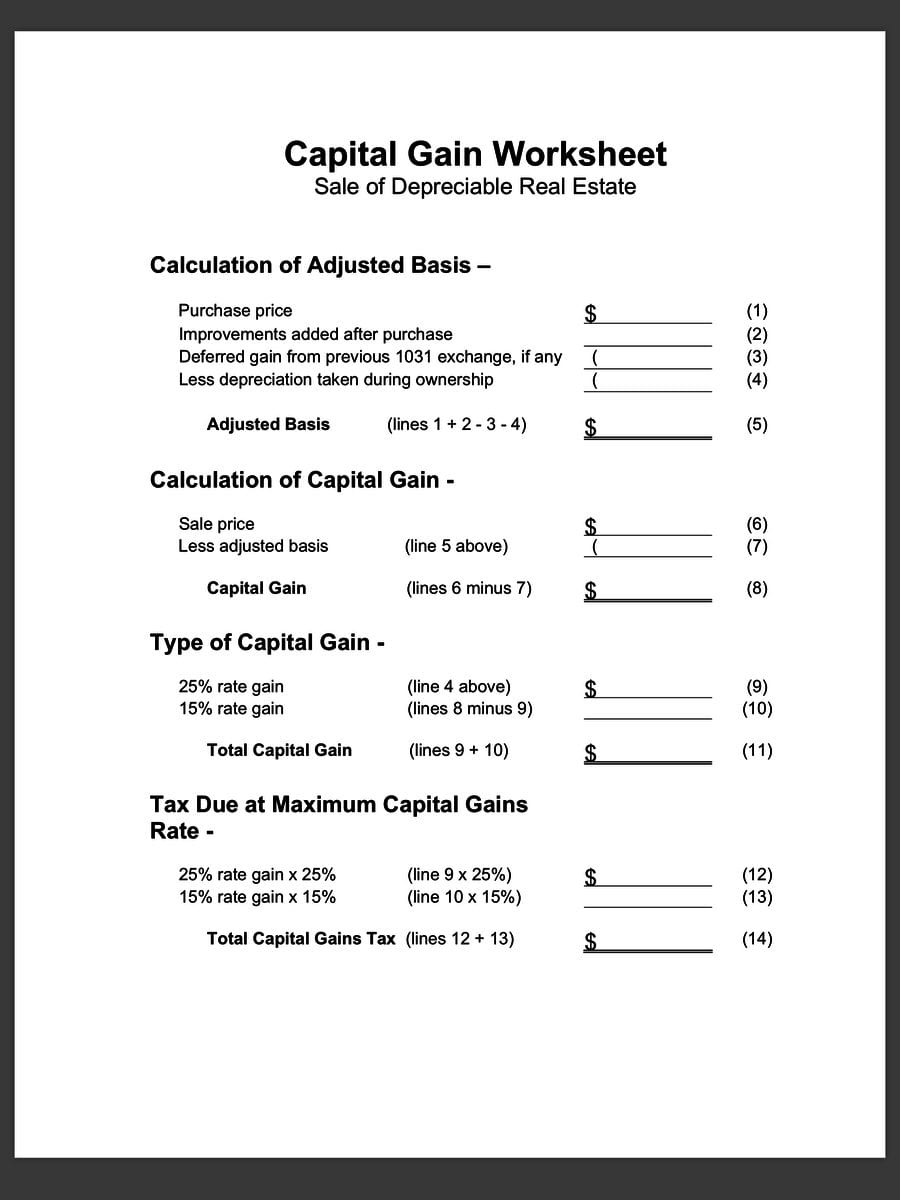

1031 Exchange Template - Ad browse available dst 1031 listings now on the kpi1031.com marketplace. Web form 8824 worksheet is a useful tool for preparing the tax return of a 1031 exchange, a transaction that allows you to defer capital gains taxes on the sale of an investment. Web requires only 10 inputs into a simple excel spreadsheet. Grab irs form 6252 (read the. Calculate the taxes you can defer when selling a property. The basis for the new asset. Ad own real estate without dealing with the tenants, toilets and trash. Web reporting gain using an installment sale method. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Web exchange & escrow agreement for 1031 tax deferred exchange i. Includes state taxes and depreciation recapture. 25 different dst sponsors available on our marketplace. Ad own real estate without dealing with the tenants, toilets and trash. The basis for the new asset. Parties & general information escrow number ________ taxpayer’s. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Web reporting gain using an installment sale method. Calculate the taxes you can defer when selling a property. The pros at equity advantage have provided everything you need in easily downloadable. This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Web exchange & escrow agreement for 1031 tax deferred exchange i. 25 different dst sponsors available on our marketplace. Web. Web exchange & escrow agreement for 1031 tax deferred exchange i. Determine that you want to report income** in the 2nd tax year. 1031 exchange dst properties and sponsors. If you’re considering performing a 1031 tax exchange instead of a taxable sale of a property, this calculator will help you figure out your tax deferment. Web purchase price, exchange property. Web reporting gain using an installment sale method. Parties & general information escrow number ________ taxpayer’s. Current 1031 exchange dst properties and sponsors. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. 25 different dst sponsors available on our marketplace. Grab irs form 6252 (read the. Includes state taxes and depreciation recapture. Web form 8824 worksheet is a useful tool for preparing the tax return of a 1031 exchange, a transaction that allows you to defer capital gains taxes on the sale of an investment. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of. Visit our library of important 1031 exchange forms. Determine that you want to report income** in the 2nd tax year. 25 different dst sponsors available on our marketplace. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. Ad own real. Ad own real estate without dealing with the tenants, toilets and trash. Web exchange & escrow agreement for 1031 tax deferred exchange i. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web requires only 10 inputs into a simple excel spreadsheet. This documentation is required, both to. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web form 8824 worksheet is a useful tool for preparing the tax return of a 1031 exchange, a transaction that allows you to defer capital gains taxes on the sale. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. Web up to $40 cash back once you are ready to share your trec 1031 exchange form, you can easily send it to others and get the esigned document back just as quickly. To pay no tax when executing a 1031 exchange, you must purchase. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web up to $40 cash back once you are ready to share your trec 1031 exchange form, you can easily send it to others and get the esigned document back just as quickly. 25 different dst sponsors available on our marketplace. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. To pay no tax when executing a 1031 exchange, you must purchase at least. Web david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be. The basis for the new asset. Web the exchange of relinquished property for replacement property via the 1031 exchange also requires documentation. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Calculate the taxes you can defer when selling a property. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Ad own real estate without dealing with the tenants, toilets and trash. This documentation is required, both to. Determine that you want to report income** in the 2nd tax year. Web requires only 10 inputs into a simple excel spreadsheet. Web reporting gain using an installment sale method. Parties & general information escrow number ________ taxpayer’s. Ad browse available dst 1031 listings now on the kpi1031.com marketplace. This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. Visit our library of important 1031 exchange forms.What is a 1031 Exchange Mt. Helix Lifestyles Real Estate Services

1031 Exchange Documents Form Fill Out and Sign Printable PDF Template

1031 Exchange Order Form

1031 Exchange Worksheet Excel Master of Documents

1031 Exchange Calculation Worksheet CALCULATORVGW

Partial 1031 Exchange Worksheet

1031 Exchange Order Form

1031 Exchange Basics Rules & Timeline in Hilo Hawaii Sonoma Real

Partial 1031 Exchange Worksheet

1031 Exchange Worksheet Excel Promotiontablecovers

Related Post: